Clasquin: Q2 2023

27 Juli 2023 - 5:45PM

Business Wire

Strong Business Growth

Gross Profit Holding up Well

Regulatory News:

Clasquin (Paris:ALCLA):

Half-year

Quarters

H1 2023

H1 2022

Change

Like for like (lfl)***

Q2 2023/

Q2 2022

Q1 2023/

Q1 2022

CONSOLIDATED (unaudited)

Number of shipments**

163,301

154,435

+5.7%

+2.7%

+6.8%

+4.6%

Sales (€m)*

284.3

463.1

-38.6%

-45.0%

-36.7%

-40.5%

Gross profit (€m)

67.4

71.8

-6.1%

-16.1%

+1.4%

-14.1%

* Sales is not a relevant indicator of business in our sector,

as it is greatly impacted by changing air and sea freight rates,

fuel surcharges, exchange rates (particularly versus USD), etc.

Changes in the number of shipments, volumes shipped and, in

financial terms, gross profit are relevant indicators. ** The

number of shipments does not include the Timar acquisition. ***

Constant consolidation scope: excluding acquisitions of Exaciel

(01/07/22), CVL (01/07/22), Timar (28/03/23) and Log System

(01/03/22)

Q2 2023 HIGHLIGHTS

- Integration of the Timar group following Clasquin’s

acquisition of 63.52% of the share capital on 28 March 2023.

- Reminder:

- Timar is a Moroccan group specialising in the design of

innovative solutions in the fields of international transport,

logistics and goods transit. The group is listed on the Casablanca

Stock Exchange.

- 14 companies, 18 offices in 9 countries in North Africa

(Morocco, Tunisia, Mauritania), West Africa (Senegal, Mali, Ivory

Coast) and Europe (France, Spain, Portugal).

- Headcount: 424 people (30/06/2023).

- Several projects have been launched and are proceeding

according to plan (cross-selling, financial reporting, IT security,

HR policies, etc.).

- Furthermore, the mandatory takeover bid launched on 9 June 2023

was completed on 28 June 2023. At 17 July 2023, the Group held

66.01% of Timar’s capital.

MARKET AND BUSINESS REVIEW

The fall in demand combined with increased market

capacity, for both air and sea, continued to weigh on

freight rates in Q2.

The sea freight market has returned to pre-COVID levels, while

air freight rates, although also down sharply, remain higher than

in the pre-pandemic period.

Against this backdrop, as in Q1 2023, the Group succeeded in

maintaining significant business volumes in Q2, with

a 6.8% increase in the number of shipments (excluding the

Timar acquisition).

The air freight business (excluding the Timar

acquisition), up 25.0% in terms of number of shipments and

up 15.3% in terms of tonnage, made a significant contribution to

this growth thanks to new client acquisitions.

The sea freight business (excluding the Timar

acquisition), up 3.4% in terms of number of shipments and

down 1.0% in terms of number of containers shipped, performed well

amid a significant fall in volumes.

The Road brokerage business (mainly Europe from and North

Africa) grew 5.2% (excluding the Timar acquisition),

consolidating its position in the automotive industry.

Despite unit margins declining in both air freight (down 27.2%)

and sea freight (down 23.4%), consolidated gross profit rose

1.4% in Q2, driven by:

- The acquisitions of CVL (July 2022), Exaciel

(July 2022) and Timar (consolidated from 1 April 2023);

Growth at constant scope & exchange rates: down 15.6%;

- New client acquisitions, which accounted for 8.1% of

total gross profit in H1 2023 (excluding the Timar

acquisition).

Moreover, the Timar Group’s Q2 gross profit amounted to

€5.8m, in line with expectations.

This was underpinned by:

- The acquisition of new clients in the Overseas (air/sea)

business;

- The strength of Road brokerage flows between Europe and

North Africa, driven by a buoyant Euromed market.

Europe-Africa flows accounted for 22% of the Group’s gross

profit in H1 2023 (versus 12% for FY 2022).

BREAKDOWN BY BUSINESS LINE

NUMBER OF SHIPMENTS (excl.

Timar)

GROSS PROFIT (€m)

At current scope

and exchange rates

H1 2023

H1 2022

Change

H1 2023/

H1 2022

Change

Q2 2023/

Q2 2022

H1 2023

H1 2022

Change

H1 2023/

H1 2022

Change

Q2 2023/

Q2 2022

Sea freight

65,951

66,929

-1.5%

+3.4%

33.3

39.8

-16.3%

-19.6%

Air freight

42,595

35,361

+20.5%

+25.0%

18.2

20.9

-13.1%

-5.6%

Road brokerage*

37,245

35,273

+5.6%

+5.2%

12.1

7.4

+63.4%

+105.3%

Other (rail, customs, logistics)

17,510

16,872

+3.8%

-11.1%

3.8

3.3

+15.3%

+57.5%

TOTAL OVERSEAS BUSINESS

163,301

154,435

+5.7%

+6.8%

67.4

71.4

-5.7%

+1.5%

Log System**

-

0.4

N/A

N/A

Consolidation entries

-

(0.1)

N/A

N/A

TOTAL CONSOLIDATED

67.4

71.8

-6.1%

+1.4%

* Road brokerage includes the road haulage business previously

included in “Other businesses” and the RORO business (roll on/roll

off: combined road + sea transport (trailers or trucks on ships))

** Disposal of LOG System on 01/03/2022

VOLUMES

H1 2023

H1 2022

Change

H1 2023/

H1 2022

Change

Q2 2023/

Q2 2022

Sea freight

129,409 TEUs*

134,441 TEUs*

-3.7%

-1.0%

Air freight

33,472T**

33,572T**

-0.3%

+15.3%

* Twenty-foot equivalent units ** Tons

2023 OUTLOOK

2023 MARKET

- International trade by volume: up 1.0% (source: WTO)

- Air freight by volume: down 4.3% (source: IATA)

- Sea freight by volume: down 2.5-5%

CLASQUIN 2023

Business (volumes): outperform market growth Unit margins:

return to normalised margin

UPCOMING EVENTS

(publication after-market closure)

- Wednesday 13 September 2023

- Tuesday 07 November 2023

H1 2023 results

Q3 2023 business report

CLASQUIN is an air and sea freight forwarding

and overseas logistics specialist. The Group designs and manages

the entire overseas transport and logistics chain, organising and

coordinating the flow of client shipments between France and the

rest of the world and, more specifically, to and from Asia-Pacific,

North America, North Africa and sub-Saharan Africa. Its shares are

listed on EURONEXT GROWTH, ISIN FR0004152882, Reuters ALCLA.PA,

Bloomberg ALCLA FP. Read more at www.clasquin.com. CLASQUIN

confirms its eligibility for the share savings plan for MSCs

(medium-sized companies) in accordance with Article D. 221-113-5 of

the French Monetary and Financial Code established by decree number

2014-283 of 4 March 2014 and with Article L. 221-32-2 of the French

Monetary and Financial Code, which set the conditions for

eligibility (less than 5,000 employees and annual sales of less

than €1,500m or balance sheet total of less than €2,000m). CLASQUIN

is listed on the Enternext© PEA-PME 150 index. LEI:

9695004FF6FA43KC4764

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230727931599/en/

CLASQUIN Philippe LONS – Deputy Managing Director/Group

CFO Domitille CHATELAIN – Group Head of Communication &

Marketing Tel.: +33 (0)4 72 83 17 00

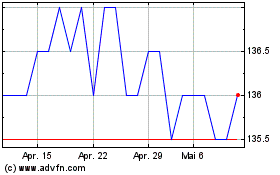

Clasquin (EU:ALCLA)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Clasquin (EU:ALCLA)

Historical Stock Chart

Von Mai 2023 bis Mai 2024