Acquisition target Evofem reported revenue of

$7.8 million for the six months ended June 30, 2024

Acquisition target Appili has received

approximately $6.0 million of the total $14.0 million to date in a

non-dilutive funding commitment from DoD

Shelf registration statement and resale

registration statement for Equity Line of Credit declared Effective

by the SEC

Effected a 1-for-40 reverse split of its common

stock, which was primarily intended to regain compliance with

Nasdaq’s minimum bid price requirement

Aditxt, Inc. (NASDAQ: ADTX) (“Aditxt” or the “Company”), an

innovation platform dedicated to accelerating promising health

innovations, today provided an update on its plans for 2024

year-end.

Business and Acquisitions

Aditxt’s two acquisition targets, Evofem Biosciences, Inc.

(“Evofem”) (OTCQB: EVFM) and Appili Therapeutics, Inc. (“Appili”)

(TSX: APLI; OTCPink: APLIF), have reported revenue of $7.8 million

for the six months ended June 30, 2024. Appili has received

approximately $6.0 million of the total $14.0 million to date in a

non-dilutive funding commitment from the DoD. These funds, along

with other potential funding sources, are anticipated to continue

advancing the ATI-1701 program toward an Investigational New Drug

(IND) submission to the U.S. Food and Drug Administration (FDA) in

2025.

Aditxt’s strategy is anchored in accelerating promising health

innovations. With two subsidiaries in immune health and precision

diagnostics already established, the proposed acquisitions of

Evofem and Appili seek to further extend Aditxt’s presence into

women’s health and public health, supporting its continued

expansion.

The Company estimates it will require approximately $4 million

in cash to fund its proposed acquisition of Evofem inclusive of the

$1.8 million purchase of Common Shares, and Aditxt's obligation to

purchase an additional $2.28 million in Evofem Series F-1

Convertible Preferred Stock by October 31, 2024. In addition, the

parties are expected to repay approximately $15.2 million to

satisfy Evofem’s Senior Secured Note in conjunction with the

closing. The Company also estimates it will require approximately

$17 million in cash to fund its acquisition of Appili.

The closing of each of the transactions with Evofem and Appili

is subject to several conditions, including but not limited to

approval of the transactions by the respective target shareholders

and Aditxt raising sufficient capital to fund its obligations prior

to and at closing. No assurance can be provided that all of the

conditions to closing will be obtained or satisfied or that either

of the transactions will ultimately close.

Capital Access & Nasdaq Compliance

A key element of Aditxt’s strategy revolves around maintaining

its Nasdaq listing and securing sufficient capital to fund its

existing operations and obligations and supporting its planned

strategic growth initiatives. In support of this objective, the

Company has filed a shelf registration statement on Form S-3, which

has been declared effective by the U.S. Securities and Exchange

Commission (SEC). This shelf registration statement covers the sale

of up to $100 million in securities. At the time of filing of the

registration statement on Form S-3, the market value of the

Company’s public float was below $75 million, the maximum amount

that the Company could sell was limited to 1/3 of its public float,

which was approximately $2 million at that time. Should the

Company’s public stock price and / or the number of shares in its

public float increase, the amount that the Company may sell off of

the shelf may increase. The Company also filed a resale

registration statement covering the shares issuable under the

Company’s Equity Line of Credit (the “Equity Line”), which was

declared effective by the SEC. This registration statement covers

the sale of up to $150 million of common stock, the maximum amount

issuable under the Company’s Equity Line. The actual amount of

common stock that the Company may sell under the Equity Line is

subject to several limitations (certain of which may be waived by

the Equity Line investor), including but not limited to, the

Company’s stock price being equal to or greater than $1.00 and

certain daily volume limitations equal to the lower of 100,000

shares or $200,000 for fixed purchases under the Equity Line, or up

to $2 million daily for certain other VWAP-based purchases. The

Equity Line investor is also prohibited from purchases which would

result in ownership by such investor in excess of 4.99% of the

Company’s then outstanding common stock.

Capital Table and Balance Sheet

The Company is making concerted efforts to clean up its balance

sheet and capitalization table. As of the date hereof, the Company

also has approximately $19 million in accounts payable and accrued

expenses and approximately $7.8 million is owed to secured

creditors. In August 2024, the Company entered into a letter

agreement with the holders of its senior notes and shares of the

Company’s Series C-1 Convertible Preferred Stock, pursuant to which

the Company agreed that it would apply 40% of the net proceeds

from: (i) any sales of securities utilizing its currently effective

Shelf Registration Statement, (ii) sales of its common stock under

its Equity Line, or (iii) any public offering of securities to make

payments on such notes. In addition, pursuant to the Letter

Agreement, commencing on the date that the senior notes have been

repaid in full, the Company shall ratably redeem all holders of the

Company’s then outstanding Series C-1 Convertible Preferred Stock

in the aggregate amount of approximately $10.9 million, in an

amount equal to 40% of the net proceeds raised from any shelf

takedowns, any sales of common stock under the Equity Line or any

public offering. In addition to the foregoing, in connection with

any shelf takedown or public offering, in the event that a Series

C-1 holder participates in such shelf takedown or a public

offering, the Company shall use 50% of the gross proceeds received

in such Shelf Takedown or public offering from such Series C-1

holder to redeem such Series C-1 Holder’s shares of Series C-1

Convertible Preferred Stock.

In addition, the Company has approximately $1.0 million in

senior notes with an original maturity date of August 2024, which

was extended to September 30, 2024, and $1.5 million in senior

notes with a maturity date of October 7, 2024. The Company does not

presently have sufficient capital to meet such obligations in full,

nor can it provide any assurance that it will successfully raise

such capital from its shelf registration statement, Equity Line, or

otherwise to satisfy such obligations or meet its current

operational needs.

“The closing of the two target acquisitions, maintaining our

Nasdaq listing and accessing strategic capital, and reduction of

debt and accounts payable, are key to our future plans,” said Amro

Albanna, Chairman, Co-Founder, and CEO of Aditxt. “We understand

the many challenges that lie ahead but believe that through our

current efforts Aditxt will be well-positioned to meet

transformational milestones in 2025 that will deliver value to our

shareholders and stakeholders.”

About Aditxt, Inc.

Aditxt, Inc.® is an innovation platform dedicated to

accelerating promising health innovations. Aditxt’s ecosystem of

research institutions, industry partners, and shareholders

collaboratively drives their mission to "Make Promising Innovations

Possible Together." The innovation platform is the cornerstone of

Aditxt’s strategy, where multiple disciplines drive disruptive

growth and address significant societal challenges. Aditxt operates

a unique model that democratizes innovation, ensures every

stakeholder’s voice is heard and valued, and empowers collective

progress.

Aditxt currently operates two programs focused on immune health

and precision health. The Company plans to introduce two additional

programs dedicated to public health and women’s health. For these,

Aditxt has entered into an Arrangement Agreement with Appili

Therapeutics, Inc. (“Appili”) (TSX: APLI; OTCPink: APLIF), which

focuses on infectious diseases, and a Merger Agreement with Evofem

Biosciences, Inc. (OTCQB: EVFM). Each program will be designed to

function autonomously while collectively advancing Aditxt’s mission

of discovering, developing, and deploying innovative health

solutions to tackle some of the most urgent health challenges. The

closing of each of the transactions with Appili and Evofem is

subject to several conditions, including but not limited to

approval of the transactions by the respective target shareholders

and Aditxt raising sufficient capital to fund its obligations at

closing. No assurance can be provided that all of the conditions to

closing will be obtained or satisfied or that either of the

transactions will ultimately close.

For more information, www.aditxt.com.

Follow us on: LinkedIn: https://www.linkedin.com/company/aditxt

Facebook: https://www.facebook.com/aditxtplatform/

Forward-Looking Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of federal

securities laws. Forward-looking statements include statements

regarding the Company’s intentions, beliefs, projections, outlook,

analyses, or current expectations concerning, among other things,

the Company’s ongoing and planned product and business development;

the Company’s ability to finance and execute its strategic M&A

initiatives; the Company’s ability to obtain the necessary funding

and partner to commence clinical trials; the Company’s intellectual

property position; the Company’s ability to develop commercial

functions; expectations regarding product launch and revenue; the

Company’s results of operations, cash needs, spending, financial

condition, liquidity, prospects, growth, and strategies; the

Company’s ability to raise additional capital; the industry in

which the Company operates; and the trends that may affect the

industry or the Company. Forward-looking statements are not

guarantees of future performance, and actual results may differ

materially from those indicated by these forward-looking statements

as a result of various important factors, as well as market and

other conditions and those risks more fully discussed in the

section titled “Risk Factors” in Aditxt’s most recent Annual Report

on Form 10-K, as well as discussions of potential risks,

uncertainties, and other important factors in the Company’s other

filings with the Securities and Exchange Commission. All such

statements speak only as of the date made, and the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241003918360/en/

Aditxt, Inc. Mary O’Brien Mobrien@aditxt.com

516-753-9933

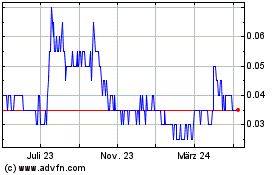

Appili Therapeutics (TSX:APLI)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

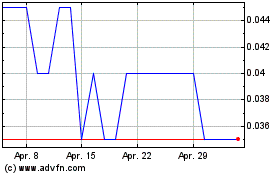

Appili Therapeutics (TSX:APLI)

Historical Stock Chart

Von Apr 2024 bis Apr 2025