Northland Power Announces the Completion on an Amendment Increasing Its Corporate Credit Facility from $250 to $600 Million

07 März 2014 - 10:36PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OR ITS POSSESSIONS. ANY FAILURE TO COMPLY WITH THIS RESTRICTION

MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAW

Northland Power Inc. ("Northland")

(TSX:NPI)(TSX:NPI.PR.A)(TSX:NPI.PR.C)(TSX:NPI.DB.A)(TSX:NPI.DB.B) today

announced it has completed an amendment to its corporate credit facility with a

syndicate of financial institutions led by Canadian Imperial Bank of Commerce

and the Bank of Montreal. The credit facility has been increased from $250

million to $600 million comprising of a $350 million revolving facility and a

$250 million term facility. The revolving facility is available for general

corporate purposes and working capital, which accommodates; issuances of letters

of credit and support of growth and development opportunities. The term facility

will be used to complete funding Northland's investment in Project Gemini. The

Credit Agreement also incorporates a $100 million accordion feature which

provides Northland with access to additional revolving credit if required.

The amended credit facility benefits from lower borrowing rates and allows for

Canadian dollar, US dollar and Euro-denominated borrowings to support

Northland's international growth activities. The maturity of the revolving

facility has been extended from May 2015 to March 2019, with further annual

renewal options; the maturity of the term facility is March 2018 with a 1 year

renewal option.

Northland CFO Paul Bradley commented, "This amendment confirms the financial

community's confidence in Northland, and reflects the quality and stability of

Northland's cash flows, our continued success in bringing projects into

operation on-time and on-budget, and our commitment to growth particularly with

our sponsorship of the 600 MW Project Gemini in the North Sea."

The syndicate of banks underwriting Northland's credit facility has increased

from nine to eleven and comprises both Canadian and international lenders.

ABOUT NORTHLAND

Northland is an independent power producer founded in 1987, and publicly traded

since 1997. Northland develops, builds, owns and operates facilities that

produce 'clean' (natural gas) and 'green' (wind, solar, and hydro) energy,

providing sustainable long-term value to shareholders, stakeholders, and host

communities.

The company owns or has a net economic interest in 1,349 MW of operating

generating capacity, with an additional 110 MW (80 MW net to Northland) of

generating capacity currently in construction, and another 150 MW (79 MW net to

Northland) of wind, solar and run-of-river hydro projects with awarded power

contracts. In addition, Northland has acquired the rights to a majority equity

stake in Gemini. Northland's cash flows are diversified over five geographically

separate regions and regulatory jurisdictions in Canada, Europe and the United

States.

Northland's common shares, Series 1 and Series 3 preferred shares and

convertible debentures trade on the Toronto Stock Exchange under the symbols

NPI, NPI.PR.A, NPI.PR.C, NPI.DB.A and NPI.DB.B,respectively.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements which are provided for

the purpose of presenting information about management's current expectations

and plans. Readers are cautioned that such statements may not be appropriate for

other purposes. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or conditions, or

include words such as "expects," "anticipates," "plans," "believes,"

"estimates," "intends," "targets," "projects," "forecasts" or negative versions

thereof and other similar expressions, or future or conditional verbs such as

"may," "will," "should," "would" and "could." These statements may include,

without limitation, statements regarding the use of proceeds of the Offering and

Private Placement, future adjusted EBITDA, free cash flows, dividend payment and

dividend payout ratios, the construction, completion, attainment of commercial

operations, cost and output of development projects, plans for raising capital,

and the operations, business, financial condition, priorities, ongoing

objectives, strategies and outlook of Northland and its subsidiaries. These

statements are based upon certain material factors or assumptions that were

applied in developing the forward-looking statements, including the design

specifications of development projects, the provisions of contracts to which

Northland or a subsidiary is a party, management's current plans, its perception

of historical trends, current conditions and expected future developments, as

well as other factors that are believed to be appropriate in the circumstances.

Although these forward-looking statements are based upon management's current

reasonable expectations and assumptions, they are subject to numerous risks and

uncertainties. Some of the factors that could cause results or events to differ

from current expectations include, but are not limited to, construction risks,

counterparty risks, operational risks, foreign exchange rates, regulatory risks,

maritime risks for construction and operation, and the variability of revenues

from generating facilities powered by intermittent renewable resources and the

other factors described in the "Risks and Uncertainties" section of Northland's

2013 Annual Report and Annual Information Form, both of which can be found at

www.sedar.com under Northland's profile and on Northland's website

www.northlandpower.ca. Northland's actual results could differ materially from

those expressed in, or implied by, these forward-looking statements and,

accordingly, no assurances can be given that any of the events anticipated by

the forward-looking statements will transpire or occur.

The forward-looking statements contained in this release are based on

assumptions that were considered reasonable on March 7, 2014. Other than as

specifically required by law, Northland undertakes no obligation to update any

forward-looking statements to reflect events or circumstances after such date or

to reflect the occurrence of unanticipated events, whether as a result of new

information, future events or results, or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Northland Power Inc.

Barb Bokla

Investor Relations

647-288-1438

Northland Power Inc.

Adam Beaumont

Director of Finance

647-288-1929

(416) 962-6266 (FAX)

investorrelations@northlandpower.ca

www.northlandpower.ca

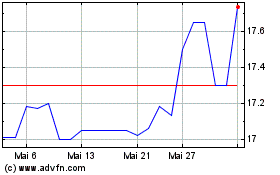

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024