Interfor Expands and Extends Its Revolving Credit Facility

18 Dezember 2021 - 12:16AM

INTERFOR CORPORATION (“Interfor” or the “Company”)

(TSX: IFP) today announced that it has closed an early renewal and

expansion of its revolving credit facility with a syndicate of

major Canadian and U.S. banks co-led by RBC Capital Markets, TD

Securities and Wells Fargo.

The commitment amount under the facility has been increased by

C$150 million to a total of C$500 million, and the term of the

facility has been extended from March 2024 to December 2026. The

security, covenants and pricing grid remain unchanged.

In addition, the renewal includes the increased ability to secure

additional long-term debt financing, which will enhance the

Company’s ongoing financial flexibility.

At September 30, 2021, Interfor had C$836 million of available

liquidity, including C$509 million of cash on hand, and this

availability will be increased by C$150 million on a pro forma

basis under the new facility. This increase will provide the

Company with ample financial capacity to complete its previously

announced acquisition of EACOM Timber Corporation in early 2022 and

provide additional flexibility to continue to pursue its strategic

growth agenda.

FORWARD-LOOKING STATEMENTS

This release contains forward-looking information about the

Company’s business outlook, objectives, plans, strategic priorities

and other information that is not historical fact. A statement

contains forward-looking information when the Company uses what it

knows and expects today, to make a statement about the future.

Statements containing forward-looking information in this release

include, but are not limited to, statements regarding future

growth, pro forma liquidity, borrowing capacity, the expected

completion of a transaction, and other future events and

circumstances. Readers are cautioned that actual results may vary

from the forward-looking information in this release, and undue

reliance should not be placed on such forward-looking information.

Risk factors that could cause actual results to differ materially

from the forward-looking information in this release are described

in Interfor’s annual Management’s Discussion & Analysis under

the heading “Risks and Uncertainties”, which is available on

www.interfor.com and under Interfor’s profile on www.sedar.com.

Material factors and assumptions used to develop the

forward-looking information in this release include volatility in

the selling prices for lumber, logs and wood chips; the Company’s

ability to compete on a global basis; the availability and cost of

log supply; natural or man-made disasters; currency exchange rates;

changes in government regulations; the availability of the

Company’s allowable annual cut (“AAC”); claims by and treaty

settlements with Indigenous peoples; the Company’s ability to

export its products; the softwood lumber trade dispute between

Canada and the U.S.; stumpage fees payable to the Province of

British Columbia (“B.C.”); environmental impacts of the Company’s

operations; labour disruptions; information systems security; and

the existence of a public health crises (such as the current

COVID-19 pandemic). Unless otherwise indicated, the forward-looking

statements in this release are based on the Company’s expectations

at the date of this release. Interfor undertakes no obligation to

update such forward-looking information or statements, except as

required by law.

ABOUT INTERFOR

Interfor is a growth-oriented forest products company with

operations in Canada and the United States. The Company has annual

production capacity of approximately 3.9 billion board feet and

offers a diverse line of lumber products to customers around the

world. For more information about Interfor, visit our website at

www.interfor.com.

Investor Contacts:

Rick Pozzebon, Senior Vice President & Chief Financial

Officer(604) 689-6804

Mike Mackay, Vice President of Corporate Development &

Strategy (604) 689-6846

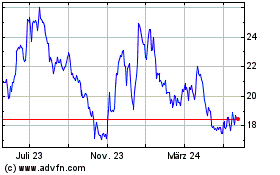

Interfor (TSX:IFP)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

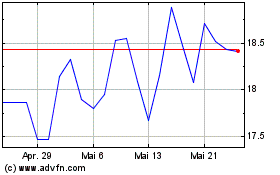

Interfor (TSX:IFP)

Historical Stock Chart

Von Jan 2024 bis Jan 2025