Investor Presentation May 2024

2 • fluctuations in commodity prices, including supply and demand considerations for our products and services; • decisions as to production levels and/or pricing by OPEC or U.S. producers in future periods; • government policy, war and political conditions and events, including the military conflicts in Israel, Ukraine and Yemen and the Red Sea; • the ability to successfully integrate the business of Aera once the Aera merger is completed; • the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Aera merger that could reduce anticipated benefits or cause the parties to abandon the Aera merger; • the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; • the possibility that the stockholders of CRC may not approve the issuance of new shares of common stock in the Aera merger; • the ability to obtain the required debt financing pursuant to our commitment letters and, if obtained, the potential impact of additional debt on our business and the financial impacts and restrictions due to the additional debt; • regulatory actions and changes that affect the oil and gas industry generally and us in particular, including (1) the availability or timing of, or conditions imposed on, permits and approvals necessary for drilling or development activities or our carbon management business; (2) the management of energy, water, land, greenhouse gases (GHGs) or other emissions, (3) the protection of health, safety and the environment, or (4) the transportation, marketing and sale of our products; • the impact of inflation on future expenses and changes generally in the prices of goods and services; • changes in business strategy and our capital plan; • lower-than-expected production or higher-than-expected production decline rates; • changes to our estimates of reserves and related future cash flows, including changes arising from our inability to develop such reserves in a timely manner, and any inability to replace such reserves; • the recoverability of resources and unexpected geologic conditions; • general economic conditions and trends, including conditions in the worldwide financial, trade and credit markets; • production-sharing contracts' effects on production and operating costs; • the lack of available equipment, service or labor price inflation; • limitations on transportation or storage capacity and the need to shut-in wells; • any failure of risk management; • results from operations and competition in the industries in which we operate; • our ability to realize the anticipated benefits from prior or future efforts to reduce costs; • environmental risks and liability under federal, regional, state, provincial, tribal, local and international environmental laws and regulations (including remedial actions); • the creditworthiness and performance of our counterparties, including financial institutions, operating partners, CCS project participants and other parties; • reorganization or restructuring of our operations; • our ability to claim and utilize tax credits or other incentives in connection with our CCS projects and clean energy projects; • our ability to realize the benefits contemplated by our energy transition strategies and initiatives, including CCS projects and other renewable energy efforts; our ability to successfully identify, develop and finance carbon capture and storage projects and other renewable energy efforts, including those in connection with the Carbon TerraVault JV, and our ability to convert our CDMAs to definitive agreements and enter into other offtake agreements; • our ability to maximize the value of our carbon management business and operate it on a stand alone basis; • our ability to successfully develop infrastructure projects and enter into third party contracts on contemplated terms; • uncertainty around the accounting of emissions and our ability to successfully gather and verify emissions data and other environmental impacts; • changes to our dividend policy and share repurchase program, and our ability to declare future dividends or repurchase shares under our debt agreements; • limitations on our financial flexibility due to existing and future debt; • insufficient cash flow to fund our capital plan and other planned investments and return capital to shareholders; • changes in interest rates; our access to and the terms of credit in commercial banking and capital markets, including our ability to refinance our debt or obtain separate financing for our carbon management business; • changes in state, federal or international tax rates, including our ability to utilize our net operating loss carryforwards to reduce our income tax obligations; • effects of hedging transactions; • the effect of our stock price on costs associated with incentive compensation; • inability to enter into desirable transactions, including joint ventures, divestitures of oil and natural gas properties and real estate, and acquisitions, and our ability to achieve any expected synergies; • disruptions due to earthquakes, forest fires, floods, extreme weather events or other natural occurrences, accidents, mechanical failures, power outages, transportation or storage constraints, labor difficulties, cybersecurity breaches or attacks or other catastrophic events; • pandemics, epidemics, outbreaks, or other public health events, such as the COVID-19 pandemic; and • other factors discussed in Part I, Item 1A – Risk Factors in our 2023 Annual Report. This document contains statements that we believe to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than historical facts are forward-looking statements, and include statements regarding our future financial position, business strategy, projected revenues, earnings, costs, capital expenditures and plans and objectives of management for the future. Words such as "expect," “could,” “may,” "anticipate," "intend," "plan," “ability,” "believe," "seek," "see," "will," "would," “estimate,” “forecast,” "target," “guidance,” “outlook,” “opportunity”, “strategy” or similar expressions are generally intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, such statements. Additionally, the information in this report contains forward-looking statements related to the pending Aera Merger. Although we believe the expectations and forecasts reflected in our forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. No assurance can be given that such forward-looking statements will be correct or achieved or that the assumptions are accurate or will not change over time. Particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include: Forward – Looking / Cautionary Statements – Certain Terms

3 Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the transactions contemplated by the merger agreement pursuant to which California Resources Corporation (“CRC”) has agreed to combine with Aera Energy, LLC (“Aera”) (the “Merger Agreement”), including the proposed issuance of CRC’S common stock pursuant to the Merger Agreement. In connection with the transaction, CRC filed a proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (“SEC”), as well as other relevant materials. Following the filing of the definitive proxy statement, CRC mailed the definitive proxy statement and a proxy card to its stockholders. INVESTORS AND SECURITY HOLDERS OF CRC ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CRC, AERA, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain copies of the proxy statement (when available) as well as other filings containing information about CRC, Aera and the transaction, without charge, at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by CRC will be available, without charge, at CRC’s website, www.crc.com. Participants in Solicitation CRC and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the transaction. Information about the directors and executive officers of CRC is set forth in the proxy statement for CRC’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on March 21, 2024. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the transaction when it becomes available. Non-GAAP Financial Measures: This presentation contains certain financial measures that are not prepared in accordance with generally accepted accounting principles (“GAAP”). These measures are identified with an “*” and include but are not limited to Adjusted EBITDAX, PV-10, Leverage Ratio, Net Debt, Liquidity, Net Cash Provided by Operating Activities Before Changes in Operating Assets and Liabilities, Net and Free Cash Flow. For all historical non-GAAP financial measures please see the Investor Relations page at www.crc.com for a reconciliation to the nearest GAAP equivalent and other additional information. We caution you not to place undue reliance on forward-looking statements contained in this document, which speak only as of the filing date, and we undertake no obligation to update this information. This document may also contain information from third party sources. This data may involve a number of assumptions and limitations, and we have not independently verified them and do not warrant the accuracy or completeness of such third-party information. Forward – Looking / Cautionary Statements – Certain Terms (Cont.) Pro Forma Financial Data: This presentation includes certain proforma financial and operating data. As used herein, except as otherwise indicated, the term “proforma” when used with respect to any financial or operating data, refers to the historical data of CRC, as adjusted after giving effect to the Aera Merger. The proforma adjustments are based on available information and upon assumptions that management believes are reasonable in order to reflect, on a proforma basis, the effect of the Aera Merger and related events on the historical financial information of CRC. In addition, future results may vary significantly from the results reflected in the pro forma financial data and should not be relied on as an indication of the future results of CRC. For additional information regarding the pro forma data included or incorporated by reference herein, see the section titled “Unaudited Pro Forma Condensed Combined Financial Information” in the definitive proxy statement filed with the SEC on May 7, 2024. Industry and Market Data: This presentation has been prepared by us and includes market data and other statistical information from sources we believe to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on our good faith estimates, which are derived from our review of internal sources as well as the independent sources described above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. CRC owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with CRC or an endorsement or sponsorship by or of CRC. Reserves: This presentation provides certain disclosure relating to oil, natural gas and natural gas liquids proved reserves. Reserve engineering is a process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reservoir engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Unless otherwise indicated, reserve and PV- 10 estimates shown herein are based on a reserves report as of December 31, 2023 prepared by the Company’s and Aera’s respective independent reserve engineers in accordance with applicable rules, guidelines of the SEC and except as otherwise noted.

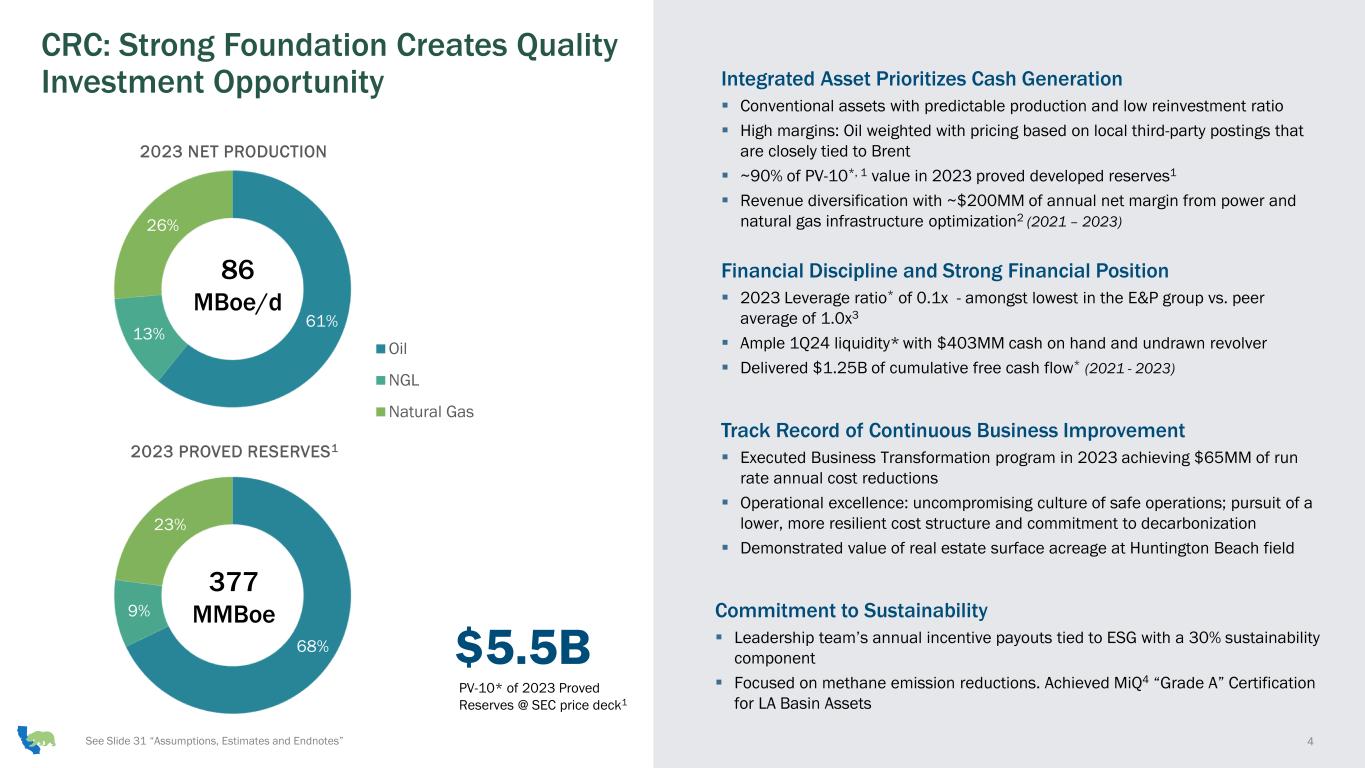

4See Slide 31 “Assumptions, Estimates and Endnotes” CRC: Strong Foundation Creates Quality Investment Opportunity Integrated Asset Prioritizes Cash Generation ▪ Conventional assets with predictable production and low reinvestment ratio ▪ High margins: Oil weighted with pricing based on local third-party postings that are closely tied to Brent ▪ ~90% of PV-10*, 1 value in 2023 proved developed reserves1 ▪ Revenue diversification with ~$200MM of annual net margin from power and natural gas infrastructure optimization2 (2021 – 2023) Financial Discipline and Strong Financial Position ▪ 2023 Leverage ratio* of 0.1x - amongst lowest in the E&P group vs. peer average of 1.0x3 ▪ Ample 1Q24 liquidity* with $403MM cash on hand and undrawn revolver ▪ Delivered $1.25B of cumulative free cash flow* (2021 - 2023) Track Record of Continuous Business Improvement ▪ Executed Business Transformation program in 2023 achieving $65MM of run rate annual cost reductions ▪ Operational excellence: uncompromising culture of safe operations; pursuit of a lower, more resilient cost structure and commitment to decarbonization ▪ Demonstrated value of real estate surface acreage at Huntington Beach field Commitment to Sustainability ▪ Leadership team’s annual incentive payouts tied to ESG with a 30% sustainability component ▪ Focused on methane emission reductions. Achieved MiQ4 “Grade A” Certification for LA Basin Assets 61% 13% 26% 2023 NET PRODUCTION Oil NGL Natural Gas 86 MBoe/d 68% 9% 23% 2023 PROVED RESERVES1 377 MMBoe $5.5B PV-10* of 2023 Proved Reserves @ SEC price deck1

CRC: Robust 1Q24 Results, Strong Balance Sheet Position, Ample Liquidity and Financial Flexibility ▪ Generated $149MM in Adj. EBITDAX*; $33MM in free cash flow* ▪ Net Production: 76MBoe/d (63% oil); Reservoirs performed as expected with flat entry to exit gross production ▪ CRC has filed the Aera Merger definitive proxy with SEC and is targeting to close in mid-2024 ➢ Targeting $150MM in annual synergies 15 months post close; $50MM within 6 months post close ▪ Significant bank market support with recent upsize of Reserve Based Lending (“RBL”) elected commitments and increased borrowing base1 ($MM) RCF Borrowing Base $ 1,200 1Q24 Cash & Cash Equivalents $403 1Q24 Net Debt* $142 1Q24 Net Debt* / LTM Adjusted EBITDAX* 0.2x LTM Adjusted EBITDAX* / LTM Interest & Debt Expense 11.9x MULTIPLES DEMONSTRATE FLEXIBILITY 1Q24 UPDATES See Slide 31 “Assumptions, Estimates and Endnotes” DELIVERING LOWER QUARTERLY OPERATING COSTS Quarterly Operating Costs ($MM) $100 $125 $150 $175 $200 $225 $250 $275 1Q23 2Q23 3Q23 4Q23 1Q24 $30 $35 $40 $45 $50 $55 $60 1Q23 2Q23 3Q23 4Q23 1Q24 DELIVERING LOWER ADJ. G&A* Adj. General and Administrative Expenses* ($MM) 5

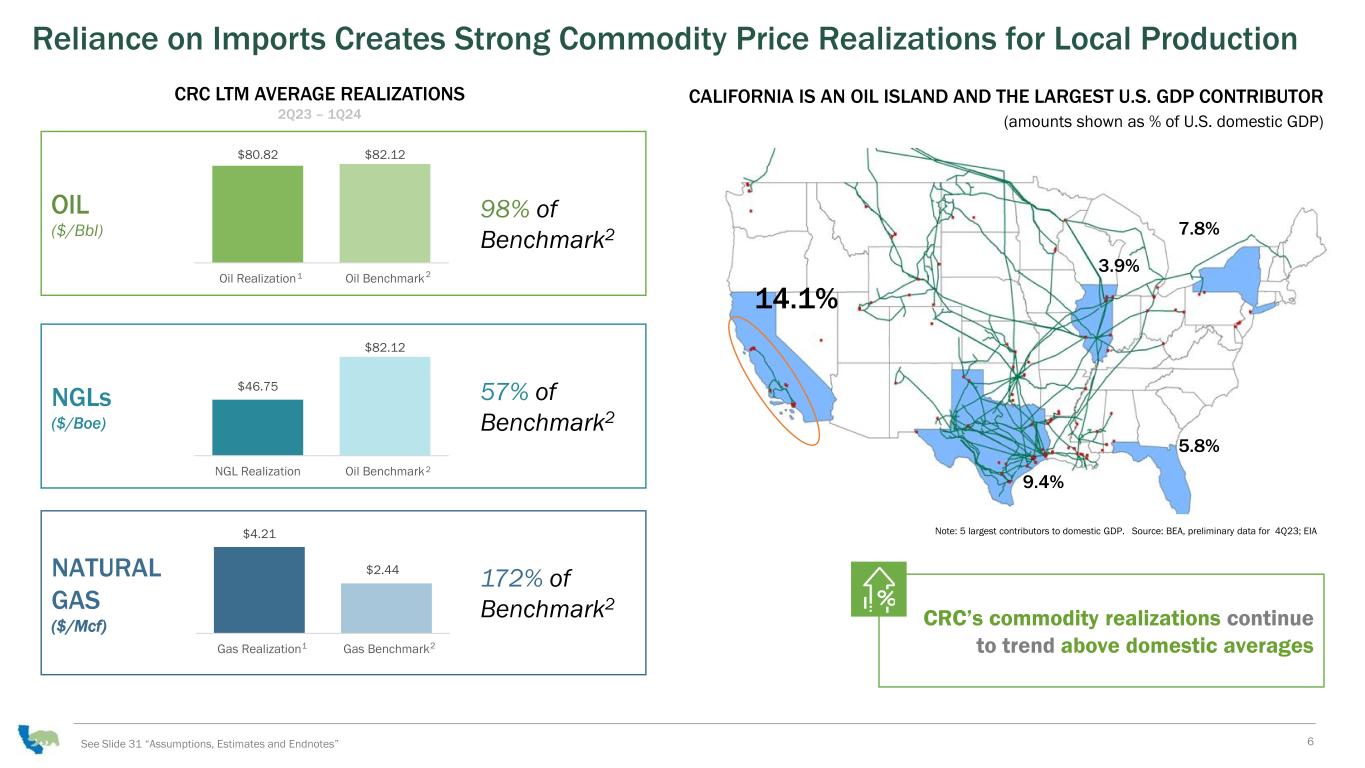

14.1% 7.8% 9.4% 5.8% 3.9% Note: 5 largest contributors to domestic GDP. Source: BEA, preliminary data for 4Q23; EIA Reliance on Imports Creates Strong Commodity Price Realizations for Local Production CRC’s commodity realizations continue to trend above domestic averages See Slide 31 “Assumptions, Estimates and Endnotes” 6 CRC LTM AVERAGE REALIZATIONS 2Q23 – 1Q24 CALIFORNIA IS AN OIL ISLAND AND THE LARGEST U.S. GDP CONTRIBUTOR (amounts shown as % of U.S. domestic GDP) NATURAL GAS ($/Mcf) NGLs ($/Boe) OIL ($/Bbl) $80.82 $82.12 Oil Realization Oil Benchmark $46.75 $82.12 NGL Realization Oil Benchmark $4.21 $2.41 Gas Realization Gas Benchmark 98% of Benchmark2 57% of Benchmark2 172% of Benchmark2 1 1 2 2 2 $2.44

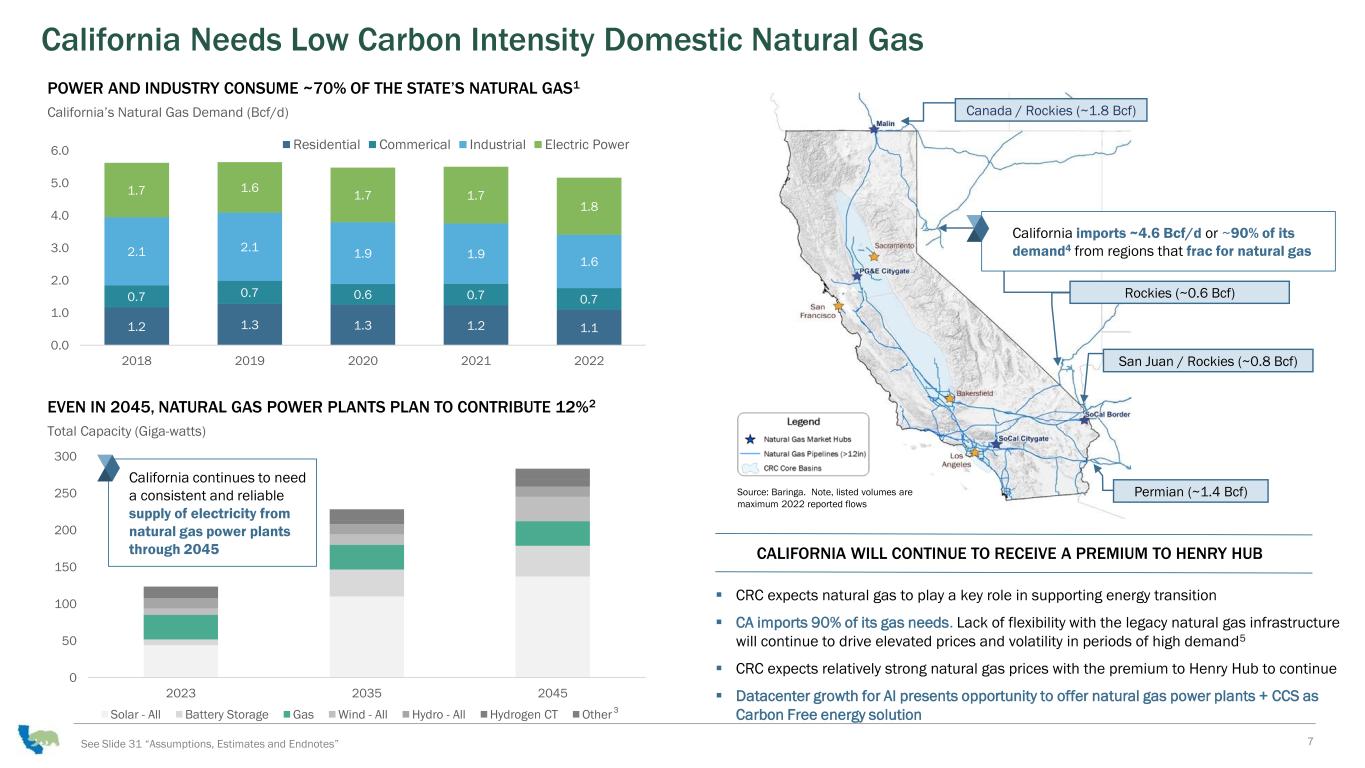

0 50 100 150 200 250 300 2023 2035 2045 Solar - All Battery Storage Gas Wind - All Hydro - All Hydrogen CT Other California Needs Low Carbon Intensity Domestic Natural Gas See Slide 31 “Assumptions, Estimates and Endnotes” 7 1.2 1.3 1.3 1.2 1.1 0.7 0.7 0.6 0.7 0.7 2.1 2.1 1.9 1.9 1.6 1.7 1.6 1.7 1.7 1.8 0.0 1.0 2.0 3.0 4.0 5.0 6.0 2018 2019 2020 2021 2022 Residential Commerical Industrial Electric Power POWER AND INDUSTRY CONSUME ~70% OF THE STATE’S NATURAL GAS1 EVEN IN 2045, NATURAL GAS POWER PLANTS PLAN TO CONTRIBUTE 12%2 California continues to need a consistent and reliable supply of electricity from natural gas power plants through 2045 CALIFORNIA WILL CONTINUE TO RECEIVE A PREMIUM TO HENRY HUB ▪ CRC expects natural gas to play a key role in supporting energy transition ▪ CA imports 90% of its gas needs. Lack of flexibility with the legacy natural gas infrastructure will continue to drive elevated prices and volatility in periods of high demand5 ▪ CRC expects relatively strong natural gas prices with the premium to Henry Hub to continue ▪ Datacenter growth for AI presents opportunity to offer natural gas power plants + CCS as Carbon Free energy solution California’s Natural Gas Demand (Bcf/d) Total Capacity (Giga-watts) Source: Baringa. Note, listed volumes are maximum 2022 reported flows 3 Canada / Rockies (~1.8 Bcf) Rockies (~0.6 Bcf) San Juan / Rockies (~0.8 Bcf) Permian (~1.4 Bcf) California imports ~4.6 Bcf/d or ~90% of its demand4 from regions that frac for natural gas

CRC’s Natural Gas Inventory Depth – 1Tcf1 Opportunity See Slide 31 “Assumptions, Estimates and Endnotes” 8 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Socal Border $/MMBtu Socal CG $/MMBtu PGE CG $/MMBtu NYMEX HENRY HUB $/MMBtu CRC’s Opportunity Set1 by Basin >250 Bcf >800 Bcf Sacramento Basin Opportunity Set1 ▪ ~110Bcf of actionable inventory ▪ Resource: ▪ >250 Bcf of dry gas ▪ ~300 locations Up to 220Bcf of near-term inventory3 San Joaquin Basin Opportunity Set1 ▪ ~700Bcf of actionable inventory ▪ Resource: ▪ >800 Bcf of associated gas ▪ ~1,100 locations CALIFORNIA’S NATURAL GAS FORWARD CURVES4 ($/MMBtu) CRC received a “Grade A” MiQ2 certification for CRC's operating assets in Los Angeles and Orange Counties. CRC plans to continue to work with MiQ to expand its ICG certifications to operations in the SJ and Sac basins. Avg. 2024 – 2033 Price NYMEX HH $3.79 PG&E City-gate $5.16 SoCal Bdr $4.66 SoCal City-gate $5.53

Delivered a Valuation Marker for Huntington Beach Real Estate Asset ▪ Fort Apache: 1810 Pacific Coast Highway, Huntington Beach, CA ▪ CRC sold the real estate asset for total proceeds of $10MM ▪ Remediation work: • Plugged and abandoned (P&A) six wells • Minimal surface infrastructure removal Over 1 mile of direct access to Pacific Coast Highway Ft Apache Huntington Beach – Upland Strip Pacific Coast Highway ▪ Continuing re-zoning, re-entitlements and due diligence • Anticipated to be a multi year process ▪ Developing strategy to optimize production and ARO schedule • Huntington Beach field 2023 gross production1: ~3MBOD ▪ Targeting to permanently plug 48 wells in 2024 • Expected average plugging cost per well: ~$300K Fort Apache – 0.9 Acre Parcel $MM Total purchase price $10 Remediation work ~$2 Proceeds after remediation ~$8 See Slide 31 “Assumptions, Estimates and Endnotes” FT APACHE | 0.9 ACRE PARCEL – FUTURE HUNTINGTON BEACH STRATEGY | ~90 ACRES PARCEL 9 Huntington Beach - 90 Acres Parcel ARO Estimates Surface and infrastructure removal ($MM)2 $65 – $120 Total number of idle and active wells to P&A ~350 Total P&A estimate2 ($MM) $170 - $225

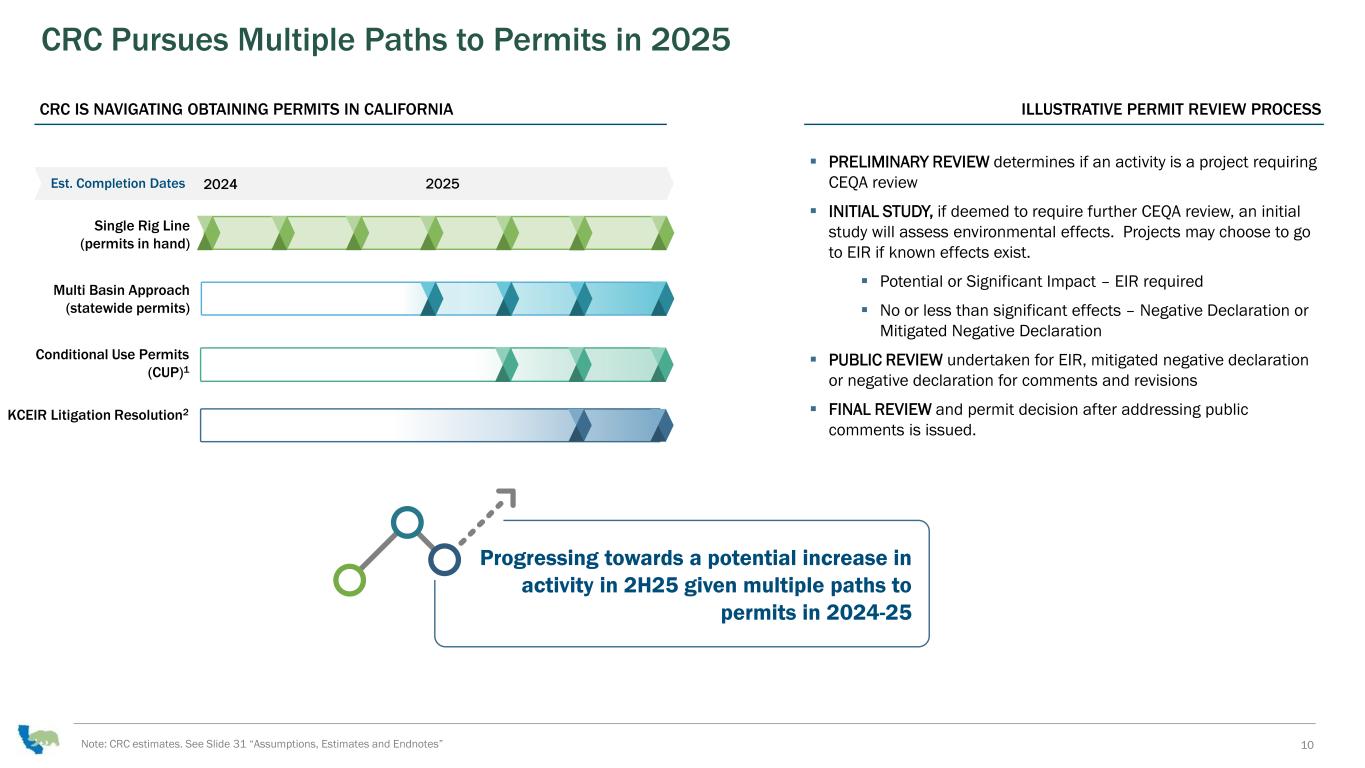

CRC Pursues Multiple Paths to Permits in 2025 10 ▪ PRELIMINARY REVIEW determines if an activity is a project requiring CEQA review ▪ INITIAL STUDY, if deemed to require further CEQA review, an initial study will assess environmental effects. Projects may choose to go to EIR if known effects exist. ▪ Potential or Significant Impact – EIR required ▪ No or less than significant effects – Negative Declaration or Mitigated Negative Declaration ▪ PUBLIC REVIEW undertaken for EIR, mitigated negative declaration or negative declaration for comments and revisions ▪ FINAL REVIEW and permit decision after addressing public comments is issued. ILLUSTRATIVE PERMIT REVIEW PROCESSCRC IS NAVIGATING OBTAINING PERMITS IN CALIFORNIA 2024 2025 Conditional Use Permits (CUP)1 Multi Basin Approach (statewide permits) KCEIR Litigation Resolution2 Single Rig Line (permits in hand) Est. Completion Dates Progressing towards a potential increase in activity in 2H25 given multiple paths to permits in 2024-25 Note: CRC estimates. See Slide 31 “Assumptions, Estimates and Endnotes”

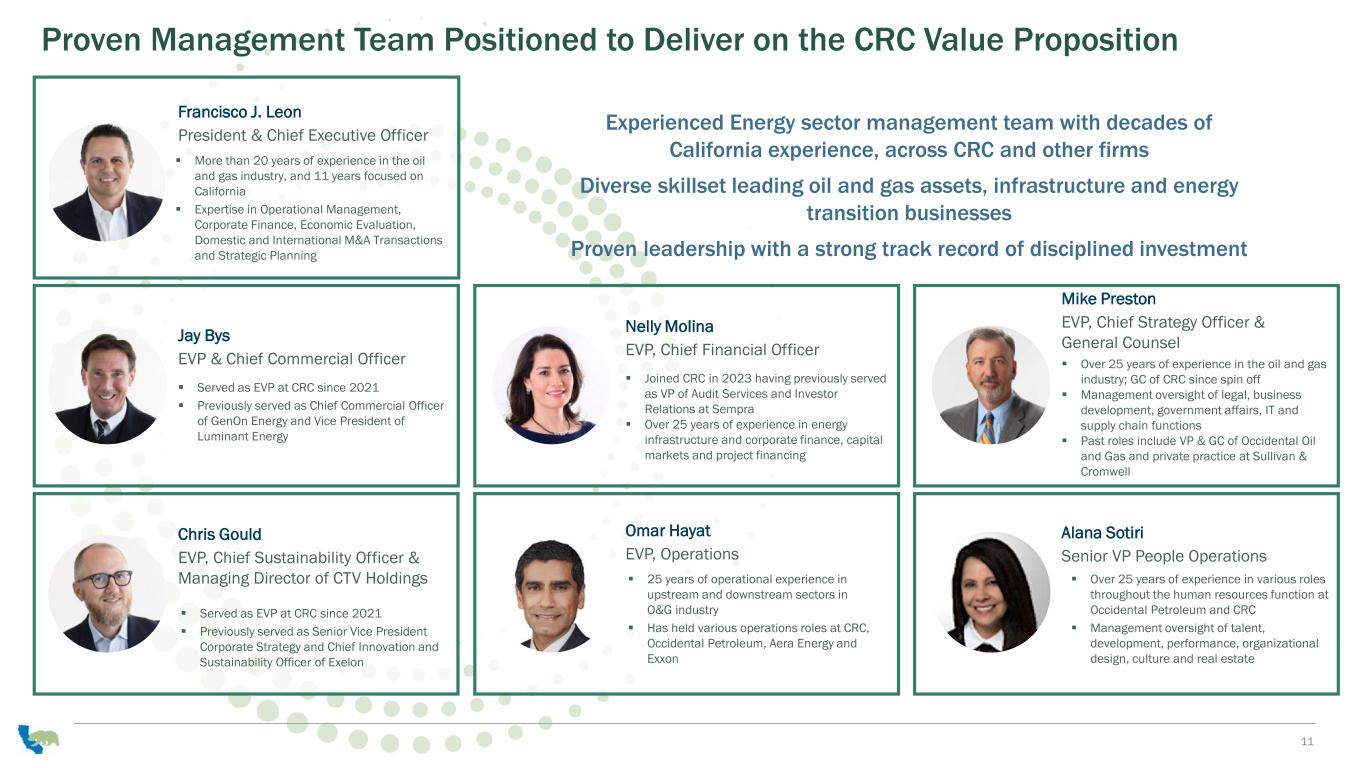

Proven Management Team Positioned to Deliver on the CRC Value Proposition 11 Experienced Energy sector management team with decades of California experience, across CRC and other firms Diverse skillset leading oil and gas assets, infrastructure and energy transition businesses Proven leadership with a strong track record of disciplined investment Francisco J. Leon President & Chief Executive Officer ▪ More than 20 years of experience in the oil and gas industry, and 11 years focused on California ▪ Expertise in Operational Management, Corporate Finance, Economic Evaluation, Domestic and International M&A Transactions and Strategic Planning Jay Bys EVP & Chief Commercial Officer ▪ Served as EVP at CRC since 2021 ▪ Previously served as Chief Commercial Officer of GenOn Energy and Vice President of Luminant Energy Chris Gould EVP, Chief Sustainability Officer & Managing Director of CTV Holdings Nelly Molina EVP, Chief Financial Officer ▪ Joined CRC in 2023 having previously served as VP of Audit Services and Investor Relations at Sempra ▪ Over 25 years of experience in energy infrastructure and corporate finance, capital markets and project financing Omar Hayat EVP, Operations ▪ 25 years of operational experience in upstream and downstream sectors in O&G industry ▪ Has held various operations roles at CRC, Occidental Petroleum, Aera Energy and Exxon Mike Preston EVP, Chief Strategy Officer & General Counsel ▪ Over 25 years of experience in the oil and gas industry; GC of CRC since spin off ▪ Management oversight of legal, business development, government affairs, IT and supply chain functions ▪ Past roles include VP & GC of Occidental Oil and Gas and private practice at Sullivan & Cromwell Alana Sotiri Senior VP People Operations ▪ Served as EVP at CRC since 2021 ▪ Previously served as Senior Vice President Corporate Strategy and Chief Innovation and Sustainability Officer of Exelon ▪ Over 25 years of experience in various roles throughout the human resources function at Occidental Petroleum and CRC ▪ Management oversight of talent, development, performance, organizational design, culture and real estate

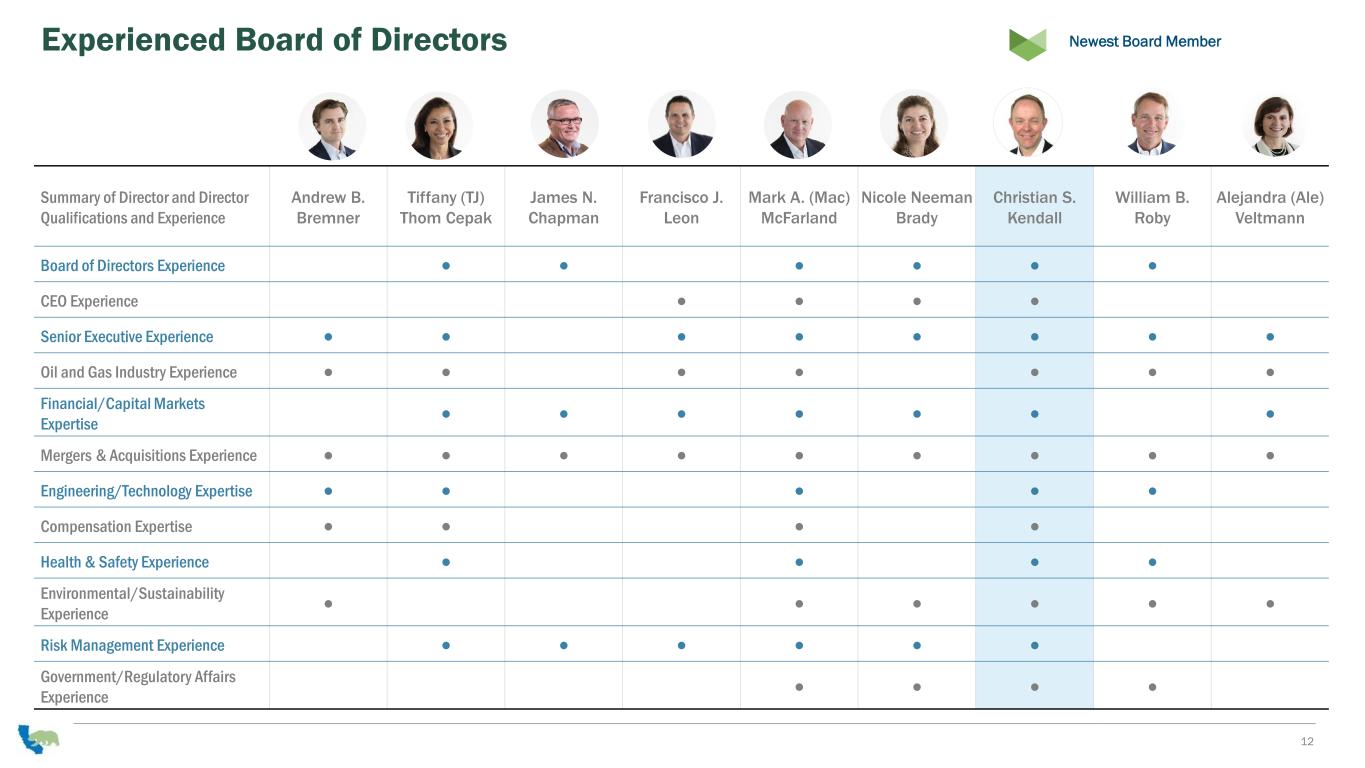

Experienced Board of Directors 12 Summary of Director and Director Qualifications and Experience Andrew B. Bremner Tiffany (TJ) Thom Cepak James N. Chapman Francisco J. Leon Mark A. (Mac) McFarland Nicole Neeman Brady Christian S. Kendall William B. Roby Alejandra (Ale) Veltmann Board of Directors Experience • • • • • • CEO Experience • • • • Senior Executive Experience • • • • • • • • Oil and Gas Industry Experience • • • • • • • Financial/Capital Markets Expertise • • • • • • • Mergers & Acquisitions Experience • • • • • • • • • Engineering/Technology Expertise • • • • • Compensation Expertise • • • • Health & Safety Experience • • • • Environmental/Sustainability Experience • • • • • • Risk Management Experience • • • • • • Government/Regulatory Affairs Experience • • • • Newest Board Member

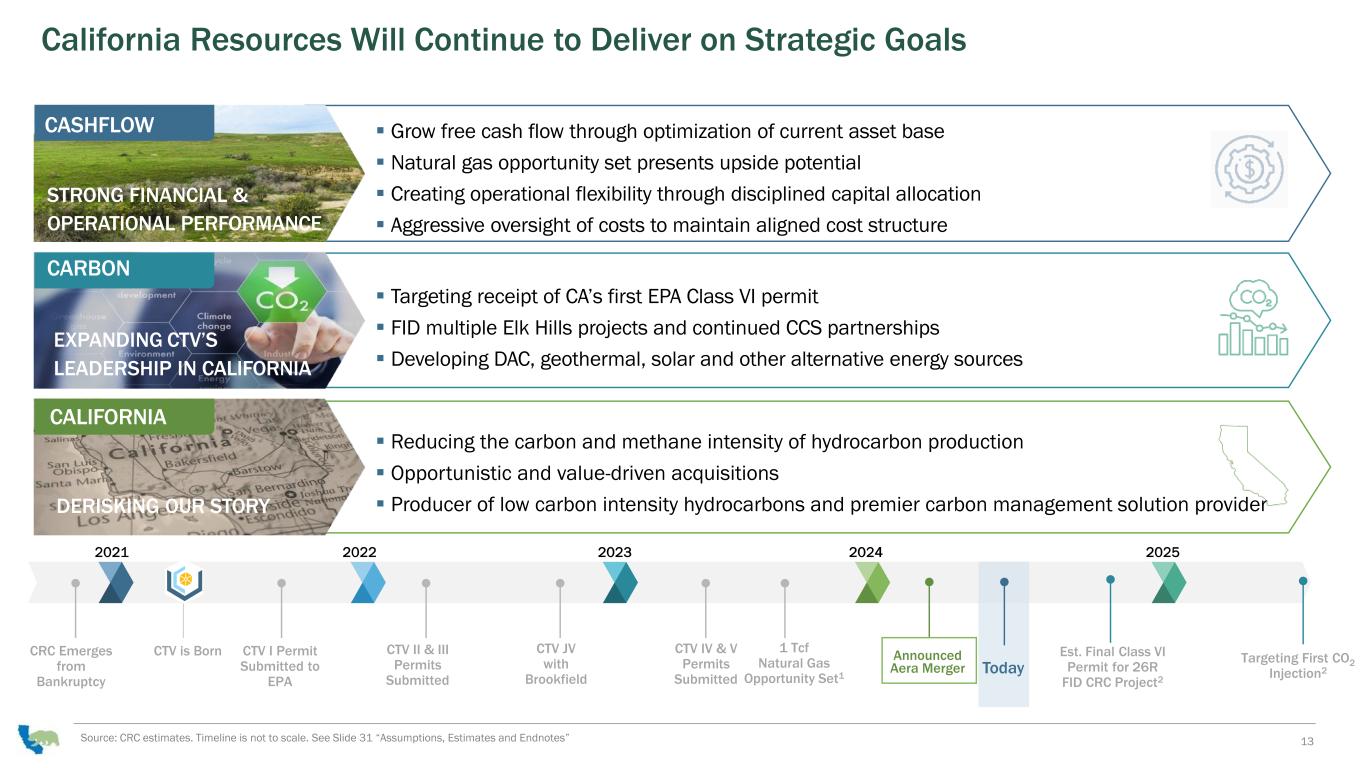

California Resources Will Continue to Deliver on Strategic Goals Source: CRC estimates. Timeline is not to scale. See Slide 31 “Assumptions, Estimates and Endnotes” 13 ▪ Grow free cash flow through optimization of current asset base ▪ Natural gas opportunity set presents upside potential ▪ Creating operational flexibility through disciplined capital allocation ▪ Aggressive oversight of costs to maintain aligned cost structure CTV is Born Today CTV I Permit Submitted to EPA CTV II & III Permits Submitted CTV JV with Brookfield Targeting First CO2 Injection2 CTV IV & V Permits Submitted Announced Aera Merger ▪ Targeting receipt of CA’s first EPA Class VI permit ▪ FID multiple Elk Hills projects and continued CCS partnerships ▪ Developing DAC, geothermal, solar and other alternative energy sources ▪ Reducing the carbon and methane intensity of hydrocarbon production ▪ Opportunistic and value-driven acquisitions ▪ Producer of low carbon intensity hydrocarbons and premier carbon management solution provider STRONG FINANCIAL & OPERATIONAL PERFORMANCE EXPANDING CTV’S LEADERSHIP IN CALIFORNIA DERISKING OUR STORY CARBON CALIFORNIA 2021 CRC Emerges from Bankruptcy CASHFLOW 2022 2023 2024 2025 1 Tcf Natural Gas Opportunity Set1 Est. Final Class VI Permit for 26R FID CRC Project2

Pro Forma CRC

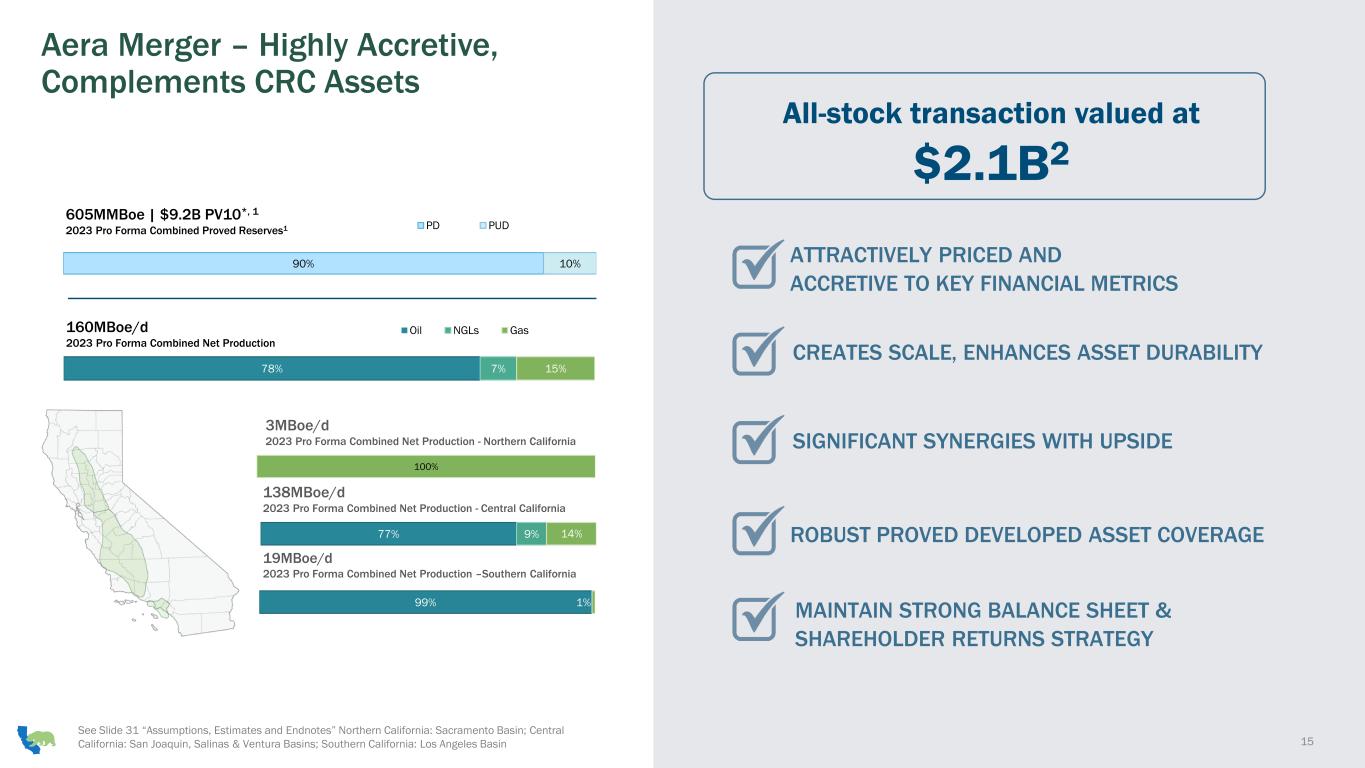

15 See Slide 31 “Assumptions, Estimates and Endnotes” Northern California: Sacramento Basin; Central California: San Joaquin, Salinas & Ventura Basins; Southern California: Los Angeles Basin Aera Merger – Highly Accretive, Complements CRC Assets ATTRACTIVELY PRICED AND ACCRETIVE TO KEY FINANCIAL METRICS SIGNIFICANT SYNERGIES WITH UPSIDE MAINTAIN STRONG BALANCE SHEET & SHAREHOLDER RETURNS STRATEGY CREATES SCALE, ENHANCES ASSET DURABILITY ROBUST PROVED DEVELOPED ASSET COVERAGE All-stock transaction valued at $2.1B2 78% 7% 15% Oil NGLs Gas160MBoe/d 2023 Pro Forma Combined Net Production 90% 10% PD PUD 605MMBoe | $9.2B PV10*, 1 2023 Pro Forma Combined Proved Reserves1 100% 3MBoe/d 2023 Pro Forma Combined Net Production - Northern California 99% 1% 19MBoe/d 2023 Pro Forma Combined Net Production –Southern California 138MBoe/d 2023 Pro Forma Combined Net Production - Central California 77% 9% 14%

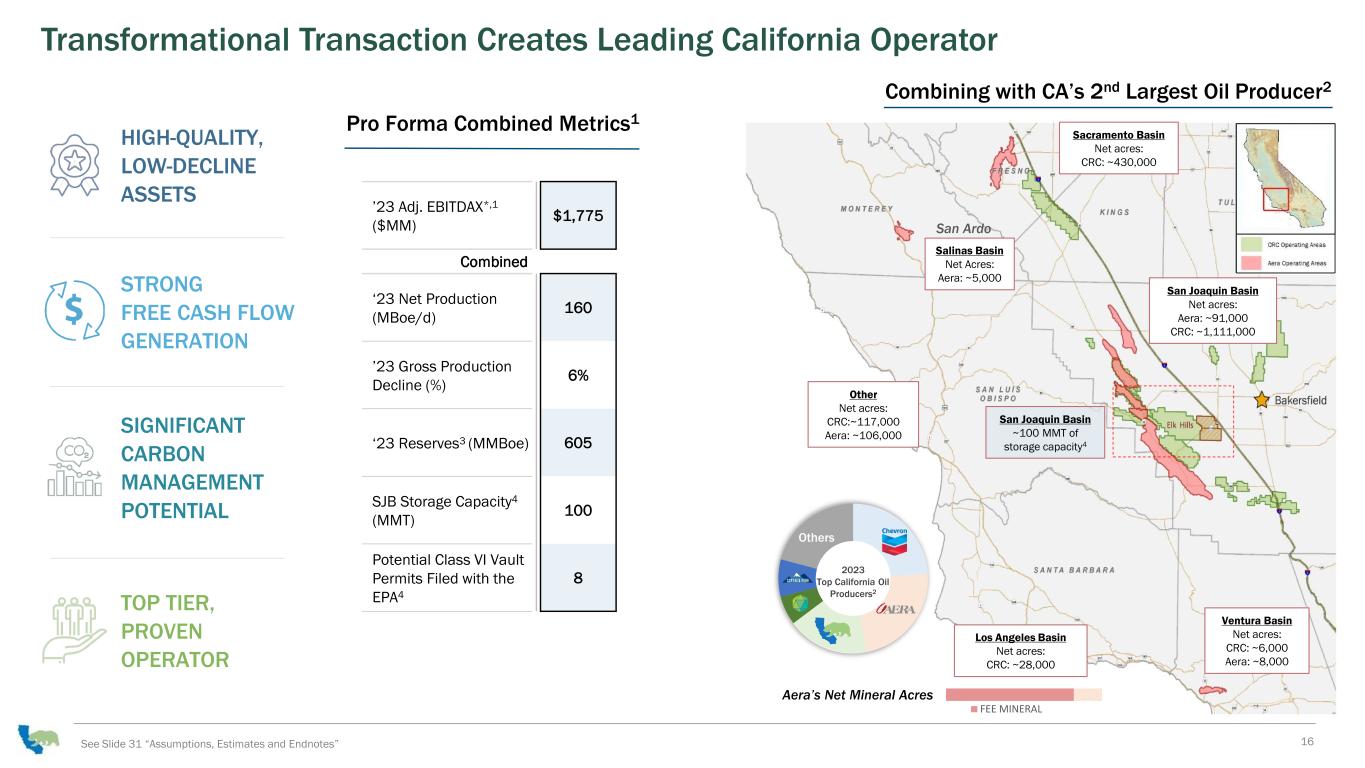

’23 Adj. EBITDAX*,1 ($MM) $1,775 Combined ‘23 Net Production (MBoe/d) 160 ’23 Gross Production Decline (%) 6% ‘23 Reserves3 (MMBoe) 605 SJB Storage Capacity4 (MMT) 100 Potential Class VI Vault Permits Filed with the EPA4 8 San Ardo Combining with CA’s 2nd Largest Oil Producer2 Salinas Basin Net Acres: Aera: ~5,000 FEE MINERAL Aera’s Net Mineral Acres HIGH-QUALITY, LOW-DECLINE ASSETS STRONG FREE CASH FLOW GENERATION SIGNIFICANT CARBON MANAGEMENT POTENTIAL TOP TIER, PROVEN OPERATOR Transformational Transaction Creates Leading California Operator See Slide 31 “Assumptions, Estimates and Endnotes” 16 Pro Forma Combined Metrics1 Other Net acres: CRC:~117,000 Aera: ~106,000 Ventura Basin Net acres: CRC: ~6,000 Aera: ~8,000 Los Angeles Basin Net acres: CRC: ~28,000 San Joaquin Basin Net acres: Aera: ~91,000 CRC: ~1,111,000 Sacramento Basin Net acres: CRC: ~430,000 2023 Top California Oil Producers2 Others San Joaquin Basin ~100 MMT of storage capacity4

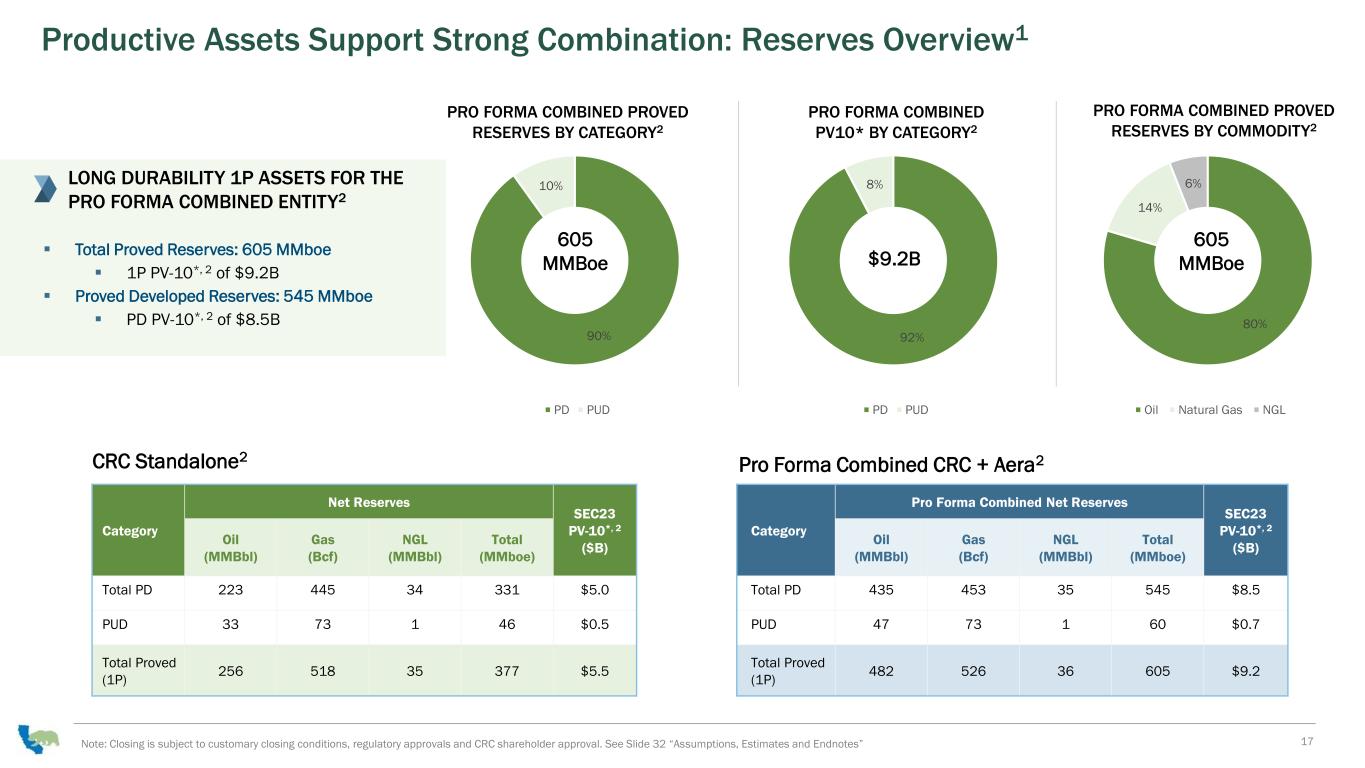

17 92% 8% PD PUD 80% 14% 6% Oil Natural Gas NGL 90% 10% PD PUD Productive Assets Support Strong Combination: Reserves Overview1 Note: Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. See Slide 32 “Assumptions, Estimates and Endnotes” Category Net Reserves SEC23 PV-10*, 2 ($B) Oil (MMBbl) Gas (Bcf) NGL (MMBbl) Total (MMboe) Total PD 223 445 34 331 $5.0 PUD 33 73 1 46 $0.5 Total Proved (1P) 256 518 35 377 $5.5 Category Pro Forma Combined Net Reserves SEC23 PV-10*, 2 ($B) Oil (MMBbl) Gas (Bcf) NGL (MMBbl) Total (MMboe) Total PD 435 453 35 545 $8.5 PUD 47 73 1 60 $0.7 Total Proved (1P) 482 526 36 605 $9.2 ▪ Total Proved Reserves: 605 MMboe ▪ 1P PV-10*, 2 of $9.2B ▪ Proved Developed Reserves: 545 MMboe ▪ PD PV-10*, 2 of $8.5B PRO FORMA COMBINED PROVED RESERVES BY CATEGORY2 PRO FORMA COMBINED PV10* BY CATEGORY2 PRO FORMA COMBINED PROVED RESERVES BY COMMODITY2 605 MMBoe $9.2B 605 MMBoe CRC Standalone2 Pro Forma Combined CRC + Aera2 LONG DURABILITY 1P ASSETS FOR THE PRO FORMA COMBINED ENTITY2

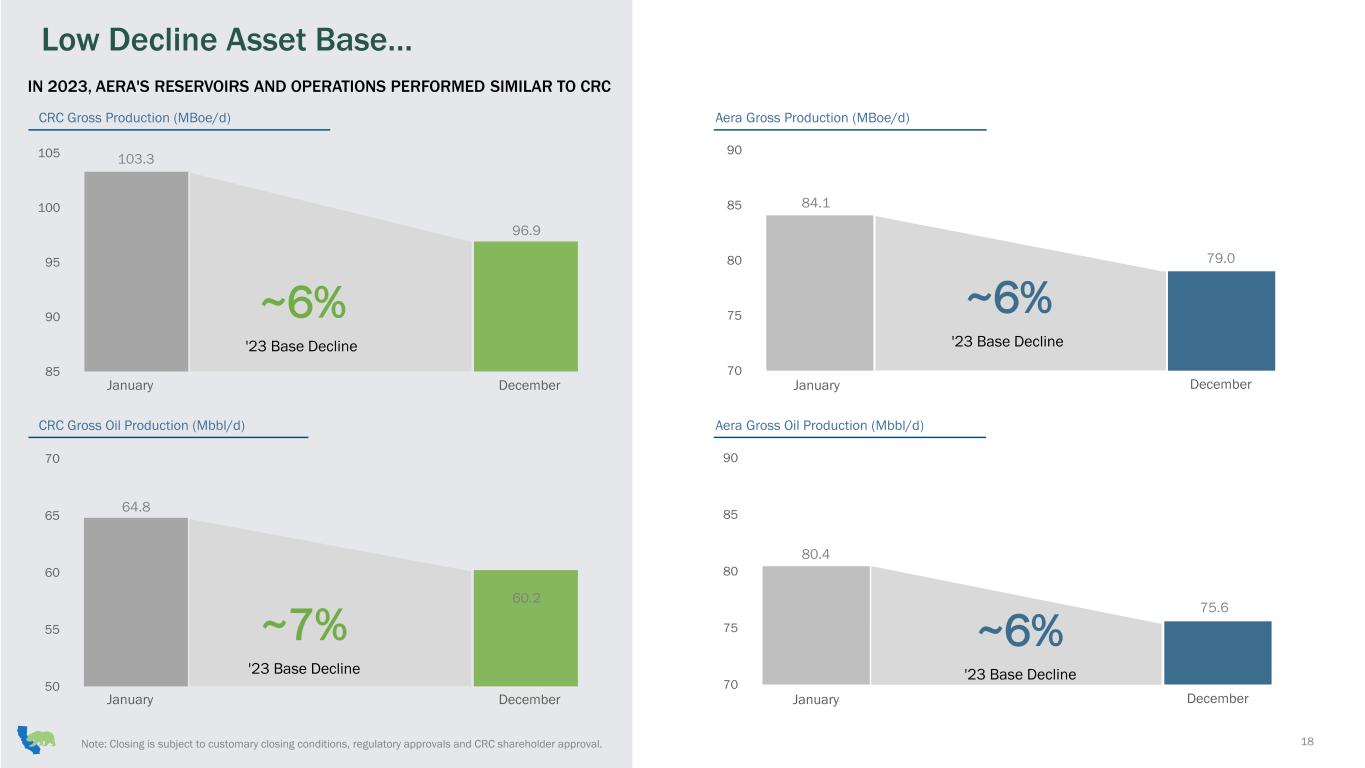

18 50 55 60 65 70 85 90 95 100 105 January December 103.3 96.9 IN 2023, AERA'S RESERVOIRS AND OPERATIONS PERFORMED SIMILAR TO CRC CRC Gross Production (MBoe/d) January December CRC Gross Oil Production (Mbbl/d) ~6% '23 Base Decline ~7% '23 Base Decline 64.8 60.2 Low Decline Asset Base… 70 75 80 85 90 70 75 80 85 90 Aera Gross Production (MBoe/d) 84.1 79.0 January December Aera Gross Oil Production (Mbbl/d) January December 80.4 75.6 ~6% '23 Base Decline ~6% '23 Base Decline Note: Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval.

29.0% 55.0% 28.0% 2021 2022 2023 10.0% 18.0% 39.0% 2021 2022 2023 Available Activity Net Production impact (% Decline per Year) Pro Forma Combined Capital ($MM per year) Targeted Near Term Planned Activity Base Decline of 10% to 13% 1 rig Through 2025 ~3% - 5% $50 - $65 per rig Plus $80 - $100 in workoversPermits in Hand plus Workovers Expected Production Decline -5% to -7% Targeted Long Term Annual Development Activity Workovers and Sidetracks 12 Workover Rigs ~3% $100 New Drill Opportunities2 8 Rigs ~1% per rig $40 - $65 per rig4 Natural Gas Opportunity Set Upside3 ~220Bcf TBD TBD Expected Production Decline Flat 0% 10% 20% 30% 40% PRODUCTION DECLINES VS PEERS5 4Q23 Annualized BOE Decline (%) Operator A Operator B Operator C Operator D Operator E Operator F Operator G Operator H Operator I Operator J Operator K Historical Reinvestment Rate (%) LOW CAPITAL INTENSITY RESERVOIRS 19 Operator L Operator NOperator M Note: Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. See Slide 32 “Assumptions, Estimates and Endnotes” CRC Aera1 …Resulting in Modest Reinvestment Capacity Need

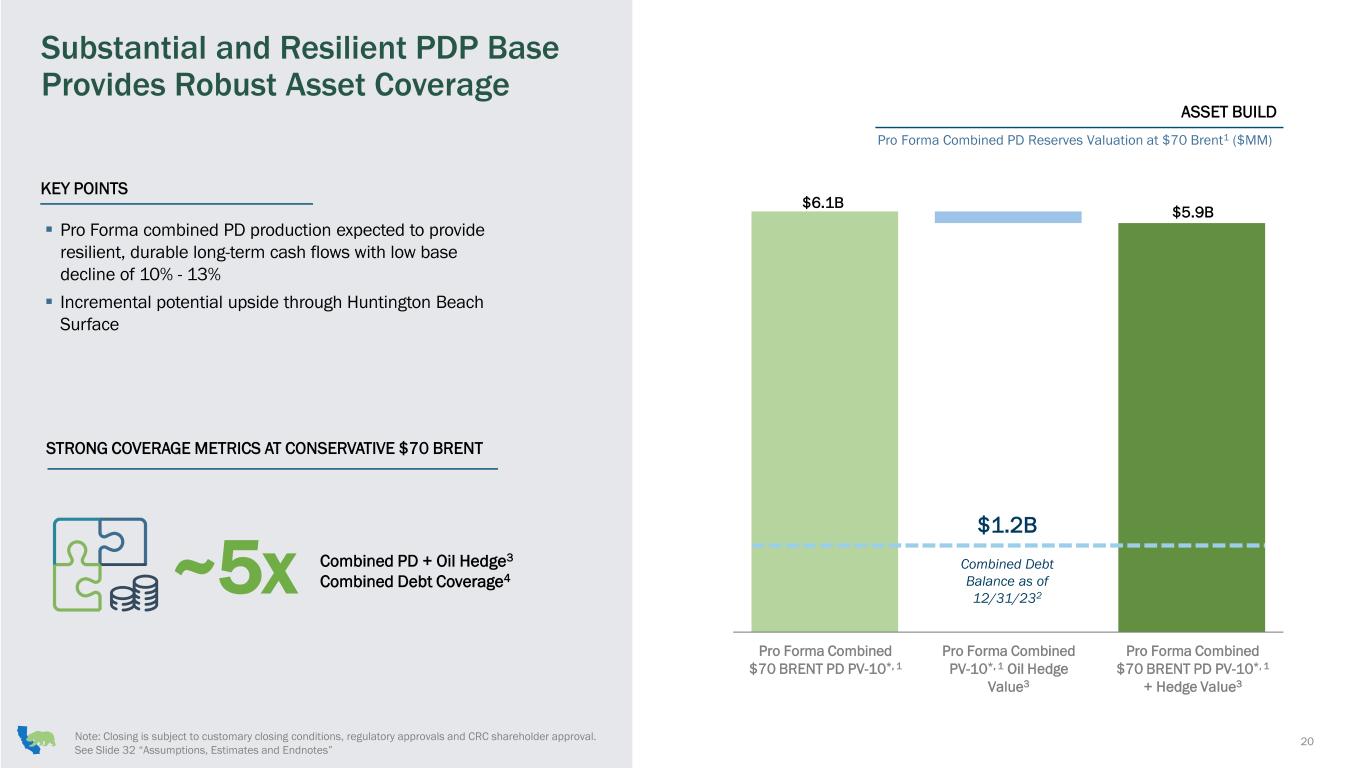

20 Note: Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. See Slide 32 “Assumptions, Estimates and Endnotes” Substantial and Resilient PDP Base Provides Robust Asset Coverage KEY POINTS ▪ Pro Forma combined PD production expected to provide resilient, durable long-term cash flows with low base decline of 10% - 13% ▪ Incremental potential upside through Huntington Beach Surface STRONG COVERAGE METRICS AT CONSERVATIVE $70 BRENT ASSET BUILD Pro Forma Combined PD Reserves Valuation at $70 Brent1 ($MM) ~5x Combined PD + Oil Hedge3 Combined Debt Coverage4 Pro Forma Combined $70 BRENT PD PV-10*, 1 Pro Forma Combined PV-10*, 1 Oil Hedge Value3 $6.1B $1.2B Combined Debt Balance as of 12/31/232 $5.9B Pro Forma Combined $70 BRENT PD PV-10*, 1 + Hedge Value3

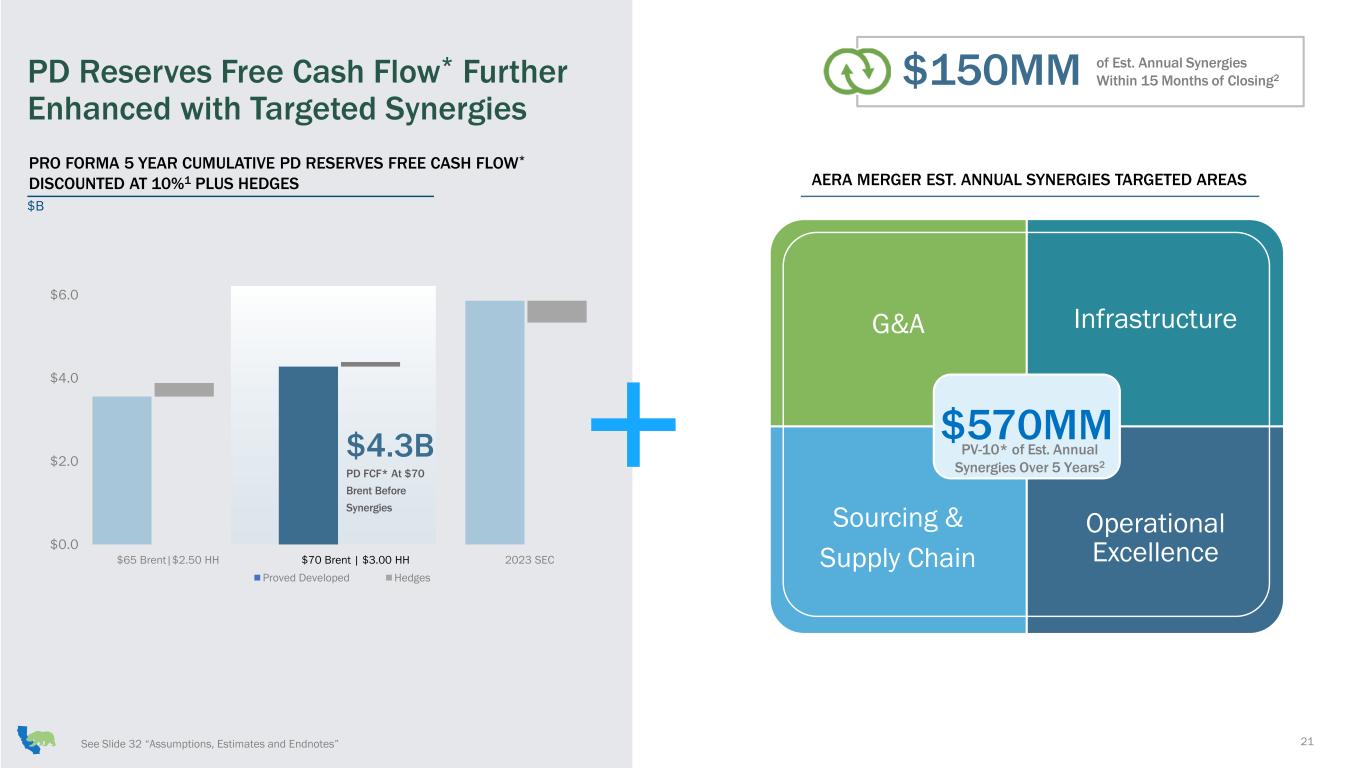

PD Reserves Free Cash Flow* Further Enhanced with Targeted Synergies PRO FORMA 5 YEAR CUMULATIVE PD RESERVES FREE CASH FLOW* DISCOUNTED AT 10%1 PLUS HEDGES $B 21 AERA MERGER EST. ANNUAL SYNERGIES TARGETED AREAS G&A Infrastructure Sourcing & Supply Chain Operational Excellence $570MM See Slide 32 “Assumptions, Estimates and Endnotes” $65 Brent|$2.50 HH $70 Brent | $3.00 HH 2023 SEC $4.3B PD FCF* At $70 Brent Before Synergies $150MM PV-10* of Est. Annual Synergies Over 5 Years2 of Est. Annual Synergies Within 15 Months of Closing2 $0.0 $2.0 $4.0 $6.0 Proved Developed Hedges

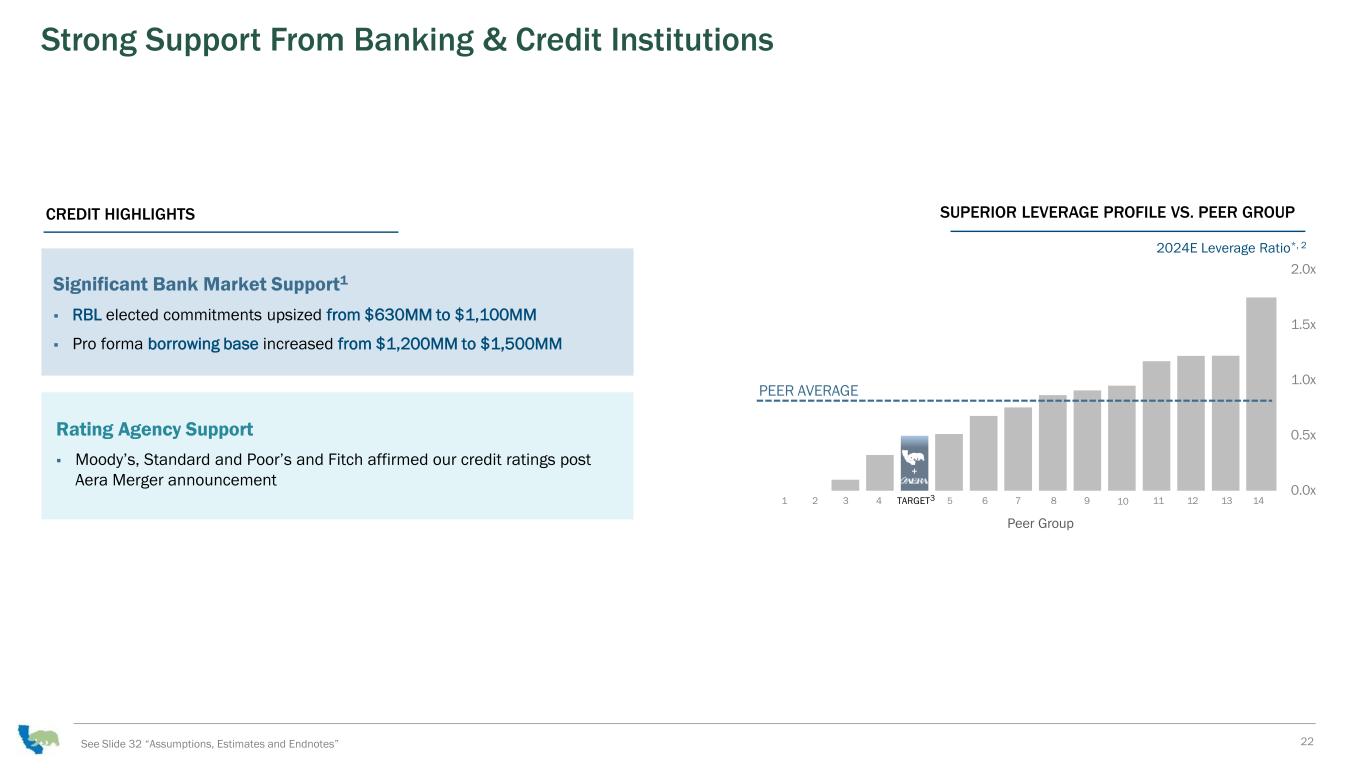

22 SUPERIOR LEVERAGE PROFILE VS. PEER GROUPCREDIT HIGHLIGHTS Strong Support From Banking & Credit Institutions 2024E Leverage Ratio*, 2 Significant Bank Market Support1 ▪ RBL elected commitments upsized from $630MM to $1,100MM ▪ Pro forma borrowing base increased from $1,200MM to $1,500MM Rating Agency Support ▪ Moody’s, Standard and Poor’s and Fitch affirmed our credit ratings post Aera Merger announcement 4 TARGET3 5 0.0x 0.5x 1.0x 1.5x 2.0x Peer Group PEER AVERAGE 1 2 3 6 7 8 9 10 11 12 13 14 + See Slide 32 “Assumptions, Estimates and Endnotes”

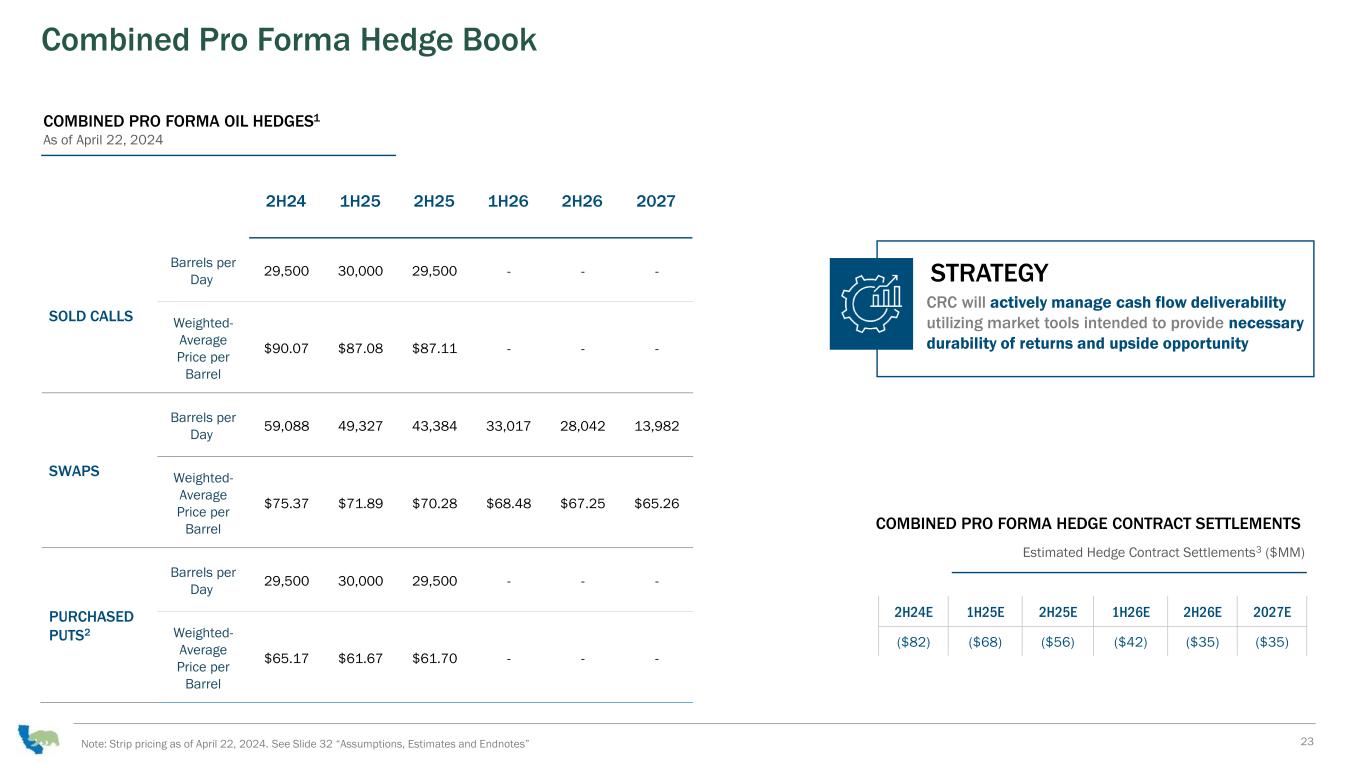

Combined Pro Forma Hedge Book Note: Strip pricing as of April 22, 2024. See Slide 32 “Assumptions, Estimates and Endnotes” 23 2H24 1H25 2H25 1H26 2H26 2027 SOLD CALLS Barrels per Day 29,500 30,000 29,500 - - - Weighted- Average Price per Barrel $90.07 $87.08 $87.11 - - - SWAPS Barrels per Day 59,088 49,327 43,384 33,017 28,042 13,982 Weighted- Average Price per Barrel $75.37 $71.89 $70.28 $68.48 $67.25 $65.26 PURCHASED PUTS2 Barrels per Day 29,500 30,000 29,500 - - - Weighted- Average Price per Barrel $65.17 $61.67 $61.70 - - - COMBINED PRO FORMA OIL HEDGES1 As of April 22, 2024 2H24E 1H25E 2H25E 1H26E 2H26E 2027E ($82) ($68) ($56) ($42) ($35) ($35) COMBINED PRO FORMA HEDGE CONTRACT SETTLEMENTS Estimated Hedge Contract Settlements3 ($MM) CRC will actively manage cash flow deliverability utilizing market tools intended to provide necessary durability of returns and upside opportunity STRATEGY

Cash Flow Priorities and Credit Highlights

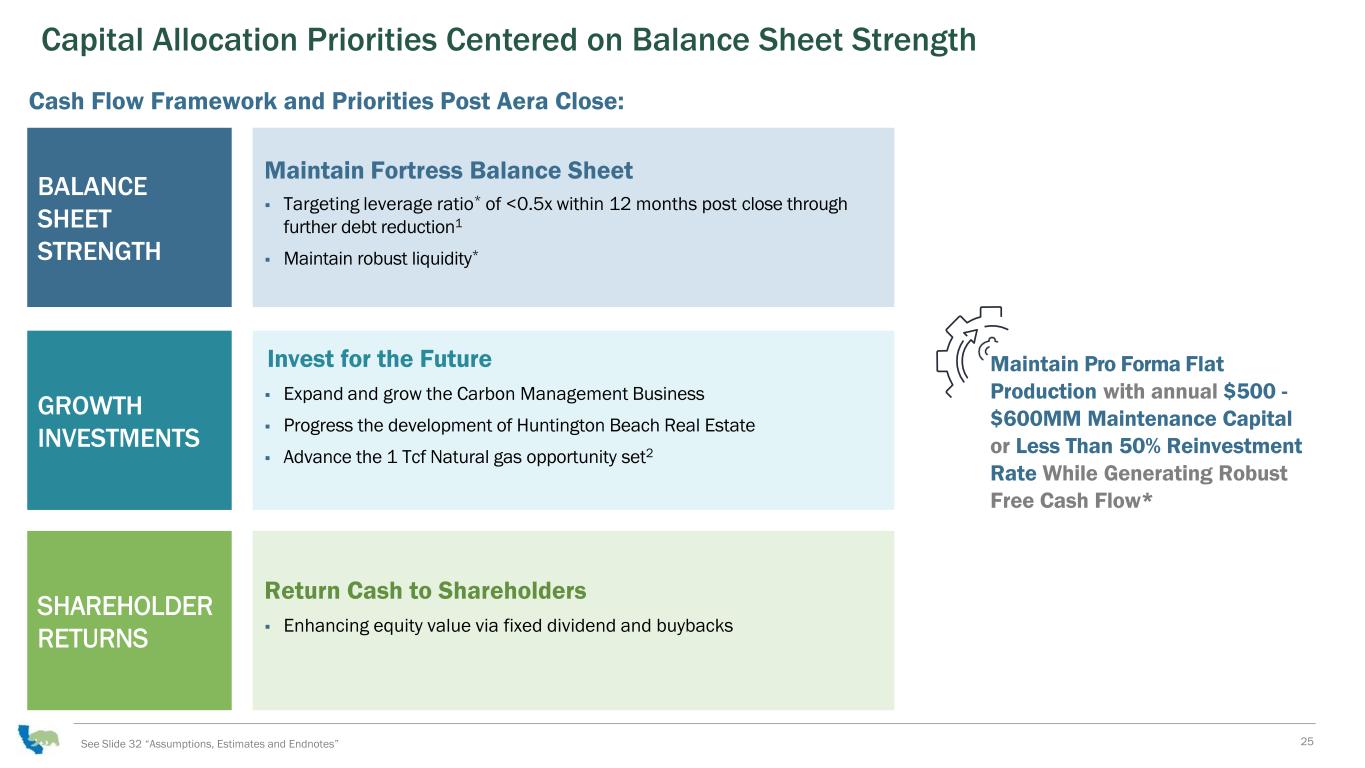

Capital Allocation Priorities Centered on Balance Sheet Strength 25 Maintain Fortress Balance Sheet ▪ Targeting leverage ratio* of <0.5x within 12 months post close through further debt reduction1 ▪ Maintain robust liquidity* Return Cash to Shareholders ▪ Enhancing equity value via fixed dividend and buybacks Invest for the Future ▪ Expand and grow the Carbon Management Business ▪ Progress the development of Huntington Beach Real Estate ▪ Advance the 1 Tcf Natural gas opportunity set2 BALANCE SHEET STRENGTH SHAREHOLDER RETURNS GROWTH INVESTMENTS Cash Flow Framework and Priorities Post Aera Close: Maintain Pro Forma Flat Production with annual $500 - $600MM Maintenance Capital or Less Than 50% Reinvestment Rate While Generating Robust Free Cash Flow* See Slide 32 “Assumptions, Estimates and Endnotes”

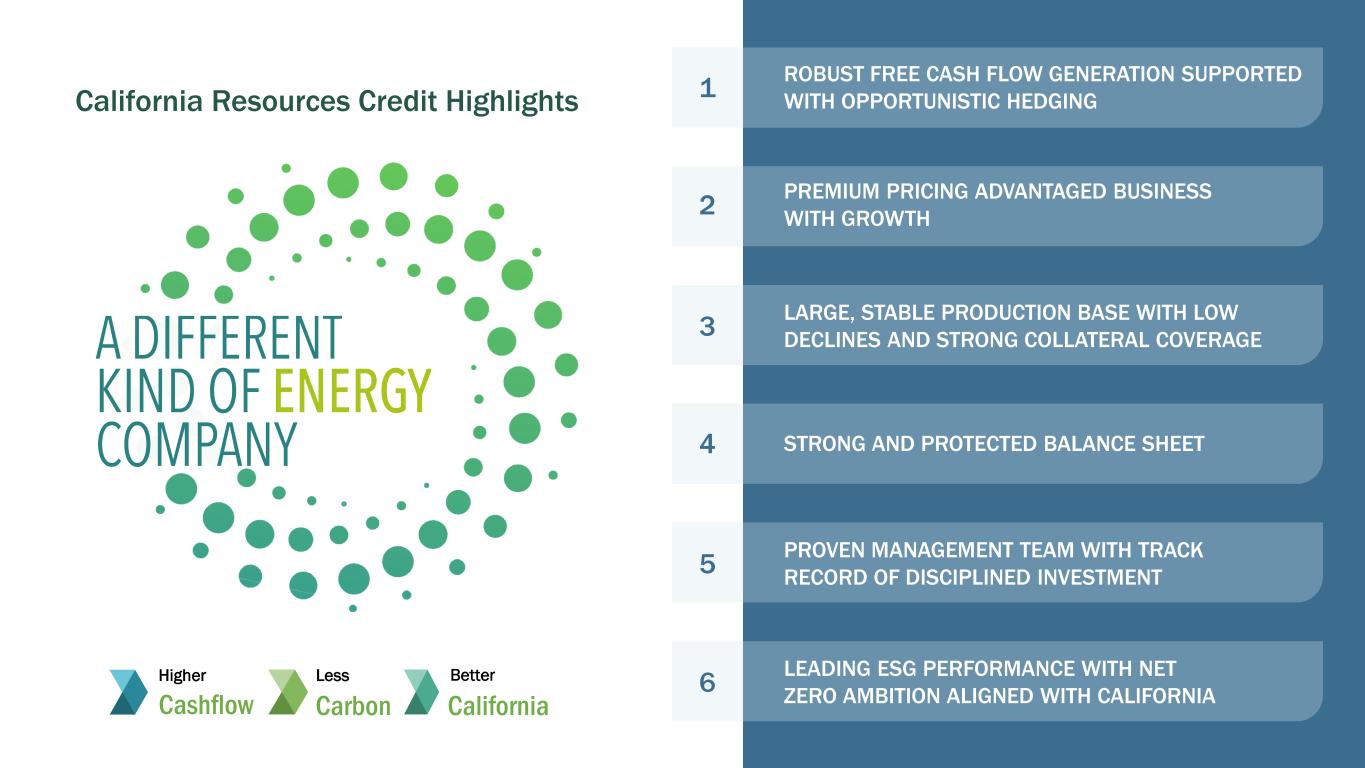

California Resources Credit Highlights LARGE, STABLE PRODUCTION BASE WITH LOW DECLINES AND STRONG COLLATERAL COVERAGE ROBUST FREE CASH FLOW GENERATION SUPPORTED WITH OPPORTUNISTIC HEDGING PREMIUM PRICING ADVANTAGED BUSINESS WITH GROWTH STRONG AND PROTECTED BALANCE SHEET PROVEN MANAGEMENT TEAM WITH TRACK RECORD OF DISCIPLINED INVESTMENT LEADING ESG PERFORMANCE WITH NET ZERO AMBITION ALIGNED WITH CALIFORNIACaliforniaCashflow Carbon Higher Less Better 3 1 2 4 5 6

Appendix

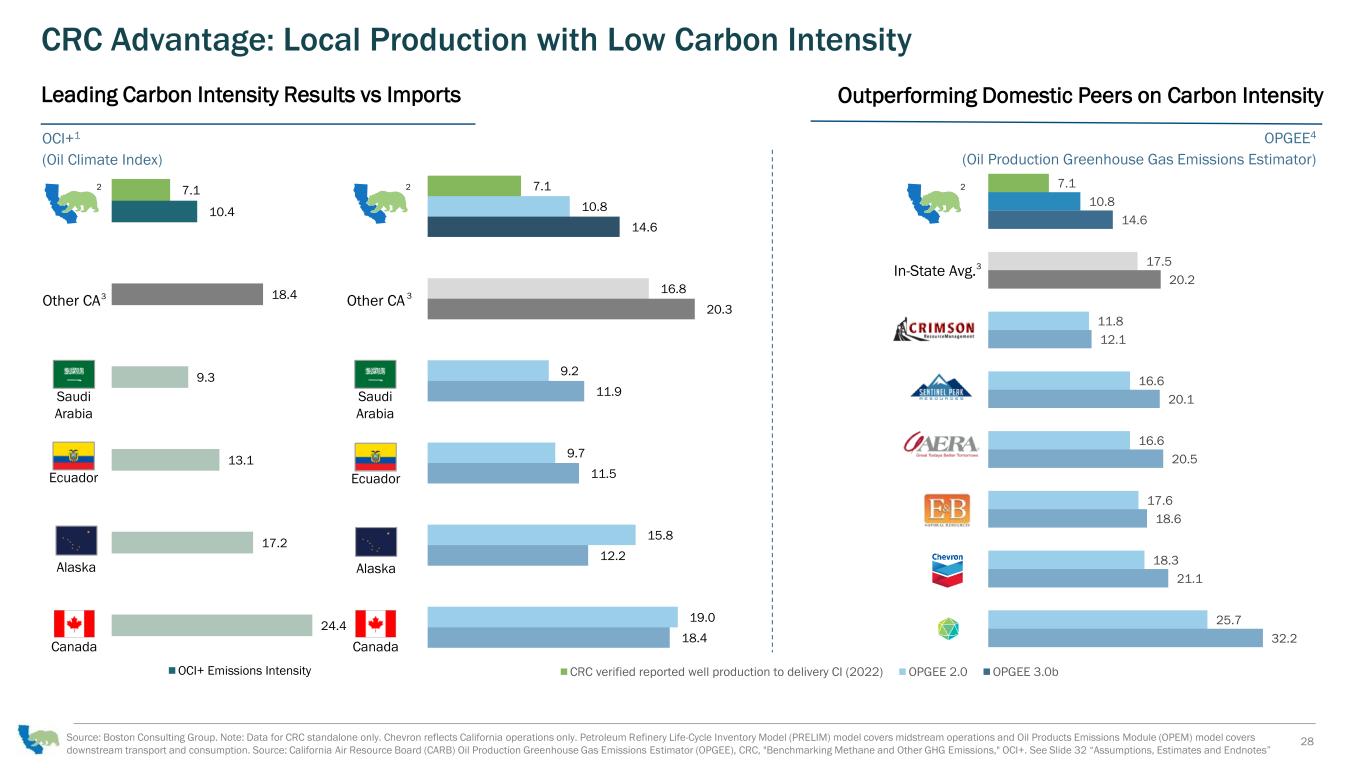

28 CRC Advantage: Local Production with Low Carbon Intensity Source: Boston Consulting Group. Note: Data for CRC standalone only. Chevron reflects California operations only. Petroleum Refinery Life-Cycle Inventory Model (PRELIM) model covers midstream operations and Oil Products Emissions Module (OPEM) model covers downstream transport and consumption. Source: California Air Resource Board (CARB) Oil Production Greenhouse Gas Emissions Estimator (OPGEE), CRC, "Benchmarking Methane and Other GHG Emissions," OCI+. See Slide 32 “Assumptions, Estimates and Endnotes” Leading Carbon Intensity Results vs Imports 24.4 17.2 13.1 9.3 18.4 10.4 7.1 OCI+ Emissions Intensity Other CA Alaska Canada Ecuador Saudi Arabia 18.4 12.2 11.5 11.9 20.3 14.6 19.0 15.8 9.7 9.2 16.8 10.8 7.1 Other CA Alaska Canada Ecuador Saudi Arabia 7.1 10.8 17.5 11.8 16.6 16.6 17.6 18.3 25.7 14.6 20.2 12.1 20.1 20.5 18.6 21.1 32.2 CRC verified reported well production to delivery CI (2022) OPGEE 2.0 OPGEE 3.0b In-State Avg. Outperforming Domestic Peers on Carbon Intensity OPGEE4 (Oil Production Greenhouse Gas Emissions Estimator) OCI+1 (Oil Climate Index) 2 2 2 3 3 3

2023: Sustainability & Social Responsibility Is In Our Business Model 29 ▪ Achieved our second-best TRIR1 in the Company’s history (CRC’s best since 2020 COVID period) ▪ Qualified for 22 National Safety Awards for 2023 safety performance ▪ Donated $2.5MM in total charitable giving to non-profit organizations across California to help fund public health, safety, environmental; STEM/job training; and DEI initiatives ▪ 135+ non-profits supported | 200+ employee volunteers | 864+ hours at community events ▪ Female professional hires increased from 28% to 42% ▪ Investor-favored changes included the removal of Supermajority votes ▪ Board exhibited diversity with 33% being gender diverse and 44% consisting of members from underrepresented communities ▪ 30% of the 2023 executive compensation scorecard metrics relating to Company performance tied to ESG-related carbon management, environmental stewardship, and worker safety ▪ Recertified Wildlife Habitat Council projects at THUMS, Bolsa Chica, and Elk Hills ▪ Eliminated 269 pneumatic venting devices reducing methane emissions by >400 Mt/year ▪ Delivered more than 113 million barrels of water for agricultural use, or more than 3 times the amount for our internal use ▪ Reduced internal freshwater consumption by 1,500 barrels of water/day ▪ Plugged and abandoned 614 wells Reduced Scope 1 & 2 Emissions 9.5% from 2020 to 2022 Reduced Methane Emissions 15.5% from 2020 to 2022 2022 Sustainability Update Highlights (Published in August 2023) ENVIRONMENT GOVERNANCE SOCIAL See Slide 32 “Assumptions, Estimates and Endnotes”

Disclosures

Slide 4: (1) Reserves information shown as of December 31, 2023 using SEC Prices (after factoring in price realizations) of $82.84 per barrel for oil and $2.64 per MMbtu for natural gas. PV-10 is a non-GAAP measure. (2) Electricity Margin is calculated as the difference between Electricity Sales and Electricity Generation Expenses. Margin from Marketing of Purchased Commodities is calculated as the difference between Revenue from Marketing of Purchased Commodities and Costs Related to Marketing of Purchased Commodities. (3) 2023 leverage metrics data from FactSet. Peer group includes: BRY, CHRD, CIVI, CRGY, KOS, MGY, MTDR, MUR, PR, SM, TALO and VTLE. (4) MiQ is an independent not-for-profit established to facilitate a rapid reduction in methane emissions from the oil and gas sector. Slide 5: (1) Contingent on a successful close of Aera Merger which is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. Slide 6: (1) Average realized prices exclude hedges on oil and natural gas. (2) Benchmark prices are based on Brent for oil and NGLs, and on NYMEX average daily price for natural gas. Slide 7: (1) Source: EIA; excludes Vehicle Fuel which was less than 0.029 mcf/d from 2018 to 2022. (2) CARB Scoping Plan 2022. (3) Other includes pumped storage, shed DR, geothermal, nuclear, biomass, CHP and coal. (4) Source: CARB. (5) CRC estimates. Slide 8: (1) Internal estimates. The SEC prohibits oil and gas companies, in their filings with the SEC, from disclosing estimates of oil or gas resources other than “reserves,” as that term is defined by the SEC. This presentation includes estimates of quantities of oil and gas using certain terms, such as “opportunity set” or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly prohibit us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being recovered. Readers are urged to consider closely the reserves and other disclosures in our periodic filings with the SEC. (2) MiQ is an independent not-for-profit established to facilitate a rapid reduction in methane emissions from the oil and gas sector. (3) Subject to availability of drilling permits and additional surface infrastructure which may be needed. (4) Source: ICE forward market price as of April 24, 2024. Slide 9: (1) Source: CRC’s 2023 total gross production. (2) CRC internal preliminary estimates. Actual costs could be higher. Slide 10: (1) Seeking CUPs that would allow for drilling via an alternative path to the zoning ordinance. (2) Based on communications with the County and the County’s timeline for prior certifications, CRC anticipates completion and certification of a supplemental environmental impact report by year-end. Following the County’s certification of the supplemental environmental impact report and approval of the ordinance, CRC expects the trial court could lift the stay on permitting within 6 to 12 months thereafter assuming no further challenge to the supplemental environmental impact report. Slide 13: (1) Internal estimates. The SEC prohibits oil and gas companies, in their filings with the SEC, from disclosing estimates of oil or gas resources other than “reserves,” as that term is defined by the SEC. This presentation includes estimates of quantities of oil and gas using certain terms, such as “opportunity set” or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly prohibit us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being recovered. Readers are urged to consider closely the reserves and other disclosures in our periodic filings with the SEC. (2) CRC estimate. Subject to issuance of EPA class VI permit. Slide 15: (1) Reserves determined as of December 31, 2023 and use 2023 SEC Prices of $82.84 per barrel for oil, and $2.64 per MMBtu for Henry Hub and $6.52 per MMBtu for PG&E city gate for natural gas. PV-10 is a non-GAAP measure. See Aera Merger definitive proxy statement filed May 7, 2024 and page 35 of this presentation for additional information and reconciliation of PV-10 to the nearest GAAP equivalent of SMOG. Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. (2) See “The California Resources and Aera Energy Merger” announcement presentation from February 7, 2024, for calculation of transaction value and other important information. Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. Slide 16: (1) See “The California Resources and Aera Energy Merger” announcement presentation from February 7, 2024, for calculation of transaction value and other important information. See Aera Merger definitive proxy statement filed May 7, 2024 for additional information. Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. See slides 33 and 34 for reconciliation of the pro forma combined Adj. EBITDAX. (2) Source: Enverus 2023 data as of May 8, 2024. In 2023, California’s oil producers accounted for approximatively 23% of oil consumed by local refiners in California, source: www.energy.ca.gov. (3) Reserves determined as of December 31, 2023 and use 2023 SEC Prices of $82.84 per barrel for oil, and $2.64 per MMBtu for Henry Hub and $6.52 per MMBtu for PG&E city gate for natural gas. (4) Includes 27MMT Carbon Frontier Class VI permit submitted to EPA and a 27MMT Class VI EPA permit at Coles Levee that CRC plans to file in a reasonable period of time after the closing of the Aera Merger. The Coles Levee reservoir is still being evaluated and actual storage capacity could range between 20MMT and 30MMT. Assumptions, Estimates and Endnotes 31

Slide 17: (1) See “The California Resources and Aera Energy Merger” announcement presentation from February 7, 2024, for calculation of transaction value and other important information. See Aera Merger definitive proxy statement filed May 7, 2024 for additional information. Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. As of December 31, 2023, with respect to CRC, approximately 18% of proved developed oil reserves, 7% of proved developed NGLs reserves, 10% of proved developed natural gas reserves and, overall, 15% of total proved developed reserves are non-producing. As of December 31, 2023, with respect to Aera, all proved developed reserves are producing. (2) Reserves information shown as of December 31, 2023 using SEC Prices (after factoring in price realizations) of $82.84 per barrel for oil and $2.64 per MMbtu for natural gas. PV-10 is a non-GAAP measure. See Aera Merger definitive proxy statement filed May 7, 2024 and page 35 of this presentation for additional information and reconciliation of PV-10 to the nearest GAAP equivalent of SMOG. Slide 19: (1) Includes capital accruals. (2) Subject to procuring new drill permits (3) Internal estimates. The SEC prohibits oil and gas companies, in their filings with the SEC, from disclosing estimates of oil or gas resources other than “reserves,” as that term is defined by the SEC. This presentation includes estimates of quantities of oil and gas using certain terms, such as “opportunity set” or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly prohibit us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being recovered. Readers are urged to consider closely the reserves and other disclosures in our periodic filings with the SEC. Subject to availability of drilling permits and additional surface infrastructure which may be needed. (4) The prescribed range of potential per rig capital needs will depend on the depth, directional difficulty and operational requirements. CRC uses a portfolio approach for its rigs in operation. (5) Source: Enverus. Slide 20: (1) Reserves information shown as of December 31, 2023 and based on $70.00 per barrel for oil and $3.00 per MMbtu for natural gas. PV-10 is a non-GAAP measure. GAAP does not prescribe a standardized measure of reserves on a basis other than SEC Prices. As such, a GAAP reconciliation for reserves estimated using $70.00 per barrel for oil and $3.00 per MMbtu for natural gas has not been provided. (2) See Aera Merger definitive proxy statement filed May 7, 2024 for additional information. Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. (3) Hedges are as of December 31, 2023 and assume an average Brent price of $70.00 per barrel of oil and $3.00 per MMBtu for natural gas for the 2024 – 2028 period. (4) Debt coverage calculated as pro forma proved developed reserves PV-10 valuation using $70 Brent plus the PV-10 hedge value of $5.9B divided by the combined debt balance as of December 31, 2023 of $1.2B. Slide 21: (1) The 2024 – 2028 cumulative free cash flow amount shown is based on proved developed reserves estimates determined as of December 31, 2023 and includes impact of existing hedge settlements. The 3 scenarios are calculated assuming $65, $70 and 2023 SEC pricing of $82.84 per barrel of oil Brent price through 2024 - 2028, and Henry Hub natural gas prices of $2.50, $3.00 and 2023 SEC pricing of $2.64 per MMBtu through 2024 - 2028, respectively. Pro forma 2024 - 2028 estimates are forward-looking statements and are based on management’s expectations. Actual results could differ materially. (2) See “The California Resources and Aera Energy Merger” announcement presentation from February 7, 2024, for calculation of transaction value and other important information. Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. Slide 22: (1) Contingent on a successful close of Aera Merger which is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. (2) 2024E leverage metrics data from FactSet as of February 1, 2024. Peer group includes: BRY, CHRD, CIVI, CRGY, KOS, MGY, MTDR, MUR, PR, SM, TALO and VTLE. (3) Targeted pro forma leverage ratio of ~0.5x within 12 months post close. Slide 23: (1) Hedges are based on weighted-average Brent prices per barrel. CRC also entered in natural gas hedges for the purchases of natural gas used in our operations which can be found in our 1Q24 10-Q. (2) Purchased and sold puts with the same strike price have been netted together. (3) Represents estimated net cash settlement payments for derivative contracts as of April 22, 2024. Assumes forward commodity prices as of April 22, 2024 and assumes an average Brent price of $82.87 per barrel of oil for 2H 2024, $78.45 per barrel of oil for 2025, $74.79 per barrel of oil for 2026 and $72.31 per barrel of oil for 2027. Slide 25: (1) See “The California Resources and Aera Energy Merger” announcement presentation from February 7, 2024, for calculation of transaction value and other important information. Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. (2) Internal estimates. The SEC prohibits oil and gas companies, in their filings with the SEC, from disclosing estimates of oil or gas resources other than “reserves,” as that term is defined by the SEC. This presentation includes estimates of quantities of oil and gas using certain terms, such as “opportunity set” or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly prohibit us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being recovered. Readers are urged to consider closely the reserves and other disclosures in our periodic filings with the SEC. Slide 28: (1) OCI uses the OPGEE, PRELIM, and OPEM models to calculate carbon intensity. (2) CRC average CI adjusted to exclude Ventura but not adjusted for Elk Hills Power. (3) In-state average includes producers from list with production only in CA based on report (Berry, Sentinel Peak, and E&B). (4) OPGEE is a Stanford-designed model used by CARB to calculate global CI based on reported data and presets. Slide 29: (1) Total Recordable Incident Rate (TRIR) calculated as recordable incidents per 200,000 hours for all workers (employees and contractors). Assumptions, Estimates and Endnotes 32

Adjusted EBITDAX Reconciliation 33 For the Year Ended December 31, 2023 For the Year Ended December 31, 2023 For the 58-days Ended February 27, 2023 For the Year Ended December 31, 2023 For the Year Ended December 31, 2023 ($MM) CRC Aera Aera Aera Combined Transaction Adjustments - Disposals Transaction Adjustments - Acquisitions Financing Adjustments CRC Proforma Combined Net income (loss) $564 $205 $(101) $104 $ - $(46) $(48) $574 Interest and debt expense, net 56 110 - 110 - (110) 67 123 Income tax provision (benefit) 184 (1) - (1) - 23 (19) 187 Interest income (21) (5) - (5) - - - (26) Depreciation, depletion and amortization 225 292 77 369 - 112 - 706 Exploration expense 3 - - - - - - 3 Unusual, infrequent and other items: Non-cash derivative loss (gain) (260) 109 - 109 - - - (151) Asset impairment 3 - - - - - 3 Severance and termination costs 10 37 - 37 - - - 47 Transaction costs 15 43 - 43 - 46 - 104 Information technology infrastructure 17 - - - - - - 17 Retention payments 3 - - - - 22 - 25 Net loss on early extinguishment of debt 1 - - - - - - 1 Net gain on asset divestitures (32) (13) - (13) - - - (45) Other, net 19 6 2 8 - - - 27 Total unusual, infrequent and other items (224) 182 2 184 - 68 - 28 Non-cash items - Accretion expense 46 122 13 135 - (47) - 134 Stock-based compensation 27 - - - - - - 27 Post-retirement medical and pension 2 14 3 17 - - - 19 Adjusted EBITDAX $862 $919 $(6) $913 $ - $ - $ - $1,775 We define adjusted EBITDAX as earnings before interest expense; income taxes; depreciation, depletion and amortization; exploration expense; other unusual, infrequent and out-of-period items; and other non-cash items. We believe this measure provides useful information in assessing our financial condition, results of operations and cash flows and is widely used by the industry, the investment community and our lenders. Although this is a non-GAAP measure, the amounts included in the calculation were computed in accordance with GAAP. Certain items excluded from this non-GAAP measure are significant components in understanding and assessing a company’s financial performance, such as cost of capital and tax structure, as well as depreciation, depletion and amortization of assets. This measure should be read in conjunction with the information contained in our financial statements prepared in accordance with GAAP. A version of Adjusted EBITDAX is a material component of certain of our financial covenants under our Revolving Credit Facility and is provided in addition to, and not as an alternative for, income and liquidity measures calculated in accordance with GAAP. The following table represents a reconciliation of the GAAP financial measures of net income and net cash provided by operating activities to the non-GAAP financial measure of adjusted EBITDAX.

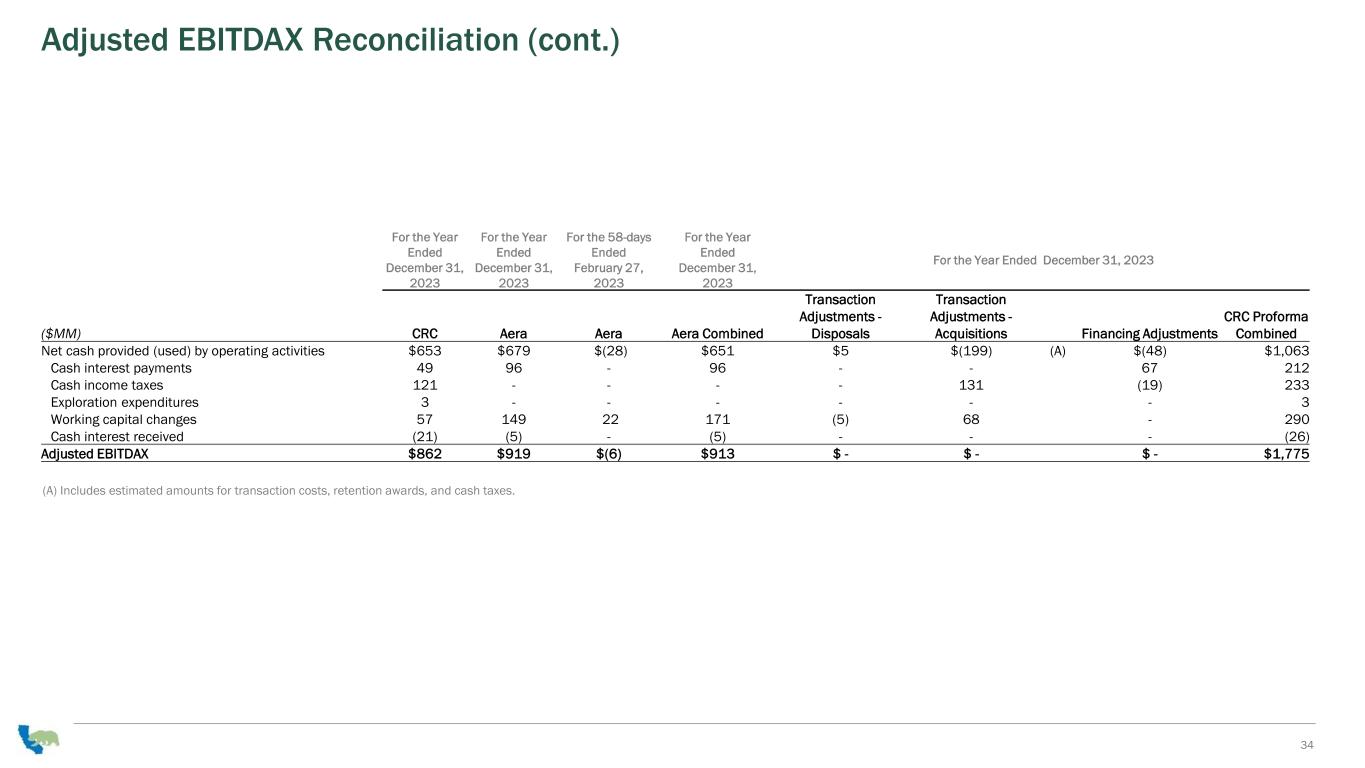

Adjusted EBITDAX Reconciliation (cont.) 34 For the Year Ended December 31, 2023 For the Year Ended December 31, 2023 For the 58-days Ended February 27, 2023 For the Year Ended December 31, 2023 For the Year Ended December 31, 2023 ($MM) CRC Aera Aera Aera Combined Transaction Adjustments - Disposals Transaction Adjustments - Acquisitions Financing Adjustments CRC Proforma Combined Net cash provided (used) by operating activities $653 $679 $(28) $651 $5 $(199) (A) $(48) $1,063 Cash interest payments 49 96 - 96 - - 67 212 Cash income taxes 121 - - - - 131 (19) 233 Exploration expenditures 3 - - - - - - 3 Working capital changes 57 149 22 171 (5) 68 - 290 Cash interest received (21) (5) - (5) - - - (26) Adjusted EBITDAX $862 $919 $(6) $913 $ - $ - $ - $1,775 (A) Includes estimated amounts for transaction costs, retention awards, and cash taxes.

Non-GAAP Reconciliations 35 The following table presents a reconciliation of the GAAP financial measure of Standardized Measure of discounted future net cash flows (Standardized Measure) to the non-GAAP financial measure of PV-10. PV-10 is a non-GAAP financial measure and represents the year-end present value of estimated future cash inflows from proved oil and natural gas reserves, less future development and operating costs, discounted at 10% per annum to reflect the timing of future cash flows and using SEC prescribed pricing assumptions for the period. PV-10 differs from Standardized Measure because Standardized Measure includes the effects of future income taxes on future net cash flows. Neither PV-10 nor Standardized Measure should be construed as the fair value of oil and natural gas reserves. Standardized Measure is prescribed by the SEC as an industry standard asset value measure to compare reserves with consistent pricing costs and discount assumptions. PV-10 facilitates the comparisons to other companies as it is not dependent on the tax-paying status of the entity. We have presented Aera's Standardized Measure on a pro forma basis which reflects a change Aera's tax-paying status. See additional information in the definitive merger proxy filed on May 7, 2024. PV-10 and Standardized Measure (1). Aera’s present value of future income taxes discounted at 10% reflects the future income tax expense associated with Aera discounted future net cash flows. December 31, 2023 ($B) Aera CRC Pro Forma Combined Standardized Measure of Discounted Future Net Cash Flows $2.8 $4.1 $6.9 Present Value of Future Income Taxes Discounted at 10% $0.91 $1.5 $2.3 PV-10 of cash flows $3.7 $5.5 $9.2 We calculate the leverage ratio by dividing net debt by adjusted EBITDAX for the applicable period. We define net debt as the face value of debt less available cash. We believe the leverage ratio is an important metric of the operational and financial health of a Company and is useful to investors as an indicator of our ability to incur additional debt and to service existing debt. The following table presents a reconciliation of pro forma combined leverage ratio. The leverage ratio is a supplemental measure of pro forma combined performance that is not required by or presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Pro Forma Combined Leverage Ratio and Net Debt Pro Forma Combined ($MM) 2023 Face value of debt $1,2451 Available Cash 172 Net Debt as of December 31, 2023 $1,228 2023 Adjusted EBITDAX $1,775 2023 Leverage Ratio 0.69x (1). Assumes $700MM of long-term debt related to the Aera merger plus CRC's existing long-term debt of $545MM as of December 31, 2023. (2). See Aera Merger definitive proxy statement, page 97, filed May 7, 2024 for additional information. Closing is subject to customary closing conditions, regulatory approvals and CRC shareholder approval.

. Joanna Park (Investor Relations) 818-661-3731 Joanna.Park@crc.com Richard Venn (Media) 818-661-6014 Richard.Venn@crc.com CaliforniaCashflow Carbon Higher Less Better