USANA Health Sciences, Inc. (NYSE: USNA) today announced

financial results for its fiscal third quarter ended September 28,

2024.

Key Financial & Operating Results

- Third quarter net sales were $200 million versus $213 million

during Q3 2023.

- Third quarter diluted EPS was $0.56 as compared with $0.59

during Q3 2023.

- Company updates fiscal year 2024 net sales and diluted EPS

outlook to approximately $850 million and $2.45, respectively

(previously $850 million to $880 million and $2.40 to $2.55).

Q3 2024 Financial Performance

Consolidated Results

Net Sales

$200 million

- No meaningful YOY FX impact

Diluted EPS

$0.56

Active Customers

452,000

“Third quarter operating results reflected continued top line

headwinds across many of our key markets,” said Jim Brown,

President and Chief Executive Officer. “Our sales force continued

to face challenges in attracting new customers as consumer

sentiment remained cautious, including in our largest market,

mainland China. Despite these challenges, we remain confident in

our direction and continue to make progress on the five key

initiatives that underpin our long-term strategy. Our commercial

team, which was reorganized earlier this year, has been executing

on these initiatives to enhance the overall value proposition of

our business to our customers and we are beginning to see results

in several of these areas.

“During the quarter, we continued to prioritize engagement with

our sales leaders, highlighted by our Americas & Europe

Convention in Las Vegas, Nevada during August. Training and

development were key focus areas at this event, with an emphasis on

actionable initiatives to help our sales leaders grow their

businesses. Feedback has been positive and leaders are actively

adopting these new initiatives.

“We have also prioritized our product innovation strategy with

an emphasis on increasing the cadence with which we introduce new

and upgraded premium products relevant to our customers’ needs.

Illustrative of this effort, we launched two new products at our

recent event in Las Vegas: a Celavive Resurfacing Serum and a Whey

Protein Isolate.”

Q3 2024 Regional Results:

Asia Pacific Region

Net Sales

$160 million

- No meaningful YOY FX impact

- 80% of consolidated net sales

Active Customers

360,000

Asia Pacific

Sub-Regions

Greater China

Net Sales

$102 million

- -5% constant currency vs. Q3 2023

Active Customers

243,000

North Asia

Net Sales

$21 million

- -12% constant currency vs. Q3 2023

Active Customers

41,000

Southeast Asia Pacific

Net Sales

$37 million

- -6% constant currency vs. Q3 2023

Active Customers

76,000

Americas and Europe

Region

Net Sales

$40 million

- -6% constant currency vs. Q3 2023

- 20% of consolidated net sales

Active Customers

92,000

Balance Sheet and Share Repurchase Activity

The Company generated $30 million in operating cash flow during

the third quarter and ended the quarter with $365 million in cash

and cash equivalents while remaining debt-free. The Company did not

repurchase any shares during the quarter. As of the end of the

third quarter, the Company had approximately $62 million remaining

under the current share repurchase authorization.

Fiscal Year 2024 Outlook

The Company is updating its net sales and earnings per share

outlook for fiscal year 2024, as follows:

Fiscal Year 2024

Outlook

Target

Previous Range

Consolidated Net Sales

$850 million

$850 - $880 million

Diluted EPS

$2.45

$2.40 - $2.55

“Third quarter net sales were modestly below expectations as we

continue to see downward pressure on customer acquisition and

consumer spending in several key markets, resulting in lower

customer counts and average spend per customer,” said Doug Hekking,

Chief Financial Officer. “We are monitoring the recently-announced

stimulus initiatives in China, but we do not expect them to

meaningfully impact our near-term operating results. Accordingly,

we have adjusted our fiscal 2024 guidance to reflect year-to-date

operating performance as well as promotional activity planned for

the fourth quarter. Notwithstanding the macroeconomic challenges we

have faced in 2024, our business fundamentals remain strong. We’ve

generated $47 million of free cash flow year-to-date and our

balance sheet remains pristine with $365 million of cash and no

debt.”

Management Commentary Document and Conference Call

For further information on the USANA’s operating results, please

see the Management Commentary document, which has been posted on

the Company’s website (http://ir.usana.com) under the Investor

Relations section. USANA’s management team will hold a conference

call and webcast to discuss today’s announcement with investors on

Wednesday, October 23, 2024 at 11:00 AM Eastern Time. Investors

may listen to the call by accessing USANA’s website at

http://ir.usana.com. The call will consist of brief opening

remarks by the Company’s management team, followed by a questions

and answers session.

Non-GAAP Financial Measures

The Company prepares its financial statements using U.S.

generally accepted accounting principles (“GAAP”). Constant

currency net sales, earnings, EPS and other currency-related

financial information (collectively, “Financial Results”) are

non-GAAP financial measures that remove the impact of fluctuations

in foreign-currency exchange rates (“FX”) and help facilitate

period-to-period comparisons of the Company’s Financial Results

that we believe provide investors an additional perspective on

trends and underlying business results. Constant currency Financial

Results are calculated by translating the current period's

Financial Results at the same average exchange rates in effect

during the applicable prior-year period and then comparing this

amount to the prior-year period's Financial Results.

About USANA

USANA develops and manufactures high-quality nutritional

supplements, functional foods and personal care products that are

sold directly to Associates and Preferred Customers throughout the

United States, Canada, Australia, New Zealand, Hong Kong, China,

Japan, Taiwan, South Korea, Singapore, Mexico, Malaysia, the

Philippines, the Netherlands, the United Kingdom, Thailand, France,

Belgium, Colombia, Indonesia, Germany, Spain, Romania, Italy, and

India. More information on USANA can be found at

www.usana.com.

Safe Harbor

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act. Our actual results could differ

materially from those projected in these forward-looking

statements, which involve a number of risks and uncertainties,

including: global economic conditions generally, including

continued inflationary pressure around the world and negative

impact on our operating costs, consumer demand and consumer

behavior in general; reliance upon our network of independent

Associates; risk that our Associate compensation plan, or changes

that we make to the compensation plan, will not produce desired

results, benefit our business or, in some cases, could harm our

business; risk associated with governmental regulation of our

products, manufacturing and direct selling business model in the

United States, China and other key markets; potential negative

effects of deteriorating foreign and/or trade relations between or

among the United States, China and other key markets; potential

negative effects from geopolitical relations and conflicts around

the world, including the Russia-Ukraine conflict and the conflict

in Israel; compliance with data privacy and security laws and

regulations in our markets around the world; potential negative

effects of material breaches of our information technology systems

to the extent we experience a material breach; material failures of

our information technology systems; adverse publicity risks

globally; risks associated with commencing operations in India and

future international expansion and operations; uncertainty relating

to the fluctuation in U.S. and other international currencies; and

the potential for a resurgence of COVID-19, or another pandemic, in

any of our markets in the future and any related impact on consumer

health, domestic and world economies, including any negative impact

on discretionary spending, consumer demand, and consumer behavior

in general. The contents of this release should be considered in

conjunction with the risk factors, warnings, and cautionary

statements that are contained in our most recent filings with the

Securities and Exchange Commission. The forward-looking statements

in this press release set forth our beliefs as of the date hereof.

We do not undertake any obligation to update any forward-looking

statement after the date hereof or to conform such statements to

actual results or changes in the Company’s expectations, except as

required by law.

USANA HEALTH SCIENCES, INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data) (unaudited)

Quarter Ended

September 28,

2024

September 30,

2023

Net sales

$

200,221

$

213,365

Cost of sales

39,257

42,529

Gross profit

160,964

170,836

Operating expenses:

Associate incentives

84,068

89,926

Selling, general and administrative

61,295

63,303

Total operating expenses

145,363

153,229

Earnings from operations

15,601

17,607

Other income (expense):

Interest income

3,142

2,733

Interest expense

(49

)

(43

)

Other, net

(86

)

234

Other income (expense), net

3,007

2,924

Earnings before income taxes

18,608

20,531

Income taxes

8,001

9,184

Net earnings

$

10,607

$

11,347

Earnings per common share

Basic

$

0.56

$

0.59

Diluted

$

0.56

$

0.59

Weighted average common shares

outstanding

Basic

19,078

19,245

Diluted

19,083

19,372

USANA HEALTH SCIENCES, INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (in

thousands) (unaudited)

As of September 28,

2024

As of December 30,

2023

ASSETS

Current assets

Cash and cash equivalents

$

364,889

$

330,420

Inventories

63,984

61,454

Prepaid expenses and other current

assets

22,318

25,872

Total current assets

451,191

417,746

Property and equipment, net

98,033

99,814

Goodwill

17,196

17,102

Intangible assets, net

29,237

29,919

Deferred tax assets

16,823

13,284

Other assets*

58,828

54,892

Total assets

$

671,308

$

632,757

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

7,041

$

10,070

Line of credit - short term

—

786

Other current liabilities

107,738

107,989

Total current liabilities

114,779

118,845

Deferred tax liabilities

4,727

4,552

Other long-term liabilities

18,715

12,158

Stockholders' equity

533,087

497,202

Total liabilities and stockholders'

equity

$

671,308

$

632,757

*Other assets include noncurrent

inventories of $2,938 and $3,128 as of 28-Sep-24 and 30-Dec-23,

respectively. Total inventories were $66,922 and $64,582 as of

28-Sep-24 and 30-Dec-23, respectively.

USANA HEALTH SCIENCES, INC.

AND SUBSIDIARIES SALES BY REGION (in thousands) (unaudited)

Quarter Ended

Change from prior

year

Percent change

Currency impact on

sales

% change excluding

currency impact

September 28, 2024

September 30, 2023

Asia Pacific

Greater China

$

102,261

51.1

%

$

106,609

50.0

%

$

(4,348

)

(4.1

%)

$

865

(4.9

%)

Southeast Asia Pacific

37,267

18.6

%

$

39,151

18.3

%

(1,884

)

(4.8

%)

561

(6.2

%)

North Asia

20,541

10.2

%

$

24,244

11.4

%

(3,703

)

(15.3

%)

(721

)

(12.3

%)

Asia Pacific Total

160,069

79.9

%

170,004

79.7

%

(9,935

)

(5.8

%)

705

(6.3

%)

Americas and Europe

40,152

20.1

%

43,361

20.3

%

(3,209

)

(7.4

%)

(727

)

(5.7

%)

$

200,221

100.0

%

$

213,365

100.0

%

$

(13,144

)

(6.2

%)

$

(22

)

(6.2

%)

USANA HEALTH SCIENCES,

INC. AND SUBSIDIARIES ACTIVE ASSOCIATES AND ACTIVE PREFERRED

CUSTOMERS BY REGION (unaudited)

Active Associates by

Region(1)

(unaudited)

As of September 28,

2024

As of September 30,

2023

Asia Pacific:

Greater China

65,000

34.6

%

69,000

34.0

%

Southeast Asia Pacific

52,000

27.6

%

55,000

27.1

%

North Asia

28,000

14.9

%

33,000

16.2

%

Asia Pacific Total

145,000

77.1

%

157,000

77.3

%

Americas and Europe

43,000

22.9

%

46,000

22.7

%

188,000

100.0

%

203,000

100.0

%

Active Preferred Customers by

Region(2)

(unaudited)

As of September 28,

2024

As of September 30,

2023

Asia Pacific:

Greater China

178,000

67.4

%

161,000

61.7

%

Southeast Asia Pacific

24,000

9.1

%

28,000

10.7

%

North Asia

13,000

4.9

%

16,000

6.1

%

Asia Pacific Total

215,000

81.4

%

205,000

78.5

%

Americas and Europe

49,000

18.6

%

56,000

21.5

%

264,000

100.0

%

261,000

100.0

%

(1)

Associates are independent distributors of

our products who also purchase our products for their personal use.

We only count as active those Associates who have purchased from us

any time during the most recent three-month period, either for

personal use or resale.

(2)

Preferred Customers purchase our products

strictly for their personal use and are not permitted to resell or

to distribute the products. We only count as active those Preferred

Customers who have purchased from us any time during the most

recent three-month period. China utilizes a Preferred Customer

program that has been implemented specifically for that market.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022996115/en/

Investor contact: Andrew Masuda Investor Relations (801)

954-7201 investor.relations@usanainc.com

Media contact: (801) 954-7280 media@usanainc.com

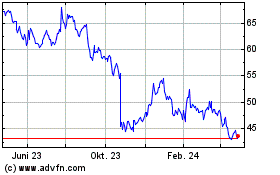

USANA Health Sciences (NYSE:USNA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

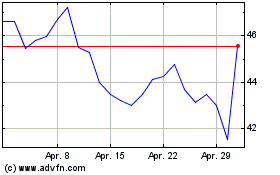

USANA Health Sciences (NYSE:USNA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025