2023 Q3 Revenue Report

- Revenue up +18.0% in the third quarter of 2023 to

€250.7 million

- Revenue up +17.2% in the first 9 months of 2023 to

€769.7 million

- Growth driven by excellent momentum in the Benelux, confirming

the group’s international dimension

- Confirmation of double-digit growth this year, the group

expects to surpass the symbolic revenue milestone of

€1 billion in 2023

- Profitability set to improve in every geographic segment in the

second half of 2023

|

In millions of euros |

9 months |

Q3 |

|

2023 |

2022 |

% change |

2023 |

2022 |

% change |

|

Total |

769.7 |

656.8 |

+17.2% |

250.7 |

212.4 |

+18.0% |

|

From France |

297.8 |

318.6 |

-6.5% |

98.4 |

96.7 |

+1.7% |

|

From Benelux |

269.6 |

152.1 |

+77.2% |

89.6 |

53.6 |

+67.1% |

|

From Other Countries |

202.3 |

186.1 |

+8.7% |

62.7 |

62.1 |

+1.0% |

61% of group revenue generated outside

of France

Consolidated revenue

In the third quarter of 2023, Solutions30 posted

consolidated revenue of €250.7 million, up +18.0% compared to

the same period in 2022 (17.3% organic growth).

In the first nine months of 2023, Solutions30’s

consolidated revenue amounted to €769.7 million, up +17.2%

compared to €656.8 million in 2022. This represents organic

growth of +16.9%.

This growth is mainly driven by Solutions30’s

excellent momentum from the Benelux countries. The group’s

recognized expertise in the deployment of ultra-fast Internet

networks (FTTH) has helped position it as a leader in this market.

The group will leverage this position as other countries open up,

seeing its first significant contracts coming out of Germany in the

next few weeks.

Revenue by region

In France, revenue in the third

quarter of 2023 was €98.4 million compared to

€96.7 million a year earlier, representing growth of 1.7%

(0.2% organic growth).

Connectivity Solutions generated revenue of

€70.9 million, up 2.9% compared to the third quarter of 2022.

The usual peak in activity that occurs between September and

November was especially significant in September and October this

year. This had a positive impact on revenue for this quarter, but

it means that the fourth quarter may see a slightly negative impact

as a consequence. Nonetheless, this will not undermine the overall

progress made by France this year.

Revenue from Energy Solutions amounted to

€13.0 million compared to €11.5 million the previous

year, up 12.9% (0.4% organic growth). This strong performance is

due to the growth of operations related to the energy transition.

This includes the contribution from Elec ENR, which has been

consolidated into the group’s financials since the start of July

2023. This completely offsets the decline in Linky business, and

affirms the group’s successful strategic shift in this area, now

that the supply chains are fully operational again. Lastly,

Technology Solutions posted revenue of €14.5 million, down

11.2% over the quarter, due to worsening economic conditions which

are causing customers to cut back on investments.

Over the first nine months of the year, revenue

in France is down 6.5% to €297.8 million (-7% organic

decline).

In France, the focus is on returning to

profitability by executing a five-point action plan:

- Restructuring Energy Solutions around a five-pillar strategy,

which includes rolling out charging stations for electric vehicles

in a B-to-B-to-C model, setting up B-to-B electric vehicle charging

stations, industrial-scale photovoltaic solutions, solar panels for

the mass market, and the development of smart grids.

- Developing technicians’ skills to allow them to work across the

group’s diverse operations.

- Further integrating Scopelec’s activities in the Southeast and

optimizing production infrastructure.

- Streamlining and enhancing processes and IT systems to

continuously boost quality and leverage synergies across different

business areas.

- Reducing central costs and overhead.

The initial effects of this plan were felt in

the first half of the year and are expected to continue in the

coming quarters.

In the Benelux, revenue in the

third quarter of 2023 amounted to €89.6 million compared to

€53.6 million a year earlier, representing organic growth of

67.1%.

Revenue from Connectivity Solutions was

€72.4 million during the quarter, compared to

€40.3 million in the third quarter of 2022. The 79.7% surge in

revenue reflects the rapid expansion of the ultra-fast network in

Belgium and the Netherlands, along with the group’s capacity to

quickly hire, train, and deploy technicians in the field, which has

enabled it to gain and consolidate significant market share.

Solutions30 is fully leveraging its extensive expertise from the

French market and demonstrating its ability to replicate its

successful business model in other European nations.

Revenue from Energy Solutions was up 35.4% to

€12.8 million, compared with €9.5 million a year earlier.

This business is driven by the ongoing deployment of smart meters

in Flanders and the start of new contracts related to new energies,

electric mobility, and smart grids, demonstrating the synergies of

the model created by Solutions30.

Lastly, Technology Solutions posted revenue of

€4.3 million, up 12.9%.

For the first nine months of 2023, revenue

amounted to €269.6 million, up 77.2%. Benelux now accounts for

35% of the group’s total revenue, almost as much as its historical

market in France, underscoring Solutions30 new international

dimension.

The EBITDA margin, temporarily affected by rapid

growth in the first half of the year, is rebounding as anticipated.

This improvement is due to enhanced coordination of our field teams

and the streamlining of operational procedures.

In all other countries, the

group posted quarterly revenue of €62.7 million, compared to

€62.1 million a year earlier, representing purely organic

growth of 1.0%.

In Germany, revenue amounted to

€16.4 million compared to €16.2 million the previous

year. The group renewed a major contract with its first customer in

this country. Under the terms of the contract, the two partners

will be working together more closely on coaxial infrastructures.

Following the successful conclusion of fiber pilot projects,

Solutions30 expects to sign major deployment contracts in the

coming weeks. These contracts are highly strategic for the group,

as the German market has the greatest potential in Europe, with

only 4 million households subscribing to fiber, representing

less than 10% of the total number of German households. They are

poised to be the next catalysts for the group’s expansion following

the Benelux region, ensuring strong organic growth and,

consequently, improved visibility.

In Italy, revenue amounted to €12.7 million

in the third quarter of 2023, compared to €14.8 million one

year earlier. Due to worsening conditions under which its contracts

are being executed, the group has chosen to slow down the pace of

its fiber rollouts. Meanwhile, it is reassessing its structure to

mitigate losses in this market until an agreement is reached with

its customers.

On the Iberian Peninsula, revenue reached

€13.0 million, compared to €14.4 million a year earlier.

As previously indicated, the group is concentrating on its most

profitable activities, especially within the energy sector, in

response to the largely mature telecoms market.

In Poland, revenue amounted to

€11.7 million, up 48.8%. The country continues to benefit from

market share gains, in both fixed and mobile networks.

Finally, in the United Kingdom, Solutions30’s

quarterly revenue was up 2.3% to €9.0 million. The group has

discontinued some of its long-established operations to pivot

towards expanding its more lucrative FTTH deployments, aligning

with the group’s profitability criteria.

In all these countries, the group posted revenue

of €202.4 million for the first nine months of 2023, an

increase of 8.7% (8.6% organic growth) compared to the same period

in 2022.

Outlook

Solutions30 reaffirms its goal to surpass one

billion euros in revenue in 2023.

The group is actively refining its service

offerings to bring profit margins back to a double-digit EBITDA

margin (IFRS). However, during periods when Solutions30 is

intensively hiring, training, and structuring its operations to

manage increased production speeds, the business model is not at

peak efficiency. Consequently, the EBITDA margin may experience a

temporary decline. In the second half of 2023, the EBITDA margin

will continue to improve. The group expects to return to a

double-digit EBITDA margin in the course of 2024, the exact timing

will hinge on how quickly the deployments in Germany will ramp

up.

The group aims to resume a path of profitable

and sustainable growth, entering a new phase characterized by the

expansion into the German market. Solutions30’s financing policy,

which relies on self-financing and keeping a low leverage, will

continue to be based on three pillars:

- Recurring working capital on historical contracts is financed

by factoring. The deconsolidating factoring program remains

competitive, even in the current context of rising interest rates,

given the quality of the customers and assigned receivables.

- Ramp-ups are financed by the group’s cash. Solutions30 has

proven in the past that it can finance its substantial growth

internally. By concentrating on profitable activities and

redeploying its longstanding business model, Solutions30 is well

positioned to maintain this growth trajectory, which will be

further supported by incorporating the German market.

- The group finances acquisitions through long-term borrowing,

supported by a strong borrowing capacity, as evidenced by a net

debt to EBITDA ratio of 1.7 as of the end of June 2023.

By adhering to this non-dilutive financing

approach, which Solutions30 plans to maintain, along with executing

an improved operational strategy and introducing its services in

profitable markets with high potential, the group seeks to rapidly

relaunch the creation of shareholder value.

Communication timetable for

2024

Webinar – Solutions30 Growth Model: 13

December 2023

2023 Revenue Report: January 24,

2024

2023 Earnings Report: April 3,

2024

2023 Annual Report: April 19, 2024

Capital Markets Day: May 2024

2024 Q1 Revenue Report: May 13, 2024

Annual Shareholders Meeting: June

2024

2024 Q2 Revenue Report: July 24, 2024

2024 HY Earnings

Report: September 18, 2024

2024 Q3 Revenue Report: November 6,

2024

About Solutions30

SE

The Solutions30 group is the European leader in

solutions for new technologies. Its mission is to make the

technological developments that are transforming our daily lives

accessible to everyone, individuals and businesses alike.

Yesterday, it was computers and the Internet. Today, it’s digital

technology. Tomorrow, it will be technologies that make the world

even more interconnected in real time. With more than

65 million call-outs carried out since it was founded and a

network of more than 15,000 local technicians, Solutions30

currently covers all of France, Italy, Germany, the Netherlands,

Belgium, Luxembourg, the Iberian Peninsula, the United Kingdom, and

Poland. The capital of Solutions30 SE consists of

107,127,984 shares, equal to the number of theoretical votes

that can be exercised.Solutions30 SE is listed on the Euronext

Paris exchange (ISIN FR0013379484- code S30). Indexes: MSCI Europe

ex-UK Small Cap | SBF 120 | CAC Mid 60 | NEXT 150 | CAC

Technology | CAC PME. Visit our website for more information:

www.solutions30.com

Contact

Individual Shareholders:Investor Relations -

Tel: +33 1 86 86 00 63 - shareholders@solutions30.com

Analysts/Investors:Nathalie Boumendil - Tel: +33

6 85 82 41 95 - nathalie.boumendil@solutions30.com

Press - Image 7:Charlotte Le Barbier - Tel:

+33 6 78 37 27 60 - clebarbier@image7.frLeslie Jung - Tel: +33 6 78

70 05 55 - ljung@image7.fr

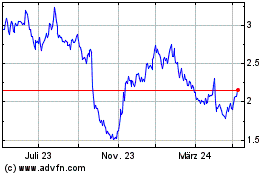

Solutions 30 (EU:S30)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Solutions 30 (EU:S30)

Historical Stock Chart

Von Apr 2023 bis Apr 2024