SGL Carbon Shares Fall on Plan to Issue Around EUR120 Million in Convertible Bonds

21 Juni 2023 - 10:15AM

Dow Jones News

By Pierre Bertrand

SGL Carbon shares fell in Wednesday trading after the German

company said it would issue approximately 120 million euros ($131

million) in convertible bonds due in 2028.

At 0739 GMT shares traded 8.5% lower at EUR7.75.

The bonds, which will only be offered to institutional investors

outside the U.S. by way of an accelerated bookbuilding, would be

convertible into up to 12.2 million no-par value ordinary shares,

SGL Carbon said.

"The convertible bonds will have a maturity of years and will be

issued and redeemed at 100% of their principal amount, with a

coupon of between 5.50% and 6.00% p.a., payable semi-annually in

arrear on June 28 and December 28, commencing on Dec. 28, 2023,"

the company said.

SGL Carbon shareholder SKion GmbH has indicated that it is

interested in placing an order in the accelerated bookbuilding, SGL

Carbon said.

The company said it plans to use the net proceeds from the bond

issue to help refinance its 4.625% bonds due next year.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

June 21, 2023 04:00 ET (08:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

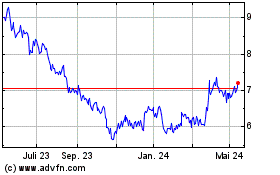

SGL Carbon (TG:SGL)

Historical Stock Chart

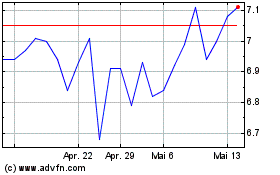

Von Apr 2024 bis Mai 2024

SGL Carbon (TG:SGL)

Historical Stock Chart

Von Mai 2023 bis Mai 2024