Melcor Developments Ltd. (TSX: MRD), a real estate development and

asset management company with operations across western Canada and

in the United States, today reported results for the fourth quarter

and year ended December 31, 2022. Revenue decreased by 23% to

$241.75 million in 2022 compared to a record high of $315.63

million in 2021. Net income was up 59% to $89.35 million or $2.75

per share (basic) in 2022, compared to $56.31 million or $1.70 per

share (basic) in 2021. Net income is impacted by non-cash items

including fair value adjustments on REIT units and investment

properties. These fair value adjustments are due to market factors

outside management's control and that is why management prefers

funds from operations (FFO)(1). FFO per share was down 24% to $1.88

per share in 2022 compared to $2.46 per share in 2021 correlated

with decreased revenue.

Tim Melton, Melcor’s Executive Chair and Chief Executive

Officer, commented on the year: "I'm pleased to announce another

year of satisfactory results for the company as Melcor enters its

100th year as a real estate focused company. We achieved revenue of

$241.75 million and net income of $89.35 million.

Melcor had a successful year, with steady demand in Canadian

markets and increased momentum in the Calgary region where two new

communities were introduced over the past few years with plans for

additional communities to be launched in 2023. The big outlier for

the year was the lack of community sales in the US. Community sales

revenue in the US is typically characterized by bulk sales

agreements, which can result in variability from one period to

another, making it challenging to compare results over time.

We completed the sale of 117 residential units in the US,

generating cash of $35.00 million (US$26.15 million). These

properties were originally purchased between 2010 and 2013 for

$11.94 million, which represents a gain of $23.06 million.

Subsequent to the year, we returned $24.01 million (US$18.00

million) in cash to Canada to reduce borrowings on our credit

facility as we navigate interest rate uncertainty.

Our commercial income divisions, Investment Properties and REIT,

contributed $117.12 million in revenue up 4% over the prior

year with growth in square footage owned and improved occupancy.

Their higher contribution to revenue also improved gross margin for

the year to 49% from 44% last year. Investment Properties manages

4.80 million sf of commercial GLA and 476 residential units

(including property owned by the REIT). The Recreational Properties

division also had a successful year despite weather conditions

leading to a shorter golf season than 2021.

In 2022, we increased our dividend 32% to $0.58 per share. We

also repurchased the maximum shares allowable under our Normal

Course Issuer Bid, thereby reducing shares outstanding by 5% and

increasing each shareholders' ownership position marginally.

I am also pleased to announce the appointment of Naomi Stefura

as Chief Operating Officer (COO) of the company. Naomi has been an

exceptional CFO, and we are confident that she will excel in her

new role while concurrently holding her position as CFO. During her

14 year tenure with Melcor, Naomi has demonstrated an unwavering

commitment to the company's values, and has gained a deep

understanding of the company's operating divisions. She has earned

the respect of all stakeholders, including the board, employees,

and partners. Naomi's promotion to COO is a testament to her hard

work, expertise, and leadership skills. It is my pleasure to work

with Naomi, and the entire Melcor team, to achieve our company

objectives.

On behalf of the board and all shareholders, I wish to

acknowledge the entire Melcor team for their hard work and

commitment to serving all company stakeholders and producing good

results for the company.

Rising interest rates, combined with general inflation and

geopolitical conflict provided some pause in 2022; however, we

remain confident that our assets position the company to navigate

changing economic times as we have done for the past 100 years.

In closing, Melcor wishes to thank shareholders for their

continued support and confidence. We remain committed to protecting

and enhancing your investment in the company."

Today the Board declared a dividend of $0.16 per share, payable

on March 31, 2023 to shareholders of record on March 24, 2023. The

dividend is an eligible dividend for Canadian tax purposes.

________________________ (1) Readers are reminded that

established key performance measures may not have standardized

meaning under GAAP. For further information on the Melcor's

non-standard measures, non-GAAP measures, operating measures and

non-GAAP ratios, refer to the information in the press release

below along with the Non-GAAP and Non-Standard Measures section on

page 39 of the MD&A

Selected Highlights

|

($000s except as noted) |

Three Months Ended December 31, |

Twelve Months Ended December 31, |

|

|

2022 |

|

2021 |

|

% Change |

2022 |

|

2021 |

|

% Change |

|

Revenue |

76,261 |

|

150,598 |

|

(49 |

)% |

241,747 |

|

315,628 |

|

(23 |

)% |

|

Gross margin (%)(3) |

48.6 |

% |

40.3 |

% |

23 |

% |

48.9 |

% |

44.4 |

% |

10 |

% |

|

Fair value adjustment on investment properties |

21,801 |

|

9,330 |

|

120 |

% |

21,554 |

|

19,370 |

|

11 |

% |

|

Net income |

37,202 |

|

44,769 |

|

(17 |

)% |

89,354 |

|

56,311 |

|

59 |

% |

|

Net margin (%)(3) |

49 |

% |

30 |

% |

64 |

% |

37.0 |

% |

17.8 |

% |

108 |

% |

|

Funds from operations(1) |

22,297 |

|

42,311 |

|

(47 |

)% |

60,859 |

|

81,327 |

|

(25 |

)% |

|

Per Share Data ($) |

|

Basic earnings |

1.15 |

|

1.35 |

|

(15 |

)% |

2.75 |

|

1.70 |

|

62 |

% |

|

Diluted earnings |

1.15 |

|

1.35 |

|

(15 |

)% |

2.74 |

|

1.70 |

|

61 |

% |

|

Funds from operations(2) |

0.68 |

|

1.27 |

|

(46 |

)% |

1.88 |

|

2.46 |

|

(24 |

)% |

|

Dividends |

0.68 |

|

1.27 |

|

(46 |

)% |

0.58 |

|

0.44 |

|

32 |

% |

|

As at ($000s except share and per share amounts) |

|

December 31, 2022 |

December 31, 2021 |

% Change |

|

Shareholders' equity |

|

1,178,336 |

1,116,469 |

6 |

% |

|

Total assets |

|

2,167,050 |

2,113,927 |

3 |

% |

|

Total Shares outstanding |

|

31,248,628 |

32,961,015 |

5 |

% |

|

Book value(2) |

|

37.71 |

33.87 |

11 |

% |

(1) Non-GAAP financial measure. Refer to the Non-GAAP and

Non-Standard Measures section on page 40 for further

information.(2) Non-GAAP financial ratio. Refer to the Non-GAAP and

Non-Standard Measures section on page 40 for further

information.(3) Supplementary financial measure. Refer to the

Non-GAAP and Non-Standard Measures section on page 40 for further

information.

Consolidated revenue for 2022 was $241.75 million down 23%

from the record revenue set in 2021. Gross margin was 49% due to

higher contributions from our higher margin commercial properties

divisions. Net income was up 59% to $89.35 million and FFO was

down 25.2% to $60.86 million. Although FFO was down, we also

generated additional cash through the sale of US residential units

for proceeds of $35.00 million, not reflected in FFO. This

represents a gain of $23.06 million, however as Investment

Properties are carried at fair value, the increase would have been

captured in fair value adjustments in the current and comparative

periods.

The significant factor in comparing our results to the prior

year is the lack of US Community Development sales in 2022. In

2021, this region sold 280 lots and 155 acres (595 paper lots) for

revenue of $54.89 million and earnings of $21.18 million.

In the current year, no lots or acres were sold. Land sales in the

US differ from Canadian as we often sell the lots in bulk

agreements leading to dramatic swings in sales period over period.

New home sales in our Canadian regions remain strong, resulting in

1,060 single-family lots being sold compared to 1,261 lots in

2021.

Property Development revenue is primarily derived from internal

transfers to our Investment Properties division. In 2022, the value

of transfers to Investment Properties was $13.63 million

(eliminated on consolidation). Transfers added 36,846 sf (5 retail

buildings) to our portfolio of income-generating properties.

Margins on transfers was 17%, up compared to 2021.

Investment Properties revenue was up 10% due to GLA growth

(transfers from the Property Development division) and improved

occupancy. As mentioned above, the division also sold 117

residential units in Phoenix, Arizona for $35.00 million

(US$26.15 million) net of transaction costs. These sales are not

included in revenue however the value of the assets increased over

time through both exchange rates changes and market improvements,

contributing to a total realized gain on sale of $23.06 million. As

the properties were unencumbered at the time of sale, they

contributed $35.00 million cash to proceeds from investing

activities. Subsequent to year end, $24.01 million (US$18.00

million) was repatriated and used to pay down our line of

credit.

Revenue in the Recreational Properties division was up 5% with

slightly lower revenue from green fees due to weather conditions

during the golf season offset by an increase in food and beverage

revenues over 2021.

The US contributed 7% of total revenue or $15.83 million in

the year, all from Investment Properties. This compares to 2021

revenue of $70.38 million (22% of total revenue). As noted

above, the large swing in US revenue was due to timing of sales in

our US Community Development.

Throughout the year, we maintained our conservative and

disciplined approach to investment and development activities and

the management of our assets and liabilities.

Investing for growthWe purchased 13.01 acres

adjacent to other holdings in Buckeye, Arizona. This land is

immediately developable and fits our strategy of purchasing land to

rezone in the US. While we may participate in strategic land

purchase opportunities such as this, our primary focus is on

harvesting our current inventory of 9,857 acres.

Our Property Development division completed and transferred 5

buildings (36,846 sf) in 2022 with a further 61,850 sf under

development, with all completed buildings at year end transferred

to our Investment Property division. Revenue from the Property

Development division is eliminated on consolidation. Transfers to

Investment Properties will positively impact results in future

years as we continue to grow our income-producing assets for

long-term holding or for sale to the REIT. We continued to progress

commercial land through the development, approvals and lease-up

process and have an additional 6 buildings in 4 projects expected

to be completed and transferred to Investment Properties in

2023.

Asset DispositionsDuring the year, we sold 117

residential units in Arizona for $35.00 million (US$26.15

million) net of transaction costs.

We also entered into an unconditional agreement to sell a

REIT-owned investment property for gross proceeds of $19.50 million

($19.03 million net of transaction costs). This asset was

reclassified as asset held for sale at year end and was

subsequently sold on February 1, 2023.

Shareholder HighlightsWe continued to return

value to our shareholders and unitholders:

Melcor Developments:We increased dividends paid

to shareholders by 31.8% to $0.58 per share (2021 - $0.44 per

share).

On March 16, 2023 we declared a quarterly dividend of $0.16

per share, payable on March 31, 2023 to shareholders of record on

March 24, 2023. The dividend is an eligible dividend for Canadian

tax purposes.

We have been paying dividends since 1969.

On December 22, 2022, Melcor filled the current NCIB by

purchasing the final shares bringing the total purchased to the

maximum 1,641,627 shares allowed. The current NCIB period ends on

March 31, 2023 and no additional shares can be purchased at this

time.

Melcor REIT:The REIT distributed $0.48 per unit

to unitholders in 2022 compared to $0.45 per unit in 2021.

Subsequent to the year, the REIT declared distributions of $0.04

per unit for January, February and March 2023.

The REIT has been paying distributions since inception in

2013.

OutlookMelcor owns a high quality portfolio of

assets, including raw land, developed land inventory (residential

lots and acres for multi-family and commercial development),

income-producing properties and championship golf courses.

Alberta, our largest market, has undergone dramatic changes

throughout the past few years, due to volatile oil prices, pandemic

operating constraints and rising interest rates. We have

diversified our business across asset class and geography,

including investment in the US with raw land and commercial

property acquisitions and the continued development of our

community in Aurora, CO.

Inflation and interest rate increases have generally slowed the

Canadian market however we have found stable demand for quality new

homes and office and retail space. Alberta is projected to have

Canada's highest GDP growth in 2023.

We expect to develop approximately 1,000 new single-family lots

across our portfolio in 2023 to meet market demand. On the

commercial side, retail activity remains steady and we expect that

to continue in 2023. Although our 2022 US Community Development

division did not provide us with strong results, we have a positive

outlook for 2023.

Our business model has adapted to changing times and economic

cycles over the years. We will maintain our disciplined,

conservative approach to operations to ensure that we remain

profitable while achieving our fundamental goals of protecting

shareholder investment and sharing corporate profit with our

shareholders.

With appropriate levels of serviced land inventory, movement of

residential and commercial land through the municipal approvals

process, steady occupancy rates and capacity on our operating

facility, we remain well-positioned for the future.

Non-GAAP & Non-Standard MeasuresFFO is a

key measures of performance used by real estate operating

companies; however, that is not defined by International Financial

Reporting Standards (“IFRS”), do not have standard meanings and may

not be comparable with other industries or income trusts. This

non-IFRS measures are more fully defined and discussed in the

Melcor’s management discussion and analysis for the period ended

December 31, 2022, which is available on SEDAR at

www.sedar.com.

FFO Reconciliation

|

Consolidated |

|

|

|

|

($000s) |

Three Months Ended December 31, |

Twelve Months Ended December 31, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Net income for the period |

37,202 |

|

44,769 |

|

89,354 |

|

56,311 |

|

|

Amortization of operating lease incentives |

1,941 |

|

2,238 |

|

7,561 |

|

8,160 |

|

|

Fair value adjustment on investment properties |

(21,801 |

) |

(9,330 |

) |

(21,554 |

) |

(19,370 |

) |

|

Depreciation on property and equipment |

209 |

|

227 |

|

1,350 |

|

1,334 |

|

|

Stock based compensation expense |

(6 |

) |

370 |

|

841 |

|

1,132 |

|

|

Non-cash financing costs |

(607 |

) |

(668 |

) |

(8,518 |

) |

3,479 |

|

|

Gain on sale of asset |

(3 |

) |

(24 |

) |

(40 |

) |

(151 |

) |

|

Deferred income taxes |

8,214 |

|

5,288 |

|

8,225 |

|

4,684 |

|

|

Fair value adjustment on REIT units |

(2,852 |

) |

(559 |

) |

(16,360 |

) |

25,748 |

|

|

FFO |

22,297 |

|

42,311 |

|

60,859 |

|

81,327 |

|

|

|

|

|

|

|

|

Investment Properties |

|

|

|

|

|

($000s) |

Three Months Ended December 31, |

Twelve Months Ended December 31, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Segment Earnings |

31,399 |

|

11,755 |

|

48,097 |

|

31,077 |

|

|

Fair value adjustment on investment properties |

(26,212 |

) |

(7,374 |

) |

(25,663 |

) |

(10,850 |

) |

|

Amortization of operating lease incentives |

447 |

|

410 |

|

1,620 |

|

1,624 |

|

|

Divisional FFO |

5,634 |

|

4,791 |

|

24,054 |

|

21,851 |

|

| |

|

|

|

|

|

(1) Refer to note 24 to the consolidated financial statements |

|

|

| |

|

|

|

|

|

REIT |

|

|

|

|

|

($000s) |

Three Months Ended December 31, |

Twelve Months Ended December 31, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Segment Earnings |

485 |

|

10,019 |

|

27,723 |

|

43,710 |

|

|

Fair value adjustment on investment properties |

9,130 |

|

(214 |

) |

11,995 |

|

(2,879 |

) |

|

Amortization of operating lease incentives |

962 |

|

1,251 |

|

3,725 |

|

4,218 |

|

|

Divisional FFO |

10,577 |

|

11,056 |

|

43,443 |

|

45,049 |

|

MD&A and Financial StatementsInformation

included in this press release is a summary of results. This press

release should be read in conjunction with Melcor’s 2022

consolidated financial statements and management’s discussion and

analysis for the year ended December 31, 2022, which can be

found on the Company’s website at www.Melcor.ca or on SEDAR

(www.sedar.com).

Annual General MeetingWe invite unitholders to

join us at our annual general meeting on April 26, 2023 at

11:00 AM MT at the Fairmont Hotel Macdonald, Empire Ballroom, 10065

100 Street NW, Edmonton, AB. The meeting will also be webcast at

https://www.gowebcasting.com/12427

About Melcor Developments Ltd.Melcor is a

diversified real estate development and asset management company

that transforms real estate from raw land through to high-quality

finished product in both residential and commercial built form.

Melcor develops and manages mixed-use residential communities,

business and industrial parks, office buildings, retail commercial

centres and golf courses. Melcor owns a well diversified portfolio

of assets in Alberta, Saskatchewan, British Columbia, Arizona and

Colorado.

Melcor has been focused on real estate since 1923. The Company

has built over 140 communities across western Canada and today

manages 4.8 million sf in commercial real estate assets and 476

residential rental units. Melcor is committed to building

communities that enrich quality of life - communities where people

live, work, shop and play.

Melcor’s headquarters are located in Edmonton, Alberta, with

regional offices throughout Alberta and in British Columbia and

Arizona. Melcor has been a public company since 1968 and trades on

the Toronto Stock Exchange (TSX:MRD).

Forward Looking StatementsIn order to provide

our investors with an understanding of our current results and

future prospects, our public communications often include written

or verbal forward-looking statements.

Forward-looking statements are disclosures regarding possible

events, conditions, or results of operations that are based on

assumptions about future economic conditions, courses of action and

include future-oriented financial information.

This news release and other materials filed with the Canadian

securities regulators contain statements that are forward-looking.

These statements represent Melcor’s intentions, plans,

expectations, and beliefs and are based on our experience and our

assessment of historical and future trends, and the application of

key assumptions relating to future events and circumstances.

Future-looking statements may involve, but are not limited to,

comments with respect to our strategic initiatives for 2020 and

beyond, future development plans and objectives, targets,

expectations of the real estate, financing and economic

environments, our financial condition or the results of or outlook

of our operations.

By their nature, forward-looking statements require assumptions

and involve risks and uncertainties related to the business and

general economic environment, many beyond our control. There is

significant risk that the predictions, forecasts, valuations,

conclusions or projections we make will not prove to be accurate

and that our actual results will be materially different from

targets, expectations, estimates or intentions expressed in

forward-looking statements. We caution readers of this document not

to place undue reliance on forward-looking statements. Assumptions

about the performance of the Canadian and US economies and how this

performance will affect Melcor’s business are material factors we

consider in determining our forward-looking statements. For

additional information regarding material risks and assumptions,

please see the discussion under Business Environment and Risk in

our annual MD&A.

Readers should carefully consider these factors, as well as

other uncertainties and potential events, and the inherent

uncertainty of forward-looking statements. Except as may be

required by law, we do not undertake to update any forward-looking

statement, whether written or oral, made by the Company or on its

behalf.

Contact Information:

Corporate Communications

Tel: 1.855.673.6931 x4707

ir@Melcor.ca

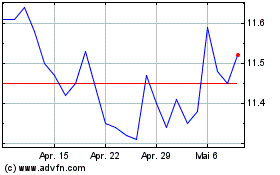

Melcor Developments (TSX:MRD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Melcor Developments (TSX:MRD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025