Is A Major Bitcoin Dip Coming? What the Coinbase Index Tells Us

31 Juli 2024 - 5:00AM

NEWSBTC

An analyst from the CryptoQuant QuickTake platform has now drawn

attention to a particular trend tied to the Coinbase Premium Index

(CPI) which currently suggests a grim move brewing for Bitcoin.

This indicator, when placed with its Simple Moving Average over 14

days (SMA14), has often shown a significant correlation with

Bitcoin’s selling pressure, shedding light on how crucial its

impact is on the market. Bull or Bear: What the Coinbase Index

Tells Us Before diving into what the Coinbase Premium Index is

currently signalling for Bitcoin, it is worth explaining further

the essence of this indicator to grasp the credibility of it.

Notably, the Coinbase Premium Index (CPI) is an analytical tool

that measures the variance between Bitcoin’s price on Coinbase Pro

and its price on other major exchanges. A negative CPI value

suggests that Bitcoin is trading at a lower price on Coinbase Pro

compared to other platforms, which typically indicates a selling

pressure in the US market. Related Reading: Bitcoin Eyes $63,000:

Key Indicators Signal Further Decline – Time To Sell? According to

the CryptoQuant analyst with the name ‘burakkesmeci,’ this

phenomenon has been observed more frequently after the US approved

the trading of spot exchange-traded funds (ETFs), which currently

seems to have amplified the significance of CPI as a leading

indicator. When Coinbase Premium Index is below SMA14, selling

pressure increases “Examining the data for 2024, we clearly see

that Bitcoin price corrections have occurred when the CPI (Coinbase

Premium Index) fell below its’ SMA14.” – By @burak_kesmeci Link

👇https://t.co/Bc3N1cfh5W pic.twitter.com/tN99LNhNkr —

CryptoQuant.com (@cryptoquant_com) July 30, 2024 The analyst

disclosed that for 2024, the data reveals a clear pattern: Bitcoin

often faces price corrections when the CPI dips below its SMA14.

This specific behaviour points to a bearish sentiment when the

index falls short of the moving average, signaling increased

selling activity. Currently, the CPI stands at -0.008, contrasting

with the SMA14 at 0.020. This discrepancy according to burakkesmeci

“indicates that sellers have a stronger hand in the US market.”

Bitcoin Market Performance Looking at Bitcoin’s market performance

so far, the phenomenon of a seller-driven market, as indicated by

the CPI, appears to hold true. Currently, Bitcoin trades at a price

of $65,805, marking a 3% dip in the past 24 hours and roughly 2% in

the past week. In the past day alone, the asset’s market cap has

declined by over $40 billion, a stark contrast to its 24-hour

trading volume, which has seen quite the opposite, surging from

below $30 billion as of yesterday to as high as $36.7 billion, at

the time of writing. Regardless of the price performance, a handful

of crypto analysts remain optimistic. For instance, Crypto Rover, a

renowned enthusiast in the crypto space, disclosed that Bitcoin is

currently just consolidating inside a notable bull flag pattern.

Related Reading: Bitcoin ‘Back On Radar’ To Hit $80,000, Then New

ATH, Analyst Says According to Rover, “This is the worst time to be

bearish. The breakout will be massive.” #Bitcoin is basically

consolidating in one of the largest bull flags I’ve ever seen. This

is the worst time to be bearish. The breakout will be massive.

pic.twitter.com/oauSgiBNRY — Crypto Rover (@rovercrc) July 30, 2024

Featured image created with DALL-E, Chart from TradingView

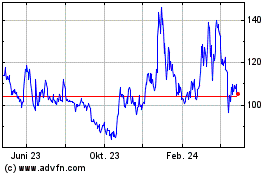

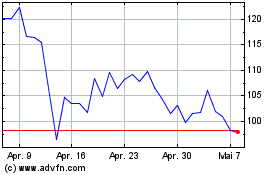

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Jul 2024 bis Jul 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024