- Revenue of €28.4m (+1.7% compared with the 1st half-year

2023)

- EBITDA margin at 11%

- Cash position of €4.2m

- Simplified tender offer project initiated by Kenerzeo1 for

all Groupe Berkem shares it will not hold, at a price of €3.10 per

share

Regulatory News:

Groupe Berkem, a leading player in plant-based chemistry

(ISIN code: FR00140069V2 - mnemonic: ALKEM), announces its

half-year results for the financial year ended 30 June 2024, as

approved by the Board of Directors on 26 September 2024.

HALF-YEAR RESULTS 2024

Consolidated income statement

In thousands of euros

30/06/2024

30/06/2023

Variation

Revenue

28,394

27,912

1,73%

Other income

-101

16

Purchases consumed

-11,829

-12,448

External expenses

-7,010

-6,812

Personnel costs

-6,797

-7,146

Taxes

-256

-283

Depreciation and amortisation

-2,641

-1,902

Depreciation and provisions

-95

-225

Change in inventories of work in progress

and finished goods

67

329

Other operating income and expenses

602

1 079

Current operating income

334

519

-35,65%

Other operating income and expenses

2,911

5,016

Operating income

3,245

5,536

-41,38%

Cost of net financial debt

-845

-728

Other financial income and expenses

-227

-127

Income before tax

2,174

4,700

-53,74%

tax

84

-655

Income after tax

2,258

4,045

Net income, Group share

2,258

4,045

-44,18%

Breakdown of revenue by business area

for the 1st half 2024

in thousands of euros

30/06/2024

30/06/2023

Variation

Construction & Materials

11,953

12,401

-3.6%

Hygiene & Protection

5,801

6,476

-10.4%

Health, Beauty & Nutrition

9,441

8,574

+10.1%

Industry

884

374

+136.4%

Central / Shared

315

87

TOTAL

28,394

27,912

+1.7%

At 30 June 2024, Berkem Group revenue totaled €28.4m, compared

with €27.9m in the first half of 2023, up by 1.7%.

The persistent difficulties affecting the "Construction &

Materials" and "Hygiene & Protection" business areas

resulted in a decline in revenue of -3.6% and -10.4% respectively

compared with the first half of 2023, in addition to the

significant delays affecting the marketing authorisations for the

Group's new products. The “Health, Beauty & Nutrition”

business area saw an improvement in revenue of 10.1% compared with

the performance achieved in the first half of 2023. In line with

previously published figures, the "Industry" business area

is continuing to enjoy strong growth, rising from €0.4m in the

first half of 2023 to €0.9m in the first half of 2024, although it

remains marginal in the Group's business mix.

Current operating income recurring declined by -36% compared

with the first half of 2023, to €0.3 million. This drop is partly

due to higher depreciation and amortization charges, but also to a

proactive investment policy in R&D, regulatory affairs and

business development aimed at supporting the Group's various areas.

In particular, the Group has intensified its resources in the

United States, with the recruitment of 3 new employees to cover the

entire American and Canadian markets.

This brings the EBITDA margin to 11%, compared with 10.4%

in the 1st half-year to 2023.

Other operating income corresponds in part to a revaluation of

the assets of Berkem IBERICA, the company Naturex Iberian Partners,

Givaudan's industrial site in Valencia (Spain), acquired by the

Group in June 1st, 2024. The net cost of debt of €845k (+16%) at 30

June 2024 is due to the increase in the level of gross debt.

After taking into account financial income and expenses, net

income attributable to the Group was €2.3m in the first half of

2024, compared with €4m in the first half of 2023.

CASH POSITION

As of 30 June 2024, Groupe Berkem had net cash of €4.2 million,

compared with €11.3 million at 31 December, 2023.

As a reminder, on July 26, 2022, the Group arranged €70m of

financing, including €63.5m of senior debt with a pool of 6 French

banks and €6.5m in Recovery Bonds. As of 30 June 2024, €45 million

of the €70 million had been used.

HIGHLIGHTS OF THE 1er HALF-YEAR 2024

External growth

February 2024: Acquisition of

Naturex Iberian Partners, Givaudan's industrial site in

Valencia (Spain) specialized in plant and marine extraction

activities, for players in the food, nutrition (nutraceuticals) and

cosmetics markets. With this acquisition, Groupe Berkem

significantly increases its production capacity for plant extracts

destined for the “Health, Beauty & Nutrition” business

area.

Activity

January 2024: Extension of the

H2OLIXIR range of 100% natural floral waters, with the launch

of lavender water and thyme water, two new 97.5% organic floral

waters for the cosmetics industry.

May 2024: Presentation of

BiombalanceTM and Pineol® Premium, two active ingredients from

the Group's new range for the Nutraceuticals market.

Proposed simplified tender offer

As announced in the press releases issued on 18 July 2024 and 31

July 2024, Kenerzeo will file a simplified tender offer for the

remaining outstanding Berkem Group shares at a price of €3.10 per

share. Kenerzeo intends to implement a squeeze-out following the

public offer in the event that the minority shareholders of the

Company who have not tendered their shares to the offer represent

less than 10% of the share capital and voting rights of Groupe

Berkem. At the date of this press release, Kenerzeo held 75.38% of

the share capital and 75.37% of the theoretical voting rights of

the Group.

On 4 September 2024, Groupe Berkem announced the appointment of

Paper Audit & Conseil, represented by Mr Xavier PAPER, as

independent expert to draw up a report on the financial terms of

the proposed simplified compulsory takeover bid by Kenerzeo for the

outstanding Groupe Berkem shares not held by Kenerzeo, to be filed

by Kenerzeo before the end of September 2024. The Group will keep

the market informed of the terms and conditions of this

assignment.

OUTLOOK

Within the framework of the transaction announced today, Groupe

Berkem has reconsidered its business plan and financial

projections. This revision takes into account the persistent

difficulties affecting the “Construction & Materials” business

area since the Ukrainian crisis, as well as delays in obtaining

marketing authorizations for its bio-based products, both in France

and internationally. Lastly, in view of the numerous investments to

be made at its new production site in Valencia, Spain, and the

ever-changing economic and geopolitical context, Groupe Berkem has

no immediate plans to make any new acquisitions in the short to

medium term.

In view of the above, Groupe Berkem now expects to achieve

revenue of at least €70 million by 2025, and an EBITDA2 margin of

at least 16% by 2027.

Availability of the 2024 half-year financial report

The interim financial statements were approved by the Board of

Directors and reviewed on 26 September 2023. The 2024 half-year

financial report will be filed with the Autorité des marchés

financiers and will be available by 31 October 2024 on the

Company's investor website.

Next financial publication :

- Revenue for the 3rd quarter of 2024: October 24, 2024

(after market close)

ABOUT GROUPE BERKEM

Founded in 1993 by Olivier Fahy, Chairman and Chief Executive

Officer, Groupe Berkem is a leading force in the bio-based

chemicals market. Its mission is to advance the environmental

transition of companies producing the chemicals used in everyday

life (Construction & Materials, Health, Beauty & Nutrition,

Hygiene & Protection, and Industry). By harnessing its

expertise in both plant extraction and innovative formulations,

Groupe Berkem has developed bio-based boosters—unique high-quality

bio-based solutions augmenting the performance of synthetic

molecules. Groupe Berkem achieved revenue of €51.9 million in 2023.

The Group has almost 250 employees working at its head office

(Blanquefort, Gironde) and 5 production facilities in Gardonne

(Dordogne), La Teste-de-Buch (Gironde), Chartres (Eure-et-Loir),

Tonneins (Lot-et-Garonne) and Valence (Spain).

Groupe Berkem has been listed on Euronext Growth Paris since

December 2021 (ISIN code: FR00140069V2 - ALKEM).

www.groupeberkem.com

____________________________ 1 Simplified joint-stock company

(RCS 928 791 813) with Kenercy as Chairman. 2 Earnings Before

Interest, Taxes, Depreciation and Amortization (EBITDA),

corresponds to the operating cash flow generated by the Group,

taking into account other operating income and other operating

expenses, but excluding depreciation and amortization and the

Group's financing policy.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926633210/en/

Groupe Berkem Olivier Fahy,

Chairman and CEO Anthony Labrugnas, Chief Financial Officer Phone:

+33 (0)5 64 31 06 60 investisseurs@berkem.com

NewCap Investor Relations

Mathilde Bohin / Nicolas Fossiez Phone: +33 (0)1 44 71 94 94

berkem@newcap.eu

NewCap Media Relations

Nicolas Merigeau Phone: +33 (0)1 44 71 94 94 berkem@newcap.eu

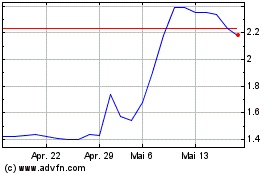

Groupe Berkem (EU:ALKEM)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Groupe Berkem (EU:ALKEM)

Historical Stock Chart

Von Nov 2023 bis Nov 2024