Alaris Equity Partners Income Trust (the "

Trust"

and, collectively with its subsidiaries, "

Alaris")

(TSX: AD.UN) is pleased to announce the redemption of Alaris'

interest in Brown & Settle Investments, LLC

("

B&S"), which closed on April 12, 2024, and

resulted in gross proceeds to Alaris of US$71.5 million (CAD$97.8

million) (the "

B&S Proceeds"). Alaris'

total return on our B&S investment is US$30.8 million (CAD

$42.2 million) delivering an unlevered IRR(3) of 15% and a MOIC(4)

of 1.5x.

After today’s announcement, Alaris will have

approximately CA$166.0 million drawn on its senior credit facility

and CA$334 million available for investment purposes based on our

credit agreement that provides for up to $500 million of

indebtedness. Alaris' total senior debt-to-EBITDA(2) on a

proforma basis is approximately 1.14x. Alaris estimates its Run

Rate Payout Ratio(1) to be between 65% and 70% following the

B&S redemption.

"Today’s exit from B&S crystalizes another

successful investment for Alaris. With future deployments into new

and existing partners on the horizon as well as the expiration of

our convertible debentures in June, these proceeds allow for us to

keep a very healthy balance sheet without needing to go to the

market. I’d like to thank the management of B&S, who went

through some early challenges during our partnership but worked

tirelessly to create an excellent outcome", said Steve King, Chief

Executive Officer, Alaris.

ABOUT ALARIS:

Alaris, through its subsidiaries, provides

alternative financing to private companies

("partners") in exchange for distributions,

dividends and interest (collectively,

"distributions") with the principal objective of

generating stable and predictable cash flows for dividend payments

to its unitholders. Distributions from the partners are adjusted

each year based on the percentage change of a "top line" financial

performance measure such as gross margin and same-store sales and

rank in priority to the owners' common equity position.

NON-GAAP and Other Financial

Measures:

The terms Run Rate Payout Ratio, EBITDA and IRR

are financial measures used in this news release that are not

standard measures under International Financial Reporting Standards

("IFRS"). The Trust’s method of calculating Run

Rate Payout Ratio, EBITDA and IRR may differ than from methods used

by other issuers. Therefore, the Trust’s Run Rate Payout Ratio,

EBITDA and IRR amounts may not be comparable to similar measures

used by other issuers.

(1) "Run Rate Payout Ratio" is

a non-GAAP financial ratio that refers to Alaris’ total

distribution per unit expected to be paid over the next twelve

months divided by the free cash flow per unit. Run Rate Payout

Ratio is a useful metric for Alaris to track and to outline as it

provides a summary of the percentage of the free cash flow that can

be used to either repay senior debt during the next twelve months

and/or be used for additional investment purposes.

(2) "EBITDA" is a non-GAAP

financial measure and refers to earnings determined in accordance

with IFRS, before depreciation and amortization, interest expense

(finance costs) and income tax expense. EBITDA is used by

management and many investors to determine the ability of an issuer

or a partner to generate cash from operations. Management believes

EBITDA is a useful supplemental measure from which to determine

partner’s ability to generate cash available for servicing its

loans and borrowings, income taxes and distributions to

unitholders.

(3) "IRR" is a supplementary

financial measure and refers to internal rate of return, which is a

metric used to determine the discount rate that derives a net

present value of cash flows to zero. Management uses IRR to analyze

partner returns. The Trust’s method of calculating this

supplementary financial measure may differ from the methods used by

other issuers. Therefore, it may not be comparable to similar

measures by other issuers.

(4) "MOIC" is a supplementary

financial measure and refers to multiple of capital invested, which

is a financial metric used to evaluate the value of an

investment relative to the initial capital. Management uses MOIC to

analyze partner returns. The Trust’s method of calculating this

supplementary financial measure may differ from the methods used by

other issuers. Therefore, it may not be comparable to similar

measures by other issuers.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements, including forward-looking statements within the meaning

of "safe harbor" provisions under applicable securities laws

("forward-looking statements"). Statements other than statements of

historical fact contained in this news release may be

forward-looking statements, including, without limitation,

management's expectations, intentions and beliefs concerning: the

B&S redemption and the financial impact on Alaris including the

impact on Run Rate Payout Ratio. Many of these statements can be

identified by words such as "believe", "expects", "will",

"intends", "projects", "anticipates", "estimates", "continues" or

similar words or the negative thereof. Any forward-looking

statements herein which constitute a financial outlook or

future-oriented financial information (including the impact on Run

Rate Payout Ratio) were approved by management as of the date

hereof and have been included to provide an understanding of

Alaris' financial performance and are subject to the same risks and

assumptions disclosed herein. There can be no assurance that the

plans, intentions or expectations upon which these forward-looking

statements are based will occur.

By their nature, forward-looking statements

require Alaris to make assumptions and are subject to inherent

risks and uncertainties. Assumptions about the performance of the

Canadian and U.S. economies over the next 24 months and how that

will affect Alaris’ business and that of its partners are material

factors considered by Alaris management when setting the outlook

for Alaris. Key assumptions include, but are not limited to,

assumptions that: interest rates will not rise in a matter

materially different from the prevailing market expectations over

the next 12 to 24 months; that COVID-19 or any variants therefore

will not impact the economy or any partners’ operations in a

material way in the next 12 months; the businesses of the majority

of our partners will continue to grow; the businesses of new

partners and those of existing partners will perform in line with

Alaris’ expectations and diligence; more private companies will

require access to alternative sources of capital and that Alaris

will have the ability to raise required equity and/or debt

financing on acceptable terms. Management of Alaris has also

assumed that the Canadian and U.S. dollar trading pair will remain

in a range of approximately plus or minus 15% of the current rate

over the next 6 months. In determining expectations for economic

growth, management of Alaris primarily considers historical

economic data provided by the Canadian and U.S. governments and

their agencies as well as prevailing economic conditions at the

time of such determinations.

Forward-looking statements are subject to risks,

uncertainties and assumptions and should not be read as guarantees

or assurances of future performance. The actual results of the

Trust and the partners could materially differ from those

anticipated in the forward-looking statements contained herein as a

result of certain risk factors, including, but not limited to: the

ability of our partners and, correspondingly, Alaris to meet

performance expectations for 2024; any change in the senior lenders

under our credit facility’s outlook for Alaris’ business;

management's ability to assess and mitigate the impacts of any

local, regional, national or international health crises like

COVID-19; the dependence of Alaris on the partners; reliance on key

personnel; general economic conditions in Canada, North America and

globally; failure to complete or realize the anticipated benefit of

Alaris’ financing arrangements with the partners; a failure of the

Trust or any partners to obtain required regulatory approvals on a

timely basis or at all; changes in legislation and regulations and

the interpretations thereof; risks relating to the partners and

their businesses, including, without limitation, a material change

in the operations of a partner or the industries they operate in;

inability to close additional partner contributions in a timely

fashion, or at all; a change in the ability of the partners to

continue to pay Alaris’ distributions; a change in the unaudited

information provided to the Trust; a failure of a partner (or

partners) to realize on their anticipated growth strategies; a

failure to achieve the expected benefits of the third-party asset

management strategy or similar new investment structures and

strategies; a failure to achieve resolutions for outstanding issues

with partners on terms materially in line with management’s

expectations or at all; and a failure to realize the benefits of

any concessions or relief measures provided by Alaris to any

partner or to successfully execute an exit strategy for a partner

where desired. Additional risks that may cause actual results to

vary from those indicated are discussed under the heading "Risk

Factors" and "Forward Looking Statements" in the Trust’s Management

Discussion and Analysis for the year ended December 31, 2023, which

is filed under the Trust’s profile at www.sedar.com and on its

website at www.alarisequitypartners.com.

This news release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about increases to the

Trust's net operating cash per flow per unit and liquidity, each of

which are subject to the same assumptions, risk factors,

limitations, and qualifications as set forth above. Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on FOFI and forward-looking statements.

Alaris' actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and FOFI, or if any of them do so, what

benefits the Trust will derive therefrom. The Trust has included

the forward-looking statements and FOFI in order to provide readers

with a more complete perspective on Alaris’ future operations and

such information may not be appropriate for other purposes. Alaris

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Readers are cautioned not to place undue

reliance on any forward-looking information contained in this news

release as a number of factors could cause actual future results,

conditions, actions or events to differ materially from the

targets, expectations, estimates or intentions expressed in the

forward-looking statements. Statements containing forward-looking

information reflect management’s current beliefs and assumptions

based on information in its possession on the date of this news

release. Although management believes that the assumptions

reflected in the forward-looking statements contained herein are

reasonable, there can be no assurance that such expectations will

prove to be correct.

The forward-looking statements contained herein

are expressly qualified in their entirety by this cautionary

statement. The forward-looking statements included in this news

release are made as of the date of this news release and Alaris

does not undertake or assume any obligation to update or revise

such statements to reflect new events or circumstances except as

expressly required by applicable securities legislation.

Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

For further information please

contact:

ir@alarisequity.comP: (403) 260-1457Alaris Equity

Partners Income TrustSuite 250, 333 24th Avenue S.W.Calgary,

Alberta T2S 3E6

www.alarisequitypartners.com

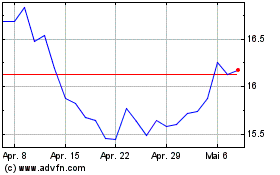

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024