Canoe Financial proposes changes to Canoe Premium Income Fund

28 März 2024 - 9:15PM

Canoe Financial LP (“Canoe Financial”) announced today its intent

to make changes to the investment objective of Canoe Premium Income

Fund (the “Fund”).

Proposed changes

The changes are subject to securityholder

approval. If approved:

- the Fund’s

investment objectives will be to generate income and long-term

capital growth by primarily writing put options, investing in

equity securities, and/or writing call options on these

equities,

- the Fund will

seek to achieve its objectives by primarily writing cash covered

put options on North American equities, as well as investing in a

diversified portfolio of North American equities, writing covered

calls, and employing other options strategies, and

- the Fund will be

renamed Canoe Premium Yield Fund.

Securityholder voting

At a special meeting of securityholders of the

Fund expected to be held on or about June 10, 2024, the Manager

will seek the approval of securityholders of record of the Fund as

at April 24, 2024 to change its fundamental investment objective.

If approved, the investment objective change will take effect as at

the close of business on or about June 20, 2024, at which time the

name of the Fund will be changed to Canoe Premium Yield Fund.

A Notice-and-Access document, which outlines the

procedures for accessing the management information circular

containing full details of the proposals, will be mailed on or

about May 7, 2024, to securityholders of record on the record date.

The management information circular will also be made available

following the mailing date on www.sedarplus.ca. All costs and

expenses associated with the change in objectives will be borne by

Canoe Financial.

About Canoe Financial

Canoe Financial is one of Canada’s fastest

growing independent mutual fund companies managing over $15 billion

in assets across a diversified range of award-winning investment

solutions. Founded in 2008, Canoe Financial is an employee-owned

investment management firm focused on building financial wealth for

Canadians. Canoe Financial has a significant presence across

Canada, including offices in Calgary, Toronto and Montreal.

Further information

Investor RelationsCanoe Financial

LP1–877–434–2796info@canoefinancial.com

Commissions, trailing commissions, management

fees and expenses all may be associated with mutual fund

investments. Please read the prospectus before investing. The

indicated rates of return are the historical annual compounded

total returns including changes in unit value and reinvestment of

all distributions and do not take into account sales, redemption,

distribution or optional charges or income taxes payable by any

unitholder that would have reduced returns. Mutual funds are not

guaranteed, their values change frequently, and past performance

may not be repeated.

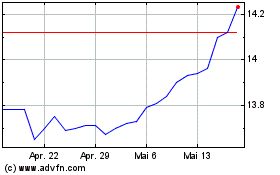

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024