- Proposed capital increase with preferential subscription rights

to be carried out in January 2024 and put to a vote at an

Extraordinary General Meeting to be held on November 16, 2023

Regulatory News:

IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible for

PEA-PME plans), a medical technology company specializing in

implants for orthopedic surgery and the distribution of

technological medical equipment, today announces its revenue for

the third quarter of 2023 and the first nine months to September

30, 2023.

Ludovic Lastennet, IMPLANET’s Chief Executive Officer,

said: “Our third-quarter revenue was significantly impacted by the

under-performance recorded abroad. Faced with an economic

environment that remains complex, one of our priority objectives

for the next 12 months is to reinvigorate our presence in the

United States, a key market for our industry, notably by

strengthening our sales teams and by obtaining FDA clearance for

new products resulting from our OriginTM range and our partnership

with Sanyou Medical and its subsidiary SMTP. Regarding our export

activity, we are also intending to capitalize on our existing

partnerships, and notably our strategic alliance with Sanyou

Medical and SMTP. We are eager to initiate the distribution of our

JAZZ® platform in China, which is subject to the Chinese

authorities’ approval. This new territory should be a major future

growth driver for Implanet. Alongside our strategic partnership, we

are planning to continue our commercial development and our

proactive investment policy to establish IMPLANET as a key player

in the field of spine surgery. It is with this in mind that we

would like to invite you to attend the Extraordinary General

Meeting of November 16, the aim of which will be to approve the

resolutions enabling the launch of a capital increase with

preferential subscription rights, an operation our main shareholder

intends to extensively contribute to1”.

Third quarter of 2023

In € thousands – IFRS2

2023

2022

Change %

France

729

691

+5%

United States

228

476

-52%

Rest of the world

562

696

-19%

Spine revenue

1,518

1,863

-18%

Medical equipment (SMTP)

28

0

-

Services (MADISON)

-10

-1

Total third-quarter revenue

1,537

1,862

-17%

Spine activity generated sales of €1.52 million in the third

quarter of 2023, down 18% compared with the revenue of €1.86

million recorded in the same quarter of 2022.

Activity in France grew by 5%, with revenue of €0.73 million in

the third quarter of 2023 versus €0.69 million a year earlier. In

contrast, as mentioned at the time of the 2023 Half-Year Results

announcement, in the United States the Company recorded revenue of

€0.23 million in the third quarter of 2023 versus €0.48 million in

2022, a 52% decrease in activity. This decrease was notably a

result of the lack of sales within the framework of the partnership

with SeaSpine (which generated €93 thousand in the third quarter of

2022). Export activity in the rest of the world recorded revenue of

€0.56 million in the third quarter of 2023 versus €0.70 million in

the same period of 2022, a decrease of 19%.

The Company is also continuing the rollout of its medical

equipment distribution activity with Sanyou Medical subsidiary

SMTP’s ultrasound surgical scalpel. The revenue generated by this

activity in the third quarter of 2023 was €0.03 million.

First nine months of

2023

In € thousands – IFRS3

2023

2022

Change %

Total first-quarter revenue

2,208

2,016

+10%

Total second-quarter revenue

2,060

2,096

-2%

Total third-quarter revenue

1,537

1,862

-17%

Total nine-month

France

2,516

2,492

+1%

United States

1,046

1,278

-18%

Rest of the world

1,896

2,183

-13%

Spine revenue

5,459

5,952

-8%

Medical equipment (SMTP)

279

-

Services (MADISON)

68

21

-

Total nine-month revenue

5,806

5,974

-3%

Altogether over the first nine months of 2023, the Company

recorded revenue of €5.81 million, compared with €5.97 million over

the same period of 2022.

Spine activity generated revenue of €5.46 million in the first

nine months of 2023, versus €5.95 million in 2022. Activity was

stable in France, with revenue totaling €2.52 million. Over the

same period, activity in the United States generated revenue of

€1.05 million, compared with €1.28 million the previous year

(-18%), as a result of this under-performance in the third quarter

of 2023. Export activity in the rest of the world also fell over

the period, by 13%, totaling €1.90 million in the first nine months

of 2023 compared with €2.18 million in 2022.

The medical equipment distribution activity generated €0.28

million over the first nine months of 2023.

Cash position

As of September 30, 2023, the Company’s cash position stood at

€0.43 million4.

Implanet’s cash position not being sufficient in view of its

current operational development plan to finance business over the

coming twelve months, and in particular the needs associated with

the continued development of the Sanyou Medical project (see the

2023 half-year results publication), the Company is planning to

launch a capital increase with preferential subscription rights

that should take place in January 2024 for an amount between €5.5

million and €6.4 million (excluding the possible exercise of a

maximum 15% extension option).

Based on current business assumptions and anticipated commercial

developments with Sanyou Medical, the Company estimates that this

capital increase, for a minimum amount of €5.5 million, would give

it financial visibility of over 12 months once completed.

As the capital increase will take several months to complete

(time required to hold the General Meeting convened for November

16, time required to obtain a waiver regarding the requirement to

file a public tender offer and time required to obtain the approval

of the relevant Chinese government authorities), the Company has

been actively looking into several short-term financing options to

enable it to meet its cash requirements until the implementation of

this capital increase, favoring non-dilutive financing in the form

of non-convertible bonds.

The Company’s Board of Directors, at its meeting of October 9,

2023, therefore authorized short-term financing of up to €1.3

million nominal in non-convertible bonds through two investors who

are not shareholders in the Company5. These non-convertible bonds,

subscribed in cash for €1.0 million via the issuance of 260 bonds

with a nominal value of €5,000 subscribed at 77% of the bond’s

nominal value, are subject to two tranches each representing a

nominal amount of €0.65 million subscribed at 77% of the par value

through the issuance of 130 bonds per tranche. The Company received

the sum of €0.5 million corresponding to the first tranche drawdown

on October 9, 2023.

On the basis of current cash forecasts and in the absence of any

new sources of financing being obtained, the drawdown of the first

tranche enables the Company to be financed through to December 31,

2023.

Reminder of 2023

highlights

- Commercial launch of the SMTP (Sanyou Medical subsidiary)

ultrasound scalpel in March 2023;

- FDA clearance of the SqualeTM range of anterior cervical cages

the United States;

- Commercial launch in Europe of the MIS range, a minimally

invasive pedicle screw positioning system;

- Proposed capital increase with preferential subscription rights

to be carried out in January 2024 to strengthen the Company’s

capital and enable its commercial development, to be voted on at an

Extraordinary General Meeting scheduled for November 16, 2023.

Upcoming financial

publication

- 2023 Full-Year Revenue, on January 23, 2024, after

market close

About IMPLANET Founded in 2007, IMPLANET is a medical

technology company that manufactures high-quality implants for

orthopedic surgery and distributing medical technology equipment.

Its activity revolves around a comprehensive innovative solution

for improving the treatment of spinal pathologies (JAZZ®)

complemented by the product range offered by Orthopaedic &

Spine Development (OSD), acquired in May 2021 (thoraco-lumbar

screws, cages and cervical plates). Implanet’s tried-and-tested

orthopedic platform is based on the traceability of its products.

Protected by four families of international patents, JAZZ® has

obtained 510(k) regulatory clearance from the Food and Drug

Administration (FDA) in the United States, the CE mark in Europe

and ANVISA approval in Brazil. In 2022, IMPLANET entered into a

commercial, technological and financial partnership with SANYOU

MEDICAL, China's second largest medical device manufacturer.

IMPLANET employs 43 staff and recorded a consolidated revenue of

€8.0 million in 2022. Based near Bordeaux in France, IMPLANET

opened a US subsidiary in Boston in 2013. IMPLANET is listed on the

Euronext Growth market in Paris. For further information, please

visit www.Implanet.com.

Disclaimer This press release contains forward-looking

statements about Implanet and its business. Implanet believes that

these forward-looking statements are based on reasonable

assumptions. However, no assurance can be given that the forecasts

expressed in these forward-looking statements will materialize, as

they are subject to risks, including those described in Implanet's

reference document filed with the Autorité des marchés financiers

(AMF) on April 16, 2018 under number D.18-0337 and in the annual

financial report for December 31, 2022, which are available on the

Company's website (www.implanet-invest.com), and to changes in

economic conditions, financial markets and the markets in which

Implanet operates. The forward-looking statements contained in this

press release are also subject to risks that are unknown to

Implanet or that Implanet does not currently consider material. The

occurrence of some or all of these risks could cause Implanet's

actual results, financial condition, performance or achievements to

differ materially from those expressed in the forward-looking

statements. This press release is for information purposes only and

does not and shall not under any circumstances constitute an offer

to sell or subscribe, or the solicitation of an order to buy or

subscribe, Implanet securities in any country.

1 Sanyou Medical has pledged to subscribe to this capital

increase in cash, on an irreducible and reducible basis, at a

maximum price of €0.13, up to a maximum of €5 million, subject to

(i) the approval of Sanyou Medical's Board of Directors, (ii)

obtaining prior approval from the Autorité des Marchés Financiers

(AMF) for a waiver regarding the obligation to file a public tender

offer (in accordance with the provisions of articles 234-8 and

234-9, 2° of the AMF General Regulations) in the event of a

post-transaction crossing of the 50% capital or voting rights

threshold and (iii) the approval of the relevant Chinese government

authorities. 2 Unaudited figures 3 Unaudited figures 4 This amount

does not include the drawdown of the first €0.5 million tranche of

short-term financing granted to the Company in October 2023. 5 This

financing is not subject to any other related agreements, nor to

any guarantees or security interests in respect of the bond

subscribers. Penalties in the event of default will be applied in

the form of (i) interest at a rate of 15% from the date of default

and (ii) the issuance of Equitization Warrants until repayment of

the outstanding debt. In such a case, the issuance of these

"Equitization" warrants will be the subject of a detailed press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231017898596/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tél. : +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Mathilde Bohin Nicolas Fossiez

Tél.: +33 (0)1 44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Arthur Rouillé Tél.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

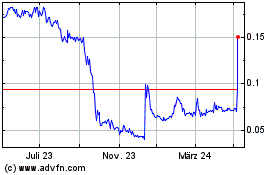

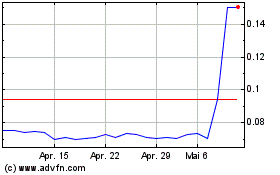

Implanet (EU:ALIMP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Implanet (EU:ALIMP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024