High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) released its’ second quarter results today.

Highlights

The following highlights the Corporation’s

results for Q2-2020 and YTD-2020:

- Focus on working capital management

to preserve our cash balances and maintain a strong balance sheet

during the current global coronavirus (“COVID-19”)

crisis has positioned High Arctic to be ready once restrictions

loosen through the following:

- Increased net cash balance by $5.2 million.

- Strong working capital position of $49.7 million at June 30,

2020, and

- Unused bank credit facility of $35.0 million.

- Revenue of $16.1 million and $55.7

million for the three and six months ended June 30, 2020 (2019 -

$46.6 million and $93.1 million, respectively) and adjusted EBITDA

of $1.2 million and $3.9 million (2019 - $4.0 million and $9.5

million) for the Quarter and YTD, respectively.

- On a year to date basis as compared

to 2019, capital expenditures and business acquisition expenditures

have been reduced by $12.0 million, dividends have been reduced by

$3.4 million and cost reduction and control measures have been

implemented throughout the organization.

- Year to date oilfield services

expenses have been reduced by $31.7 million as compared to

2019. After the inclusion of $0.9 million in YTD-2020

restructuring costs, as well as $0.6 million in bad debt provision,

general and administrative expenses have decreased by $0.1

million.

- Service delivery to our customers

with safety of personnel and quality of service top of mind during

this COVID-19 crisis, lifted the Canadian market share of Concord

Well Servicing to 26% in Q2-2020.

- Benefits from the Canadian

Emergency Wage Subsidy (“CEWS”) were obtained, which provided $2.1

million toward wages of Canadian workers and was utilized to retain

a capable workforce to service current and prospective customers

now, and when restrictions loosen and markets improve.

Mike Maguire, Chief Executive Officer

commented: “The health and economic environments have been

exceptionally challenging and we have risen to the challenge.

We have reacted swiftly to restructure and flatten our Management

reporting lines, remove costs, suspend our dividend and reduce our

Capex. In the field, our ability to react has been made

possible because of our people. They range from dedicated

individuals in Papua New Guinea who remained in working “isolation

bubbles” for months without seeing their families, to teams in

Canada and USA working in their own “bubbles” through harsh

seasonal conditions wearing additional layers of PPE and adopting

special protocols to prevent exposure to and spread of

COVID-19.

It is not possible at this point to predict when

global economic conditions will improve, but we are confident that

we have found a way to operate effectively through these

challenges. Corporately, a disciplined balance sheet management

approach will continue to be our objective, including cost control

measures that will allow us to capitalize on strategic

opportunities. In the meantime, we expect to continue to increase

our activity through working closely with our customers who are

planning work programs for resumption of shut-in production as

commodity prices continue to lift, and from the various Western

Canada well abandonment programs as the focus shifts more towards

isolating and capping wellbores.”

The Corporation’s strategic priorities for 2020

continue to include:

- Safety excellence and a focus on

quality through global standards, including safeguarding our people

against COVID-19.

- Reinforcement of existing core

markets evidenced by top-tier customer market share in Canada and

PNG.

- Cost control focused on operating

cash flow while balancing strategic priorities, to emerge from the

current conditions ready to reactivate and grow, and

- Capital stewardship characterized

by disciplined working capital management and capital allocation to

maintain value for shareholders including common share buybacks,

where appropriate.

The unaudited interim consolidated financial

statements (“Financial Statements”) and management discussion &

analysis (“MD&A”) for the quarter ended June 30, 2020 will be

available on SEDAR at www.sedar.com, and on High Arctic’s website

at www.haes.ca. Non-IFRS measures, such as EBITDA, Adjusted EBITDA,

Adjusted net earnings (loss), Oilfield services operating margin,

Operating margin %, Percent of revenue, Funds provided from

operations, Working capital and Net cash are included in this News

Release. See Non-IFRS Measures section, below. All amounts are

denominated in Canadian dollars (“CAD”), unless otherwise

indicated.

Within this News Release, the three months ended

June 30, 2020 may be referred to as the “Quarter”

or “Q2-2020”, and similarly the six months ended

June 30, 2020 may be referred to as “YTD-2020”.

The comparative three months ended June 30, 2019 may be referred to

as “Q2-2019”, and similarly the six months ended

June 30, 2019 may be referred to as “YTD-2019”.

References to other quarters may be presented as

“QX-20XX” with X being the quarter/year to which

the commentary relates.

Outlook

High Arctic’s Outlook dated March 12, 2020,

outlined the instability which existed at that time due to

COVID-19. As events unfolded we took very quick action to prepare

for a serious disruption in economic growth and demand destruction.

These steps included restructuring our work force, while ensuring

the close relationships with our lender, customers and vendors were

appropriately managed and maintained.

While the outlook for the global energy industry

continues to be challenging, High Arctic has and is taking measures

during this period of uncertainty to provide financial flexibility

and reinforce our solid base of business. Commodity price increases

at the end of June 2020 are signaling the likelihood of an increase

in energy demand, moving forward from a very difficult time for the

industry. With observations of second waves of COVID-19 in various

communities around the world and the non-ceasing growth in cases in

the US and elsewhere, it is entirely possible that the appreciation

of commodity prices and improvement in price stability could be

further compromised before a vaccine or other solutions is

implemented. Resilience, adaptability, and seizing appropriate

strategic opportunities will remain critical in the coming months

and quarters.

We consider this an environment to continue to

prudently conserve capital while remaining engaged with customers

to implement sustainable strategies to deploy our assets on a

continual basis. We are focussed on strategies that lead to

cost efficiency, building upon our decision to combine management

teams and generate positive cash flow in a depressed market. High

Arctic has maintained adequate readiness of plant and personnel and

is well positioned for an increase in activity. Our people continue

to focus on quality as measured by safety performance excellence

and long-term customer relationships.

In Papua New Guinea, the Corporation’s Drilling

Services are suspended, however, we continue to provide skilled

personnel and rental services to assist our customers to maintain

production while travel restrictions remain and tighten amid a late

upswing in COVID-19 cases at the beginning of August, after

relaxing the State of Emergency imposed in late March.

We are working with major customers to plan an

effective return to work amid ongoing and substantive constraints,

leveraging off the acknowledgment of our demonstrated recent and

long-term capacity as a PNG specialist contractor.

In Canada we have been busy working with our

core, high value customers to pass on cost savings, secure contract

extensions and maintain preferred contractor status.

We have experienced a substantially better

utilization than our peers and plan to use that position and our

healthy balance sheet to invest in technology that will deliver on

our customers needs for reliable, low cost well work solutions that

reduce environmental impact while creating job opportunities for

the new generation of oilfield workers. High Arctic is confident of

increasing work driven in the near term by the well abandonment

stimulus programs as the barriers to the Alberta Site

Rehabilitation Program expansion start to dissipate, and are

coupled with the positive work conducted in Canada suppressing the

COVID-19 curve and our customers growing realization of the

opportunity to deliver on ESG obligations while reducing end of

life well abandonment cost liabilities. We are actively

seeking out work partners who share our value of the opportunity to

execute services while delivering on ESG objectives.

High Arctic believes we are positioned to manage

through these challenging times given our decisive actions and our

continued focus on pruning unprofitable operations, chasing cost

efficiencies, maintaining adequate readiness and delivering quality

services in a socially responsible manner. The health of our

balance sheet, our strong working capital position and the skill of

our management team provide us the ability to weather the economic

slowdown for some considerable time. Business combinations

and acquisitions will be reviewed to the extent they strengthen our

service base but will not be our primary focus.

Results Overview

|

|

For the three months ended June

30 |

For the six months ended June

30 |

| ($

millions, except per share amounts) |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| Revenue |

16.1 |

|

46.6 |

|

55.7 |

|

93.1 |

|

| EBITDA (1) |

1.4 |

|

4.6 |

|

6.9 |

|

10.8 |

|

| Adjusted EBITDA (1) (3) |

1.2 |

|

4.0 |

|

3.9 |

|

9.5 |

|

| Adjusted EBITDA as % of

revenue |

8% |

|

9% |

|

7% |

|

10% |

|

| Operating loss |

(6.2 |

) |

(2.9 |

) |

(10.9 |

) |

(4.7 |

) |

| Net loss |

(6.0 |

) |

(4.0 |

) |

(8.2 |

) |

(5.0 |

) |

|

Per share (basic and diluted) (2) |

(0.12 |

) |

(0.08 |

) |

(0.17 |

) |

(0.10 |

) |

| Funds provided from operations

(1) |

0.9 |

|

2.1 |

|

2.9 |

|

6.9 |

|

|

Per share (basic and diluted) (2) |

0.02 |

|

0.04 |

|

0.06 |

|

0.14 |

|

| Dividends |

- |

|

2.5 |

|

1.6 |

|

5.0 |

|

|

Per share (basic and diluted) (2) |

- |

|

0.05 |

|

0.03 |

|

0.10 |

|

| Capital expenditures |

1.3 |

|

4.3 |

|

3.2 |

|

6.9 |

|

| Capital

expenditures - acquisitions |

- |

|

8.3 |

|

- |

|

8.3 |

|

| (1) |

Readers

are cautioned that EBITDA (Earnings before interest, tax,

depreciation and amortization), Adjusted EBITDA, Adjusted net

earnings, Funds provided from operations, and working capital do

not have standardized meanings prescribed by IFRS – see “Non IFRS

Measures” on page 19 of the MD&A for calculations of these

measures. |

| (2) |

The

number of common shares used in calculating net loss per share,

funds provided from operations per share, dividends per share and

shareholders’ equity per shares is determined as explained in Note

7 of the Financial Statements. |

| (3) |

Adjusted

EBITDA includes the impact of wage subsidies (CEWS) received. |

|

|

|

As at and for six months / year

ended |

|

($ millions, except share amounts) |

|

|

June 302020 |

December 31 2019 |

| Working capital (1) |

|

|

49.7 |

35.8 |

| Cash, end of period |

|

|

33.5 |

9.3 |

| Total assets |

|

|

243.7 |

251.8 |

| Long-term debt |

|

|

10.0 |

- |

| Total long-term financial

liabilities |

|

|

18.5 |

9.1 |

| Shareholders’ equity |

|

|

200.4 |

205.6 |

| YTD/share (basic and diluted)

(2) |

|

|

4.04 |

4.11 |

| Common

shares outstanding, millions |

|

|

49.6 |

49.6 |

| (1) |

Readers

are cautioned that EBITDA (Earnings before interest, tax,

depreciation and amortization), Adjusted EBITDA, Adjusted net

earnings, Funds provided from operations, and working capital do

not have standardized meanings prescribed by IFRS – see “Non IFRS

Measures” on page 19 of the MD&A for calculations of these

measures. |

| (2) |

The

number of common shares used in calculating net loss per share,

funds provided from operations per share, dividends per share and

shareholders’ equity per shares is determined as explained in Note

7 of the Financial Statements. |

|

|

Three months endedJune 30 |

Six months endedJune 30 |

|

Operating Highlights |

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

Revenue: |

|

|

|

|

|

Drilling Services |

$ |

5.2 |

|

$ |

20.5 |

|

$ |

19.1 |

|

$ |

39.3 |

|

|

Production Services |

|

9.6 |

|

|

21.0 |

|

|

31.4 |

|

|

43.8 |

|

|

Ancillary Services |

|

1.6 |

|

|

5.9 |

|

|

6.1 |

|

|

11.6 |

|

|

Inter-segment eliminations |

|

(0.3 |

) |

|

(0.8 |

) |

|

(0.9 |

) |

|

(1.6 |

) |

|

|

$ |

16.1 |

|

$ |

46.6 |

|

$ |

55.7 |

|

$ |

93.1 |

|

|

Production Services - Canada: |

|

|

|

|

|

Service rigs: |

|

|

|

|

|

Average fleet |

|

50 |

|

|

57 |

|

|

51 |

|

|

57 |

|

|

Utilization |

|

32% |

|

|

54% |

|

|

46% |

|

|

54% |

|

|

Operating hours |

|

14,759 |

|

|

27,889 |

|

|

41,657 |

|

|

55,299 |

|

|

Revenue per hour ($) |

|

556 |

|

|

606 |

|

|

599 |

|

|

620 |

|

|

|

|

|

|

|

|

Snubbing rigs: |

|

|

|

|

|

Average fleet |

|

8 |

|

|

18 |

|

|

9 |

|

|

18 |

|

|

Utilization |

|

8% |

|

|

10% |

|

|

20% |

|

|

14% |

|

|

Operating hours |

|

574 |

|

|

1,565 |

|

|

3,129 |

|

|

4,490 |

|

|

Production Services - US: |

|

|

|

|

|

Service rigs: |

|

|

|

|

|

Average fleet |

|

2 |

|

|

2 |

|

|

3 |

|

|

2 |

|

|

Utilization |

|

5% |

|

|

51% |

|

|

27% |

|

|

40% |

|

|

Operating hours |

|

99 |

|

|

932 |

|

|

1,213 |

|

|

1,435 |

|

|

Revenue per hour ($) |

|

638 |

|

|

997 |

|

|

909 |

|

|

1,001 |

|

|

|

|

|

|

|

|

Snubbing rigs: |

|

|

|

|

|

Average fleet |

|

6 |

|

|

5 |

|

|

6 |

|

|

5 |

|

|

Utilization |

|

10% |

|

|

23% |

|

|

9% |

|

|

24% |

|

|

Operating hours |

|

538 |

|

|

1,063 |

|

|

1,004 |

|

|

2,144 |

|

Second Quarter 2020:

- High Arctic reported revenue of

$16.1 million, incurred a net loss of $6.0 million and realized

Adjusted EBITDA of $1.2 million during Q2-2020. This compares

to Q2-2019, with revenue of $46.6 million, and a net loss of $4.0

million and Adjusted EBITDA of $4.0 million. Changes were mainly

due to $30.5 million of reduced revenue, attributable predominantly

to reduced drilling in PNG and production services activity in

Canada, offset by reduced operating and administrative costs of

$27.7 million compared to Q2-2019. During Q2-2019, $0.7

million of other revenue was recorded, which was not replicated in

Q2-2020.

- CEWS provided $2.1 million in wage

subsidy relief, of which $1.8 million related to Oilfield services

expenses and $0.3 million to General and administrative

expenses.

- Protocols regarding new and

enhanced safety measures were initiated, both as legislated by

various levels of government and as best practice to protect our

customers, employees and the communities in which we provide our

services.

- Utilization for High Arctic’s 50

registered Concord Well Servicing rigs was 32% in the Quarter

versus industry utilization of 9% (source: Canadian Association of

Oilwell Drilling Contractors “CAODC”).

- There were no dividends declared or

paid in Q2-2020, compared to $2.5 million in Q2-2019 ($0.05 per

share).

- Cash increased by $5.2 million

during Q2-2020 as compared to a decrease of $8.3 million in

Q2-2019.

- No further amounts were drawn on

the Corporation’s remaining $35.0 million loan facility, and

- High Arctic did not repurchase any

shares during the Quarter.

Year to date 2020:

- High Arctic reported revenue of $55.7 million, incurred a net

loss of $8.2 million and realized Adjusted EBITDA of $3.9 million

YTD-2020. This compares to YTD-2019, which had revenue of

$93.1 million, a net loss of $5.0 million and Adjusted EBITDA of

$9.5 million. Changes were mainly attributable to $37.4 million of

reduced activity and therefore revenue, offset by reduced operating

and administrative costs of $31.8 million. Income tax amounts were

also lower by $1.9 million, year over year. YTD-2020 results

included $0.9 million in restructuring costs and additional bad

debt provision of $0.6 million that did not exist YTD-2019.

- YTD-2020 dividends amounted to $1.6 million ($0.03 per share),

compared to $5.0 million in YTD-2019 ($0.10 per share).

- Dividends were suspended in March 2020, which had amounted to

approximately $0.8 million per month.

- High Arctic has not repurchased any common shares through the

normal course issuer bid (“NCIB”) YTD-2020.

Responding to Global

Developments

The impact of volatile oil prices and COVID-19

has been challenging. At the outset, and during Q2-2020,

COVID-19 continued to have much of the global economy halted, with

governments around the world attempting to balance the

implementation of measures to contain the virus against the need to

start opening up economies. As economies start to open up, the

demand for crude oil along with other products and services will

also increase, however the timing of these events continues to be

uncertain.

Market pressures, movement restriction and the

actions by the Organization of Petroleum Exporting Countries

(“OPEC”) and non-OPEC members, led by Saudi

Arabia, returned some stability to the overall global supply of oil

during Q2-2020. The emergence of China and other Asian nations from

COVID-19 restrictions also resulted in a net increase in LNG

imports, which coupled with an increase in energy use in developed

nations improved natural gas demand. Notwithstanding the ongoing

commodity price instability, closing benchmark crude oil prices at

June 30,2020 have increased by 39% over March 31, 2020.

As customers continue to complete their capital

and other spending re-forecasts in order to manage through this

crisis event, the services needed for drilling and completions and

other services to the oil and gas industry continue to come under

pressure, with an uncertain end date. This is offset with

government stimulated initiatives that include abandonment and

reclamation opportunities at a time when the marketplace looks

favorably on such activity.

High Arctic’s quick adjustment to the severe

financial impact of COVID-19 together with commodity price pressure

implications, has resulted in measures to reduce certain cash

outflows by approximately $25.0 million over prior-year 2019 levels

including:

- A 54% reduction in capital

expenditures, where YTD-2020 capital spending of $3.2 million

compares to YTD-2019 capital spending of $6.9 million.

- The suspension of monthly

shareholder dividends in March 2020 has decreased cash outflows by

$2.5 million in Q2-2020 compared to Q2-2019.

- The Company was forced to downsize

its workforce, where a total reduction of approximately 40% at

executive, management and support personnel levels was made.

- Acceleration of changes to

globalize processes and reduce fixed infrastructure costs, and

- Board Executive Committee oversight

as the Corporation operates through the COVID-19 crisis and

beyond.

High Arctic’s focus remains on being well

positioned to navigate through the uncertainty with capacity ready

for deployment as markets recover and activity levels increase, and

includes:

- Resilient emphasis on the safety

and well being of our people through mature health, safety and

environment policies.

- Renewal and extension of contracts

at modest rate reductions with a core customer base in Canada

including a term contract through Q3-2022 for well servicing with a

large investment grade customer in western Canada.

- Continued support services to our

major customer in PNG where we are contracted through Q3-2021 for

heli-portable drilling services, and a ramp up in support

operations for a large multi-national investment grade customer in

PNG.

- Use of wage subsidy programs to

maintain regional workforce strength while carefully controlling

recertification and maintenance expenditures results in equipment

poised for quick activation from all our regional bases.

- Our dominant market share and niche

service offering positioned for liquified natural gas development

with heli-portable drilling services in PNG, and snubbing services

in western Canada, and

- Strong and improved liquidity,

increasing $5.2 million to $68.5 million, with cash of $33.5

million combined with $35.0 million in Bank Facility borrowing

capacity.

High Arctic’s near-term outlook will continue to

be impacted until such time as the COVID-19 pandemic stabilizes

including the reduction of rebound shut-downs, world economies are

able to heat back up, and when travel restrictions are removed. In

addition, the impact of potential impairment charges, the increased

risk of collectability of accounts receivable and measurement

uncertainty associated with these considerations will continue to

be relevant in future periods if conditions persist or worsen. The

Corporation’s operating plan provides options to prudently manage

operations and preserve financial flexibility.

The Corporation’s suspension of its monthly

dividend in March 2020 will continue indefinitely.

High Arctic continues to maintain close working

relations with its customers and focus on high quality service and

customer service differentiation as an absolute imperative. These

attributes have been, and continue to be, key principles for High

Arctic throughout the energy industry economic cycle.

The Corporation remains acutely aware that the

impact to our customers’ capital spending and operating budgets and

their ability to pay for work completed on a timely basis could

have a significant impact on High Arctic’s financial and operating

results as the time period associated with the global slow-down

extends beyond the Quarter. We continue to work closely with our

customers to ensure credit and operating risks are

minimized.

The Canadian federal government’s $1.7 billion

well abandonment and site reclamation stimulus plan announced in

April 2020 has begun, with responsibility for fund distribution

assigned to the British Columbia, Alberta and Saskatchewan

provincial governments. High Arctic has directly applied for

hundreds of wells across the first tranches of the Alberta

controlled process, receiving only a handful of approvals as the

early tranches focussed on above ground site reclamation and low

complexity works. With tens of thousands of inactive oil and

gas wells across western Canada, we expect that over the stimulus

period, there will be meaningful opportunity for High Arctic to

participate in the resulting work programs through our Production

Services segment, as the government becomes more focussed on award

grants and focus shifts to securing, isolating and capping

wellbores.

Liquidity and Capital

Resources

Operating Activities

Cash provided from operations of $7.8 million

for the Quarter (Q2-2019 - $8.9 million) resulted from $0.9

million of funds provided from operations (Q2-2019 - $2.1 million),

as well as $6.9 million due to working capital changes (Q2-2019 -

$6.8 million), predominantly the collection of accounts receivable

of over $17.0 million, offset by payments to vendors of $8.9

million during the Quarter.

YTD-2020, cash provided from operations amounted

to $16.4 million (YTD-2019 - $8.9 million), with funds provided

from operations amounting to $2.9 million (Q2-2019 - $6.9 million),

where the collection of approximately $23.0 million of accounts

receivable, offset by payments to vendors of $10.5 million were the

primary reasons for the increase in cash.

Investing Activities

During the Quarter, the Corporation’s cash used

in investing activities amounted to $1.5 million (Q2-2019 – use of

$12.3 million). Capital expenditures during the Quarter of $1.3

million (Q2-2019 - $4.3 million) accounted for the majority of this

activity. Q2-2019 included cash used of $8.3 million

associated with the acquisition of the snubbing business from

another company.

YTD-2020, cash provided from investing

activities totalled $0.4 million (YTD-2019 – use of $13.7

million). YTD-2020 capital expenditures amounted to $3.2

million (YTD-2019 - $6.9 million), proceeds of disposal were $4.9

million (YTD-2019 - $1.4 million), with working capital changes

representing the balance of the change. YTD-2019 included the

business acquisition amounting to $8.3 million, as discussed

above.

Financing Activities

During the Quarter, the Corporation did not draw

further on its available long-term debt facility. YTD-2020, $10.0

million of the available $45.0 million long-term debt facility has

been drawn. No long-term debt existed at June 30, 2019.

High Arctic suspended dividends in March 2020,

and as such no dividends were paid during Q2-2020. YTD-2020,

$1.6 million in dividends were paid to shareholders, down $3.4

million from $5.0 million YTD-2019.

No common share buy-backs were completed in the

Quarter or YTD-2020, compared to $1.8 million and $4.7 million that

were purchased and cancelled in Q2-2019 and YTD-2019, respectively,

under the Normal Course Issuer Bid (“NCIB”).

Credit Facility

As noted above, the Corporation has drawn $10.0

million of the $45.0 million revolving loan facility available,

which matures on August 31, 2021. The facility is renewable with

the lender’s consent and is secured by a general security agreement

over the Corporation’s assets.

The available amount under the $45.0 million

revolving loan facility is limited to 60% of the net book value of

the Canadian fixed assets plus 75% of acceptable accounts

receivable (85% for investment grade receivables), plus 90% of

insured receivables, less priority payables as defined in the loan

agreement.

The Corporation’s loan facility is subject to

two financial covenants which are reported to the lender on a

quarterly basis. As at June 30, 2020, the Corporation remains

in compliance with these two financial covenants under the credit

facility.

The first covenant requires the Funded Debt to

Covenant EBITDA ratio to be under 3.0 to 1.0, and the second

covenant requires Covenant EBITDA to Interest Expense ratio to be a

minimum of 3.0 to 1.0. Both are calculated on the last day of

each fiscal quarter on a rolling four quarter basis.

The covenant calculations at June 30, 2020 are:

|

Covenant |

As at |

|

|

|

Required |

June 30, 2020 |

| Funded debt to Covenant EBITDA

(1)(2) |

|

|

3.0 : 1 Maximum |

0.75 : 1 |

|

Covenant EBITDA to Interest expense (2) |

|

|

3.0 : 1 Minimum |

19.17 : 1 |

| (1) |

Funded

debt to Covenant EBITDA is defined as the ratio of consolidated

Funded Debt to the aggregate EBITDA for the trailing four

quarters. Funded debt is the amount of debt provided and

outstanding at the date of the covenant calculation. |

| (2) |

EBITDA

for the purposes of calculating the covenants, “Covenant EBITDA,”

is defined as net income plus interest expense, current tax

expense, depreciation, amortization, future income tax expense

(recovery), share based compensation expense less gains from

foreign exchange and sale or purchase of assets. Interest expense

excludes an impact from IFRS 16. |

There have been no changes to these financial

covenants subsequent to June 30, 2020.

Non - IFRS Measures

This News Release contains references to certain

financial measures that do not have a standardized meaning

prescribed by International Financial Reporting Standards (“IFRS”)

and may not be comparable to the same or similar measures used by

other companies. High Arctic uses these financial measures to

assess performance and believes these measures provide useful

supplemental information to shareholders and investors. These

financial measures are computed on a consistent basis for each

reporting period and include EBITDA, Adjusted EBITDA, Adjusted net

earnings (loss), Oilfield services operating margin, Percent of

revenue, Funds provided from operations, Working capital, and Net

cash, none of which have standardized meanings prescribed under

IFRS.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), Cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at www.sedar.com

and through High Arctic’s website at www.haes.ca.

Forward-Looking Statements

This News Release contains forward-looking

statements. When used in this document, the words “may”,

“would”, “could”, “will”, “intend”, “plan”, “anticipate”,

“believe”, “seek”, “propose”, “estimate”, “expect”, “prepare”,

“determine” and similar expressions are intended to identify

forward-looking statements. Such statements reflect the

Corporation’s current views with respect to future events and are

subject to certain risks, uncertainties and assumptions. Many

factors could cause the Corporation’s actual results, performance

or achievements to vary from those described in this News

Release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this News Release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this News Release include, among

others, statements pertaining to the following: general economic

and business conditions which will, among other things, impact

demand for and market prices for the Corporation’s services;

expectations regarding the Corporation’s ability to raise capital

and manage its debt obligations; commodity prices and the impact

that they have on industry activity; initiatives to reduce cash

outlays by $25.0 million over 2019 levels; continued safety

performance excellence; realization of work from Site

Rehabilitation Programs; oversight of working capital to maintain a

strong balance sheet; estimated capital expenditure programs for

fiscal 2020 and subsequent periods; projections of market prices

and costs; factors upon which the Corporation will decide whether

or not to undertake a specific course of operational action or

expansion; the Corporation’s ongoing relationship with major

customers; treatment under governmental regulatory regimes and

political uncertainty and civil unrest; the Corporation’s ability

to maintain a USD bank account and conduct its business in USD in

PNG; and the Corporation’s ability to repatriate excess funds from

PNG as approval is received from the Bank of PNG and the PNG

Internal Revenue Commission.

With respect to forward-looking statements

contained in this News Release, the Corporation has made

assumptions regarding, among other things, its ability to: obtain

equity and debt financing on satisfactory terms; market

successfully to current and new customers; the general continuance

of current or, where applicable assumed industry conditions;

activity and pricing; assumptions regarding commodity prices, in

particular oil and gas; the Corporation’s primary objectives, and

the methods of achieving those objectives; obtain equipment from

suppliers; construct property and equipment according to

anticipated schedules and budgets; remain competitive in all of its

operations; and attract and retain skilled employees.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this News Release, along with the risk factors set out

in the most recent Annual Information Form filed on SEDAR at

www.sedar.com.

The forward-looking statements contained in this

News Release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this News Release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy Services

High Arctic’s principal focus is to provide

drilling and specialized well completion services, equipment

rentals and other services to the oil and gas industry. High Arctic

is a market leader providing drilling and specialized well

completion services and supplies rig matting, camps and drilling

support equipment on a rental basis in Papua New Guinea. The

Canadian and US operation provides well servicing, well

abandonment, snubbing and nitrogen services and equipment on a

rental basis to a large number of oil and natural gas exploration

and production companies operating in Western Canada and the United

States.

For further information contact:

|

Michael J. Maguire |

Christopher C. Ames, CPA, CA |

|

Chief Executive Officer |

Vice-President Finance & CFO |

|

P: (587) 318-3826 |

P: (587) 318-2218 |

|

E: mike.maguire@haes.ca |

E: chris.ames@haes.ca |

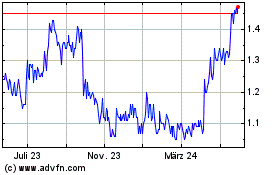

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

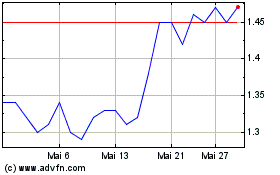

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025