SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No.)*

Integrated Wellness Acquisition Corp

(Name of Issuer)

Class A Ordinary Shares, par value $0.0001 per

share

(Title of Class of Securities)

G4828B100

(CUSIP Number)

Jiang Hui Bao

Chief Executive Officer

Suntone Investment Pty Ltd

c/o Integrated Wellness Acquisition Corp

59 N. Main Street, Suite 1, Florida, NY 10921

(845) 651-5039

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

Copies to:

Andrew Tucker

Nelson Mullins Riley & Scarborough LLP

101 Constitution Avenue NW, Suite 900

Washington, DC 20001

Telephone: (202) 689-2800

February 1, 2024

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are

to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. G4828B100

| 1. |

|

Names of Reporting Persons.

Suntone Investment Pty Ltd |

| 2. |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ¨ (b) ¨ |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of Organization

Australia |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Persons

With |

|

7. |

|

Sole Voting Power

2,000,000 (1) |

| |

8. |

|

Shared Voting Power

-- |

| |

9. |

|

Sole Dispositive Power

2,000,000(1) |

| |

10. |

|

Shared Dispositive Power

-- |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,000,000 |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions)

☐ |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

69.6% (2) |

| 14. |

|

Type of Reporting Person:

CO |

| (1) |

Consisting of 2,000,000 Class A Ordinary Shares. |

| (2) |

Calculated

based upon 2,875,000 Class A Ordinary Shares outstanding as of February 1, 2024, as reported in the Issuer’s schedule 14f-1, filed

with Securities and Exchange Commission on February 1, 2024. |

Item 1. Security and Issuer.

This

statement on Schedule 13D (the “Schedule 13D”) relates to the Class A Ordinary Shares, par value $0.0001 per share (the “Class

A Ordinary Shares”) of Integrated Wellness Acquisition Corp, a Cayman Islands exempted company (the “Issuer”), whose

principal executive offices are located at 59 N. Main Street, Suite 1, Florida, NY 10921.

Item 2. Identity and Background.

| (a) | This Schedule 13D is being filed by Suntone Investment Pty Ltd (the “Reporting Person”). |

| (b) | The principal business address for the Reporting Person is c/o Integrated Wellness Acquisition Corp, 59

N. Main Street, Suite 1, Florida, NY 10921. |

| (c) | During the last five years, none of the Reporting Person has been convicted

in a criminal proceeding. |

| (d) | During the last five years, the Reporting Person has not been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order

enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation

with respect to such laws. |

| |

(e) |

The Reporting Person is a proprietary limited company under the laws

of Australia |

Item 3. Source and Amount of Funds or Other

Consideration.

The aggregate purchase price of the Class A Ordinary

Shares currently beneficially owned by the Reporting Person was $1. The source of these funds was working capital of Suntone Investment

Pty Ltd (the “Sponsor”).

Item 4. Purpose of Transaction.

The Class A Ordinary Shares

purchased by the Sponsor and beneficially owned by the Reporting Person have been acquired for investment purposes.

Purchase and Sponsor Handover Agreement

On November 8, 2023, the Issuer

entered into a purchase agreement (the “Purchase Agreement”) with IWH Sponsor LP, a Delaware limited partnership, the Issuer’s

current sponsor (the “Sponsor”) and Sriram Associates, LLC (the “Acquirer”), pursuant to which, the Sponsor agreed

to transfer to the Acquirer’s designee Suntone Investment Pty Ltd (i) 2,012,500 of the Issuer’s Class A Ordinary Shares and (ii) 4,795,000 of the Issuer’s private

placement warrants for a total purchase price of one dollar (the “Transfer”). In connection with the Transfer, the Acquirer

may, in its sole discretion, replace any new officers or directors to the Issuer and the Issuer agreed to take such actions necessary

to effectuate such changes (the “Management Change”). The Transfer, the Management Change and the other transactions contemplated

by the Purchase Agreement are hereinafter referred to as the “Sponsor Handover.”

The consummation of the Sponsor

Handover is subject to a number of conditions, including but not limited to: (i) the Issuer’s board of directors shall have approved

the Transfer; (ii) the members of the Sponsor shall have approved such transfer in accordance with the operating agreement of the Sponsor;

(iii) payment by the Acquirer of the costs associated with the Issuer’s existing extension; (iv) the Issuer shall have filed (or

be in the process of filing) its Form 10-Q for the quarter ended September 30, 2023; and (v) the underwriters for the Issuer’s initial

public offering shall have either waived their rights or have agreed to amend the deferred underwriting commission specified therein under

the underwriting agreement, dated December 8, 2021, by and between the Issuer and BTIG, LLC, as representative of the several underwriters.

In connection with the Sponsor

Handover, the Acquirer agreed to assume (i) certain vendor payables currently outstanding by the Issuer; (ii) the costs and expenses associated

with the monthly extensions of the Issuer until December 13, 2023 including monthly payments of $160,000; (iii) the costs and expenses

for the Issuer to take all actions necessary to file a proxy statement and hold a shareholders meeting prior to December 13, 2023 in order

to extend the term of the Issuer until December 13, 2024 structured in such manner as requested by the Acquirer (the “Extension”).

The Acquirer also agreed to (i) cause the Issuer to satisfy all of its public company reporting requirements; (ii) to pay the D&O

insurance premiums to extend the Issuer’s existing D&O insurance policy; and (iii) to pay all outstanding legal fees owed by

the Issuer at or before a business combination.

As disclosed in the Issuer’s

definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on November 21, 2023, the Issuer is seeking

to, among other things, extend the period of time for the Issuer to complete its business combination from December 13, 2023 to December

13, 2024 (the “Extension Amendment Proposal”) at its extraordinary general meeting in lieu of an annual general meeting of

shareholders on December 11, 2023. If the Extension Amendment Proposal is implemented and all other closing conditions to the Sponsor

Handover have been satisfied or waived, then, the Acquirer or its designee has agreed to loan to the Issuer the lesser of (i) $125,000

and (ii) $0.045 per public share that remain outstanding and is not redeemed in connection with the Extension, for each calendar month

(commencing on December 14, 2023 and ending on the 13th day of each subsequent month), or portion thereof, that is needed by the Issuer

to complete a business combination from December 13, 2023 until December 13, 2024.

Item 5. Interest in Securities of the Issuer.

| (a) – |

Calculations of the percentage of Class A Ordinary Shares beneficially owned is

based on 2,875,000 Class A. |

| |

|

| (b) |

Ordinary Shares as of the Record Date, as reported in the Issuer’s 14f-1, filed with the SEC on February 1, 2024. |

| |

|

| (c) |

Except as set forth in this Schedule 13D, the Reporting

Person has not effected any transactions in the Class A Ordinary Shares in the past 60 days. |

| |

|

| (d) |

Not applicable. |

| |

|

| (e) |

Not applicable. |

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

On November 8, 2023, the Reporting Person and

the Issuer entered the Agreement described in Item 4 above. The Agreement is filed as Exhibit 10.1 hereto and incorporated by herein reference.

Item 7. Materials to be Filed as Exhibits

| Exhibit No. |

|

Description |

| 10.1 |

|

Purchase and Sponsor Handover Agreement, dated November 8, 2023, by and among Sriram

Associates, LLC, Integrated Wellness Acquisition Corp, and IWH Sponsor LP. |

SIGNATURES

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 28, 2024

| |

Suntone Investment Pty Ltd

|

| |

|

|

| |

By: |

/s/ Jiang Hui Bao |

| |

Name: |

Jiang Hui Bao |

| |

Title: |

Chief Executive Officer |

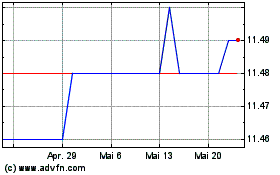

Integrated Wellness Acqu... (NYSE:WEL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

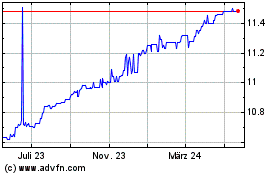

Integrated Wellness Acqu... (NYSE:WEL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024