Canoe EIT Income Fund Announces July 2014 Distribution

10 Juli 2014 - 11:00PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OF AMERICA.

Canoe EIT Income Fund ("Canoe" or the "Fund") (TSX:EIT.UN) announces the July

2014 distribution of $0.10 per unit. The distribution will be paid on August 15,

2014 to unitholders of record on July 22, 2014. The ex-distribution date for

this distribution is July 18, 2014.

About the Distribution

The Fund's objective is to maximize monthly distributions relative to risk and

maximize net asset value, while maintaining and expanding a diversified

investment portfolio.

About the Fund

The Fund is one of Canada's largest, diversified closed-end investment funds and

is listed on the TSX under the symbol EIT.UN. The Fund is actively managed and

invests in a diversified portfolio of income-generating and capital

growth-oriented securities listed primarily on the TSX. The Fund is designed to

maximize distributions and net asset value for the benefit of its unitholders.

The Fund is managed by Robert Taylor, Senior Vice President and Portfolio

Manager of Canoe Financial.

About Canoe Financial LP

Canoe Financial is an investment management firm focused on building financial

wealth for Canadians through investing in Canada. Its 'GO CANADA!(R)' investment

thesis reflects Canoe's strategic confidence in Canada as a place to invest.

With continued global urbanization, increasing worldwide demand for resources,

and Canada's sound fiscal structure, Canoe believes this country provides

long-term growth potential for investors.

Canoe is one of Canada's fastest-growing mutual fund companies and as at June

30, 2014, manages approximately $2.7 billion in assets through its investment

products. To learn more about Canoe Financial, visit www.canoefinancial.com.

(R) 'GO CANADA!' is a registered trade-mark of Canoe Financial LP.

Forward Looking Statement: Certain statements included in this news release

constitute forward looking statements which reflect Canoe Financial's current

expectations regarding future results or events. Words such as "may," "will,"

"should," "could," "anticipate," "believe," "expect," "intend," "plan,"

"potential," "continue" and similar expressions have been used to identify these

forward-looking statements. In addition, any statement regarding future

performance, strategies, prospects, action or plans is also a forward-looking

statement. Market predictions and forward-looking statements are subject to

known and unknown risks and uncertainties and other factors that may cause

actual results, performance, events, activity and achievements to differ

materially from those expressed or implied by such statements. Forward- looking

statements involve significant risks and uncertainties and a number of factors

could cause actual results to materially differ from expectations discussed in

the forward looking statements including, but not limited to, changes in general

economic and market conditions and other risk factors. Although the

forward-looking statements are based on what Canoe Financial believes to be

reasonable assumptions, we cannot assure that actual results will be consistent

with these forward-looking statements. Investors should not place undue reliance

on forward-looking statements. These forward-looking statements are made as of

the current date and we assume no obligation to update or revise them to reflect

new events or circumstances.

The Fund makes monthly distributions of an amount comprised in whole or in part

of Return of Capital (ROC) of the net asset value per unit. A ROC reduces the

amount of your original investment and may result in the return to you of the

entire amount of your original investment. ROC that is not reinvested will

reduce the net asset value of the fund, which could reduce the fund's ability to

generate future income. You should not draw any conclusions about the fund's

investment performance from the amount of this distribution.

Commissions, trailing commissions, management fees and expenses all may be

associated with investment funds. Please read the information filed about the

fund on www.sedar.com before investing. The indicated rates of return are the

historical and annual compounded total returns including changes in unit value

and reinvestment of all distributions and do not take into account sales,

redemption, distribution, or optional charges or income taxes payable by any

security holder that would have reduced returns. Investment funds are not

guaranteed and past performance may not be repeated.

This communication is not to be construed as a public offering to sell, or a

solicitation of an offer to buy securities. Such an offer can only be made by

way of a prospectus or other applicable offering document and should be read

carefully before making any investment. This release is for information purposes

only. Investors should consult their Investment Advisor for details and risk

factors regarding specific strategies and various investment products.

FOR FURTHER INFORMATION PLEASE CONTACT:

Canoe Financial LP

Investor Relations

1-877-434-2796

info@canoefinancial.com

www.canoefinancial.com

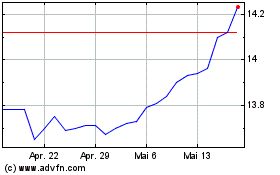

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024