Alstom S.A.: Alstom completes the sale of its North American conventional signalling business

02 September 2024 - 8:30AM

UK Regulatory

Alstom S.A.: Alstom completes the sale of its North American

conventional signalling business

- Alstom has sold its North American conventional signalling

business to Knorr-Bremse AG for a purchase price of approximately

USD 690 million1

- Closing of the sale completes the execution of the company’s

€2 billion deleveraging plan

- Alstom will continue to serve the North American signalling

market, with communication-based train control (CBTC) and European

train control systems (ETCS) solutions

September 2, 2024 – Alstom, global leader

in smart and sustainable mobility, announces today that it has

closed the sale of its North American conventional signalling

business to Knorr-Bremse AG, following the binding agreement signed

on 19 April 2024.

This divestiture was part of the comprehensive

company action plan that Alstom announced on 15 November 2023,

aiming at reinforcing its balance sheet. Alstom has delivered all

three components of that plan, and it results in the stabilisation

of its Investment Grade rating.

Alstom will continue to serve the North American

signalling market on different segments, notably with

Communications Based Train Control (CBTC) and European Train

Control System (ETCS) solutions.

Alstom is a mobility technology leader in the

U.S., with a history dating back more than 170 years. Alstom

transfers technology and localizes manufacturing to create new,

sustainable, high-tech engineering and industrial jobs across the

country to serve a growing list of customers that includes major

American cities, transit agencies, railroads, and airport transit

systems. Its history is steeped in its experience building and

repairing rail cars and locomotives, supplying signalling solutions

and turnkey transit systems, and providing a complete range of

customized services. To date, Alstom has delivered more than 12,000

new or renovated vehicles for U.S. customers and more than 50% of

signalling for North America’s railroads.

For this transaction, Alstom was accompanied by

Crédit Agricole CIB as financial advisor, White & Case LLP as

legal advisor, Cleary Gottlieb Steen & Hamilton LLP as

antitrust advisor, and Accuracy for financial due diligences.

Alstom™ is a protected trademark of the Alstom

Group.

|

|

About Alstom |

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 64 countries and a talent base of over 84,700 people from 184

nationalities, the company focuses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €17.6 billion

for the fiscal year ending on 31 March 2024.

For more information, please visit www.alstom.com.

|

|

|

|

| |

Contacts |

Press

Thomas ANTOINE (HQ) – Tel.: +33 (0)6 11 47 28 60

thomas.antoine@alstomgroup.com

Dani SIMONS (AMERICAS) – Tel.: + 1-646-856-3412

dani.simons@alstomgroup.com

Investor Relations

Martin VAUJOUR – Tel.: +33 (0)6 88 40 17 57

martin.vaujour@alstomgroup.com

Estelle MATURELL ANDINO – Tel.: +33 (0)6 71 37 47 56

estelle.maturell@alstomgroup.com

|

|

1 Accounting treatment: the perimeter

sold will contribute to Alstom’s sales, adjusted EBIT and Free

Cash-Flow for the first 5 months of the FY 2024/25. The capital

gain will be accounted for as non-operating income below adjusted

EBIT in the first half P&L.

- 20240902_AME_conventional signalling EN (final)

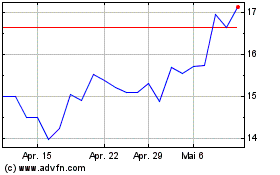

Alstom (TG:AOMD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Alstom (TG:AOMD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024