MTY Food Group Inc. (“MTY”) (TSX:MTY) and Papa Murphy’s Holdings,

Inc. (“Papa Murphy’s”) (NASDAQ:FRSH) today announced they have

entered into a definitive merger agreement (the “Merger Agreement”)

under which MTY would acquire all of the issued and outstanding

shares of common stock of Papa Murphy’s for cash consideration of

US$6.45 per share, representing total transaction value of

approximately US$190.0 million (C$253.2 million) (the

“Transaction”), including Papa Murphy’s net debt outstanding. The

purchase price per share of Papa Murphy’s common stock implies a

premium of 31.9% to the Papa Murphy’s closing price on April 10,

2019 and 46.3% to the unaffected Papa Murphy’s closing price on

November 7, 2018 prior to the announcement by Papa Murphy’s that it

was conducting a process to explore and evaluate strategic

alternatives to maximize shareholder value and had engaged a

financial advisor to assist with the review. The terms and

conditions of the Merger Agreement were unanimously approved by the

boards of directors of both companies. The Transaction is subject

to customary closing conditions including receipt of applicable

regulatory approvals.

MTY is a leading franchisor in the North

American restaurant industry. MTY’s multi-concept model allows MTY

to position itself across a broad range of demographic, economic

and geographic sectors. As at February 28, 2019, its network had

5,941 locations in operation, mostly all franchised, including over

500 locations operating in 39 countries outside North America.

Papa Murphy's is a franchisor and operator of

the largest Take ‘n’ Bake pizza brand and the 5th largest pizza

chain in the United States, selling fresh, hand-crafted pizzas

ready for customers to bake at home. In addition to scratch-made

pizzas, Papa Murphy’s offers a growing menu of grab 'n' go items,

including salads, sides and desserts. Papa Murphy’s was founded in

1981 and operated 1,331 franchised and 106 corporate-owned stores

in 37 U.S. states, Canada and the United Arab Emirates as of

December 31, 2018.

Eric Lefebvre, Chief Executive Officer of MTY

said, “This is an important transaction for MTY as we add a brand

with a differentiated position in pizza to our existing U.S.

portfolio. We are thrilled about the prospect of welcoming the Papa

Murphy’s brand, its franchise partners and employees, to the MTY

family. Papa Murphy’s is a unique concept with over a 35 year

history of providing a superior quality product made with fresh

ingredients. We believe the pizza segment is highly attractive due

to its size, fragmented nature and growth potential. The Papa

Murphy’s brand is well loved by its loyal customers and is

supported by a strong network of franchise partners. We expect the

combination of these two companies and the expertise it brings to

produce tremendous opportunities for MTY’s U.S. expansion

objectives.”

“The board of directors and our advisors have

thoroughly evaluated all options available to us and are confident

that this agreement provides immediate value to our stockholders at

a premium over our current share price. Merging our unique,

differentiated brand with a global leader in franchised restaurant

concepts will accelerate on-going efforts to enhance our

convenience and relevance and maintain our position as the number

one Take ‘n’ Bake pizza chain in the United States,” said Jean

Birch, Chairperson of the board of directors of Papa Murphy’s.

Transaction Highlights

- Strengthens MTY’s leading portfolio of brands through the

acquisition of the 5th largest pizza chain in the U.S.

° Leading Take ‘n’ Bake pizza concept serving award-winning,

superior quality products made with fresh ingredients.

° Increasing MTY’s exposure to the robust and growing

U.S. pizza market. ° MTY’s combined network to

have approximately 7,378 stores globally after completion of the

Transaction with future runway for growth.

- Complements MTY’s U.S. operations and reduces seasonality of

its results. ° Papa Murphy’s had US$809 million

System-wide Sales for the twelve-month period ended December 31,

2018. ° Papa Murphy’s generated US$22.3 million in

Adjusted EBITDA for the twelve-month period ended December 31,

2018.

- Strategically timed as Papa Murphy’s system is building

momentum after implementation of refreshed corporate strategy and

refocus on the brand. ° MTY anticipates working

with Papa Murphy’s to make capital investments focused on growing

top line sales and increasing franchise partner

profitability.

- MTY welcomes a seasoned management team and looks forward to

building on Papa Murphy’s employees’ expertise and maintaining the

current support center in Vancouver, WA.

- Expected to be immediately accretive to MTY’s EBITDA and cash

flow per share.

- MTY remains committed to pursuing its acquisition strategy. Pro

Forma MTY is expected to continue to generate significant cash flow

allowing for deleveraging and providing liquidity to pursue future

M&A opportunities.

Transaction Details

Under the terms of the Merger Agreement, a

subsidiary of MTY will commence a tender offer to purchase all of

the outstanding shares of Papa Murphy’s common stock for US$6.45

per share in cash. The closing of the tender offer is subject to

customary conditions, including antitrust clearance and the tender

of a majority of the outstanding shares of Papa Murphy’s common

stock. Following successful completion of the tender offer, MTY

would acquire all remaining shares not tendered in the offer

through a merger at the same price as in the tender offer.

The Transaction is not subject to any financing

condition and consideration will be 100% funded in cash. MTY will

use its cash on hand and its existing credit facility to fund the

cash consideration and to repay Papa Murphy’s net debt outstanding

as of the close of the Transaction, which today is approximately

US$77.4 million.

Pursuant to the terms of the Merger Agreement,

Papa Murphy’s has agreed that it will not solicit or initiate

discussions regarding any other business combination or sale of

material assets. MTY has the right to match any superior proposals.

The Transaction provides for a termination fee of approximately

US$5.7 million payable by Papa Murphy’s to MTY in certain

circumstances if the Transaction is not completed.

The Transaction is expected to close in the

second calendar quarter of 2019. There is no assurance the

Transaction will be completed as described above or at all, or that

the anticipated closing date will materialize. Following the close

of the transaction, Papa Murphy’s will be a wholly-owned subsidiary

of MTY and will continue to be operated as an independent

brand.

Transaction Approvals

The Transaction has been unanimously approved by

the board of directors of MTY and has been unanimously approved by

the board of directors of Papa Murphy’s. Each director and

executive officer of Papa Murphy’s, cumulatively having beneficial

ownership and control over 2.2% of Papa Murphy’s shares

outstanding, have signed support agreements to tender all of their

shares into the offer. Moreover, certain additional Papa Murphy’s

shareholders having beneficial ownership and control over 49.8% of

Papa Murphy’s shares outstanding have also signed such agreement to

tender all of their shares into the offer. In total, holders of

approximately 52.1% of Papa Murphy’s shares have agreed to tender

their shares into the offer, subject to potential adjustments in

certain circumstances provided in the support agreement. The

consummation of the Transaction is conditioned upon the tender of a

majority of Papa Murphy’s issued and outstanding shares of common

stock.

Financial and Legal Advisors

National Bank Financial Inc. is acting as

exclusive financial advisor to MTY and Fasken Martineau DuMoulin

LLP and Morrison & Foerster LLP are acting as its legal

advisors. North Point Advisors LLC is acting as exclusive financial

advisor to Papa Murphy’s and Perkins Coie LLP is acting as its

legal advisor.

Conference Call

MTY will be available for questions on the

Transaction during its quarterly earnings conference call today

April 11, 2019 at 8:30 AM EDT and will provide supplemental slides

on its corporate website at www.mtygroup.com. Participants are

invited to access the conference call by dialing 647-788-4922 (For

all Toronto and overseas participants) and 1-877-223-4471 (For all

other North American participants).

If you are unable to call in at this time, you may access a

recording of the meeting by calling 1-800-585-8367 and entering the

passcode 1483329 on your phone. This recording will be available on

April 11, 2019 as of 11:30 AM until 11:59 PM on May 10, 2019.

Notice to Investors

The tender offer described in this press release

has not yet commenced. This press release is for informational

purposes only and is not a recommendation, an offer to purchase or

a solicitation of an offer to sell shares of Papa Murphy’s. The

solicitation and offer to buy Papa Murphy’s shares will only be

made pursuant to an offer to purchase and related materials.

At the time the tender offer is commenced, MTY Franchising USA,

Inc., a wholly owned subsidiary of MTY, and its acquisition

subsidiary will file a tender offer statement and related exhibits

with the U.S. Securities and Exchange Commission (the “SEC”) and

Papa Murphy’s will file a solicitation/recommendation statement

with respect to the tender offer. Investors and stockholders of

Papa Murphy’s are strongly advised to read the tender offer

statement (including the related exhibits) and the

solicitation/recommendation statement, as they may be amended from

time to time, when they become available, because they will contain

important information, including the terms and conditions of the

offer, that stockholders should consider before making any decision

regarding tendering their shares. The tender offer statement

(including the related exhibits) and the

solicitation/recommendation statement will be available at no

charge on the SEC’s website at www.sec.gov. In addition, the tender

offer statement and other documents that MTY Franchising USA, Inc.

or its acquisition subsidiary files with the SEC will be made

available to all stockholders of Papa Murphy’s free of charge from

the information agent for the tender offer. The

solicitation/recommendation statement and the other documents filed

by Papa Murphy’s with the SEC will be made available to all

stockholders of Papa Murphy’s free of charge at

http://investors.papamurphys.com. Further information regarding the

Transaction will be contained in the Merger Agreement, copies of

the Agreement will be available on SEDAR at

www.sedar.com.

All dollar values herein presented in Canadian

dollars unless otherwise indicated. US dollar values converted to

Canadian dollars at 1.3326.

Non‑IFRS and Non-GAAP Measures

This news release makes reference to certain

non‑IFRS and non-GAAP measures. These measures are not recognized

measures under IFRS or GAAP, do not have a standardized meaning

prescribed by IFRS or GAAP and are therefore unlikely to be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement those IFRS and GAAP measures by providing further

understanding of MTY or Papa Murphy’s results of operations from

their respective management’s perspective. Accordingly, they should

not be considered in isolation nor as a substitute for analysis of

MTY or Papa Murphy’s financial information reported under IFRS or

GAAP, respectively. MTY or Papa Murphy’s use non-IFRS and non-GAAP

measures including “Adjusted EBITDA” “System-wide Sales" and

“EBITDA" to provide investors with a supplemental measure of their

operating performance and thus highlight trends in their core

businesses that may not otherwise be apparent when relying solely

on IFRS or GAAP financial measures. MTY and Papa Murphy’s also

believe that securities analysts, investors and other interested

parties frequently use non-IFRS or non-GAAP measures in the

evaluation of issuers and other reporting companies. MTY or Papa

Murphy’s management also uses non-IFRS and non-GAAP measures in

order to facilitate operating performance comparisons from period

to period, to prepare annual operating budgets, and to determine

components of management compensation.

“System-wide Sales” represents the net sales

received from restaurant guests at both corporate and franchise

restaurants including take-out and delivery customer orders.

System-wide Sales includes sales from both established restaurants

as well as new restaurants. MTY and Papa Murphy’s management

believes System-wide Sales provides meaningful information to

investors regarding the size of MTY’s and Papa Murphy’s restaurant

networks, the total market share of their brands and the overall

financial performance of their brands and restaurant owner bases,

which ultimately impacts MTY and Papa Murphy’s consolidated

financial performance.

“EBITDA” is a non-IFRS measure presented by MTY

and is defined as net earnings (loss) from continuing operations

before net interest expense and other financing charges, losses

(gains) on derivative, income taxes, depreciation of property,

plant and equipment, amortization of intangible assets, and

impairment of assets, net of reversals.

“Adjusted EBITDA” is a non-GAAP measure

presented by Papa Murphy’s and is defined as net income (loss)

before interest expense, provision for (benefit from) income taxes

and depreciation and amortization, with further adjustments to

reflect the elimination of various expenses that Papa Murphy’s

considers not indicative of ongoing operations. For a

reconciliation of Adjusted EBITDA of Papa Murphy’s to net income

(loss) of Papa Murphy’s, the most directly comparable GAAP measure,

see the earnings release of Papa Murphy’s dated March 14, 2019,

filed as Exhibit No. 99.1 to Papa Murphy’s Current Report on Form

8-K dated March 14, 2019.

Forward Looking Information

Certain information in this news release may

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, as amended.

Forward-looking statements involve known and unknown risks and

uncertainties future expectations and other factors which may cause

the actual results, performance or achievements of MTY, Papa

Murphy’s or the combined company to be materially different from

any future results, performance or achievements expressed or

implied by such forward-looking information. All statements other

than statements of historical facts included in this news release

may constitute forward looking statements. In particular, this news

release contains statements that may constitute forward looking

statements regarding, without limitation, the potential benefits

and effects of the Transaction, the ability of the parties to

complete the Transaction and the expected timing of completion of

the Transaction and the potential impact of the Transaction on the

combined entity's future operations, the suitability of the

Transaction for MTY and Papa Murphy’s, the effect of the

Transaction on Papa Murphy’s stakeholders; the expected EBITDA,

revenue, liquidity, cash flow, System-wide Sales and potential

growth of the combined entity; and potential future acquisition

opportunities and capital investments. Forward-looking statements

can generally be identified by the use of forward-looking

terminology such as “anticipate”, “estimate”, “may”, “will”,

“expect”, “believe”, “plan” or variations of such words and

phrases, or by the use of words or phrases which state that certain

actions, events or results may, could, would, or might occur or be

achieved. These forward-looking statements are not facts or

guarantees of future performance, but only reflections of estimates

and expectations of MTY’s and Papa Murphy’s management and involve

a number of risks, uncertainties, and assumptions.

The forward-looking information contained in

this news release reflects MTY’s and Papa Murphy’s current

expectations and assumptions regarding future events and operating

performance and speaks only as of the date of this news release.

These expectations and assumptions include, but are not limited to:

the currency exchange rates used to derive Canadian dollar

expectations; market acceptance of the Transaction; the

satisfactory fulfilment of all of the conditions precedent to the

Transaction; the receipt of all required approvals and consents;

future results of Papa Murphy’s business and operations meeting or

exceeding historical results; the success of the integration of

Papa Murphy’s operations and management team with MTY’s operations

and business; and market acceptance of potential future

acquisitions and capital investments by MTY. While these

assumptions and expectations are considered reasonable, a number of

factors could cause the actual results, level of activity,

performance or achievements to be materially different from the

expectations and assumptions of MTY and Papa Murphy’s, including

those discussed in MTY’s public filings available at www.sedar.com

and in particular in its most recent annual information form under

“Risk Factors” and in its management’s discussion and analysis for

its fiscal year ended November 30, 2018 under “Risk and

Uncertainties” and in Papa Murphy’s public filings with the

Securities and Exchange Commission, available at ww.sec.gov,

including under those discussed under “Risk Factors” in Papa

Murphy’s most recent annual report on Form 10-K for the fiscal year

ended December 31, 2018.

Risks and uncertainties inherent in the nature

of the Transaction include without limitation, the failure to

receive all required approvals and consents or to otherwise fulfill

all of the conditions precedent to the Transaction, in a timely

manner, or at all; significant transaction costs or unknown

liabilities; failure to realize the expected benefits of the

Transaction; and general economic conditions. Failure to receive

all required approvals and consents or to otherwise fulfill all of

the conditions precedent to the Transaction may result in the

Transaction not being completed on the proposed terms, or at all.

There can be no assurance that the anticipated strategic benefits

and operational, competitive and cost synergies resulting from the

Transaction will be realized. In addition, if the Transaction is

not completed and Papa Murphy’s continues as an independent entity,

there are risks that the announcement of the Transaction and the

dedication of substantial resources of Papa Murphy’s to the

completion of the Transaction could have an impact on Papa Murphy’s

business and strategic relationships, operating results and

businesses generally, and could have a material adverse effect on

the current and future operations, financial condition and

prospects of Papa Murphy’s. Furthermore, the termination of the

Merger Agreement may, in certain circumstances, result in Papa

Murphy’s being required to pay a fee to MTY, the result of which

could have a material adverse effect on Papa Murphy’s financial

position and results of operations and its ability to fund growth

opportunities and current operations.

Readers are further cautioned not to place undue

reliance on forward-looking information as there can be no

assurance that the plans, intentions or expectations upon which

they are placed will occur. Forward-looking information contained

in this news release is expressly qualified by this cautionary

statement. Except as required by law, neither of MTY or Papa

Murphy’s assumes no obligation to update or revise forward-looking

information to reflect new events or circumstances. All such

forward-looking statements are made pursuant to the “safe harbour”

provisions of applicable securities laws

About MTY Food Group

MTY Group franchises and operates quick-service

and casual dining restaurants under approximately 75 different

banners in Canada, the United States and internationally. Based in

Montreal, MTY is a family whose heart beats to the rhythm of its

brands, the very soul of its multibranded strategy. For over 35

years, it has been increasing its presence by delivering new

concepts in quick-service restaurants and making acquisitions and

strategic alliances that have allowed it to reach new heights year

after year. By combining new trends with operational know-how, the

brands forming the MTY Group now touch the lives of millions of

people every year. With approximately 6,000 locations, the many

flavours of the MTY Group have the key to responding to the

different tastes and needs of consumers today and tomorrow.

For more information about MTY or the

Transaction, please contact Pierre Boucher or Jennifer McCaughey,

MaisonBrison, at 1-514-731-0000 or by email at

pierre@maisonbrison.com or jennifer@maisonbrison.com or

visit our website, https://mtygroup.com or SEDAR’s website at

www.sedar.com under the Company’s name.

About Papa Murphy’s

Holdings

Papa Murphy’s Holdings, Inc. is a franchisor and

operator of the largest Take ‘n’ Bake pizza brand in the United

States, selling hand-crafted, fresh pizzas for customers to bake at

home. The Company was founded in 1981 and currently operates over

1,400 franchised and corporate-owned stores in 37 U.S. states,

Canada, and the United Arab Emirates. Papa Murphy’s core purpose is

to help anyone with an oven and 15 minutes serve a scratch-made

meal. In addition to fresh pizzas, the Company offers hand-crafted

salads, sides and desserts to complete the meal. Order online today

at www.papamurphys.com for easy pick up everywhere, and find Papa

Murphy’s on your favorite delivery apps in select markets.

For more information about Papa Murphy’s or the

Transaction, please contact Maurice Hines, Investor Relations at

1-360-449-4008 or by email at

maurice.hines@papamurphys.com or visit our website,

http://investors.papamurphys.com or the SEC website at and

www.sec.gov under the Papa Murphy’s name.

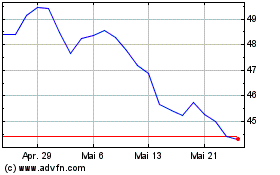

MTY Food (TSX:MTY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

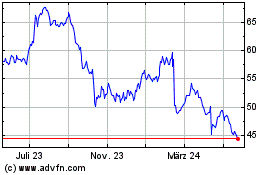

MTY Food (TSX:MTY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024