Regulatory News:

BIOSYNEX (FR0011005933/ Mnemonic : ALBIO) (Paris: ALBIO),

a major player in public health, today announces the great success

of its capital increase without shareholders' preferential

subscription rights for a final amount of € 15 million through an

offering to qualified French and international investors (“the

Transaction”) carried out by accelerated bookbuilding. The order

book was largely covered, based on sustained demand from new and

existing institutional investors, totaling € 20.24m.

The Transaction leaded to the issue of 882,352 new shares with a

unit par value of € 0.10, i.e. 9.64% of the Company's current share

capital, at a price per share of € 17.00 (issue premium included),

for a total amount of €14,999,984 (or 8.79% of the post-transaction

share capital of the Company).

Following the Transaction, the Company's share capital now

consists of 10,036,337 shares with a par value of €0.10 each. Based

on the available cash (€ 11.08 million as of June 30, 2020) and its

forecast income and expenses, the amount raised as a result of the

Transaction should enable the Company to achieve its strategic

objectives and to cover its working capital needs well beyond the

next 12 months.

Larry ABENSUR, Chairman and CEO, said on this occasion: « We

would like to thank the long-standing shareholders for having

participated in this fundraising which demonstrates their

involvement and their confidence in the Company and are delighted

to welcome new investors, particularly foreign investors, to

BIOSYNEX's share capital..»

USE OF PROCEEDS

The funds raised will enable the Group to accelerate its

development towards new outlets through external growth operations.

These external growth operations will aim to complete its range of

rapid visual tests with small, rapid, and connected diagnostic

equipment.

MAIN CHARACTERISTICS OF THE TRANSACTION

A total number of 882,352 new ordinary shares, with a unit par

value of €0.10, were issued to 23 qualified investors, including 9

foreign investors (Europe), within the meaning of article 2 (e) of

Regulation (EU) No. 2017/1129 of June 14, 2017, as referred to in 1

° of Article L.411-2 of the Monetary and Financial Code, in

accordance with the 9th resolution of the General Meeting of the

Company held on June 8, 2020.

The new shares were issued by decisions of the Board of

Directors of January 28, 2021 and of the Chairman and CEO of

January 28, 2021, in accordance with the delegation of authority

conferred by the 9th resolution approved by the General Meeting of

the Company held on June 8, 2020.

The issue price of the new shares was set at €17.00 per share,

representing a discount of 17.62% compared to the volume-weighted

average of the BIOSYNEX share on the Euronext Growth Paris market

of the quoted prices of the last five (5) trading sessions prior to

the price being set (ie from January 22 to January 28, 2021), i.e.

€20.635 , and a discount of 13.27% compared to the BIOSYNEX share

closing price on January 28, 2021, i.e. €19.60, in accordance with

the decisions of the Board of Directors of January 28, 2021, taken

pursuant to the 9th resolution of the General Meeting held on June

8, 2020, which set the maximum authorized discount at 20% of the

average weighted prices of the quoted prices of the last five (5)

trading sessions preceding the fixing of the price.

BIOSYNEX's share capital will consist of 10,036,337 shares

following the settlement-delivery of the capital increase.

To the best of the Company's knowledge, the shareholder base

before and after the completion of the Transaction is as

follows:

Before completion of the

Transaction

After completion of the

Transaction

Actionnaires

# of shares

% of capital

#of voting rights

% of voting rights

# of shares

% of capital

#of voting rights

% of voting rights

ALA FINANCIERE

3 694 406

40,36%

5 975 434

45,60%

3 694 406

36,81%

5 975 434

42,72%

Larry ABENSUR

187 666

2,05%

348 332

2,66%

187 666

1,87%

348 332

2,49%

Larry ABENSUR Family

2 001

0,02%

2 002

0,02%

2 001

0,02%

2 002

0,01%

Sub total ABENSUR

Family

3 884 073

42,43%

6 325 768

48,27%

3 884 073

38,70%

6 325 768

45,23%

AJT FINANCIERE

1 000 138

10,93%

2 000 276

15,26%

1 000 138

9,97%

2 000 276

14,30%

Thomas LAMY

144 060

1,57%

288 120

2,20%

144 060

1,44%

288 120

2,06%

Sub total Thomas LAMY

1 144 198

12,50%

2 288 396

17,46%

1 144 198

11,40%

2 288 396

16,36%

AXODEV

303 061

3,31%

606 122

4,63%

303 061

3,02%

606 122

4,33%

Thierry PAPER

60 936

0,67%

121 872

0,93%

60 936

0,61%

121 872

0,87%

Sub total Thierry

PAPER

363 997

3,98%

727 994

5,56%

363 997

3,63%

727 994

5,21%

Public

3 761 717

41,09%

3 761 717

28,71%

4 644 069

46,27%

4 644 069

33,20%

Total

9 153 985

100%

13 103 875

100%

10 036 337

100,00%

13 986 227

100,00%

For illustration purposes, the participation of a shareholder

holding 1% of the Company's share capital prior to the Transaction

will be diminished to 0.91%.

ADMISSION TO TRADING OF NEW SHARES

The new shares will bear dividend rights and will be admitted to

trading on the Euronext Growth Paris market under the same ISIN

code FR0011005933 - ALBIO. The settlement and delivery of the new

shares and their admission to trading on the Euronext Growth Paris

market are scheduled for February 2, 2021.

The information presented in this press release is issued at the

end of the placement of the shares by accelerated bookbuilding,

which is now closed, but remains conditional on the correct

execution of the settlement-delivery operations.

Pursuant to the provisions of article L.411-2 of the Monetary

and Financial Code and article 1.4 of Regulation (EU) 2017/1129 of

the European Parliament and of the Council of June 14, 2017, the

Offer has not given and will not give rise to the preparation of a

prospectus subject to the approval of the Autorité des marchés

financiers (the “AMF”).

RISK FACTORS

The main risk factors associated with the Transaction are listed

below:

- The market price of the Company's shares could fluctuate and

fall below the subscription price of the new shares issued in the

context of the Transaction;

- Due to stock market fluctuations, the volatility and liquidity

of the Company's shares could vary significantly;

- Sales of Company shares could occur on the secondary market,

after completion of the Transaction and have an unfavorable impact

on the Company's share price;

- The Company has not paid dividends during the last three fiscal

years.

Detailed information concerning the Company, in particular

relating to its activity and its results, appears in the management

report of the Company for the financial year ended on December 31,

2019, which can be consulted, as well as the other regulated

information and all Company press releases on its website

(www.biosynex.com).

TRANSACTION PARTNERS

Lead Partner and

Bookrunner

Transaction Advisory

Legal Counsel

Financial

communication

STIFEL

EuroLand Corporate

fieldfisher

capvalue

About BIOSYNEX

Created in 2005 and based in Illkirch-Graffenstaden in Alsace, a

major player in public health with more than 180 employees, the

French laboratory BIOSYNEX designs, manufactures and distributes

Rapid Diagnostic Tests (RDTs). In their professional version, they

offer better medical care for patients thanks to the speed of their

results and their ease of use. In their self-test version, they

allow the general public to self-monitor various pathologies, thus

ensuring better prevention and accelerating the demand for care.

Leader on the RDT market in France, BIOSYNEX is the only player to

fully control its value chain thanks to its technological platform

that can be used in many applications and adapted to different

types of users such as laboratories, hospitals, doctors and General

public.

More information on www.biosynex.com

Disclaimer

This press release, and the information it contains, does not

constitute an offer to sell or subscribe, nor a solicitation of an

order to buy or subscribe, for BIOSYNEX shares in any country.

This press release constitutes a promotional communication and

not a prospectus within the meaning of Regulation (EU) No.

2017/1129 of the European Parliament and of the Council of June 14,

2017 (the “Prospectus Regulation”).

In the Member States of the European Economic Area and in the

United Kingdom, this communication and any offers which may follow

it are addressed exclusively to persons who are “qualified

investors” within the meaning of article 2 (e) of Prospectus

Regulations.

This press release does not constitute an offer to sell any

securities or any solicitation of an offer to buy or subscribe for

securities in the United States of America. BIOSYNEX shares, or any

other security, may only be offered or sold in the United States of

America following registration under the US Securities Act of 1933,

as amended (the "Securities Act ”), or as part of an exemption from

this registration obligation, it being specified that the shares of

the company BIOSYNEX have not been and will not be registered under

the US Securities Act. BIOSYNEX does not intend to register the

offering in whole or in part in the United States of America or to

make a public offering in the United States of America.

Regarding the United Kingdom, the distribution of this press

release is not made by and has not been approved by an authorized

person within the meaning of Article 21 (1) of the Financial

Services and Markets Act 2000. Accordingly, the press release is

addressed only to persons who (i) are investment professionals

within the meaning of section 19 (5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 (as currently in

force, hereinafter the “Financial Promotion Order”), (ii) are

referred to in article 49 (2) (a) to (d) (“high net worth

companies, unincorporated associations etc. ”) Of the Financial

Promotion Order, (iii) are outside the United Kingdom (all such

persons being together referred to as the “Qualified Persons”).

This press release is addressed only to Authorized Persons and may

not be used by anyone other than an Authorized Person.

This press release contains information on BIOSYNEX's objectives

as well as forward-looking statements. This information is not

historical data and should not be interpreted as a guarantee that

the facts and data stated will occur. This information is based on

data, assumptions and estimates considered reasonable by BIOSYNEX.

The latter operates in a competitive and rapidly changing

environment. It is therefore not in a position to anticipate all

the risks, uncertainties or other factors likely to affect its

activity, their potential impact on its activity or to what extent

the materialization of a risk or a combination of risks could have

results that are significantly different from those mentioned in

any forward-looking information. This information is given only as

of the date of this press release. BIOSYNEX makes no commitment to

publish updates to this information or the assumptions on which it

is based, except for any legal or regulatory obligation that may

apply to it.

The distribution of this press release may, in certain

countries, be subject to specific regulations. Accordingly, persons

physically present in these countries and in which the press

release is disseminated, published, or distributed must inform

themselves and comply with these laws and regulations.

This press release must not be

published, transmitted, or distributed, directly or indirectly, in

the territory of the United States of America, Australia, Canada or

Japan.

This press release may not be released,

published, or distributed, directly or indirectly, in the United

States, Canada, Japan or Australia. This press release does not

constitute an offer and is provided for informational purposes

only.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210129005166/en/

BIOSYNEX Larry Abensur Chairman & CEO

abensur@biosynex.com

EuroLand Corporate Julia Bridger Listing Sponsor +33 1 44

70 20 84 jbridger@elcorp.com

cap value Gilles Broquelet Financial communication + 33 1

80 81 50 00 gbroquelet@capvalue.fr

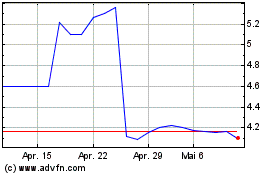

Biosynex (EU:ALBIO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Biosynex (EU:ALBIO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024