Corbion full year 2021 results

25 Februar 2022 - 7:00AM

Corbion full year 2021 results

Corbion reported net sales of €

1,070.8

million in 2021. Organic

net sales growth was

14.7%

for the year. Adjusted EBITDA in

2021 decreased

organically by

7.6% to €

135.8

million. The company proposes to distribute a regular cash

dividend of € 0.56 per share.

Olivier Rigaud, CEO, commented: “2021 was an extraordinary year

for Corbion. Our strong organic growth in our core activities of

15% – mostly driven by volume growth – was achieved under

challenging circumstances. Our colleagues have done a tremendous

job navigating these volatile conditions. The Q4 margin was

adversely impacted by a temporary production outage in our lactic

acid plant in the US. Increasing our sales prices has been one of

our key priorities over the past quarters. We have successfully

increased prices to fully compensate for the additional input

costs. I am happy to see that the higher sales price levels and our

continuous drive for operational efficiencies are starting to have

a positive effect on our results since the beginning of 2022. Given

the continued volatile business environment, we moved to a more

flexible contract structure allowing for faster pricing

adjustments. We are encouraged by the strong opportunity pipeline

and sales growth momentum. We made substantial progress in our

sustainability efforts. In 2021 we already surpassed our 2025 GHG

emission reduction target. Our strategy, intended to enhance

sustainable growth, is clearly materializing, and we remain

confident on the delivery of our Advance 2025 targets.”

Key financial highlights FY

2021*:

- Total net sales was € 1,070.8 million (FY 2020: € 986.5

million)

- Net sales organic growth was 14.7%. Core net sales organic

growth: 15.0%

- Adjusted EBITDA was € 135.8 million (FY 2020: € 158.8 million;

organic decrease: 7.6%)

- Adjusted EBITDA margin was 12.7% (FY 2020: 16.1%)

- Operating result was € 82.0 million (FY 2020: € 104.1

million)

- Free cash flow was € -97.0 million (FY 2020: € 32.1

million)

- Covenant net debt/covenant EBITDA at year-end was 2.6x

(year-end 2020: 1.7x)

|

€ million |

YTD 2021 |

YTD 2020 |

Total growth |

Organic growth |

|

Net sales |

1,070.8 |

986.5 |

8.5% |

14.7% |

|

Adjusted EBITDA |

135.8 |

158.8 |

-14.5% |

-7.6% |

|

Adjusted EBITDA margin |

12.7% |

16.1% |

|

|

|

Operating result |

82.0 |

104.1 |

-21.2% |

-12.7% |

|

ROCE |

9.6% |

12.9% |

|

|

- 20220225 Press release 4Q21 ENG final

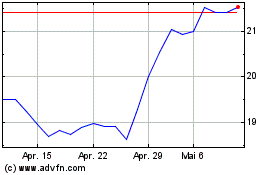

Corbion N.V (EU:CRBN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Corbion N.V (EU:CRBN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025