Bitcoin Price Stalls Ahead Of FOMC Meeting, How To Trade It

21 März 2023 - 11:00AM

NEWSBTC

After a massive rally of over 42% in the last ten days, Bitcoin is

currently stagnating below the $28,000 mark, due to the upcoming

Federal Open Market Committee (FOMC) meeting of the US Federal

Reserve (Fed). As seen before previous FOMC meetings, the Bitcoin

market is moving to a risk-off strategy ahead of the Fed’s release

of the new policy rate. Tomorrow, Wednesday, the March rate

decision will be released at 2 pm EST, before Fed chair Jerome

Powell steps in front of the cameras for the FOMC press conference

at 2:30 pm EST. Expectations have changed massively in recent days,

and are also seeing almost hourly shifts. At press time, there was

a 17% probability of a pause and an 83% probability of a 0.25%

increase in the U.S. federal funds rate, according to the FedWatch

tool. More important, however, will be Jerome Powell’s forward

guidance and how the dot plot, and thus the estimated terminal

rate, will evolve. For the first time this year, the Fed will

publish the dot plot, which will provide great insight into the

Fed’s view, especially in light of the further deepening banking

crisis. Bitcoin Scenarios For The FOMC Meeting Co-founders of

on-chain analysis firm Glassnode, Yann Allemann and Jan Happel,

write in their latest analysis that the Bitcoin market is well

positioned for the FOMC. According to the Glassnode co-founder, the

Bitcoin risk signal shows a bullish structure similar to the one

seen in March-April 2020 and summer 2021. According to the

analysts, the market is already set for a 25 basis point rate hike,

so the market should not react too aggressively if the Fed

continues to raise rates. However, if the Fed does pause, the

analysts “expect a strong upside move.” In terms of the options

market, the analysts explain that the price dynamics between puts

and calls indicate that demand for calls has increased

significantly despite Bitcoin’s break below $28,000. “Notice the

low 1-month 25D skew indicating more expensive (higher demand)

calls with respect to puts.” Related Reading: Why The Crypto Market

Could Soon Go “Parabolic” However, the Glassnode co-founders also

warn, “However, implied and realized volatility have increased and

TradFi shows signs of cautiousness,” noting that robust buy and

sell walls have formed around $25,500 and $30,000, respectively.

The biggest risk, they note, is the number of long positions opened

in the perpetual market between $27,000 and $28,000, which could

lead to liquidations. According to Eight Global founder and analyst

Michaël van de Poppe, Bitcoin still looks like it is about to roll

over and is showing a slight distribution pattern. According to

him, there are two scenarios for the FOMC meeting. Sweep above

recent high to $28,800 through FOMC and then sharp drop [or] losing

$27,000 and continuing the fall to $25,000. I’m interested at

$23,300 and $25,000 for dips. Charlie Bilello, chief market

strategist at Creative Planning, said in his latest tweet that the

2-year Treasury bond yield is now below 4%. A week ago, it was

above 5%. This is the sharpest 5-day decline in yields since the

October 1987 crash, so he concludes: Market is calling the Fed’s

bluff on further tightening after next week’s FOMC meeting. Fed

Funds Futures: 1 more hike, then rate cuts. In general, traders

should be cautious about betting on a pivot as early as March. At

every single FOMC since March 2022 Jerome Powell has said: “the job

is not finished”, “will continue to increase rates “and “history

warns about loosening prematurely”. Yet leading into the FOMC, some

market analysts say that “this one he will pivot.” Related Reading:

Bitcoin To $30,000? Fed Unveils New Tool To Bailout Non-US Banks

Still, a surprise is not out of the question. Goldman Sachs

predicts that the FOMC will pause at its March meeting this week

because of stress in the banking system and then proceed with three

more 25 bps hikes in April, May and June. The Base Scenarios The

following base scenarios could therefore be considered. In a max

hawkish case, the Fed hikes by 25 bps and the dot plot shows a hike

to 525-550. Neutral can be classified if the Fed hikes by 25 bps

and leaves the final target unchanged at 500-525. Neutral would

also be if the Fed does not hike in March and leaves its final

target unchanged at 500-525. This would mean that the Fed has two

rate hikes ahead – March and April. Dovish, on the other hand,

would be if there is no hike and the Fed lowers its terminal target

to 475-500, which would mean that there is likely to be only one

rate hike left (March). Maximum dovish would be no hike and leaving

the target rate at current levels. Both of the latter scenarios

could trigger a strong rally, with Bitcoin rising towards $30,000.

At press time, the BTC price was at $27,628, facing the resistance

zone above $28,300. Featured image from iStock, chart from

TradingView.com

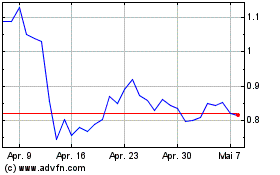

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024