Maker (MKR) Price Continues to Climb Higher Level, Will It Surpass $1500?

26 September 2023 - 1:58PM

NEWSBTC

Maker DAO’s MKR has recorded a big push amid the slight uptick in

the broader cryptocurrency market. Yesterday, September 25, the

token rose from a low of $1,265 to a high of $1,343. Although

most tokens struggle to recover, MKR consolidated on its upswing

with an impressive 5% 24-hour increase. MKR trades at $1335,

striding to conquer the critical resistance at $1,350. Its

latest strides show buyers are in control, and their activity could

facilitate more gains for MKR. But is the bullish momentum strong

enough to push MKR to the $1,500 price mark? Let’s find out.

Related Reading: Market Analysts Outline When The First Spot

Bitcoin ETF Will Be Approved MKR Stands Among Top-gaining

Cryptocurrencies MKR ranked number one among today’s top-gaining

cryptocurrencies, gapping Chainlink and Bitcoin Cash by 2%. This

comes while the overall crypto market cap recorded a slight uptick

of 0.63%, with the trading volume down 4%, indicating a decline in

trading activity. However, amid the sparse buying activities in the

general market, MKR recorded a 47% increase in trading

volume. This observation depicts increased buy action in the

Maker market. But while this increased buying strength could fuel

the coin’s price rally, it’s important to identify the factors

behind it. The buzz around the new proposal to deploy Spark

Protocol on zkSync Era Mainnet has boosted investor sentiment. This

proposal will include wETH, rETH, wstETH, and DAI as initial

collaterals for borrowing on the Spark Protocol. Also, if adopted,

the proposal will set a 2 million liquidity goal to spur Spark

Protocol’s growth on zkSync. Already, 100% of the Maker community

voted yes to launching Spark on Gnosis Chain. This development

makes DAI, Maker DAO’s stablecoin, the native gas token of Gnosis

Chain. In addition, it allows users to earn increased yield when

lending their DAI tokens. Given this benefit, this

development yielded positive sentiment in the Maker ecosystem. This

positive sentiment must have translated into increased demand for

MKR, the governance token of the Maker protocol, a plausible reason

behind the surge in trading activities. MKR Strives To

Conquer The Key Resistance Level: Is $1,500 Possible? The daily

chart shows that MKR has formed two consecutive bullish

candlesticks around the $1,300 price. This set-up depicts high

token demand and increased buying strength around this zone.

The increased buy actions have pushed MKR above a key support level

of $1,086 and a critical moving average of $1,166. But, the bulls

met strong opposition at the $1,354. The sell activities from

profit-taking traders, evident in forming two bearish candlesticks

at this level, hinder further strides. Furthermore, MKR has

remained a few pipes below $1,354 since opening today’s trading

session at $1,338. However, the Relative Strength Index,

which increased from 63 to 64.97, approaching the overbought area,

signals rising buying strength. It suggests that more buyers are

entering longer positions, ready to counter the selling pressure

resisting rally. Related Reading: Bitcoin Price Predictions

For 2024: Insights From Major Banks To Hedge Funds Suppose buyers

maintain the ongoing momentum; a breakout above $1,354 and a move

towards $1,500 before the day ends is possible. Featured image from

Pixabay and chart from TradingView.com

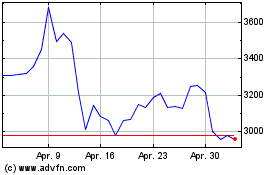

stETH (COIN:STETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024