Filed by World Wrestling Entertainment,

Inc.

Pursuant to Rule 425 under

the Securities Act of 1933

Subject

Company: World Wrestling Entertainment, Inc.

Commission File No. 001-16131

Date: May 3, 2023

On May 3, 2023, World Wrestling Entertainment, Inc. (“WWE”)

hosted a conference call to review its first quarter 2023 earnings (“Q1 2023”). The following are excerpts from the Q1 2023

earnings release and related presentation relating to the proposed business combination with Endeavor Group Holdings, Inc. (the “Proposed

Transaction”).

The excerpts below contain only those portions of the Q1 2023

earnings release relating to discussions of the Proposed Transaction:

WWE and Endeavor Transaction Highlights

| • | As

previously disclosed, on April 3, 2023, WWE and Endeavor announced an agreement to combine WWE and UFC to form a new, publicly listed

company. Upon close, Endeavor will hold a 51% controlling interest and existing WWE shareholders will hold a 49% interest in the new

company |

| • | The

transaction values UFC at an enterprise value of $12.1 billion and WWE at an enterprise value of $9.3 billion. The transaction

represents a contribution price of WWE of approximately $106 per share (before any post-closing dividend) |

| • | Following

the closing, the new public company, in which WWE shareholders will initially hold 100% of the economic interest, is expected to issue

a post-closing dividend consisting of excess cash at WWE |

| • | The

transaction is expected to close in the second half of 2023. The transaction is subject to the satisfaction of customary closing conditions,

including receipt of required regulatory approvals |

“Strategically, we entered into a historic

agreement with Endeavor to create a one-of-a-kind company. With WWE and UFC we intend to form a global sports and entertainment business

that has the potential to unlock vast growth opportunities for both businesses. We believe that bringing these two iconic and highly complementary

brands together will allow us to increasingly capitalize on the rapidly expanding, global appetite for live sports events and premium

entertainment content, with the goal being to maximize value for our shareholders.”

WWE and Endeavor Transaction

As previously disclosed, in January, Vincent K. McMahon, the Company’s Executive Chairman and shareholder with a controlling

interest, in cooperation with WWE’s management team and Board of Directors, announced the intent to undertake a review of strategic

alternatives with the goal of maximizing value for all WWE shareholders. On April 3, 2023, WWEand Endeavor Group Holdings, Inc. (“Endeavor”)

announced an agreement to combine WWE and Ultimate Fighting Championship (“UFC”) to form a new, publicly listed company. Upon

close, Endeavor will hold a 51% controlling interest and existing WWE shareholders will hold a 49% interest in the new company. The transaction

values UFC at an enterprise value of $12.1 billion and WWE at an enterprise value of $9.3

billion. The transaction represents a contribution price of WWE of approximately $106 per

share (before any post-closing dividend). Pursuant to the transaction agreement, at closing, WWE will distribute its excess cash to the

new public company. Following the closing, the new public company may determine to dividend such excess cash to its shareholders. The

transaction is expected to close in the second half of 2023. The transaction is subject to the satisfaction of customary closing conditions,

including receipt of required regulatory approvals. As a result of the agreement with Endeavor, the review of strategic alternatives has

been concluded. For the three-month period ended March 31, 2023, the Company’s consolidated pre-tax results included $6.7

million of expenses related to the strategic alternatives review and agreement with Endeavor.

The excerpts below contain only those portions of the presentation

pertaining to the Q1 2023 results relating to discussions of the Proposed Transaction:

▪ Combine WWE and UFC to create a global live sports and entertainment company ▪ Brings together two iconic and complimentary brands ▪ Led by a seasoned management team with a proven track record ▪ Operates in an attractive and fast - growing sports and entertainment ecosystem ▪ Highly attractive financial profile with strong free cash flow characteristics ▪ Significant organic growth opportunities ▪ Substantial potential to create incremental value through expected revenue and cost synergies WWE & ENDEAVOR TRANSACTION RATIONALE 3

▪ New, publicly listed company (NYSE : TKO) □ Endeavor will hold a 51 % controlling interest □ Existing WWE shareholders will hold a 49 % interest ▪ Values WWE at an enterprise value of $ 9 . 3 billion □ Represents a contribution price of approximately $ 106 per share (before any post - closing dividend) ▪ Post - closing dividend is expected to consist of excess cash at WWE 1 ▪ Transaction is expected to close in the second half of 2023 □ Subject to the satisfaction of customary closing conditions, including receipt of required regulatory approvals WWE & ENDEAVOR TRANSACTION OVERVIEW 4 1 Pursuant to the transaction agreement, at closing, WWE will distribute its excess cash to the new public company. Following t he closing, the new public company may determine to dividend such excess cash to its shareholders.

Cautionary Statement Regarding Forward-Looking Statements

This communication, and oral statements made from time to time by

our representatives contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking

statements generally include statements regarding the potential transaction between Endeavor and WWE, including statements regarding the

expected timetable for completing the potential transaction, the ability to complete the potential transaction, expected synergies, impacts

and benefits of the potential transaction, the expected leadership team of the new public company (“NewCo”), the projected

financial information, future opportunities, expected cash distributions and other statements regarding NewCo’s and WWE’s

future expectations, beliefs, plans, objectives, results of operations, financial condition and cash flows, or future events or performance.

Statements that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation,

the expected market opportunity, growth, financial performance, expected synergies and closing of the transaction. All statements other

than statements of historical facts contained in this communication may be forward-looking statements. In some cases, you can identify

forward-looking statements by terms such as “may,” “will,” “outlook”, “should,” “expects,”

“plans,” “anticipates,” “could,” “intends,” “targets,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue”

or the negative of these terms or other similar expressions. The forward-looking statements in this communication are only predictions.

Endeavor and WWE management have based these forward-looking statements largely on their current expectations and projections about future

events and financial trends that management believes may affect its business, financial condition and results of operations. These statements

are neither promises nor guarantees and involve known and unknown risks, uncertainties and other important factors that may cause actual

results, performance or achievements to be materially different from what is expressed or implied by the forward-looking statements, including,

but not limited to: the transaction will not be consummated; there may be difficulties with the integration and in realizing the expected

benefits of the transaction; Endeavor and WWE may need to use resources that are needed in other parts of its business to do so; there

may be liabilities that are not known, probable or estimable at this time; the transaction may result in the diversion of management’s

time and attention to issues relating to the transaction and integration; expected synergies and operating efficiencies attributable to

the transaction may not be achieved within its expected time-frames or at all; there may be significant transaction costs and integration

costs in connection with the transaction; the possibility that neither WWE nor Endeavor will have sufficient cash at close to distribute

to shareholders (or that the amount of cash available for distribution will be less than what the parties expect); unfavorable outcome

of legal proceedings that may be instituted against WWE and Endeavor following the announcement of the transaction; and risks inherent

to the business may result in additional strategic and operational risks, which may impact Endeavor’s, NewCo’s and WWE’s

risk profiles, which each company may not be able to mitigate effectively. In addition, a number of important factors could cause Endeavor’s

or NewCo’s actual future results and other future circumstances to differ materially from those expressed in any forward-looking

statements, including but not limited to those important factors discussed in Part I, Item 1A “Risk Factors” in Endeavor’s

or WWE’s respective Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as any such factors may be updated from

time to time in its other filings with the Securities and Exchange Commission (the “SEC”), accessible on the SEC’s website

at www.sec.gov, Endeavor’s investor relations site at investor.endeavorco.com and WWE’s investor relations site at https://corporate.wwe.com/.

Forward-looking statements speak only as of the

date they are made and, except as may be required under applicable

law, neither Endeavor nor WWE undertakes no obligation to update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

Important Information For Investors And Stockholders

This communication is for informational purposes only and is not

intended to, and does not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote or approval, nor shall there be any issuance or sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. In connection

with the transaction, NewCo expects to file a registration statement on Form S-4 with the SEC, which will include an information statement

of WWE and a preliminary prospectus of NewCo. After the registration statement is declared effective, WWE will mail to its stockholders

a definitive information statement that will form part of the registration statement on Form S-4. This communication is not a substitute

for the information statement/prospectus or registration statement or for any other document that WWE may file with the SEC and send

to its stockholders in connection with the transaction. INVESTORS AND SECURITY HOLDERS OF WWE ARE URGED TO READ THE INFORMATION STATEMENT/PROSPECTUS

AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the information statement/prospectus (when

available) and other documents filed with the SEC by WWE through the website maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with the SEC by WWE will be available free of charge on WWE’s website at https://corporate.wwe.com/.

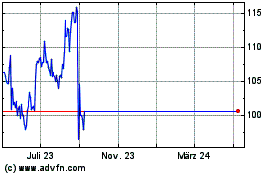

World Wrestling Entertai... (NYSE:WWE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

World Wrestling Entertai... (NYSE:WWE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024