Biotalys Reports Half-Year 2022 Financial Results and Business

Highlights

Biotalys Reports Half-Year 2022 Financial

Results and Business Highlights

- Established

strategic partnerships, paving the way for market calibration in

the U.S. of Biotalys’ first biocontrol product Evoca™*

- Realized R&D

breakthrough for Evoca, increasing the commercial potential of the

product by 2026

- Expanded

Executive and Board leadership

- Cash and cash

equivalents amounted to €45.6 million end of June 2022

- Management to

host a conference call at 16:00 CEST / 15:00 BST / 10:00 EDT today,

details below

Biotalys (Euronext - BTLS), an Agricultural

Technology (AgTech) company protecting crops and food with

protein-based biocontrol solutions, today announces its key

business achievements and consolidated financial results for the

first half of 2022, prepared in accordance with International

Accounting Standard 34 ‘Interim Financial Reporting’ as adopted by

the European Union. The full interim financial report is available

here on the Biotalys website.

Patrice

Sellès, Chief Executive Officer of

Biotalys, commented: "Biotalys continues to forge the path

toward a safer, more sustainable food supply by building a strong

product pipeline, an exceptionally talented team and a global

partner network. As we are coming closer towards the regulatory

approval of our first biocontrol Evoca, the continued positive

feedback the product has earned both in the field and from renowned

industry experts has created great excitement throughout our

international team. We achieved a series of major milestones during

the first half of 2022, and remain focused on our mission to bring

innovative, protein-based biocontrols to growers."

H1 2022 operational

highlights

In the first half of this year, Biotalys has

been actively building its team and partnerships to further develop

its platform and pipeline:

- Biotalys

continued to enter into strategic partnerships with global leaders

to prepare for the market

calibration of Evoca, the

company’s first biofungicide.

- In January 2022,

Biotalys partnered with Olon, a world-leading bioactive

manufacturing organization, to significantly scale-up the

production of the active ingredient of Evoca – ensuring production

efficiency to increase its market potential. Biotalys also

appointed Kwizda Agro, an established crop protection manufacturer,

as formulator of its protein-based biocontrols – solidifying a

critical step in the set-up of the supply chain for Biotalys

products, starting with Evoca.

- In June 2022,

Biotalys announced a new partnership with Novozymes, a world leader

in biotech solutions, to explore additional routes for the scale-up

and production of the bioactive protein of Evoca. A feasibility

study is currently ongoing, the outcome of which can serve as a

potential key milestone for Biotalys and Novozymes to enter into

development, supply and commercialization agreements for a future

generation of Evoca.

-

Evoca continues to perform consistently well in

field trials in preparation for its planned U.S.

market introduction – demonstrating its promise as a pivotal tool

for growers looking for more sustainable ways to control

devastating fungal diseases.

- Its latest trial

results (announced in May 2022) further proved its efficacy and

ideal product positioning in grapes, with Evoca outperforming a

leading chemical product when applied at the flowering stage of

grapes in a fungicide rotation program.

- The latest

trials also demonstrated that wine grape juice quality,

vinification or wine characteristics exhibited no differences for

Evoca-treated vineyards compared to non-Evoca treated

vineyards.

- With more than

600 field trials now completed, Evoca offers fruit and vegetable

growers a new tool for their Integrated Pest Management (IPM)

programs to combat major fungal diseases to maximize yields with

significantly lower residues.

- Achieving

another major milestone in May of this year, the active ingredient

in Evoca earned an entirely new resistance class by the Fungicide

Resistance Action Committee (FRAC). The new

classification granted by this highly regarded

international panel of renowned technical experts, demonstrates to

growers that Evoca will be a new and differentiating product to

manage resistance to fungicides, complementing existing biological

and conventional crop protection solutions to fight the fungal

diseases Botrytis and powdery mildew.

- Biotalys also

earned recognition for Evoca in May 2022, winning a World

BioProtection Award 2022 for Best Biofungicide Product. The

award was granted at the World BioProtection

Summit in Birmingham (UK) based on the innovative character,

scientific value and market potential of the product.

- At the beginning

of H1, Biotalys initiated the new fungicide program funded by the

Gates Foundation (BioFun-7) to develop new biological solutions for

cowpeas and other legumes. This new program is an incredible

opportunity for the Biotalys team to leverage the antifungal

know-how built with our AGROBODY Foundry™ platform and is providing

funding to Biotalys of more than EUR 5.1 million over four

years.

- At the end of

March 2022, Biotalys also expanded its executive

team with the appointment of Carlo Boutton as chief

scientific officer. A proven leader in antibody innovation with a

track record building world-class research platforms, Carlo Boutton

supports the acceleration of technical innovation and development

of Biotalys’ AGROBODY Foundry platform.

- In April 2022,

Biotalys further strengthened its Board of

Directors with the appointment of Michiel van Lookeren

Campagne, a prominent industry leader in plant science and

biotechnology who has spent decades driving scientific advances for

the agricultural industry.

- During the first

half of 2022, Biotalys also recruited key

personnel for various departments, including Marketing,

Research, and Regulatory & Sustainability. The company had a

total staff of 75 on 30 June 2022.

- Biotalys

continues to strengthen its patent portfolio to

protect its science and products. In H1 2022, three additional

patents were granted to the company as follows: in Japan related to

transgenic plants; in Canada related to an agrochemical

composition; and in Brazil related to a method for protecting and

treating plants from infection by plant pathogenic fungi.

These accomplishments will also pave the way for

Biotalys’ pipeline of product candidates, which

includes biofungicides, biobactericides and bio-insecticides.

- After announcing

the achievement of a significant breakthrough in protein expression

(more than 500% increase in production) for the bioactive

ingredient of Evoca in January 2022, which dramatically lowers

production costs, Biotalys adapted its biofungicide pipeline to

effectively capture market share. As a result, Biotalys’ current

pipeline of protein-based biocontrols is as follows:

- Biotalys

pipeline of product candidates can be summarized as follows:

-

Once approved by the U.S. Environmental Protection Agency (EPA),

Biotalys plans to launch the first generation of

Evoca for market calibration in select states in the

United States through its distribution partner Biobest, followed by

an introduction in the EU (pending EU regulatory approval).

-

The second generation of Evoca (containing the

same protein bioactive, with enhanced manufacturing and

formulation) is currently in the development stage and on track to

be submitted to the EPA in the U.S. for follow-on

registration.

-

The third generation of Evoca (containing the same

protein bioactive, with further optimized manufacturing and

formulation) has progressed into the development stage and is

planned to enter both the US and the EU markets by 2026. The

company expects this third generation of Evoca to generate positive

cashflow margins, which will not be the case for the first and

second generation of Evoca in view of current production

costs.

-

BioFun-6 continues to progress according to plan,

allowing Biotalys to focus on throughput and selection capacity,

increasing the probability of success and a differentiating offer

in the field of fruit and vegetables protection by 2028.

-

BioFun-7 was initiated at the beginning of H1 and

is progressing as per plan with a number of academic partnerships

in preparation as well as internal development of methods and

assays to perform the first work packages.

-

The other pipeline programs (BioIns-1, BioBac-1,

BioFun-2 and BioFun-4) are expected to provide valuable IP and

know-how, strengthening the company’s AGROBODY Foundry platform and

could form the basis of further R&D collaborations.

* Evoca™: Pending Registration. This product is

not currently registered for sale or use in the United States, the

European Union, or elsewhere and is not being offered for sale.

Selected financial information

|

In € thousands |

June 30, 2022 |

June 30, 2021 |

|

| |

|

Other operating income |

1,140 |

831 |

|

|

Research and development expenses |

(7,574) |

(6,275) |

|

|

General and administration expenses |

(2,596) |

(2,241) |

|

|

Marketing expenses |

(718) |

(677) |

|

|

Other operating expenses |

- |

(1) |

|

|

Operating loss |

(9,748) |

(8,363) |

|

|

Loss of the period |

(9,892) |

(7,158) |

|

|

Net cash used in operations |

(9,559) |

(7,345) |

|

|

Net cash outflow of the period |

(10,547) |

(7,637) |

|

| Cash

and cash equivalents |

45,560 |

15,465 |

|

-

Other operating income amounted to €1.1 million and relates to

R&D tax incentives received and grants awarded to support

R&D activities. The increase mainly relates to grants to

support Biotalys’ R&D activities, which accounted for €1.0

million for the six months ended 30 June 2022 (H1 2021: €0.4

million).

-

Research and development expenses amounted to €7.6 million for the

first half of 2022, an increase of €1.3 million compared to the

same period of 2021. These increases primarily relate to higher

spending for external development (+€0.4 million) and field trial

costs (+€0.4 million) in preparation for the market calibration

with Evoca next year, as well as increased wage costs (+€0.3

million).

-

General and administrative expenses amounted to €2.6 million for

the first half of 2022, compared to €2.2 million in the same period

of 2021. The increase was mainly driven by higher wage costs

related to the expansion of the team.

-

Net cash used in operating activities increased by €2.3 million for

the six months ended 30 June 2022 to €9.6 million, compared to €7.3

million for the six months ended 30 June 2021. These increases

primarily relate to a €0.8 million increase in operating loss (net

of non-cash items) and changes in working capital driven by the

higher payables balance in June 2021 related to certain IPO

costs.

Outlook for the remainder of 2022 and

beyond

- Biotalys expects

to obtain the first registration for Evoca in the United States.

The U.S. Environmental Protection Agency (EPA) is currently

reviewing the regulatory dossier Biotalys submitted for Evoca end

of December 2020. Based on recent discussions with the agency, the

company now expects to obtain product registration in early 2023.

Biotalys believes this new registration timeline will have no

impact on the business plan of the company considering Evoca (first

generation) is a market calibration product.

-

The company continues to focus on the market calibration of Evoca

in selected states in the U.S., as well as on the advancement of

its ongoing discovery and development initiatives via the AGROBODY

Foundry platform. The company will consider the future net

development costs of the first and second generation of Evoca as

R&D costs.

-

Building on its most recent field trials to perfect application

timing best practices, Biotalys is now conducting trials

at-flowering sprays within IPM programs in a broader range of

commercial important crops, including berries, cucurbits and

tomatoes as it deepens field trial data from around the globe.

-

Biotalys also aims to continue selectively leveraging its AGROBODY

Foundry platform and pipeline to expand into new markets and crops,

and to secure additional strategic collaborations and create

additional value.

-

The company has reduced the expected cash burn for the full year

2022 to a range between €24 and €26 million. Savings are

anticipated for certain manufacturing, field trial and personnel

and other operating costs, and likely extended delivery times for

some equipment purchases will delay the cash impact.

-

The outcome of the ongoing feasibility study with Novozymes is

expected in early 2023, and may serve as a potential key milestone

for Biotalys and Novozymes to enter into development, supply and

commercialization agreements for a future generation of Evoca.

Auditor Statement

The condensed consolidated financial statements

for the six-months’ period ended 30 June 2022 have been prepared in

accordance with IAS 34 ‘Interim Financial Reporting’ as adopted by

the European Union. They do not include all the information

required for the full annual financial statements and should

therefore be read in conjunction with the financial statements for

the year ended 31 December 2021. The condensed consolidated

financial statements are presented in thousands of Euros (unless

stated otherwise). The condensed consolidated financial statements

have been approved for issue by the Board of Directors. The

statutory auditor, Deloitte Bedrijfsrevisoren/Reviseurs

d’Entreprises, represented by Pieter-Jan Van Durme, has performed a

limited review of the interim financial report. The interim

financial report 2022 and the review opinion of the auditor are

available on www.biotalys.com.

Upcoming IR events

- 13 September

2022: Biotalys’ CFO and Head of IR will meet with investors at the

Berenberg’s Food & Chemical Conference in London (UK)

- 15 September

2022: Biotalys’ CEO, CFO and Head of IR will meet with investors at

the Kepler Cheuvreux / Belfius Autumn Conference in Paris

(France)

- 29 September

2022: Biotalys’ CEO, CFO and Head of IR will meet investors at the

Sustainability Conference organized by KBC Securities

(virtual)

-End-

Live webcast and conference call

Company management will host a live webcast to

discuss its half-year 2022 results and recent business performance

today, 19 August 2022 at 16:00 CEST / 15:00 BST / 10:00 EDT.

Webcast link:

https://edge.media-server.com/mmc/p/4pfcgtba

Dial-in details: To ask questions live to the

management, please also register for the conference call via

https://register.vevent.com/register/BIf4c5b351b875442796b58a40eb9c0faf.

About Biotalys

Biotalys is an Agricultural Technology (AgTech)

company protecting crops and food with proprietary protein-based

biocontrol solutions and aiming to provide alternatives to

conventional chemical pesticides for a more sustainable and safer

food supply. Based on its novel AGROBODY™ technology platform,

Biotalys is developing a strong and diverse pipeline of effective

product candidates with a favorable safety profile that aim to

address key crop pests and diseases across the whole value chain,

from soil to plate. Biotalys was founded in 2013 as a spin-off from

the VIB (Flanders Institute for Biotechnology) and has been listed

on Euronext Brussels since July 2021. The company is based in the

biotech cluster in Ghent, Belgium. More information can be found on

www.biotalys.

For further information, please

contact

Toon Musschoot, Head of IR & CommunicationT:

+32 (0)9 274 54 00E: Toon.Musschoot@biotalys.com

Important

Notice

Biotalys, its business, prospects and financial

position remain exposed and subject to risks and

uncertainties. A description of these risks and uncertainties

can be found in the annual report on the consolidated annual

accounts 2021 (see item 11.12 on p. 151 and chapter 2 on p.

159-171).

This announcement contains statements which are

"forward-looking statements" or could be considered as such. These

forward-looking statements can be identified by the use of

forward-looking terminology, including the words ‘aim’, 'believe',

'estimate', 'anticipate', 'expect', 'intend', 'may', 'will',

'plan', 'continue', 'ongoing', 'possible', 'predict', 'plans',

'target', 'seek', 'would' or 'should', and contain statements made

by the company regarding the intended results of its strategy. By

their nature, forward-looking statements involve risks and

uncertainties and readers are warned that none of these

forward-looking statements offers any guarantee of future

performance. Biotalys’ actual results may differ materially from

those predicted by the forward-looking statements. Biotalys makes

no undertaking whatsoever to publish updates or adjustments to

these forward-looking statements, unless required to do so by

law.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

| ASSETS

(in thousands of euros) |

Note |

30 June 2022 |

31 December 2021 |

|

| |

|

Non-current assets |

|

11,089 |

11,336 |

|

|

Intangible assets |

|

631 |

665 |

|

|

Property, plant and equipment |

5 |

5,382 |

5,407 |

|

|

Right-of-use assets |

|

3,610 |

3,885 |

|

| Other

non-current assets |

|

1,466 |

1,380 |

|

|

|

|

|

|

|

|

Current assets |

|

48,956 |

58,938 |

|

|

Receivables |

|

503 |

451 |

|

| Other

financial assets |

|

2,100 |

2,100 |

|

| Other

current assets |

6 |

793 |

279 |

|

| Cash

and cash equivalents |

7 |

45,560 |

56,107 |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

60,045 |

70,274 |

|

|

EQUITY AND LIABILITIES(in thousands of

euros) |

Note |

30 June 2022 |

31 December 2021 |

|

|

|

|

|

|

|

|

|

|

Equity attributable to owners of the parent |

|

50,004 |

|

58,915 |

|

|

| Share

capital |

|

82,094 |

|

81,969 |

|

|

| Share

premium |

|

31,394 |

|

31,303 |

|

|

|

Accumulated losses |

|

(65,747 |

) |

(55,855 |

) |

|

| Other

reserves |

|

2,263 |

|

1,498 |

|

|

|

|

|

|

|

|

|

Total equity |

|

50,004 |

|

58,915 |

|

|

| |

|

|

|

|

|

Non-current liabilities |

|

5,710 |

|

6,150 |

|

|

|

Borrowings |

8 |

5,591 |

|

6,037 |

|

|

|

Employee benefits obligations |

|

30 |

|

26 |

|

|

|

Provisions |

|

88 |

|

87 |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

4,331 |

|

5,209 |

|

|

|

Borrowings |

8 |

1,119 |

|

1,186 |

|

|

| Trade

and other liabilities |

|

2,254 |

|

3,119 |

|

|

| Other

current liabilities |

|

958 |

|

904 |

|

|

|

Total liabilities |

|

10,041 |

|

11,359 |

|

|

|

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES |

|

60,045 |

|

70,274 |

|

|

The accompanying notes are an integral part of

these condensed consolidated financial statements. Please see the

full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND

OTHER COMPREHENSIVE INCOME FOR THE 6 MONTHS

ENDED 30 JUNE

|

in € thousands |

Note |

2022 |

|

2021 |

|

| Other

operating income |

9 |

1,140 |

|

831 |

|

|

Research and development expenses |

10 |

(7,574 |

) |

(6,275 |

) |

| General

and administrative expenses |

10 |

(2,596 |

) |

(2,241 |

) |

| Sales

and marketing expenses |

10 |

(718 |

) |

(677 |

) |

| Other

operating expenses |

10 |

- |

|

(1 |

) |

|

Operating loss (EBIT) |

|

(9,748 |

) |

(8,363 |

) |

|

Financial income |

11 |

141 |

|

1,322 |

|

|

Financial expenses |

|

(269 |

) |

(110 |

) |

|

Loss before taxes |

|

(9,877 |

) |

(7,151 |

) |

| Income

taxes |

|

(15 |

) |

(7 |

) |

|

LOSS FOR THE PERIOD |

|

(9,892 |

) |

(7,158 |

) |

|

|

|

|

|

|

Other comprehensive income (OCI) |

|

|

|

|

Items of OCI that will be reclassified subsequently to profit or

loss |

|

|

|

|

Exchange differences on translating foreign operations |

|

9 |

|

1 |

|

|

|

|

|

|

|

TOTAL COMPREHENSIVE LOSS OF THE PERIOD |

|

(9,883 |

) |

(7,157 |

) |

| |

|

|

|

|

Basic and diluted loss per share (in €) |

12 |

(0.32 |

) |

(9.54 |

) |

| |

|

|

|

|

Loss for the period attributable to the owners of the Company |

|

(9,892 |

) |

(7,158 |

) |

| |

|

|

|

|

Total comprehensive loss for the period attributable to the owners

of the Company |

|

(9,883 |

) |

(7,157 |

) |

The accompanying notes are an integral part of

these condensed consolidated financial statements. Please see the

full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY FOR THE 6 MONTHS ENDED 30

JUNE

|

(in thousands of euros) |

Attributable to equity holders of the Company |

Total Equity |

|

Share capital |

Share premium |

Other reserves |

Accumulated losses |

|

Share-based payment reserve |

Anti-dilution reserve |

Currency translation reserve |

|

Balance at 31 December 2020 |

62,822 |

675 |

1,062 |

(4,813 |

) |

20 |

(34,117 |

) |

25,648 |

|

| Share-based payments |

- |

- |

300 |

- |

|

- |

- |

|

300 |

|

| Exercise of ESOP Warrants |

- |

15 |

- |

- |

|

- |

- |

|

15 |

|

| Total comprehensive loss |

- |

- |

- |

- |

|

1 |

(7,158 |

) |

(7,157 |

) |

|

Balance at 30 June 2021 |

62,822 |

690 |

1,362 |

(4,813 |

) |

21 |

(41,276 |

) |

18,807 |

|

| (in

thousands of euros) |

Attributable to equity holders of the Company |

Total Equity |

|

Share capital |

Share premium |

Other reserves |

Accumulated losses |

|

Share-based payment reserve |

Anti-dilution reserve |

Currency translation reserve |

|

Balance at 31 December 2021 |

81,969 |

31,303 |

1,473 |

|

- |

25 |

(55,855 |

) |

58,915 |

|

| Share-based payments |

- |

- |

847 |

|

- |

- |

- |

|

847 |

|

| Exercise of ESOP Warrants |

125 |

91 |

(91 |

) |

- |

- |

- |

|

125 |

|

| Total comprehensive loss |

- |

- |

- |

|

- |

9 |

(9,892 |

) |

(9,883 |

) |

|

Balance at 30 June 2022 |

82,094 |

31,394 |

2,229 |

|

- |

34 |

(65,747 |

) |

50,004 |

|

The accompanying notes are an integral part of

these condensed consolidated financial statements. Please see the

full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE 6 MONTHS ENDED 30 JUNE

|

in € thousands |

Note |

2022 |

|

2021 |

|

| |

|

|

|

| CASH FLOW FROM

OPERATING ACTIVITIES |

|

|

|

|

Operating result |

|

(9,748 |

) |

(8,363 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

Depreciation, amortization and impairments |

|

771 |

|

747 |

|

|

Share-based payment expense |

|

855 |

|

301 |

|

|

Changes in provisions |

|

4 |

|

13 |

|

|

R&D tax credit |

|

(203 |

) |

(186 |

) |

|

Loss on disposal of fixed assets |

|

- |

|

6 |

|

|

Other |

|

- |

|

1 |

|

|

|

|

|

|

| Changes

in working capital: |

|

|

|

|

Receivables |

|

(52 |

) |

(83 |

) |

|

Other current assets |

|

(397 |

) |

(292 |

) |

|

Trade and other payables |

|

(831 |

) |

899 |

|

|

Other current liabilities |

|

62 |

|

(371 |

) |

|

Cash used in operations |

|

(9,539 |

) |

(7,328 |

) |

|

|

|

|

|

| Taxes

paid |

|

(20 |

) |

(17 |

) |

|

|

|

|

|

|

Net cash used in operating activities |

|

(9,559 |

) |

(7,345 |

) |

| |

|

|

|

| CASH FLOW FROM

INVESTING ACTIVITIES |

|

|

|

|

Purchases of property, plant and equipment |

5 |

(328 |

) |

(975 |

) |

|

Purchases of intangible assets |

|

- |

|

(53 |

) |

|

Proceeds from disposal of PPE |

|

- |

|

3 |

|

|

Investments in other financial assets |

|

- |

|

(1,500 |

) |

|

|

|

|

|

|

Net cash used in investing activities |

|

(328 |

) |

(2,526 |

) |

| |

|

|

|

| CASH FLOW FROM

FINANCING ACTIVITIES |

|

|

|

|

Proceeds from borrowings and other financial liabilities |

8 |

- |

|

2,780 |

|

|

Repayment of borrowings |

8 |

(207 |

) |

(68 |

) |

|

Repayment of lease liabilities |

|

(416 |

) |

(422 |

) |

|

Interests paid |

|

(164 |

) |

(71 |

) |

|

Proceeds from issue of equity instruments of the Company (net of

issue costs) |

|

126 |

|

15 |

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

(661 |

) |

2,234 |

|

| |

|

|

|

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

(10,547 |

) |

(7,637 |

) |

| |

|

|

|

|

CASH AND CASH EQUIVALENTS at beginning of period |

|

56,107 |

|

23,103 |

|

| CASH

AND CASH EQUIVALENTS at end of period, calculated |

|

45,560 |

|

15,465 |

|

The accompanying notes are an integral part of

these condensed consolidated financial statements. Please see the

full interim report available on www.biotalys.com.

- Biotalys rapporteert financiële resultaten en hoogtepunten voor

het eerste halfjaar van 2022_NL

- Biotalys Reports HY 22 Financial Results and Business

Highlights_ENG_final

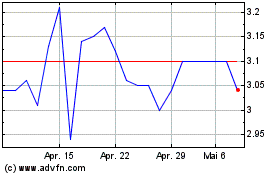

Biotalys (EU:BTLS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Biotalys (EU:BTLS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024