Petrus Resources Ltd. ("

Petrus" or the

"

Company") (TSX: PRQ) is pleased to announce that

it has entered into a definitive agreement (the

"

Agreement") to acquire a privately owned limited

partnership (the "

LP") and its general partner

(the "

GP", and together, the "

Acquired

Entities") for total consideration of approximately $14.4

million, consisting of 10 million common shares of the Company (the

"

Shares") issued at a deemed price of $1.44 per

Share based on the volume weighted average trading price of the

Shares on the Toronto Stock Exchange ("

TSX") for

the five trading days prior to the date of the Agreement (the

"

Acquisition"). The Acquisition is expected to

close in early March and is subject to customary closing

conditions, including the approval of the TSX.

Acquisition Highlights

The Acquired Entities' assets are focused in

Petrus' core area, Ferrier, Alberta. Through the Acquisition,

Petrus will receive a contiguous, high working interest, Cardium

land position in Ferrier; an area where the vast majority of

mineral rights are leased and most acreage positions are secured

through corporate sale transactions. The proximity of the acquired

lands to Petrus’ existing Ferrier assets will allow current and

future production from the assets to be tied into Petrus’ owned and

operated gathering and processing infrastructure, which is expected

to provide considerable operating and cost synergies. The

Acquisition provides Petrus with an exceptional opportunity to

leverage its expertise successfully drilling low-risk, low-cost,

high return wells in this area.

Highlights of the Acquisition include:

-

Strategic consolidation of quality Cardium assets at Ferrier

-

A high working interest, undeveloped Cardium land position in 8 net

sections of land directly offsetting Petrus’ core development in

Ferrier

-

Meaningful drilling inventory of an estimated 40 gross unbooked

drilling locations1, the majority of which have been internally

identified by Petrus as Tier 1 locations

-

Stable base production of 425 boe/d2 (83.0% conventional natural

gas, 13.5% NGLs and 3.5% light oil) with an estimated annual

decline rate of 10%3

-

Potential to materially reduce operating costs through development

and utilization of Petrus’ owned and operated infrastructure

-

Attractive type curve economics at US$80/bbl WTI and $4.00/Mcf

AECO

_____________________________

1 See "Estimates of Drilling Locations".

2 Average daily production is for the month of

December, 2021.

3 See "Estimated Decline Rate".

Related Party Matters

The Acquisition is a related party transaction

under applicable securities legislation as, among other things, the

Acquired Entities are managed and directed by Ken Gray, the

President and Chief Executive Officer of both the GP and Petrus,

and Ken Gray and two of Petrus' controlling shareholders (Stuart

Gray and Glen Gray) own or control, in aggregate, approximately

69.5% of the LP's units and 50% of the GP's shares. The board of

directors of Petrus (the "Board") established a

committee of independent and disinterested directors of Petrus (the

"Independent Committee"), comprised of Don

Cormack, Patrick Arnell and Peter Verburg, to review and recommend

approval of the Agreement and the Acquisition to the Board. The

Board, with Ken Gray and Don Gray abstaining, approved the

Agreement and the Acquisition based on, among other things, the

recommendation of the Independent Committee, their review and

assessment of an independent reserves report prepared by GLJ Ltd.

effective December 31, 2020 and mechanically updated to November

30, 2021 evaluating the reserves volumes and net present values of

the Acquired Entities, and the advice received from the Company's

financial advisor for the Acquisition.

The Acquisition is exempt from the formal

valuation and minority shareholder approval requirements of

applicable securities legislation as neither the fair market value

of the subject matter of, nor the fair market value of the

consideration for, the Acquisition, insofar as it involves

interested parties, exceeds 25% of the Company's market

capitalization.

ABOUT PETRUS

Petrus is a public Canadian oil and gas company

focused on property exploitation, strategic acquisitions and

risk-managed exploration in Alberta.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Ken Gray President and Chief Executive Officer

T: 403-930-0889 E: kgray@petrusresources.com

CAUTIONARY STATEMENTS:

Oil and Gas Advisories

The oil and natural gas industry commonly

expresses production volumes and reserves on a barrel of oil

equivalent (“boe”) basis whereby natural gas volumes are converted

at the ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved measurement of results and comparisons with

other industry participants. Petrus uses the 6:1 boe measure which

is the approximate energy equivalence of the two commodities at the

burner tip. Boes do not represent an economic value equivalence at

the wellhead and therefore may be a misleading measure if used in

isolation.

Estimates of Drilling

Locations

Unbooked drilling locations are the internal

estimates of the Company based on assumptions as to the number of

wells that can be drilled per section based on industry practice

and internal review. Unbooked locations do not have attributed

reserves or resources (including contingent and prospective).

Unbooked locations have been identified by Petrus' management as an

estimation of the multi-year drilling activities based on

evaluation of applicable geologic, seismic, engineering, production

and reserves information. There is no certainty that Petrus will

drill all unbooked drilling locations and if drilled there is no

certainty that such locations will result in additional oil and

natural gas reserves, resources or production. The drilling

locations on which Petrus will actually drill wells, including the

number and timing thereof, is ultimately dependent upon the

availability of funding, regulatory approvals, seasonal

restrictions, oil and natural gas prices, costs, actual drilling

results, additional reservoir information that is obtained and

other factors.

Estimated Decline Rate

Based on Petrus' internally developed type

curves, which were constructed as of December 31, 2021

Abbreviations

In this Press Release, the abbreviations set

forth below have the following meanings:

|

Oil and Natural Gas Liquids |

Natural Gas |

|

|

|

|

|

|

bbl |

barrel |

Mcf |

thousand cubic feet |

|

|

|

|

|

|

bbls |

barrels |

GJ |

Gigajoules |

|

|

|

|

|

|

NGLs |

natural gas liquids |

|

|

|

|

|

|

|

|

boe/d |

Barrels of oil equivalent per day |

|

|

Forward-Looking Statements

This news release contains forward‐looking

statements regarding: Petrus' ability to tie the acquired assets

into its facilities and the expectation that the Acquisition and

the proximity of the assets to Petrus' existing assets will provide

considerable operating and cost synergies; the potential to

materially reduce operating costs of the acquired assets; Petrus'

expectations regarding unbooked drilling locations (and the quality

thereof) and decline rate; and the closing of the Acquisition and

the timing of the same. These forward‐looking statements are

provided as of the date of this news release, or the effective date

of the documents referred to in this news release, as applicable,

and reflect predictions, expectations or beliefs regarding future

events based on the Company's beliefs at the time the statements

were made, as well as various assumptions made by and information

currently available to it. In making the forward-looking statements

included in this news release, the Company has applied several

material assumptions, including, but not limited to, the assumption

that: Toronto Stock Exchange approval of the Acquisition will be

obtained in a timely manner; that all conditions precedent to the

completion of the Acquisition will be satisfied in a timely manner;

assumptions regarding commodity prices, including those set forth

above; the impact of regional and/or global events, including the

ongoing COVID-19 pandemic, inflation and the Russian-Ukrainian war,

on energy demand and commodity prices; that the Company's

operations and production will not be disrupted by circumstances

attributable to the foregoing events and the responses of

governments and the public to such going forward; future capital

expenditure and decommissioning expenditure levels; future

operating costs and general and administrative costs; future crude

oil, natural gas liquids and natural gas prices and differentials

between light, medium and heavy oil prices and Canadian, WTI and

world oil and natural gas prices; future hedging activities; future

crude oil, natural gas liquids and natural gas production levels,

including that Petrus will not be required to shut-in production

due to low commodity prices or the deterioration of commodity

prices; future exchange rates and interest rates; future debt

levels; Petrus' ability to execute its capital programs as planned

without significant adverse impacts from various factors beyond its

control, including extreme weather events, wild fires,

infrastructure access and delays in obtaining regulatory approvals

and third party consents; Petrus' ability to obtain equipment in a

timely manner to carry out development activities and the costs

thereof; Petrus' ability to market its oil and natural gas

successfully to current and new customers; Petrus' ability to

obtain financing on acceptable terms, including Petrus' ability to

maintain the existing borrowing base under its syndicated bank

facility, Petrus' ability (if necessary) to replace its syndicated

bank facility; and Petrus' ability to add production and reserves

through our development and exploitation activities. Although

management considers these assumptions to be reasonable based on

information available to it, they may prove to be incorrect. By

their very nature, forward‐looking statements involve inherent

risks and uncertainties, both general and specific, and risks exist

that estimates, forecasts, projections and other forward‐looking

statements will not be achieved or that assumptions on which they

are based do not reflect future experience. We caution readers not

to place undue reliance on these forward‐looking statements as a

number of important factors could cause the actual outcomes to

differ materially from the expectations expressed in them. These

risk factors may be generally stated as the risk that the

assumptions expressed above do not occur, but specifically include,

without limitation, risks relating to: general market conditions;

the failure to receive all applicable third party and regulatory

approvals for the Acquisition, and the additional risks described

in the Company's latest Annual Information Form, and other

disclosure documents filed by the Company on SEDAR. The foregoing

list of factors that may affect future results is not exhaustive.

When relying on Petrus' forward‐looking statements, investors and

others should carefully consider the foregoing factors and other

uncertainties and potential events. The Company does not undertake

to update any forward‐looking statement, whether written or oral,

that may be made from time to time by the Company or on behalf of

the Company, except as required by law.

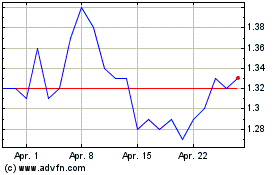

Petrus Resources (TSX:PRQ)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

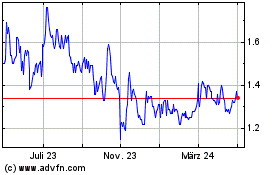

Petrus Resources (TSX:PRQ)

Historical Stock Chart

Von Apr 2023 bis Apr 2024