This press release is being disseminated as required by National

Instrument 62‐103 ‐ The Early Warning System and Related Take Over

Bids and Insider Reporting Issuers in connection with the filing of

an early warning report (the “Early Warning Report”) by Noman A.

Worthington, III in respect of his ownership position in Sangoma

Technologies Corporation (TSX: STC; Nasdaq: SANG) (the

“Corporation”).

On March 31, 2021, the Corporation acquired of

all of the shares of StarBlue Inc. (“StarBlue”) pursuant to the

terms of a stock purchase agreement dated as of January 28, 2021

between, inter alia, the Corporation, StarBlue and Star2Star

Holdings, LLC (“S2S Holdings”) (the “Acquisition Agreement”).

As partial consideration for its acquisition of

StarBlue (the “Transaction”), the Corporation agreed to issue a

total of 110,000,000 pre-Consolidation (as defined below) Shares

(the “Consideration Shares”), of which 22,000,0000

pre-Consolidation Shares (less 869,202 pre-Consolidation Shares

representing a holdback for indemnification purposes) were issued

upon the completion of the Transaction (the “Initial Consideration

Shares”) with the balance (the “Deferred Consideration Shares”) to

be issued in quarterly installments commencing on April 5,

2022.

Prior to the completion of the Transaction S2S

Holdings (which is controlled by Mr.Worthington) was StarBlue’s

largest shareholder and, in its capacity as such, received

15,142,778 pre-Consolidation Initial Consideration Shares. S2S

Holdings was also entitled to receive 88,687,156 pre-Consolidation

Deferred Consideration Shares in accordance with the distribution

schedule set out in the Acquisition Agreement.

On November 2, 2021, the Corporation

consolidated its Common Shares on the basis of one new Share for

every seven outstanding Shares (the “Consolidation”).

In May 2022, S2S Holdings distributed all of its

Initial Consideration Shares to its owners, including Old Town

Gelato, LLC (“OTG”). Mr. Worthington owns and controls OTG.

As of the date hereof, the Corporation has

issued a total of 1,714,286 post-Consolidation Deferred

Consideration Shares to S2S Holdings, representing the April 2022

and July 2022 installments. Each installment of the Deferred

Consideration Shares, less a portion that is retained for sale in

order to fund certain tax liabilities associated with the

distribution of the Deferred Consideration Shares, is immediately

distributed to the owners of S2S Holdings, including OTG.

As a result of the foregoing distributions of

Initial Consideration Shares and Deferred Consideration Shares, OTG

currently owns a total of 2,035,346 Shares, representing

approximately 9.1% of the 22,296,476 Shares outstanding (being

21,439,332 Shares outstanding as of May 12, 2022 as disclosed in

the Corporation’s Management Discussion and Analysis for the three

and nine month periods ended March 31, 2022, dated May 12, 2022

(the “MD&A”) plus 857,144 post-Consolidation Deferred

Consideration Shares issued since the date of the MD&A).

In addition, Mr. Worthington expects that, on or

about October 31, 2022, OTG will receive its share of (i) the

October 2022 installment of Deferred Consideration Shares (expected

to be 449,405 Shares, less any Shares withheld to fund tax

liabilities) and (ii) the Initial Consideration Shares that were

originally held back for indemnification purposes under the

Acquisition Agreement (the “Holdback Shares”) and are now being

released (expected to be 65,103 Shares). Because OTG expects to

receive these Shares within 60 days of the date hereof, it is now

deemed to beneficially these Shares.

Therefore, after giving effect to the October

2022 distribution of Deferred Consolidation Shares and the Holdback

Shares, Mr. Worthington will beneficially own or control a total of

2,549,854 Shares, representing approximately 10.9% of the

23,218,723 Shares outstanding (being the 21,439,332 Shares

outstanding as of May 12, 2022 as disclosed in the MD&A plus

(i) 857,144 post-Consolidation Deferred Consideration Shares issued

since the date of the MD&A, (ii) 857,144 Shares issuable

pursuant to the October 2022 distribution of Deferred Consolidation

Shares and (iii) 65,103 Holdback Shares expected to be issued

concurrently with the October 2022 distribution of the Deferred

Consolidation Shares).

The Consideration Shares were and will be

acquired by Mr. Worthington and OTG in connection with the

Transaction and are held for investment purposes. S2S Holdings is

entitled to receive the remaining distributions of Deferred

Consideration Shares in accordance with the terms of the

Acquisition Agreement, and Mr. Worthington expects that these

additional Deferred Consideration Shares will be distributed to the

owners of S2S Holdings, including OTG, in a manner consistent with

previous distributions. Mr. Worthington or OTG may or may not,

depending on market and other conditions, also increase or decrease

their beneficial ownership or control of the Shares.

A copy of the Early Warning Report to be filed

by Mr. Worthington in connection with the transactions described

above will be available on the Corporation’s SEDAR profile at

www.sedar.com.

The head office of the Corporation is located at

Suite 100, 100 Renfrew Drive, Markham, Ontario L3R 9R6 and Mr.

Worthington’s address is c/o Sangoma Technologies Corporation,

Suite 100, 100 Renfrew Drive, Markham, Ontario L3R 9R6.

To obtain a copy of the Early Warning Report

filed under National Instrument 62-103, please contact Samantha

Reburn, General Counsel of the Corporation, at 1-905-474-1990 ext.

4134.

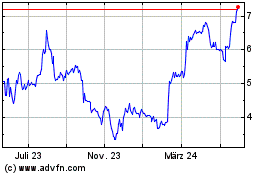

Sangoma Technologies (TSX:STC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

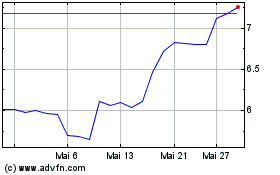

Sangoma Technologies (TSX:STC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024