Pound Declines As Risk Appetite Recedes

11 Juni 2020 - 10:06AM

RTTF2

The pound fell against its major counterparts in the European

session on Thursday, as concerns about a second wave of infections

in the U.S. and pessimistic outlook from the Federal Reserve

dampened risk sentiment.

The number of confirmed cases exceeded 2 million on Wednesday,

as all states have reopened after pandemic shutdown.

New infections have been reported in Arizona, Texas, Florida and

California, triggering warning of a potential second round of

infections in the country.

Federal Reserve Chairman Jerome Powell warned of "a long road"

to recovery and said the Fed's rescue efforts will not be enough on

their own, and it would likely require additional fiscal stimulus

from Congress to stave off a deeper economic downturn.

In economic releases, the U.K. house price indicator moved

deeper into negative territory in May amid coronavirus pandemic,

according to a survey data from the Royal Institution of Chartered

Surveyors.

The house price balance fell to -32 percent in May from -22

percent in April. This was the weakest monthly figure since

2010.

The pound weakened to a 2-day low of 1.2651 against the

greenback, compared to yesterday's closing value of 1.2747. The

pound is poised to find support around the 1.20 level.

The pound depreciated to a 9-day low of 135.32 against the yen

and a 10-day low of 1.1926 against the franc, from yesterday's

closing values of 136.54 and 1.2028, respectively. The next

possible support for the pound is seen around 128.00 against the

yen and 1.13 against the franc.

The pound hit 0.8976 against the euro, setting a 6-day low. At

yesterday's close, the pair was worth 0.8920. The pound is seen

finding support around the 0.92 level.

Looking ahead, U.S. weekly jobless claims for the week ended

June 6 and producer price index for May are due in the New York

session.

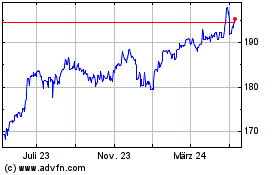

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

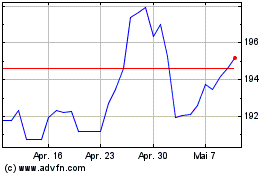

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Apr 2023 bis Apr 2024