Intact Financial Corporation (TSX: IFC) (Intact, IFC or the

Company) and its subsidiary RSA today announced that they have

reached an agreement with Direct Line Insurance Group plc (Direct

Line) to acquire Direct Line’s brokered Commercial Lines

operations. The purchase price includes an initial cash

consideration of £520 million (C$884 million), with potential for

up to a further £30 million (C$51 million) contingent payment under

earnout provisions relating to the financial performance of the

acquired business lines. The transaction will result in the

transfer of renewal rights, brands, employees, and systems to RSA.

Direct Line’s brokered Commercial Lines generated written

premiums4 of £530 million in 2022, and delivered an average

combined ratio56 of approximately 96% across 2021 and 2022.

The transaction has been unanimously approved by

the Boards of Directors of both Intact and Direct Line, and is

subject to approval by Direct Line’s shareholders (Direct Line

Shareholder Approval).

“This acquisition significantly strengthens our

UK&I business, and is strongly aligned with our strategic and

financial objectives,” said Charles Brindamour, Chief Executive

Officer, Intact Financial Corporation. “The transaction enhances

our position in the UK by doubling down on lines of business where

we already outperform.”

Ken Norgrove, Chief Executive Officer, RSA,

added: “We look forward to welcoming a team of experienced, highly

talented and skilled colleagues from strong brands, including NIG

and FarmWeb, to further enhance RSA’s strong Commercial Lines

business.”

To accelerate its outperformance ambition,

Intact is also exploring strategic options in respect of RSA’s UK

Personal lines business, including a possible sale. RSA had

previously announced its exit from the UK Personal Lines motor

market in March 2023, as well as outlined plans to optimize its

leading Home and Pet platforms.

_______________1 NOIPS is a non-IFRS ratio,

which does not have a standardized meaning prescribed by IFRS and

may not be comparable to similar measures used by other companies

in our industry. It is calculated by dividing net operating income

attributable to common shareholders, divided by the

weighted-average number of common shares outstanding on a daily

basis during a specific period. Net operating income attributable

to common shareholders is a non-IFRS measure which represents the

net income attributable to shareholders, excluding the after-tax

impact of non-operating results, net of net income (loss)

attributable to non-controlling interests (non-operating

component), preferred share dividends and other equity

distributions. See Non-IFRS measures at the end of this press

release.2 IRR is the discount rate that makes the net present value

of all cash flows equal to zero in a discounted cash flow

analysis.3 BVPS is a supplementary financial measure, which does

not have a standardized meaning prescribed by IFRS and may not be

comparable to similar measures used by other companies in our

industry. It is calculated by dividing common shareholders’ equity

by the number of common shares outstanding. See Non-IFRS measures

at the end of this press release.4Stated as Gross Written Premiums

(GWP), which is a supplementary financial measure, does not have a

standardized meaning prescribed by IFRS, and may not be comparable

to similar measures used by other companies in our industry. It is

defined as the total premiums from insurance contracts that were

incepted during the period.5 Combined ratio is a non-IFRS ratio,

which does not have a standardized meaning prescribed by IFRS and

may not be comparable to similar measures used by other companies

in our industry. It is the sum of (i) claims ratio (which is a

non-IFRS ratio which represents operating net claims divided by

operating net underwriting revenues) and (ii) expense ratio (which

is a non-IFRS ratio which represents operating net underwriting

expenses divided by operating net underwriting revenues. See

Non-IFRS measures at the end of this press release.6 Data provided

by Direct Line. Average combined ratio is presented on an IFRS 4

basis.

Strong strategic fit

The acquisition is a unique opportunity to

enhance the outperformance position of the UK&I platform.

- Strengthens our presence in the attractive small and

medium-sized enterprises (SME) and mid-market segment of the UK

market, improving the risk profile of our UK&I business.

- Acquisition of well-established and leading brands, including

NIG and FarmWeb, given Direct Line’s 125-year history in the UK

commercial insurance market.

- Broadens our broker distribution network and expands our

current Commercial lines product offering.

- Drives outperformance through greater presence and focus on our

UK&I Commercial and Specialty lines portfolios, which have

delivered a 91% combined ratio5 in the two years since the

acquisition of RSA.

- Opportunity to drive value creation through loss ratio

improvement in the acquired business by leveraging our underwriting

expertise.

Financially compelling

- Internal rate of return (IRR)2 is expected to be in excess of

15%.

- Annual UK&I Commercial Lines (including Specialty) direct

premiums written (DPW)7 is expected to increase to approximately

£2.3 billion on a pro forma basis from £1.8 billion in 2022.

- The pro forma UK&I Commercial Lines combined ratio5 is

expected to be approximately 92% in 2024. By leveraging our price

segmentation and risk selection capabilities, we expect this to

improve to approximately 90% in the subsequent 12 to 24

months.

- We expect to drive annual cost synergies of approximately £20

million by Year 3.

- We expect the transaction to be accretive to NOIPS1 in 2024,

with low single-digit accretion by Year 3. The impact on Operating

ROE8 is expected to be largely neutral.

- BVPS3 is expected to increase by approximately 2% upon the

issuance of common shares to finance the transaction.

- Intact will maintain a strong capital position after financing

the transaction, with all regulatory capital ratios remaining at or

above target operating levels.

- The pro forma adjusted debt-to-total capital ratio9 is expected

to be under 25% upon completion of the financing, and return to

pre-transaction levels by the end of 2024. Intact does not expect

that its external credit ratings will be impacted.

_______________7 Direct premiums written (DPW)

is a supplementary financial measure, which does not have a

standardized meaning prescribed by IFRS and may not be comparable

to similar measures used by other companies in our industry. It is

composed of the total amount of premiums for new and renewal

policies written during the reporting period, excluding industry

pools, fronting and exited lines. See Non-IFRS measures at the end

of this press release. 8 Operating ROE is a non-IFRS ratio, which

does not have a standardized meaning prescribed by IFRS and may not

be comparable to similar measures used by other companies in our

industry. It is calculated by dividing net operating income

attributable to common shareholders by the adjusted average common

shareholders’ equity (excluding accumulated other comprehensive

income). See Non-IFRS measures at the end of this press release.9

Adjusted debt-to-total capital ratio is a non-IFRS ratio, which

does not have a standardized meaning prescribed by IFRS and may not

be comparable to similar measures used by other companies in our

industry. It is calculated using debt outstanding (excluding hybrid

debt) divided by adjusted total capital. See Non-IFRS measures at

the end of this press release.

Transaction details and

approvals

The transaction is subject to Direct Line

Shareholder Approval, with the vote expected to take place in

October 2023.

The transaction will be effected through the

combination of:

- An agreement to transfer the new business franchise and certain

operations, brands, employees, contractors, data, renewal rights,

third party contracts and premises to RSA, with the transfer

expected to occur in Q2 2024.

- A quota share reinsurance agreement relating to premiums

written but not yet earned, whereby substantially all of the future

economics of Direct Line’s brokered Commercial Lines portfolio will

be transferred to RSA starting from October 1, 2023. If approved by

the Court, this will be followed by an insurance business

transfer.

- Certain administration and transitional services

arrangements.

As part of the transaction, Direct Line will

retain the pre-October 1, 2023 economics in relation to the

acquired portfolio. RSA is therefore not exposed to any

development on prior-year reserves. However, RSA and Direct Line

intend to enter into discussions regarding the potential transfer

of those economics at a later date.

Any additional capital required to support the

quota share reinsurance agreement and new business growth will be

funded through excess capital in our UK subsidiary, as well as

future capital generation.

RSA and Direct Line will work closely with

brokers to ensure a smooth transition process.

Around 800 Direct Line employees will move to

RSA to provide ongoing support and service delivery, which will

allow RSA to continue to maintain its excellent relationships with

brokers and provide outstanding service to customers.

Transaction financing

Following Direct Line Shareholder Approval,

Intact will make a £520 million (C$884 million) payment to Direct

Line as cash consideration for the acquired UK commercial lines

business, with potential for up to a further £30 million (C$51

million) contingent payment under certain earnout provisions

relating to the financial performance of the business lines.

The purchase price, as well as expected

integration costs of approximately £45 million, will be financed

through a combination of:

- a C$500 million bought deal public offering of common

shares;

- issuance of medium-term notes; and

- a new term loan facility

Intact has entered into an agreement with a

group of underwriters, led by CIBC Capital Markets and BMO Capital

Markets for the issuance of 2,666,000 common shares at

C$187.60 per common share (the Offering Price) for gross proceeds

to Intact of approximately C$500 million (the Offering) pursuant to

a bought deal public offering in Canada and in the United States in

a private offering to qualified institutional buyers in reliance

upon Rule 144A under the U.S. Securities Act of 1933, as amended

(the U.S. Securities Act).

Intact has granted the underwriters an option,

exercisable, in whole or in part, at any time and from time to

time, until the date that is 30 days following the closing of the

Offering, to purchase up to an aggregate

of 399,000 additional common shares for additional gross

proceeds of up to C$75 million. Closing of the Offering is expected

to occur on September 13, 2023.

In support of the transaction, Caisse de dépôt

et placement du Québec (“CDPQ”) intends to purchase common shares

pursuant to the bought deal public offering, at the Offering Price,

representing an aggregate purchase price of approximately C$50

million. As a result, CDPQ’s equity interest in Intact is expected

to remain largely unchanged at approximately 10%.

The issuance of the common shares is subject to

the approval of the Toronto Stock Exchange and other customary

closing conditions.

Advisers

J.P. Morgan Securities plc is acting as

financial adviser to Intact Financial Corporation. Skadden, Arps,

Slate, Meagher & Flom LLP is acting as legal adviser to Intact

Financial Corporation in this transaction.

Additional information

For more details on this transaction, a

pre-recorded audio webcast, transcript and presentation slides have

been posted to the corporate website. Please visit the Events and

Presentations section under “Investors” at www.intactfc.com to

access these supplementary materials.

About Intact Financial Corporation

Intact Financial Corporation (TSX: IFC) is the

largest provider of property and casualty (P&C) insurance in

Canada, a leading provider of global specialty insurance, and, with

RSA, a leader in the U.K. and Ireland. Our business has grown

organically and through acquisitions to over $21 billion of total

annual premiums.

In Canada, Intact distributes insurance under

the Intact Insurance brand through a wide network of brokers,

including its wholly-owned subsidiary BrokerLink, and directly to

consumers through belairdirect. Intact also provides affinity

insurance solutions through the Johnson Affinity Groups.

In the US, Intact Insurance Specialty Solutions

provides a range of specialty insurance products and services

through independent agencies, regional and national brokers, and

wholesalers and managing general agencies.

In the U.K., Ireland, and Europe, Intact

provides a range of personal, commercial and specialty insurance

solutions through a wide network of brokers, third party partners

and directly to customer under the RSA brands.

About RSA Insurance

RSA Insurance is a multinational insurance

group. We are one of the world’s oldest general insurers, providing

peace of mind to individuals and protecting small businesses and

large organisations from uncertainty. We use our capabilities to

anticipate and improve outcomes for customers via our direct

channel, our strong broker relationships or partner organisations.

We have established businesses in the UK, Ireland and continental

Europe.

In 2021, the former RSA Group Plc came under new

ownership and is now a wholly-owned subsidiary of Intact Financial

Corporation.

For more information about RSA Insurance, please

visit www.rsainsurance.co.uk

About Direct Line

Direct Line Insurance Group plc is a retail

general insurer with leading market positions in the United

Kingdom. The Group operates under highly recognised brands such as

Direct Line and Churchill and is comprised of five primary

segments: motor, home, rescue and other personal lines, and

commercial.

About CDPQ

CDPQ is a global investment group managing funds

for public pension and insurance plans. It invests constructively

to generate sustainable returns over the long term, working

alongside partners to build enterprises that drive performance and

progress. It is active in the major financial markets, private

equity, infrastructure, real estate and private debt.

For further information please contact:

|

Intact Media InquiriesDavid Barrett Director,

Media, Social and Owned Channels 1 416 227-7905 / 1 514 985-7165

media@intact.net |

Intact Investor InquiriesShubha Khan Vice

President, Investor Relations 1 416 341-1464 ext. 41004

shubha.khan@intact.net |

| |

|

Cautionary note regarding

forward-looking statements

Certain of the statements included in this press

release about the acquisition of Direct Line’s brokered Commercial

Lines operations and the issuance of common shares pursuant to the

Offering, including the completion of the transaction and the

Offering, the receipt of Direct Line Shareholder Approval, the

timing of the transfer of Direct Line’s brokered Commercial Lines

operations, the expected sources of financing for the transaction,

expectations regarding sources of funds for any additional capital

required to support the quota share reinsurance agreement and new

business growth, and the anticipated benefits of the transaction,

including the impact of the transaction on Intact’s business,

financial condition, capital position, cash flows and results of

operations, expectations relating to market share, combined ratio,

adjusted debt-to-total capital ratio, IRR, BVPS, NOIPS, operating

ROE, and DPW, Intact’s plans in respect of RSA’s UK Personal Lines

business and the performance of the UK&I Personal Lines

business, the timing of closing of the Offering, the expected use

of the net proceeds of the Offering, or any other future events or

developments constitute forward-looking statements. The words

"may", "will", "would", "should", "could", "expects", "plans",

"intends", "trends", "indications", "anticipates", "believes",

"estimates", "predicts", "likely", "potential" or the negative or

other variations of these words or other similar or comparable

words or phrases, are intended to identify forward-looking

statements. Unless otherwise indicated, all forward-looking

statements in this press release are made as of the date hereof and

are subject to change.

Forward-looking statements are based on

estimates and assumptions made by management based on management's

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors that

management believes are appropriate in the circumstances. Many

factors could cause the Company's actual results, performance or

achievements or future events or developments to differ materially

from those expressed or implied by the forward-looking statements.

In addition to other estimates and assumptions which may be

identified herein, estimates and assumptions have been made

regarding, among other things, the anticipated completion of the

transaction, the sources of financing for the transaction, the

anticipated closing of the Offering of and the expected use of the

net proceeds thereof. However, the completion of each of the

transaction and the Offering is subject to customary closing

conditions, termination rights and other risks and uncertainties,

and there can be no assurance that the transaction and the Offering

will be completed within anticipated timeframes or at all. All of

the forward-looking statements included in this press release are

qualified by these cautionary statements and those made in the

"Risk Management" sections of the Company's 2022 Management's

Discussion and Analysis (Sections 30-34) and the Company's Q2-2023

Management's Discussion and Analysis (Sections 19-20), in Notes 10

and 13 of the Company's Consolidated Financial Statements for the

year ended December 31, 2022 and in the Company's Annual

Information Form dated February 7, 2023, all of which are available

on the Company’s website at www.intactfc.com and on SEDAR+ at

www.sedarplus.ca and those that will be made in the prospectus

supplement to be filed in respect of the Offering. These factors

are not intended to represent a complete list of the factors that

could affect the Company. These factors should, however, be

considered carefully. Although the forward-looking statements are

based upon what management believes to be reasonable assumptions,

the Company cannot assure investors that actual results will be

consistent with these forward-looking statements. Investors should

not rely on forward-looking statements to make decisions and

investors should ensure the preceding information is carefully

considered when reviewing forward-looking statements made in this

press release. The Company has no intention and undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Disclaimer

This press release does not constitute or form

part of any offer for sale or solicitation of any offer to buy or

subscribe for any securities nor shall it or any part of it form

the basis of or be relied on in connection with, or act as any

inducement to enter into, any contract or commitment

whatsoever.

The information contained in this press release

concerning the Company does not purport to be all-inclusive or to

contain all the information that an investor may desire to have in

evaluating whether or not to make an investment in the Company. The

information is qualified entirely by reference to the Company's

publicly disclosed information and the cautionary note regarding

forward-looking statements included in this press release.

No securities regulatory authority has either

approved or disapproved the contents of this press release. The

common shares to be issued pursuant to the Offering and

over-allotment option have not been, and will not be, registered

under the U.S. Securities Act, or any state securities laws.

Accordingly, the common shares may only be offered or sold within

the United States pursuant to exemptions from the registration

requirements of the U.S. Securities Act and applicable state

securities laws. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the common shares in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

Any website address included in this press

release is an inactive textual reference only and information

appearing on such website is not part of, and is not incorporated

by reference in, this press release.

J.P. Morgan Securities plc (“J.P. Morgan”),

which is authorised in the UK by the Prudential Regulation

Authority (the “PRA”) and regulated in the UK by the PRA and the

Financial Conduct Authority, is acting as financial adviser

exclusively for Intact and its affiliates and no one else in

connection with the transaction and will not regard any other

person as a client in relation to the transaction and will not be

responsible to anyone other than Intact and its affiliates for

providing the protections afforded to clients of J.P. Morgan or its

affiliates, nor for providing advice in relation to the transaction

or any other matters referred to in this announcement.

Non-IFRS Measures

The Company uses both International Financial

Reporting Standards (IFRS) and certain non-IFRS measures to assess

performance.

Non-IFRS financial measures and non-IFRS ratios

(which are calculated using non-IFRS financial measures) do not

have standardized meanings prescribed by IFRS and may not be

comparable to similar measures used by other companies. They are

used by management to assess the Company’s performance.

Supplementary financial measures, non-IFRS

financial measures and non-IFRS ratios used in this press release

and the Company's financial reports include NOIPS, operating ROE,

BVPS, combined ratio, claims ratio, expense ratio, GWP, DPW, and

adjusted debt-to-total capital ratio.

For more information about these supplementary

financial measures, non-IFRS financial measures and non-IFRS

ratios, including definitions and explanations of how these

measures provide useful information, refer to Section 21 – Non-GAAP

and other financial measures in the Company's Q2-2023 Management's

Discussion and Analysis dated August 2, 2023, which Section is

incorporated by reference into this press release and which is

available on the Company’s website at www.intactfc.com and on

SEDAR+ at www.sedarplus.ca.

SOURCE Intact Financial Corporation

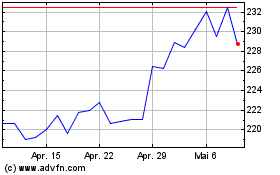

Intact Financial (TSX:IFC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Intact Financial (TSX:IFC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024