Corbion first half 2019 results

07 August 2019 - 7:00AM

Corbion first half 2019 results

Corbion reported H1 2019 sales of € 471.9 million, an

increase of 7.4% compared to H1 2018, mostly because of positive

currency effects. Organic sales growth was 0.9%. Adjusted EBITDA in

H1 2019 decreased by 0.1% to € 71.4 million due to 0.6% organic

growth, positive currency effects, more than offset by a negative

impact of the consolidation of the acquired Algae Ingredients plant

in Brazil.

“In the first half I was pleased to see a continued acceleration

in the organic sales growth rates for our important Food business

segment. Ingredient Solutions showed a mixed performance and ended

below the targeted sales growth bandwidth as the Biochemicals

business segment was facing significant headwinds in Electronics

and Agrochemicals. Our EBITDA margins remained at a healthy level

in both Food and Biochemicals. In Innovation Platforms we continued

on our growth trajectory in the first half. The Total Corbion PLA

joint venture saw a very strong performance in H1 2019, supported

by positive market developments.

I would like to thank everybody for their support in the past 5

years. It has been my privilege to have served as Corbion's CEO. As

I step down, I will be handing over to Olivier Rigaud. I would like

to wish Olivier and all Corbion colleagues all the best in taking

the business forward”, said Tjerk de Ruiter, CEO.

Key financial highlights first half of 2019

- Net sales organic growth was 0.9%; volume growth was 1.8%

- Adjusted EBITDA was € 71.4 million (H1 2018: € 71.5 million),

an organic increase of 0.6% (including 5.3% positive effect from

IFRS 16 implementation)

- Adjusted EBITDA margin was 15.1% (H1 2018: 16.3%)

- Adjustments at EBITDA level of € +3.4 million

- Operating result was € 46.4 million (H1 2018: 50.2

million)

- Free cash flow was € -29.3 million (H1 2018: €-16.3 million);

the decline is mostly due to the acquisition of Granotec do Brazil

(25 April 2019)

- Net debt/EBITDA at half-year end was 2.1x (year-end 2018:

1.8x)

| € million |

YTD 2019 |

YTD 2018 |

Total growth |

Organic growth |

| Net sales |

471.9 |

439.2 |

7.4% |

0.9% |

| Adjusted EBITDA |

71.4 |

71.5 |

-0.1% |

0.6% |

| Adjusted EBITDA

margin |

15.1% |

16.3% |

|

|

| Operating result |

46.4 |

50.2 |

-7.6% |

0.8% |

| ROCE |

10.0% |

14.9% |

|

|

- 20190807 1H19 Corbion press release ENG

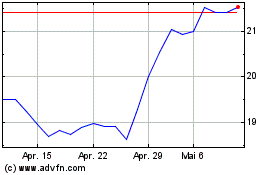

Corbion N.V (EU:CRBN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Corbion N.V (EU:CRBN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025