Worldcoin (WLD) 12% Rally Hits A Snag: Portugal Demands Halt To Biometric Data Collection

26 März 2024 - 9:00PM

NEWSBTC

In a recent development, Portugal’s data regulator, the National

Commission for the Protection of Data, also known as the CNPD, has

issued an order to stop Sam Altman’s iris scanning project,

Worldcoin, from collecting biometric data for 90 days.

Worldcoin’s Compliance Under Fire According to a Reuters report,

the CNPD’s suspension specifically targets the Worldcoin

Foundation, a memberless entity based in the Cayman Islands,

described on its website as the sole member and director of World

Assets Ltd, a company registered in the British Virgin Islands

responsible for issuing Worldcoin tokens to sign-up participants.

The CNPD cited an alleged “high risk” to citizens’ data protection

rights as the main reason for its urgent intervention. The

regulator expressed concerns about the “unauthorized” collection of

data from minors, the lack of information provided to data

subjects, and the inability to delete data or withdraw

consent. The halt order also noted that over 300,000

individuals in Portugal had provided their biometric data to

Worldcoin, leading to numerous complaints being lodged with the

CNPD. Related Reading: XRP Price Prediction: Can Bulls Pump It

Again To $0.75 Jannick Preiwisch, the data protection officer at

the Worldcoin Foundation, responded to the CNPD’s order by stating

that Worldcoin is “fully compliant” with all laws and regulations

about biometric data collection and transfer. Preiwisch emphasized

the company’s zero-tolerance policy for underage sign-ups and its

commitment to addressing any reported incidents. Worldcoin has

recently transitioned to “Personal Custody,” aiming to give users

control over their data, including options for deletion and future

use. The CNPD’s order to stop data collection is considered

temporary, allowing for additional due diligence and analysis of

complaints during the ongoing investigation. Privacy Storm Engulfs

Worldcoin The Regulatory scrutiny of Worldcoin extends beyond

Portugal. As NewsBTC reported, Spain’s data protection watchdog

issued a three-month ban earlier this month in response to privacy

complaints, and Kenya suspended Worldcoin’s operations in August

2023. Moreover, the Bavarian State Regulatory Authority,

acting as the lead authority in southeastern Germany, is currently

investigating Worldcoin under European Union data protection rules

due to the presence of a German subsidiary owned by Tools For

Humanity, the company behind Worldcoin. As the investigation into

Worldcoin’s data collection practices continues, the project faces

significant challenges in addressing regulatory concerns and

maintaining public trust in its ambitious vision. According to its

website, the project claims to have garnered over 4.5 million

sign-ups from individuals in 120 countries. Regulatory Hurdles Fail

To Dampen WLD’s Performance Despite the recent regulatory

challenges faced by Worldcoin, the decentralized cryptocurrency has

managed to maintain its gains of 12% over the past seven days.

After reaching an all-time high (ATH) of $11.95 on March 10, the

project’s native token, WLD, experienced a sharp drop to $7.24 but

has since recovered. Currently trading at $9.01, WLD has

capitalized on the overall market rebound and its seven-day

uptrend, surging by almost 9% in the past 24 hours. The

trading volume for WLD in the last 24 hours is $416,136,329,

indicating a significant 65.10% increase compared to the previous

day, suggesting renewed interest in the token. Related Reading:

Crypto Outflows Reach New Record High, Will The Bitcoin Decline

Continue? Looking ahead, the $9.5 level is expected to provide the

nearest resistance for the WLD token, followed by the $10.14 mark,

should the rally continue. On the downside, the $8.36 level is the

closest support on the daily chart. In a potential downtrend,

failure to hold this support level could decline toward the $8

mark, with the next significant resistance at $7.93. Featured image

from Shutterstock, chart from TradingView.com

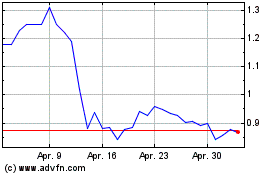

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024