Oxurion signs a Letter of Intent and enters into exclusive negotiations to potentially acquire a pioneering French CRO in stem cell production

08 Juli 2024 - 6:30PM

UK Regulatory

Oxurion signs a Letter of Intent and enters into exclusive

negotiations to potentially acquire a pioneering French CRO in stem

cell production

Oxurion signs a Letter of Intent and

enters into exclusive negotiations to potentially acquire a

pioneering French CRO in stem cell production

LEUVEN, BELGIUM - July 8, 2024 – 6:30

pm, Oxurion NV (Euronext Brussels: OXUR), a

biopharmaceutical company based in Leuven, announces that it has

signed a Letter of Intent (LOI) to enter into exclusive

negotiations with a view to, subject to certain conditions,

acquiring an 80% majority stake in a CRO (Contract Research

Organisation) operating in a fast-growing segment and with

many solid drivers to accelerate its commercial development over

the next 4 years.

This first contemplated acquisition by Oxurion

represents a major strategic step in the company's evolution,

marking its desire to diversify from its current R&D

activities. With this acquisition, Oxurion will add a profitable

and fast-growing entity to its assets.

The transaction values the shares of the target

company on a 100% basis at €12.23 million (including €3.2m of cash

and €1m of financial debt). The envisaged structuring of the

transaction consists in a 80% buyout of the current shareholders,

on a prorata basis.

Payment would be made in three steps: an initial

payment of €4.39 million at closing, an earn-out of up to

€4.39 million conditional on achieving an EBITDA of €860,000 in

2024 and a payment of €1 million payable in June 2025.

Funding for the transaction will be secured at

the level of an Oxurion's subsidiary, through a mix of debt

financing (non dilutive) and funding on Oxurion level (than can be

either a shareholder loan or equity/quasi equity financing).

While Oxurion management will maximise the use

of non-dilutive instruments, the transaction will have a dilutive

impact for shareholders, still to be quantified.

The objective of the potential transaction is to

offset the dilutive impact of its financing by creating value for

the shareholders.

The target company is the result of

collaboration between leading French institutions, notably INSERM

and CNRS. Already a world leader in the field of stem cells, the

company is projecting sales of around €3m for 2024.

The company is part of a steady and highly

profitable growth model, with a revenue CAGR (Compounded Annual

Growth Rate) of 33% between 2021 and 2023 and an EBITDA margin of

30% projected in 2024 and a highly diversified customer portfolio

including the leading global players of the pharmaceutical

sector.

The company is recognized for its pioneering

work, notably in the production of human cells, which reinforces

its strong potential for sales growth. Its performance is also

underpinned by the range of complementary CRO services it has

recently developed, and which it has been gradually rolling out to

key accounts since the beginning of the year.

Pascal Ghoson, CEO of Oxurion, comments: "This

first acquisition marks an extremely important milestone in the

life of Oxurion. Our objective was to diversify our activities

through external growth, and this is what we are currently

delivering 5 months after I started. Our aim is to put our skills

at the service of the target company, whose potential is recognized

worldwide, to enable it to achieve its business plan in 2028, with

sales of €8.1m and EBITDA of €2.8m".

The transaction is subject to the completion of

due diligence work (financial, legal, technical), which is due to

start in July, with completion scheduled for the end of September

2024. Signature of the definitive documentation is scheduled for

October 2024 at the latest.

The transaction will not impact Oxurion's

current preclinical program, neither financially nor in terms of

the dedicated workforce. This is because the transaction will not

be funded under the existing Atlas Funding Program and will

primarily be managed by external advisors. While some limited due

diligence costs will be borne under the current Atlas Funding

Program, the largest part of the contemplated transaction costs

(mostly success fees) will be part of the acquisition funding

currently being structured.

Oxurion will provide the market with information

on the progress of the transaction and the final financing terms,

which are currently still being studied and structured.

About Oxurion

Oxurion (Euronext Brussels: OXUR) is engaged in

the development of next-generation standard ophthalmic therapies

for the treatment of retinal diseases. Oxurion is headquartered in

Leuven. Further information is available at www.oxurion.com

Important information on forward-looking

statements

Certain statements contained in this press

release may be regarded as "forward-looking". These forward-looking

statements are based on current expectations and are therefore

affected by various risks and uncertainties. The company therefore

cannot guarantee that these forward-looking statements will

materialize, and undertakes no obligation to update or revise them,

whether as a result of new information, future events or otherwise.

Further information on risks and uncertainties affecting the

company and other factors that could cause actual results to differ

materially from forward-looking statements are included in the

company's annual report. This press release does not constitute an

offer or invitation to sell or buy any Oxurion securities or assets

in any jurisdiction. No Oxurion securities may be offered or sold

in the United States without registration under the U.S. Securities

Act. Securities Act of 1933, as amended, or pursuant to an

exemption therefrom, and in compliance with all applicable U.S.

state securities laws.

Contacts :

Oxurion NV

Pascal Ghoson

Chief Executive Officer

Pascal.ghoson@oxurion.com |

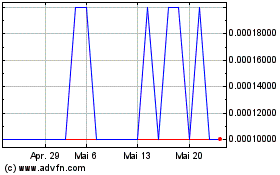

Oxurion NV (EU:OXUR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Oxurion NV (EU:OXUR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025