Current Report Filing (8-k)

30 Juni 2021 - 10:36PM

Edgar (US Regulatory)

0000773141false12/3100007731412021-06-282021-06-280000773141us-gaap:CommonStockMember2021-06-282021-06-280000773141mdc:SeniorNotesSixPercentDueJanuary2043Member2021-06-282021-06-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

_________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): June 28, 2021

M.D.C. Holdings, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

1-8951

|

84-0622967

|

(State or other

jurisdiction of

incorporation)

|

(Commission file number)

|

(I.R.S. employer

identification no.)

|

4350 South Monaco Street, Suite 500, Denver, Colorado 80237

|

|

|

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) (Zip code)

|

|

Registrant’s telephone number, including area code: (303) 773-1100

Not Applicable

|

|

|

|

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

|

552676108

|

|

New York Stock Exchange

|

|

6% Senior Notes due January 2043

|

|

552676AQ1

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

As of June 28, 2021, M.D.C. Holdings, Inc. (the “Company”) and each of Larry Mizel, the Company’s Executive Chairman, and David Mandarich, the Company’s President and Chief Executive Officer, executed amendments (collectively the “Amendments”) to the respective employment agreements dated as of October 26, 2020, between the Company and each of them. The Amendments modified the treatment of outstanding and future performance share units (PSUs) following a termination of the executive’s employment by the Company in the event of a change in control of the Company (a “CIC Termination”). Prior to the Amendments, the employment agreements provided that upon a CIC Termination all unvested PSUs granted to the executive would fully vest and paid at the maximum level, without regard to achievement of the specified performance criteria on which the applicable PSU’s were conditioned. As a result of the Amendments, upon a CIC Termination all unvested PSUs granted to the executive will vest, but the amount, if any, payable with respect to such PSUs will be conditioned on the actual achievement of the specified performance criteria and would not be paid until the end of the applicable performance period.

The Amendments also modify the potential automatic “cut back” of compensation to the executive upon a CIC Termination. Prior to the Amendments, the employment agreements provided that, in the event the amount of compensation payable following a CIC Termination (the “CIC Payment”) would be subject to the excise tax imposed by the U.S. Tax Code, the amount of the CIC Payment would be automatically reduced to avoid triggering the tax. The Amendments provide for calculations to compare the after-tax effect to the executive of (a) automatically reducing the amount of CIC Payment sufficient to avoid triggering any excise tax or, in the alternative, (b) paying the full awarded CIC Payment requiring the executive to be fully responsible for payment of the excise tax, whichever alternative results in the greatest after tax benefit to the executive.

Further, the Amendment to Mr. Mizel’s employment agreement provides that, upon Mr. Mizel’s termination of employment with the Company, other than a termination “for cause,” he is granted a 90-day option to purchase the Company’s aircraft and associated equipment and parts (collectively, the “Aircraft). The purchase price, in cash, will be at the fair market value of the Aircraft, as determined by independent valuation in the event Mr. Mizel and the Company are unable to agree upon the amount of the fair market value.

In connection with the approval of the Amendments, on June 28, 2021, the Compensation Committee of the Board of Directors of the Company accelerated the vesting of all outstanding PSUs awarded to Mr. Mizel, to be fully vested on January 1, 2023, and all outstanding PSUs awarded to Mr. Mandarich, to be fully vested on January 1, 2025 - the dates at which Messrs. Mizel and Mandarich, respectively, are entitled to retire under the terms of their respective employment agreements. Payment will be conditioned on the actual achievement of the specified performance criteria and would not be paid until the end of the applicable performance period.

Copies of the Amendments are included as Exhibits 10.1 and 10.2 to this report.

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

(e) The information in Item 1.01 is incorporated by reference.

ITEM 5.03. AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR

On June 28, 2021, the Board adopted an amendment to the Company’s Bylaws to confirm that, unless otherwise required by law, the Certificate of Incorporation or the Bylaws, any question brought before any meeting of the shareholders shall be decided by the vote of the holders of a majority of the stock represented and entitled to vote on the subject matter.

A copy of the Amendment of Bylaws is included as Exhibit 3.1 to this report.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

3.1

|

|

|

|

|

|

|

|

10.1

|

|

|

|

|

|

|

|

10.2

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data file (formatted in Inline XBRL)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

_________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M.D.C. HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

Dated:

|

June 30, 2021

|

By:

|

/s/ Joseph H. Fretz

|

|

|

|

|

|

Joseph H. Fretz

|

|

|

|

|

|

Secretary and Corporate Counsel

|

|

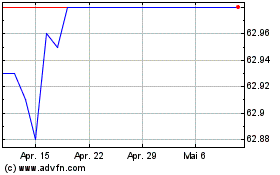

M D C (NYSE:MDC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

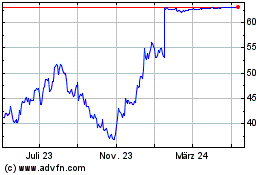

M D C (NYSE:MDC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024