Current Report Filing (8-k)

18 Mai 2022 - 10:32PM

Edgar (US Regulatory)

UNITIL CORP false 0000755001 0000755001 2022-05-12 2022-05-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 12, 2022

UNITIL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| New Hampshire |

|

1-8858 |

|

02-0381573 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 6 Liberty Lane West, Hampton, New Hampshire |

|

03842-1720 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (603) 772-0775

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common Stock, no par value |

|

UTL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

The two orders of the New Hampshire Public Utilities Commission (“NHPUC”), as well as the Settlement Agreement, to which Item 8.01 below refers, are attached as Exhibits 99.1, 99.2 and 99.3, respectively, to this Current Report on Form 8-K.

Item 8.01 Other Events

On May 3, 2022, the NHPUC issued Order No. 26,623 (the “Order”) in Docket No. DE 21-030, the distribution base rate case filed with the NHPUC on April 2, 2021 by Unitil Energy Systems, Inc. (the “Company”), Unitil Corporation’s electric utility subsidiary operating in New Hampshire.

The Order approves, in part, a comprehensive Settlement Agreement between the Company, the New Hampshire Department of Energy, the Office of Consumer Advocate, the New Hampshire Department of Environmental Services, Clean Energy New Hampshire, and ChargePoint, Inc. (the “Agreement”). In addition to authorizing an increase to permanent distribution rates of $6.3 million, effective June 1, 2022, the Order approves the following components of the Agreement: (1) a proposed multi-year rate plan, (2) a revenue decoupling mechanism, (3) proposed time-of-use rates, (4) resiliency programs to support the Company’s commitment to reliability, and (5) other rate design and tariff changes. On May 10, 2022, the Company filed a request for clarification with the NHPUC to clarify that the authorized revenue requirement should exclude expenses related to the Company’s proposed Arrearage Management Program (“AMP”), which was not approved in the Order. On May 12, 2022, the Commission issued Order No. 26,625, which clarified that because the Company will not incur the expenses associated with the AMP, those costs should be removed from the revenue requirement, and that the adjusted increase of $5.9 million will result in reasonable rates. The increase in permanent rates will be reconciled back to June 1, 2021, the effective date of temporary rates previously approved in this docket.

This distribution base rate case reflects the Company’s operating costs and investments in utility plant for a test year ended December 31, 2020 as adjusted for known and measurable changes. The Order provides for a return on equity of 9.2 percent and a capital structure reflecting 52% equity and 48% long-term debt.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| UNITIL CORPORATION |

|

|

| By: |

|

/s/ Robert B. Hevert |

|

|

Robert B. Hevert |

|

|

Senior Vice President, Chief Financial Officer and Treasurer |

|

|

| Date: |

|

May 18, 2022 |

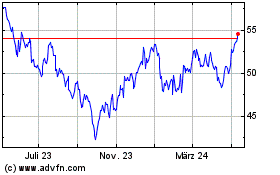

Unitil (NYSE:UTL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

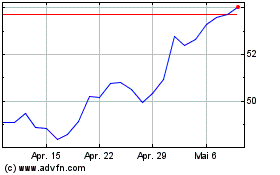

Unitil (NYSE:UTL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024