Solana Loses 60% Of Its Market Value After FTX Collapse – Can SOL Bounce Back This Week?

16 November 2022 - 7:06AM

NEWSBTC

The Solana (SOL) ecosystem, according to Laguna Labs Chief

Executive Officer (CEO) Stefan Rust, took a harder hit compared to

other major digital coins such as Bitcoin and Ethereum following

the collapse of the FTX crypto exchange. Here’s a quick glance at

SOL performance: Following the collapse of FTX, Solana lost almost

60% of its market value SOL has gone up by 2% over the last 24

hours, trading above the $14 marker Solana coins deposited on

blockchain decreased sharply, from 68 million in June to just

almost 25 million now “In the current crypto shakeout, the most

unfortunate innocent victim is the Solana ecosystem,” Rust said.

The CEO noted that the network’s native token, SOL, dropped by

nearly 60% since FTX collapsed. In comparison, Bitcoin fell by 19%

and Ethereum went down by almost 20%. Rust and other crypto players

have reasons to believe that FTX and its trading firm Alameda

Research sold large quantity of Solana crypto to mitigate its

losses and stay afloat, affecting the cryptocurrency and its

trading price. Whether the altcoin can make a comeback during the

next few days or not, it’s anyone’s guess up to this time

especially that its technical indicators are considered

underwhelming from the bulls’ perspective. How Solana Is Performing

And Where It’s Headed After dipping all the way down to $12.07, SOL

mounted a recovery of its own, going up by 2% over the last 24

hours to trade at $14.21 at the time of this writing according to

tracking from Coingecko. Related Reading: Chiliz Bulls Remain

Watchful As CHZ Feeling Bearish Impulse Source: TradingView Over

the last seven days, the crypto asset’s price action has twice

indicated the formation of a bullish block that was supposed to be

an encouraging sign for its investors. The first was in November 10

when Solana swung between the narrow range of $18.3 and $12.35,

establishing the mid-point of $15.33 as a crucial support and

resistance zone. The second instance was in November 14 when the

altcoin ignored its lower timeframe bearish structure as it climbed

all the way up to $14.43, flipping its bias to bullish. With this,

traders and investors looking to take profit should put their focus

in the $13 to $13.25 region as an optimal entry point although it

is not without risks as the asset continues to struggle right now.

Its Relative Strength Index (RSI) settled at the 50-55 score

region, indicating that SOL volatility could easily ruin any plans

for long trade set-up. Image: Altcoin Buzz Investors And App

Developers Leaving Solana In the aftermath of the FTX implosion and

the negative effects it had on the crypto asset’s ecosystem, app

developers and investors appeared to have abandoned the sinking

ship. According to data from DeFiLlama, the current number of

Solana coins deposited in the blockchain that is widely used for

decentralized finance applications stands at 24.74 million. The

number is substantially lower than the 68.2 million tally that was

recorded back in June. In light of this development, co-founder

Anatoly Yakovenko allayed the fears of investors, saying Solana

Labs didn’t have any assets deposited on FTX and as far as

financial stability, under its current condition, it will be good

for business for the next 30 months. Meanwhile, Raj Gokal, another

co-founder of the company, also expressed his sentiments, saying

this is a crucible for Solana which will make it even stronger in

the future. Related Reading: Chainlink Suffers 40% Loss In Last 7

Days – Can LINK Regain $9 Mark This Week? Crypto total market cap

at $805 billion on the daily chart | Featured image from The New

Daily, Chart: TradingView.com

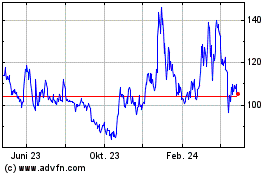

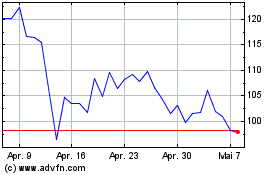

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024