NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES

OR FOR DISSEMINATION IN THE U.S.

Park Lawn Corporation (TSX:PLC)

(“PLC” or the “Company”) is

pleased to announce that it has entered into definitive agreements

to acquire all of the outstanding membership interests of two U.S.

businesses: Signature Funeral and Cemetery Investments, LCC

(“Signature” or “Signature

Acquisition”) and Citadel Management LLC

(“Citadel”, together with Signature the

“Acquisitions”) for a total purchase price of

approximately US$136.4 million in cash, subject to customary

working capital adjustments.

In conjunction with the Acquisitions, the

Company also announced that it has entered into an agreement with a

syndicate of underwriters (the “Underwriters”)

co-led by National Bank Financial Inc., CIBC Capital Markets and

Cormark Securities Inc. to issue, on a bought deal basis,

approximately C$165 million of subscription receipts (the

“Subscription Receipts”) to finance the Signature

Acquisition (the “Offering”). The

acquisition of Citadel will be funded from PLC’s existing credit

facility.

“The acquisitions of Signature and Citadel

present an exciting opportunity for Park Lawn. The acquisitions are

in line with our communicated growth strategy and significantly

increase our footprint and presence in the U.S. market,” said

Andrew Clark, Chairman and Chief Executive Officer of the PLC. “The

addition of Signature’s executive management team to PLC’s existing

leadership team will allow us to facilitate the consolidation of

our expanding U.S. operations.”

Highlights of the

Acquisitions

Strategically Compelling

- Significantly increase PLC’s footprint

and scale in the U.S. market. Together

add six new states into PLC’s portfolio, while expanding its

footprint in the Texas market.

- Enhanced scale leading to a highly attractive portfolio

of both funeral homes and cemeteries. Together add 38

cemeteries, 29 funeral homes and 5 crematoria to PLC’s

portfolio.

- Provide PLC with opportunities to grow in markets with

attractive dynamics. Locations in Dallas provide entry

into a high-growth geography, while the cemetery locations in New

Mexico and Kansas City create strong regional platforms from which

to grow. In addition, on-site funeral home operations are expected

to provide additional top-line growth, as well as incremental

margin expansion.

- Provide strong inventory and real estate

value. Key sites offer over 90 years of inventory capacity

and augment the existing PLC business with a strong portfolio of

real estate.

- Strong management team that will establish central PLC

U.S. platform. Signature Group’s Jay Dodds and Brad Green

will be taking on senior leadership positions within PLC, with a

particular focus on integrating U.S. operations into a centralized

platform. It is anticipated that both Jay and Brad will become

named executive officers of the Company following closing.

Financially Attractive

- Significantly increase PLC’s revenue, while

individually providing strong operating margins.

- In the first full year of operations following closing, PLC

management expects Signature to generate approximately US$32.9

million of revenue and US$9.6 million of EBITDA. If Signature

achieves these results and expected synergies are realized the

purchase price of US$123 million would represent a multiple of

approximately 9.8x.

- In the first full year of operations following closing, PLC

management expects Citadel to generate approximately US$15.5

million of revenue and US$2.5 million of EBITDA. If Citadel

achieves these results, the purchase price of US$13.4 million would

represent a multiple of approximately 5.4x EBITDA.

- Immediately accretive. The transactions

are expected to be immediately accretive to both PLC’s adjusted net

earnings per share and adjusted EBITDA per share before any

synergies are achieved.

- Significant synergies are expected in the near

term. Management expects annual synergies of

approximately US$3 million to be realized within 24 months of

closing, with a one-time cost of US$750 thousand, primarily in the

areas of IT systems, back office integration, consolidated

procurement, implementing proven sales practices into different

operational areas and management team optimization.

- Financed to provide PLC with dry powder to execute on

organic growth initiatives and opportunistic tuck in acquisitions

going forward. Pro forma the Acquisitions and the

Offering, PLC’s net leverage is expected to be under 1.75x adjusted

EBITDA.

“Signature is very excited to partner our

business with Park Lawn. Jay and I look forward to serving Park

Lawn in our new expanded roles. We view this as an opportunity to

match our operational and integrational expertise with the

continued growth of Park Lawn,” said Brad Green, Chief Executive

Officer of Signature. “Combining our respective portfolios under a

single leadership group will give our employees a great opportunity

and Park Lawn a competitive edge in the market place,” added Jay

Dodds, Chief Operating Officer and President of Signature.

“We look forward to working with Park Lawn and

see them as the right partner to continue growing our business

throughout our communities,” stated William W. Gaffney, current

President of Citadel. “The team at Park Lawn has established a

strong portfolio and management team that will allow us to maximize

the opportunity for growth in the long term.”

The Acquisitions are expected to close before

the end of the third quarter, with each separately subject to the

satisfaction or waiver of certain closing conditions, including,

among other things, third party consents and approvals, which are

currently in progress.

Description of Signature

Signature currently owns and operates 9

cemeteries, 21 funeral homes (including 7 on-sites) and 5

crematoria in Texas, Kansas, Missouri, New Mexico and Mississippi.

Through management’s successful growth strategy, Signature is a

recognized leader in the death care industry in the United States.

Founded in 2011 by Brad Green (CEO) and Jay Dodds (President

and COO), who together bring more than 40 years of industry

experience with them, Signature has successfully executed on a

number of accretive acquisitions over the last seven years.

Description of Citadel

Citadel currently owns and operates 29

cemeteries and 8 funeral homes (including 1 on-site) throughout

North and South Carolina. The portfolio is strategically located in

cities with attractive growth opportunities. Citadel was

established in 2001 by William W. Gaffney (CEO and majority owner),

who has more than 40 years of industry experience.

PLC Post Acquisition

With the Acquisitions, PLC and its subsidiaries

will own and operate 176 properties, including cemeteries,

crematoria, funeral homes, chapels, planning offices and a transfer

service, with its footprint now covering 11 U.S. states and 5

Canadian provinces. The Company continues to experience

strong organic growth opportunities throughout Canada and the

United States. Going forward, PLC intends to continue executing on

strategic acquisitions that complement its existing

portfolio.

Subscription Receipt

Offering

The Company has reached an agreement with a

syndicate of underwriters co-led by National Bank Financial Inc.,

CIBC Capital Markets and Cormark Securities Inc. to issue 6,735,000

Subscription Receipts at a price of C$24.50 per Subscription

Receipt, on a bought deal basis, for gross proceeds of

approximately C$165 million. The Company has also granted the

Underwriters an option to purchase up to an additional 1,010,250

Subscription Receipts on the same terms and conditions, exercisable

at any time, in whole or in part, up to 30 days after the closing

of the Offering (the “Over-Allotment Option”).

Upon the satisfaction or waiver of each of the

conditions precedent to the closing of the Signature Acquisition

(other than the payment of the consideration for the Signature

Acquisition): (a) one common share of the Company (a

“Common Share”) will be automatically issued in

exchange for each Subscription Receipt (subject to customary

anti-dilution protection), without payment of additional

consideration or further action by the holder thereof; (b) an

amount per Subscription Receipt equal to the per-share cash

dividends declared by the Company on the Common Shares to holders

of record on a date during the period that the Subscription

Receipts are outstanding, net of any applicable withholding taxes,

will become payable in respect of each Subscription Receipt; and

(c) the net proceeds from the sale of the Subscription Receipts

will be released from escrow to the Company for the purposes of

completing the Signature Acquisition.

The net proceeds from the sale of the

Subscription Receipts will be held by an escrow agent pending the

fulfillment or waiver of all outstanding conditions precedent to

closing of the Signature Acquisition (other than the payment of the

consideration for the Signature Acquisition). There can be no

assurance that the applicable consents and regulatory approvals

will be obtained, that the other closing conditions will be met or

that the Signature Acquisition will be consummated.

If the Signature Acquisition fails to close as

described above by October 31, 2018 or if the

Signature Acquisition is terminated at an earlier time, the gross

proceeds of the Offering and pro rata entitlement to interest

earned or deemed to be earned on the Subscription Receipts, net of

any applicable withholding taxes, will be paid to holders of the

Subscription Receipts and the Subscription Receipts will be

cancelled.

The Subscription Receipts will be offered

pursuant to a short-form prospectus to be filed in each of the

provinces of Canada, which will describe the terms of the Offering.

The Offering is expected to close on or about May 4, 2018 and is

subject to certain conditions including, but not limited to, the

receipt of all regulatory approvals including the approval of the

TSX Exchange (the “TSX”).

The securities offered pursuant to the Offering

have not been, nor will they be, registered under the United States

Securities Act of 1933, as amended, (the “1933

Act”) and may not be offered, sold or delivered, directly

or indirectly, in the United States, or to, or for the account or

benefit of, “U.S. persons” (as defined in Regulation S under the

1933 Act), except pursuant to an exemption from the registration

requirements of the 1933 Act. This press release does not

constitute an offer to sell or a solicitation of an offer to buy

any securities in the United States or to, or for the account or

benefit of, U.S. persons.

Conference Call and Presentation

A short presentation on the acquisition is available on

the Company’s website at www.parklawncorp.com

PLC will hold a conference call on April 16, 2018 at 3:45 p.m.

ET to review the Acquisitions. To access the conference call by

telephone, dial 647-427-7450 or 1-(888) 231-8191. Please connect

approximately 15 minutes prior to the beginning of the call to

ensure participation. A recording of the call will be available on

the company’s website following the call.

About Park Lawn Corporation

PLC provides goods and services associated with the disposition

and memorialization of human remains. Products and services are

sold on a pre-planned basis (pre-need) or at the time of a death

(at-need). PLC and its subsidiaries own and operate 104 properties

including cemeteries, crematoria, funeral homes, chapels, planning

offices and a transfer service. PLC operates in five Canadian

provinces and six US states.

Cautionary Statement Regarding Forward-Looking

Information

This news release may contain forward-looking

statements (within the meaning of applicable securities laws)

relating to the business of the Company and the environment in

which it operates. Forward-looking statements are identified by

words such as “believe”, “anticipate”, “project”, “expect”,

“intend”, “plan”, “will”, “may”, “estimate” and other similar

expressions. These statements are based on the Company’s

expectations, estimates, forecasts and projections and include,

without limitation, statements regarding the completion of the

Acquisitions, the completion of the Offering, the proposed use of

proceeds of the Offering, the Company’s continued growth strategy,

the anticipated effect of the Acquisitions and the Offering on the

performance of the Company (including the extent to which the

Acquisitions are expected to be accretive to adjusted net earnings

per share and adjusted EBITDA per share and post-closing leverage),

the quantum and timing of potential cost synergies, expected

revenues, expected EBITDA and the expected purchase price

multiples. The forward-looking statements in this news release are

based on certain assumptions, including without limitation that all

conditions to completion of the Acquisitions and the Offering will

be satisfied or waived, the Signature and Citadel businesses will

continue their recent trends of improved operating performance, the

Company will be able to implement business improvements and achieve

cost savings, the Company will be able to retain key personnel,

there will be no unexpected expenses occurring as a result of the

Acquisitions, and that currency exchange rates remain consistent.

They are not guarantees of future performance and involve risks and

uncertainties that are difficult to control or predict. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements, including, but

not limited to, the risk that either (or both) of the Acquisitions

will not be completed, the Offering will not be completed, the

Signature and Citadel businesses will not perform as expected, the

Company will not be able to successfully integrate Signature and

Citadel, and the other factors discussed under the heading

“Risk Factors” in the Company’s annual information form available

at www.sedar.com. There can be no assurance that forward-looking

statements will prove to be accurate as actual outcomes and results

may differ materially from those expressed in these forward-looking

statements. Readers, therefore, should not place undue reliance on

any such forward-looking statements. Further, these forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, the Company assumes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Non-IFRS Measures

EBITDA, adjusted EBITDA and adjusted net

earnings are not measures recognized under IFRS and do not have a

standardized meaning prescribed by IFRS. Such measures are

presented in this news release because management of the Company

believes that such measures are relevant in interpreting the effect

of the Acquisitions on the Company. Such measures, as computed by

the Company, may differ from similar computations as reported by

other similar organizations and, accordingly, may not be comparable

to similar measures reported by such other organizations. Please

see the Company’s most recent management's discussion and analysis

for how the Company reconciles such measures to the nearest IFRS

measure.

Contact Information

Andrew ClarkChairman & Chief Executive

Officer(416) 231-1462

Joseph LeederChief Financial Officer &

Director(416) 231-1462

Suzanne Cowan VP, Business Development &

Corporate Affairs scowan@parklawncorp.com(416) 231-1462

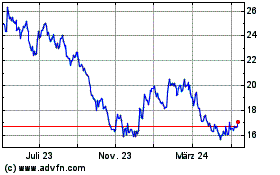

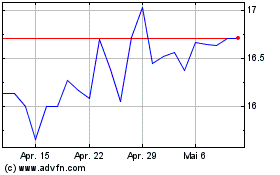

Park Lawn (TSX:PLC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Park Lawn (TSX:PLC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024