Argonaut Gold Announces 2013 Production Guidance of 120-140,000 Ounces

25 Februar 2013 - 1:02PM

Marketwired Canada

Argonaut Gold Inc. (TSX:AR) ("Argonaut", "Argonaut Gold" or the "Company") is

pleased to announce Company 2013 production guidance, project initiatives and

exploration objectives across the Company's properties throughout the Americas.

Production in 2013 is planned to increase to between 120,000 and 140,000 ounces

of gold up from 108,000 ounces of gold in 2012. Cash cost of production is also

expected to increase slightly to between $630 and $660 per ounce.

The Company is undertaking an aggressive capital expansion program in 2013 which

should prepare the Company for further production expansions in 2014 and beyond.

This will essentially complete capital expansion programs at both La Colorada

and El Castillo until 2015, when we will finalize the remaining 15mm tons of pad

capacity at El Castillo.

Exploration drilling totaling 89,000 meters has taken place at Magino, part of

this drilling has revealed a new zone.

Capital Expansion Program for 2013

El Castillo $32 million

La Colorada(1) $14 million

Magino $3 million

San Antonio(2) $3-15 million

Exploration(3) $5-11 million

----------------------------------

TOTAL $57-75 million

Notes: (1) Including $5 million in pre-stripping costs

(2) Subject to permitting process timeline

(3) Subject to exploration results

El Castillo 2013 Capex Initiatives:

The funding can be classified into three main initiatives:

-- $15 mm: New West side pad and ponds with 30mm ton capacity to be built

in 2013

-- $10 mm: Transfer of Contractor mining equipment to the Company

-- $7 mm: New crushing and overland conveying system for the West pad 8

La Colorada 2013 Capex Initiatives:

The funding can be classified into three main initiatives:

-- $7mm: New crushing system capable of producing +4mm tonnes per year at

less than 3/8"

-- $5mm: Pre-stripping of pit

-- $2mm: Plant and pad expansions

Pete Dougherty, Argonaut Gold's President and CEO stated: "2012 was a

significant year for the Company; we exceeded gold production guidance, added La

Colorada as a second operation and completed the acquisition of Prodigy Gold. El

Castillo is near a steady state of production with 2013 guidance of between

90,000 and 100,000 gold ounces at cash costs of $700 to $725 per ounce. Due to

an anticipated 14% reduction in grade, we will be increasing the volume of ore

tonnes processed to maintain gold ounce production levels. From a capital

perspective we are looking to make improvements to our cost basis by taking over

the mining from our contractor, and adding an in-pit crushing and conveying

system to deliver to West pad 8."

Mr. Dougherty added "At La Colorada, fresh ore mining has begun. The mine plan

anticipates grades to increase quarter over quarter with production loaded

towards the second half of the year. Installation of the new crusher and pad

construction will be completed in the second quarter of this year. Full year

2013 gold production at La Colorada is expected to be between 30,000 and 40,000

ounces of gold at average cash costs for the year of $450 to $475 per ounce, net

of silver credits."

Magino Exploration Update:

Argonaut Gold is pleased to report on exploration results at its recently

acquired Magino project located 40 kilometers northeast of Wawa, Ontario. In

2012 an additional 89,000 meters of drilling in 340 holes was completed to

advance the project toward a proposed pre-feasibility study. The drilling

consisted of in-fill drilling in the pit and condemnation drilling for site

layout. In-fill drill spacing averaged of 25 meters within the constrained pit.

The drilling campaign also outlined a new zone of mineralization depicted in the

southeast corner of the drilling which we are calling the PD zone. (See Figure 1

and Holes PD-atm12-002-100).

Prior Resource Drilling Additional Drilling

Meters 220,000 89,000

----------------------------------------------------------------------------

Holes 1,210 340

----------------------------------------------------------------------------

Drill Spacing (meters) 40 25 in constrained pit

(Note: Prior Resource drilling cut-off was 6-8-2012, the additional 89,000

meters completed since 6-8-2012).

----------------------------------------------------------------------------

MAGINO DRILLING SUMMARY SINCE OCTOBER 2012 RESOURCE REPORT BY AREA

----------------------------------------------------------------------------

Program Meters # Holes

----------------------------------------------------------------------------

Deep Holes 4,963 5

----------------------------------------------------------------------------

Condemnation 31,723 127

----------------------------------------------------------------------------

Pit Definition 17,643 121

----------------------------------------------------------------------------

Infill 33,599 75

----------------------------------------------------------------------------

Metallurgical 1,403 12

----------------------------------------------------------------------------

TOTAL 89,330 340

----------------------------------------------------------------------------

Highlights from the Magino Drill Program

----------------------------------------------------------------------------

Drill Hole From (meters) To (meters) Length (meters) Gold Grade

----------------------------------------------------------------------------

PD-MA12-002 9.00 50.00 41.00 1.45

----------------------------------------------------------------------------

PD-MA12-004 13.00 52.00 39.00 1.35

----------------------------------------------------------------------------

PD-MA12-023 93.00 131.00 38.00 2.06

----------------------------------------------------------------------------

PD-MA12-027 54.00 96.20 42.20 1.13

----------------------------------------------------------------------------

PD-MA12-042 39.00 66.00 27.00 2.31

----------------------------------------------------------------------------

PD-MA12-044 105.00 133.00 28.00 3.41

----------------------------------------------------------------------------

PD-MA12-060 6.50 29.00 22.50 1.30

----------------------------------------------------------------------------

PD-MA12-080 22.00 36.00 14.00 1.41

----------------------------------------------------------------------------

PD-MA12-100 75.00 86.00 11.00 1.81

----------------------------------------------------------------------------

MA12-364 74.00 162.00 88.00 0.75

----------------------------------------------------------------------------

MA12-378 175.00 319.00 144.00 0.45

----------------------------------------------------------------------------

including 231.00 265.00 34.00 1.19

----------------------------------------------------------------------------

MA12-380 84.00 108.00 24.00 0.87

----------------------------------------------------------------------------

MA12-384 180.00 642.00 462.00 0.59

----------------------------------------------------------------------------

including 180.00 336.00 156.00 0.99

----------------------------------------------------------------------------

MA12-389 157.00 374.00 217.00 0.85

----------------------------------------------------------------------------

including 329.00 374.00 45.00 2.16

----------------------------------------------------------------------------

MA12-392 54.00 75.00 21.00 0.89

----------------------------------------------------------------------------

MA12-414 191.00 235.90 44.90 1.38

----------------------------------------------------------------------------

Note: All drillholes were drilled oriented to an azimuth of 165 with dips

ranging from -45 to -60 to the South-east. The Webb Lake Stock zone has a

general ENE strike of azimuth 075 and dips to the North. Its Majority part

is sub vertical but its dip softens in angle to the south-west becoming -30

and even sub horizontal in some parts. The drill holes with a dip around -50

will be closer to the true width of the main mineralized zone at less than

400m depth. Vertical holes will be the most representative of true width in

its sub horizontal portion. Also, the western half of Webb Lake Stock has a

tilt (plunge) towards the west, becoming increasingly deeper in that

direction.

(Please see our website (www.argonautgold.com) for full Magino drill results).

To view the image associated with this press release, "Figure 1 Drill Map,"

please visit the following link:

http://media3.marketwire.com/docs/AR2502_Figure1.jpg.

To view the image associated with this press release, "Magino Block Model

Mineralization," please visit the following link:

http://media3.marketwire.com/docs/Magino_Block_Model_Mineralization.jpg.

Conceptually Argonaut Gold anticipates that a constrained pit would look at a 1

g/t cut-off of the delineated resource.

Tom Burkhart, Argonaut Gold's VP Exploration, noted "We are pleased with the

progress of our exploration efforts at Magino. The exploration team has advanced

the project and a new pre-feasibility report is expected to be issued later this

year. The drilling also provided noteworthy drill intercepts in the PD Zone. Our

latest drilling continues to demonstrate the robust nature of the Magino deposit

and the potential to expand mineralization on the property. The optimum 25 meter

drill spacing has given us increased confidence in our geologic interpretations

and resource estimates. We look forward to continuing our evaluations of the

property including further assessment of the new PD discovery."

About Argonaut Gold

Argonaut Gold is a Canadian gold Company engaged in exploration, mine

development and production activities. Its primary assets are the El Castillo

Mine in Durango, Mexico, and the La Colorada Mine in Sonora, Mexico (both in the

production stage), the advanced exploration stage San Antonio project in Mexico,

the recently acquired advanced exploration stage Magino project in Ontario,

Canada and several exploration stage projects, all of which are located in North

America.

Creating Value Beyond Gold

Non-IFRS Measures

The Company included the non-IFRS measure "Cash cost of production per ounce of

gold" and "Cash cost per gold ounce" in this press release to supplement its

information which is periodically presented in accordance with International

Financial Reporting Standards ("IFRS"). "Cash cost of production per ounce of

gold" and "Cash cost per gold ounce" is equal to cost of sales less silver sales

divided by gold ounces sold. Silver credits are included at $30 per ounce of

silver. The Company believes that this measure provides investors with an

improved ability to evaluate the performance of the Company. Non-IFRS measures

do not have any standardized meaning prescribed under IFRS. Therefore they may

not be comparable to similar measures employed by other companies. The data is

intended to provide additional information and should not be considered in

isolation or as a substitute for measures of performance prepared in accordance

with IFRS. Please see the MD&A for full disclosure on non-IFRS measures.

Cautionary Note Regarding Forward-looking Statements

This press release contains certain "forward-looking statements" and

"forward-looking information" under applicable Canadian securities laws

concerning the proposed transaction and the business, operations and financial

performance and condition of Argonaut Gold Inc. ("Argonaut"). Forward-looking

statements and forward-looking information include, but are not limited to,

statements with respect to estimated production and mine life of the various

mineral projects of Argonaut; synergies and financial impact of completed

acquisitions; the benefits of the development potential of the properties of

Argonaut; the future price of gold, copper, and silver; the estimation of

mineral reserves and resources; the realization of mineral reserve estimates;

the timing and amount of estimated future production; costs of production;

success of exploration activities; and currency exchange rate fluctuations.

Except for statements of historical fact relating to Argonaut, certain

information contained herein constitutes forward-looking statements.

Forward-looking statements are frequently characterized by words such as "plan,"

"expect," "project," "intend," "believe," "anticipate", "estimate" and other

similar words, or statements that certain events or conditions "may" or "will"

occur. Forward-looking statements are based on the opinions and estimates of

management at the date the statements are made, and are based on a number of

assumptions and subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ materially from

those projected in the forward-looking statements. Many of these assumptions are

based on factors and events that are not within the control of Argonaut and

there is no assurance they will prove to be correct.

Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions, variations in ore grade or recovery rates, risks relating to

international operations, fluctuating metal prices and currency exchange rates,

changes in project parameters, the possibility of project cost overruns or

unanticipated costs and expenses, labour disputes and other risks of the mining

industry, failure of plant, equipment or processes to operate as anticipated.

Although Argonaut has attempted to identify important factors that could cause

actual actions, events or results to differ materially from those described in

forward-looking statements, there may be other factors that cause actions,

events or results not to be anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those anticipated in such

statements. Argonaut undertakes no obligation to update forward-looking

statements if circumstances or management's estimates or opinions should change

except as required by applicable securities laws. The reader is cautioned not to

place undue reliance on forward-looking statements. Statements concerning

mineral reserve and resource estimates may also be deemed to constitute

forward-looking statements to the extent they involve estimates of the

mineralization that will be encountered if the property is developed.

Comparative market information is as of a date prior to the date of this

document.

Qualified Person

All scientific and technical information for the Magino project, has been

reviewed and approved by Tom Burkhart, Argonaut Gold's Vice President of

Exploration, who is a qualified person under the definitions established by

National Instrument 43-101. Drill core at Magino is boxed, covered, and sealed

at the drill rig and moved to the Prodigy logging and sample preparation

facilities by Prodigy Gold personnel. The core is then split down the center

using a typical table fed circular rock saw normally at one-meter intervals. One

half of the core is sent for assay to Activation Laboratories Ltd., 33 Iroquois

Road, ON, P4N 7C5,, while the other half is returned to the core box and stored

at Prodigy's sampling facility in a secure, fenced off, area. Activation

Laboratories are ISO/IEC 17025 certified and are at arm's length to Prodigy.

Prodigy QA/QC procedures include the regular use of blanks, standards and

duplicate samples in addition to sending 10% of the samples to ALS Chemex, 2090

Riverside Dr., Timmins, ON, P4R 0A2 for check assays. ALS Chemex is at arm's

length to Prodigy and is ISO 9001:2008 certified. Samples assaying greater than

3.0 gpt gold are automatically re-assayed by the metallic screen method. Gold

assays greater than 40 gpt are capped at 40 gpt when calculating composite

intervals in drill holes. Drill holes are directed as much as possible

perpendicular to the strike and dip of the mineralization at Magino. As a rough

estimate the true thickness of the above intercepts is approximately 76%.

Technical Information and Mineral Properties Reports

The technical information contained in this document has been prepared under

supervision of, and reviewed and approved by Mr. Thomas H. Burkhart, Argonaut's

Vice President of Exploration, and a qualified person as defined by National

Instrument 43-101 ("NI 43-101"). For further information on the Company's

properties discussed herein please see the reports as listed below on the

Company's website or on www.sedar.com:

----------------------------------------------------------------------------

El Castillo Mine NI 43-101 Technical Report on Resources and

Reserves, Argonaut Gold Inc., El Castillo Mine,

Durango State, Mexico dated November 6, 2010

----------------------------------------------------------------------------

La Colorada Mine NI 43-101 Preliminary Economic Assessment La

Colorada Project, Sonora, Mexico dated December 8,

2011

----------------------------------------------------------------------------

La Fortuna Property NI 43-101 La Fortuna, Durango, Mexico, Technical

Report dated October 21, 2008

----------------------------------------------------------------------------

Hercules Technical Review and Mineral Resource Estimate of

the Hercules Property dated May 26, 2010

----------------------------------------------------------------------------

Magino Gold Project NI 43-101 Technical Report and Mineral Resource

Estimate on the Magino Gold Project, Ontario,

Toronto, Canada dated October 4, 2012

----------------------------------------------------------------------------

San Antonio Gold Project NI 43-101 Technical Report and Mineral Resource

Estimate on the San Antonio Gold Project, Baja

California Sur, Mexico dated October 10, 2012

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Argonaut Gold Inc.

Nichole Cowles

Investor Relations Manager

(775) 284-4422 x 101

nichole.cowles@argonautgold.com

www.argonautgold.com

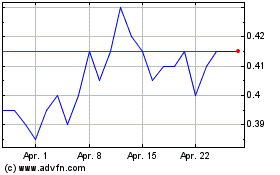

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

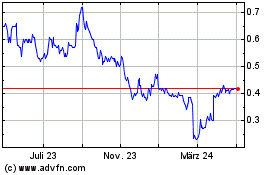

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024