Waste Management, Inc., a Delaware corporation (NYSE: WM)

(“WM”), announced today that it has further extended the expiration

date of its previously announced offer to exchange (the “Exchange

Offer”) any and all of the $500 million aggregate principal amount

outstanding of the 3.875% Senior Notes due 2029 (the “Stericycle

Notes”) issued by Stericycle, Inc., a Delaware corporation

(“Stericycle”), held by eligible holders, for a series of new notes

to be issued by WM (the “WM Notes”) and related solicitation of

consents on behalf of Stericycle (the “Consent Solicitation”) to

adopt certain proposed amendments (the “Proposed Amendments”) to

the indenture governing the Stericycle Notes (the “Stericycle

Indenture”).

WM hereby extends the expiration date of the Exchange Offer and

Consent Solicitation from 5:00 p.m., New York City time, on October

31, 2024, to 5:00 p.m., New York City time, on November 5, 2024 (as

the same may be further extended, the "Amended Expiration Date").

The withdrawal deadline remains unchanged and has passed. As a

result, any Stericycle Notes tendered after 5:00 p.m., New York

City time, on September 23, 2024 (the “Early Tender Deadline”) and

on or prior to the Amended Expiration Date may not be withdrawn and

the related consents delivered in the Consent Solicitation may not

be revoked, except in certain limited circumstances where

additional withdrawal rights are required by law.

As of the Early Tender Deadline, the requisite number of

consents were received to adopt the Proposed Amendments. WM intends

for Stericycle and the trustee for the Stericycle Indenture to

execute and deliver a supplemental indenture to amend the

Stericycle Indenture giving effect to the Proposed Amendments.

However, the Proposed Amendments will only become operative on the

settlement date of the Exchange Offer, which is expected to occur

on or about the third business day after the Amended Expiration

Date, unless WM extends or terminates the Exchange Offer (such date

and time, as the same may be extended, the “Settlement Date”), and

no earlier than the consummation of WM’s previously announced

pending acquisition of Stericycle (the “Transaction”). As a result,

the Amended Expiration Date may be further extended by WM in its

sole discretion.

As of 5:00 p.m., New York City time, on October 31, 2024,

$485,416,000 in aggregate principal amount of SRCL Notes,

representing approximately 97.08% of the aggregate principal amount

of SRCL Notes outstanding, had been validly tendered and not

validly withdrawn (and consents thereby validly given and not

validly revoked).

Except for the extensions described above, all other terms and

conditions of the Exchange Offer and Consent Solicitation set forth

in the exchange offer memorandum and consent solicitation

statement, dated September 10, 2024 (the "Offering Memorandum"),

copies of which were made available to eligible holders, remain

unchanged.

Other than the consummation of the Transaction (without which

the Exchange Offer will not be consummated), WM may generally waive

any condition with respect to the Exchange Offer and Consent

Solicitation, in its sole discretion, at any time.

The Exchange Offer is being made only to holders of Stericycle

Notes who satisfy the eligibility conditions described under

“Disclaimer” below. Holders of Stericycle Notes who desire a copy

of the eligibility letter should contact Global Bondholder Services

Corporation, the information agent and exchange agent for the

Exchange Offer and Consent Solicitation, at (855) 654-2015. Banks

and brokers should call (212) 430-3774. The eligibility letter may

also be found here: https://gbsc-usa.com/eligibility/wm. Global

Bondholder Services Corporation will also provide copies of the

Offering Memorandum to eligible holders of Stericycle Notes.

Holders of Stericycle Notes are advised to check with any bank,

securities broker or other intermediary through which they hold

Stericycle Notes as to when such intermediary needs to receive

instructions from a holder in order for that holder to be able to

participate in, or (in the circumstances in which revocation is

permitted) revoke their instruction to participate in, the Exchange

Offer and Consent Solicitation before the deadlines specified

herein and in the Offering Memorandum. The deadlines set by each

clearing system for the submission and withdrawal of exchange

instructions will also be earlier than the relevant deadlines

specified herein and in the Offering Memorandum.

Disclaimer

This press release is issued pursuant to Rule 135c under the

Securities Act of 1933, as amended (the “Securities Act”). This

press release is neither an offer to sell nor the solicitation of

an offer to buy the WM Notes or any other securities and shall not

constitute an offer, solicitation or sale in any jurisdiction in

which, or to any person to whom, such an offer, solicitation or

sale is unlawful. The Exchange Offer has not been and will not be

registered under the Securities Act, or the securities laws of any

other jurisdiction, and, accordingly, the WM Notes will be subject

to transfer restrictions unless and until the WM Notes are

registered or exchanged for registered notes. The WM Notes will be

issued in reliance upon exemptions from, or in transactions not

subject to, registration under the Securities Act. The Exchange

Offer is being made only to, and the WM Notes will be offered for

exchange only to, holders of Stericycle Notes who are (i)

reasonably believed to be “qualified institutional buyers” (as

defined in Rule 144A under the Securities Act) in reliance on the

exemption from registration provided by Section 4(a)(2) of the

Securities Act, and (ii) outside the United States, persons who are

not, and who are not acting for the account or benefit of, “U.S.

persons” (as defined in Rule 902 under the Securities Act) in

compliance with Regulation S under the Securities Act. The WM Notes

will not be offered or sold in the United States or to U.S. persons

(as defined in Rule 902 under the Securities Act) unless the

transaction is registered under the Securities Act, an exemption

from the registration requirements of the Securities Act is

available or the transaction is not subject to registration under

the Securities Act.

The Exchange Offer and Consent Solicitation are being made only

pursuant to the Offering Memorandum, as amended by WM’s press

release issued on October 8, 2024 and as further amended hereby.

The Offering Memorandum and other documents relating to the

Exchange Offer and Consent Solicitation will be distributed only to

holders of Stericycle Notes who confirm that they are within the

categories of eligible participants in the Exchange Offer. None of

WM, its directors or officers, the dealer managers and solicitation

agents, the exchange agent, the information agent, the trustees for

the WM Notes or the Stericycle Notes, their respective affiliates,

or any other person is making any recommendation as to whether

holders should tender their Stericycle Notes in the Exchange Offer

or consent to the Proposed Amendments in the Consent

Solicitation.

This press release, WM’s press release issued on October 8,

2024, the Offering Memorandum and any other offering material

relating to the Exchange Offer are not being made, and have not

been approved, by an authorized person for the purposes of Section

21 of the Financial Services and Markets Act 2000. Accordingly,

this press release, the Offering Memorandum and any other offering

material relating to the Exchange Offer are only being distributed

to and are only directed at: (i) persons who are outside the United

Kingdom, (ii) persons in the United Kingdom who have professional

experience in matters relating to investments who fall within the

definition of investment professionals as defined within Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (as amended, the “Order”) or (iii) high net

worth entities and other persons who fall within Article 49(2)(a)

to (d) of the Order (all such persons together being referred to

for purposes of this paragraph as “relevant persons”). The WM Notes

will only be available to, and any invitation, offer or agreement

to subscribe, purchase or otherwise acquire such notes will be

engaged in only with, relevant persons. Any person who is not a

relevant person should not act or rely on the Offering Memorandum

or any of its contents and may not participate in the Exchange

Offer.

The complete terms and conditions of the Exchange Offer and

Consent Solicitation are set forth in the Offering Memorandum, as

amended by WM’s press release issued on October 8, 2024 and as

further amended hereby. The Exchange Offer is only being made

pursuant to the Offering Memorandum, as amended by WM’s press

release issued on October 8, 2024 and as further amended hereby.

The Exchange Offer is not being made to holders of Stericycle Notes

in any jurisdiction in which the making or acceptance thereof would

not be in compliance with the securities, blue sky or other laws of

such jurisdiction. Neither the Securities and Exchange Commission

nor any other regulatory body has registered, recommended or

approved of the WM Notes or passed upon the accuracy or adequacy of

the Offering Memorandum.

ABOUT WM

WM is North America’s leading provider of comprehensive

environmental solutions. Previously known as Waste Management and

based in Houston, Texas, WM is driven by commitments to put people

first and achieve success with integrity. WM, through its

subsidiaries, provides collection, recycling and disposal services

to millions of residential, commercial, industrial and municipal

customers throughout the U.S. and Canada. With innovative

infrastructure and capabilities in recycling, organics and

renewable energy, WM provides environmental solutions to and

collaborates with its customers in helping them achieve their

sustainability goals. WM has the largest disposal network and

collection fleet in North America, is the largest recycler of

post-consumer materials and is a leader in beneficial use of

landfill gas, with a growing network of renewable natural gas

plants and the most landfill gas-to-electricity plants in North

America. WM’s fleet includes more than 12,000 natural gas trucks –

the largest heavy-duty natural gas truck fleet of its kind in North

America.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements that

involve risks and uncertainties, including all statements regarding

the consummation and timing of the pending acquisition of

Stericycle and the consummation and timing of the Exchange Offer

and Consent Solicitation. Factors that could cause actual results

to differ materially from those expressed or implied by the

forward-looking statements in this press release are discussed in

WM’s most recent Annual Report on Form 10-K and subsequent reports

on Form 10-Q.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031241725/en/

Waste Management

Analysts Ed Egl 713.265.1656 eegl@wm.com

Media Toni Werner media@wm.com

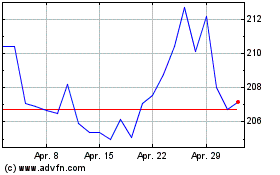

Waste Management (NYSE:WM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Waste Management (NYSE:WM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025