Northland Power Tops Up Majority Equity Stake in 600 MW North Sea Offshore Wind Farm to 60%

29 Januar 2014 - 11:00PM

Marketwired Canada

Northland Power Inc. ("Northland")

(TSX:NPI)(TSX:NPI.DB.A)(TSX:NPI.PR.A)(TSX:NPI.PR.C) today announced it has

entered into agreements for the rights to acquire Typhoon Offshore B.V.'s 5%

interest in Gemini, a 600MW offshore wind project currently in advanced

development. Subject to final documentation and the approval of its Board, this

would top up Northland's intended majority equity stake in Gemini to 60%.

Gemini is located 85 kilometres off the coast of the Netherlands in the North

Sea. Combining favourable sea bed conditions with one of the strongest and most

reliable wind resources in the world, the North Sea could produce enough energy

to power Europe four times over. Once constructed, Gemini will be the largest

wind farm in the North Sea.

Northland has taken a lead role in completing the remaining outstanding

development activities since its announcement in August 2013, and intends to

continue its active leadership role during construction and into operations.

Gemini will play an important role in helping the Government of Netherlands'

achieve renewable energy targets mandated by the European Union's Renewable

Energy Directive, which calls for all Member States to reach a 20% share of

energy from renewable sources by 2020. There is currently 5 GW of installed

capacity in 58 operating offshore wind farms in European waters with another 5.5

GW in construction or advanced development. According to the European Wind

Energy Association (EWEA), it is anticipated that there will be up to 150 GW of

installed offshore wind power in the EU by 2030, meeting 14% of the EU's

electricity demand.

"Today's announcement underlines our confidence in this project," noted John

Brace, CEO of Northland Power. "We are very pleased with the progress made to

date, and look forward to working with our consortium partners to bring Gemini

to fruition."

Gemini is well advanced, and has received commitments for EUR 950 million in

senior secured construction and term debt from 10 international commercial

banks. In association with a EUR 500 million facility previously announced by

the European Investment Bank and loans under negotiation with three European

export credit agencies (Denmark's EKF, Germany's Euler Hermes and Belgium's

ONDD), this completes the EUR 2 billion of senior debt required by Project

Gemini.

Project Gemini's total cost is projected to be EUR2.8 billion, and is expected

to be financed with a combination of non-recourse project debt, mezzanine

financing and equity from the consortium.

"Acquiring the rights to a majority equity stake in Gemini is consistent with

our commitment to fostering sustainable growth that allows us to deliver

reliable returns to investors," added James Temerty, Chairman of Northland

Power's Board of Directors. "The accretive nature of this project will benefit

Northland's shareholders over the long-term."

ABOUT NORTHLAND

Northland is an independent power producer founded in 1987, and publicly traded

since 1997. Northland develops, builds, owns and operates facilities that

produce 'clean' (natural gas) and 'green' (wind, solar, and hydro) energy,

providing sustainable long-term value to shareholders, stakeholders, and host

communities.

The company owns or has a net economic interest in 1,329 MW of operating

generating capacity, with an additional 90 MW (60 MW net to Northland) of

generating capacity currently in construction, and another 190 MW (119 MW net to

Northland) of wind, solar and run-of-river hydro projects with awarded power

contracts. In addition, Northland has acquired the rights to a majority equity

stake in Gemini. Northland's cash flows are diversified over five geographically

separate regions and regulatory jurisdictions in Canada, Europe and the United

States.

Northland's common shares, Series 1 and Series 3 preferred shares and

convertible debentures trade on the Toronto Stock Exchange under the symbols

NPI, NPI.PR.A, NPI.PR.C and NPI.DB.A, respectively.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements which are provided for

the purpose of presenting information about management's current expectations

and plans. Readers are cautioned that such statements may not be appropriate for

other purposes. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or conditions, or

include words such as "expects," "anticipates," "plans," "believes,"

"estimates," "intends," "targets," "projects," "forecasts" or negative versions

thereof and other similar expressions, or future or conditional verbs such as

"may," "will," "should," "would" and "could." These statements may include,

without limitation, statements regarding future EBITDA, free cash flows,

dividend payment and dividend payout ratios, the construction, completion,

attainment of commercial operations, cost and output of development projects,

plans for raising capital, and the operations, business, financial condition,

priorities, ongoing objectives, strategies and outlook of Northland and its

subsidiaries. These statements are based upon certain material factors or

assumptions that were applied in developing the forward-looking statements,

including the design specifications of development projects, the provisions of

contracts to which Northland or a subsidiary is a party, management's current

plans, its perception of historical trends, current conditions and expected

future developments, as well as other factors that are believed to be

appropriate in the circumstances. Although these forward-looking statements are

based upon management's current reasonable expectations and assumptions, they

are subject to numerous risks and uncertainties. Some of the factors that could

cause results or events to differ from current expectations include, but are not

limited to, construction risks, counterparty risks, operational risks, foreign

exchange rates, regulatory risks, maritime risks for construction and operation,

and the variability of revenues from generating facilities powered by

intermittent renewable resources and the other factors described in the "Risks

and Uncertainties" section of Northland's 2012 Annual Report and Annual

Information Form, both of which can be found at www.sedar.com under Northland's

profile and on Northland's website www.northlandpower.ca. Northland's actual

results could differ materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurances can be given that any

of the events anticipated by the forward-looking statements will transpire or

occur.

The forward-looking statements contained in this release are based on

assumptions that were considered reasonable on January 29, 2014. Other than as

specifically required by law, Northland undertakes no obligation to update any

forward-looking statements to reflect events or circumstances after such date or

to reflect the occurrence of unanticipated events, whether as a result of new

information, future events or results, or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Northland Power Inc.

Sarah Charuk

Director of Communications

647-288-1105

Sarah.charuk@northlandpower.ca

www.northlandpower.ca

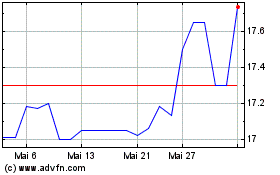

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024