Agreement with TransAlta to construct

Inter-Alberta Pipeline Network

Tidewater Midstream and Infrastructure Ltd.

(“Tidewater”) (TSX:TWM) and TransAlta Corporation (“TransAlta”)

(TSX:TA) (NYSE:TAC) announced today that the two companies have

entered into a Letter of Intent (“LOI”) for Tidewater to construct

a 120 km natural gas pipeline from its Brazeau River Complex

(“BRC”) to TransAlta’s generating units at Sundance and

Keephills. The pipeline is expected to cost approximately

$150 million and is supported by a 15 year take or pay agreement

with TransAlta.

The pipeline will provide initial capacity of

130 MMcf/d by 2020, and have expansion capability to 340 MMcf/d,

which represents approximately 50% of TransAlta’s gas requirements

at full capacity of the generating units at Sundance and

Keephills. Under the LOI, TransAlta has the option to invest

up to 50% in the pipeline.

“Construction of the natural gas pipeline

supports our strategy of being a low-cost provider of firm, clean

and reliable energy”, said Dawn Farrell, President and Chief

Executive Officer of TransAlta. “In addition, having greater access

to natural gas allows TransAlta to blend natural gas with the coal,

prior to fully converting the units, allowing us to take advantage

of low natural gas prices and reduce our carbon

costs.”

“Tidewater is excited to enter into a long term

arrangement with TransAlta which is supported by a 15 year take or

pay agreement that provides oil and gas producers throughout

Western Canada with direct connectivity to a new, large demand

source”, said Joel MacLeod, President and Chief Executive Officer

of Tidewater. “This agreement with TransAlta enables Tidewater to

transport production direct from the wellhead through Tidewater’s

extensive natural gas processing and storage infrastructure network

direct to an end market.”

Proposed issuance of senior unsecured

notes

Tidewater intends to issue, subject to market

and other conditions, a proposed private placement of senior

unsecured notes (the “Notes”).

Tidewater intends to use the net proceeds from

the offering for a non-permanent repayment of indebtedness under

Tidewater’s existing credit facility, drawn to fund its various

capital projects, and for general corporate purposes.

The Notes will not be qualified for distribution

to the public under the securities laws of any province or

territory of Canada and may not be offered or sold in Canada,

directly or indirectly, other than pursuant to applicable private

placement exemptions. The Notes will not be registered under the

U.S. Securities Act of 1933, as amended, and may not be offered or

sold in the United States absent registration or an applicable

exemption from the registration requirements of such Act. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy the Notes in any jurisdiction.

Deep Basin and Montney region

acquisition

Tidewater’s previously announced acquisition of

certain assets in the Deep Basin and Montney region for net cash

consideration of $34 Million, subject to customary adjustments, has

closed in escrow. Final closing of the transaction is subject

to regulatory license transfer approvals and is expected to occur

in December 2017. An immaterial portion of the assets is

being held in escrow pending resolution of a right of first refusal

challenge.

Closing of credit facility

increase

Tidewater is pleased to announce that an

increase to its credit facility has closed. Tidewater’s

banking syndicate increased this credit facility from $180 million

to $250 million.

Tidewater's Business

Tidewater is traded on the TSX under the symbol

“TWM”. Tidewater’s business objective is to build a diversified

midstream and infrastructure company in the North American natural

gas and natural gas liquids (“NGL”) space. Its strategy is to

profitably grow and create shareholder value through the

acquisition and development of oil and gas infrastructure.

Tidewater plans to achieve its business objective by providing

customers with a full service, vertically integrated value chain

through the acquisition and development of oil and gas

infrastructure including: gas plants, pipelines, railcars, trucks,

export terminals and storage facilities.

Cautionary Notes

Advisory Regarding Forward-Looking

Statements

In the interest of providing Tidewater's

shareholders and potential investors with information regarding

Tidewater, including management's assessment of Tidewater's future

plans and operations, certain statements in this press release are

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

“forward-looking information” within the meaning of applicable

Canadian securities legislation (collectively, “forward-looking

statements”). In some cases, forward-looking statements can be

identified by terminology such as “anticipate”, “believe”,

“continue”, “could”, “estimate”, “expect”, “forecast”, “intend”,

“may”, “objective”, “ongoing”, “outlook”, “potential”, “project”,

“plan”, “should”, “target”, “would”, “will” or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: plans to

construct a 120 km natural gas pipeline from Tidewater’s Brazeau

River Complex to TransAlta’s Sundance and Keephills facility and

expected costs of such project and associated take or pay

agreement; expectations regarding initial capacity of the planned

pipeline and expansion capability; TransAlta’s expected gas

requirements; potential future investment in the pipeline project;

a proposed offering of Notes by Tidewater; the timing and

completion of the proposed offering of Notes, and the use of

proceeds from the offering of Notes; the anticipated closing

of the Deep Basin and Montney acquisition including timing thereof

and regulatory approval of related licence transfers; and pending

resolution of rights of first refusal in connection to the Deep

Basin/Montney acquisition.

These forward-looking statements are based on

certain key assumptions including: legislative or regulatory

developments, including as it pertains to the Alberta capacity

market; the Federal and/or Provincial governments not implementing

legislation or regulations facilitating the conversion from coal

generation to gas generation; changes in economic and competitive

conditions; inability to secure natural gas supply and the

construction of a natural gas pipeline on terms satisfactory to

Tidewater; Tidewater’s ability to execute on its business plan;

operating activities; general market and other conditions; the

ability of Tidewater to market natural gas liquids to current and

new customers; the timely receipt of required governmental and

regulatory approvals; future natural gas liquids prices; laws and

regulations continuing in effect (or, where changes are proposed,

such changes being adopted as anticipated); royalty rates, taxes

and capital, operating, general & administrative and other

costs; general business, economic and market conditions; with

respect to current and planned development projects, expansions,

planned capital expenditures, completion dates and capacity

expectations: that third parties will provide any necessary

support; that any third-party projects relating to Tidewater’s

growth projects will be sanctioned and completed as expected; that

any required commercial agreements can be negotiated and effected;

that all required regulatory and environmental approvals can be

obtained on the necessary terms and in a timely manner; that

counterparties will comply with contracts in a timely manner; and

that there are no unforeseen events preventing the performance of

contracts or the completion of the relevant facilities; the ability

of Tidewater to generate sufficient cash flow from operations and

other sources to meet current and future obligations, including

costs of anticipated projects and repayment of debt; the ability of

Tidewater to obtain equipment, services, supplies and personnel in

a timely manner and at an acceptable cost to carry out its

activities; and anticipated timelines and budgets being met in

respect of Tidewater’s projects. Readers are cautioned that such

assumptions, although considered reasonable by Tidewater at the

time of preparation, may prove to be incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors including but not

limited to: risks related to regulatory approval; the ability of

management to execute its business plan; risks inherent in

Tidewater’s marketing operations, including credit risk;

fluctuations in crude oil, natural gas liquids and natural gas

prices; health, safety and environmental risks; uncertainties as to

the availability and cost of financing; the possibility that

governmental policies or laws may change or governmental approvals

may be delayed or withheld; the sufficiency of budgeted capital

expenditures in carrying out planned activities; the availability

and cost of labour and services; and other risks and uncertainties

described elsewhere in this document or in Tidewater’s other

filings with Canadian securities regulatory authorities.

The above summary of assumptions and risks

related to forward-looking statements in this press release has

been provided in order to provide shareholders and potential

investors with a more complete perspective on Tidewater's current

and future operations and such information may not be appropriate

for other purposes. There is no representation by Tidewater that

actual results achieved will be the same in whole or in part as

those referenced in the forward-looking statements and Tidewater

does not undertake any obligation to update publicly or to revise

any of the included forward-looking statements, whether as a result

of new information, future events or otherwise, except as may be

required by applicable securities law.

Tidewater Midstream & Infrastructure Ltd.

Joel MacLeod

Chairman, President and CEO

587.475.0210

jmacleod@tidewatermidstream.com

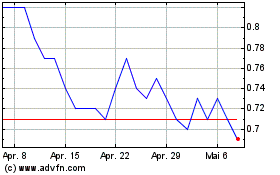

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Tidewater Midstream and ... (TSX:TWM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024