0001665918false00016659182024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 8, 2024

_____________________________

US Foods Holding Corp.

(Exact name of registrant as specified in its charter)

_____________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-37786 | | 26-0347906 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification Number) |

9399 W. Higgins Road, Suite 100

Rosemont, IL 60018

(Address of principal executive offices) (Zip code)

(847) 720-8000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | USFD | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On January 8, 2024, US Foods Holding Corp. (the "Company"), issued a press release reaffirming its fiscal year 2023 guidance introduced on its third quarter earnings call on Nov. 9 ,2023 and announcing that on Jan. 8, 2024, Dave Flitman, Chief Executive Officer of the Company, and Dirk Locascio, Chief Financial Officer of the Company, will attend the 26th Annual ICR Conference in Orlando and will participate in a fireside chat at 2:00 p.m. EST (1:00 p.m. CST). A copy of the press release is furnished as Exhibit 99.1 to this report.

Media and investors can listen to a live audio webcast by visiting the Investor Relations page of the company’s website at https://ir.usfoods.com/investors/events-and-presentations/default.aspx. A replay of the webcast will be available later that same day.

The information contained in this Item 7.01 as well as in Exhibit 99.1 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) or otherwise subject to the liabilities of that Section, and shall not be or be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | |

| DATED: January 8, 2024 | | US Foods Holding Corp. |

| | | | |

| | By: | /s/ Dirk J. Locascio |

| | | | Dirk J. Locascio |

| | | | Chief Financial Officer |

Exhibit 99.1

| | | | | |

| |

| INVESTOR CONTACT: | MEDIA CONTACT: |

| Mike Neese | Sara Matheu |

| (847) 232-5894 | (847) 720-2392 |

| Michael.Neese@usfoods.com | Sara.Matheu@usfoods.com |

US Foods Reaffirms Fiscal Year 2023 Guidance

Company to Participate at the 2024 ICR Conference

ROSEMONT, Ill. (BUSINESS WIRE) January 8, 2024 – US Foods Holding Corp. (NYSE: USFD) announced today that it is reaffirming its fiscal year 2023 guidance introduced on its third quarter earnings call on Nov. 9, 2023.

Outlook for Fiscal Year 20231

The Company is reaffirming its previously announced fiscal year 2023 guidance of:

•Adjusted EBITDA of $1.54-$1.56 billion

•Adjusted Diluted EPS of $2.60-$2.70

•Interest expense of $320-$325 million

•Total capital expenditures of $410-$430 million, consisting of $290-$310 million of cash capital expenditures and ~$120 million of fleet capital leases

•Net Debt to Adjusted EBITDA leverage below 3.0x by end of fiscal year 2023

Additionally, US Foods will be attending the 26th Annual ICR Conference in Orlando on Jan. 8 and 9. Dave Flitman, Chief Executive Officer, and Dirk Locascio, Chief Financial Officer, will participate in a fireside chat on Monday, Jan. 8 at 2:00 p.m. EST (1:00 p.m. CST).

Media and investors can listen to a live audio webcast by visiting the Investor Relations page of the company’s website at https://ir.usfoods.com/investors/events-and-presentations/default.aspx. A replay of the webcast will be available later that same day.

About US Foods

With a promise to help its customers Make It, US Foods is one of America’s great food companies and a leading foodservice distributor, partnering with approximately 250,000 restaurants and foodservice operators to help their businesses succeed. With 70 broadline locations and more than 85 cash and carry stores, US Foods and its 29,000 associates provides its customers with a broad and innovative food offering and a comprehensive suite of

1 The Company is not providing a reconciliation of certain forward-looking non-GAAP financial measures, including Adjusted EBITDA and Adjusted Diluted EPS, because the Company is unable to predict with reasonable certainty the financial impact of certain significant items, including restructuring costs and asset impairment charges, share-based compensation expenses, non-cash impacts of LIFO reserve adjustments, losses on extinguishments of debt, business transformation costs, other gains and losses, business acquisition and integration related costs and diluted earnings per share. These items are uncertain, depend on various factors, and could have a material impact on GAAP reported results for the guidance periods. For the same reasons, the Company is unable to address the significance of the unavailable information, which could be material to future results.

e-commerce, technology and business solutions. US Foods is headquartered in Rosemont, Ill. Visit www.usfoods.com to learn more.

Forward-Looking Statements

Statements in this press release which are not historical in nature, including those under the heading “Outlook for Fiscal Year 2023,” are “forward-looking statements” within the meaning of the federal securities laws. These statements often include words such as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,” “outlook,” “estimate,” “target,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecast,” “mission,” “strive,” “more,” “goal,” or similar expressions (although not all forward-looking statements may contain such words) and are based upon various assumptions and our experience in the industry, as well as historical trends, current conditions, and expected future developments. However, you should understand that these statements are not guarantees of performance or results and there are a number of risks, uncertainties and other important factors, many of which are beyond our control, that could cause our actual results to differ materially from those expressed in the forward-looking statements, including, among others: economic factors affecting consumer confidence and discretionary spending and reducing the consumption of food prepared away from home; cost inflation/deflation and commodity volatility; competition; reliance on third party suppliers and interruption of product supply or increases in product costs; changes in our relationships with customers and group purchasing organizations; our ability to increase or maintain the highest margin portions of our business; achievement of expected benefits from cost savings initiatives; increases in fuel costs; changes in consumer eating habits; cost and pricing structures; the impact of climate change or related legal, regulatory or market measures; impairment charges for goodwill, indefinite-lived intangible assets or other long-lived assets; the impact of governmental regulations; product recalls and product liability claims; our reputation in the industry; labor relations and increased labor costs and continued access to qualified and diverse labor; indebtedness and restrictions under agreements governing our indebtedness; interest rate increases; the replacement of LIBOR with an alternative reference rate; disruption of existing technologies and implementation of new technologies; cybersecurity incidents and other technology disruptions; risks associated with intellectual property, including potential infringement; effective consummation of pending acquisitions and effective integration of acquired businesses; potential costs associated with shareholder activism; changes in tax laws and regulations and resolution of tax disputes; certain provisions in our governing documents; health and safety risks to our associates and related losses; adverse judgments or settlements resulting from litigation; extreme weather conditions, natural disasters and other catastrophic events; and management of retirement benefits and pension obligations.

For a detailed discussion of these risks, uncertainties and other factors that could cause our actual results to differ materially from those anticipated or expressed in any forward-looking statements, see the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the Securities and Exchange Commission (“SEC”). Additional risks and uncertainties are discussed from time to time in current, quarterly and annual reports filed by the Company with the SEC, which are available on the SEC’s website at www.sec.gov. Additionally, we operate in a highly competitive and rapidly changing environment; new risks and uncertainties may emerge from time to time, and it is not possible to predict all risks nor identify all uncertainties. The forward-looking statements contained in this press release speak only as of the date of this press release and are based on information and estimates available to us at this time. We undertake no obligation to update or revise any forward-looking statements, except as may be required by law.

Source: US Foods

###

v3.23.4

Document Document

|

Jan. 08, 2024 |

| Document And Entity Information [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity Registrant Name |

US Foods Holding Corp.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37786

|

| Entity Tax Identification Number |

26-0347906

|

| Entity Address, Address Line One |

9399 W. Higgins Road,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Rosemont

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60018

|

| City Area Code |

(847)

|

| Local Phone Number |

720-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

USFD

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001665918

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

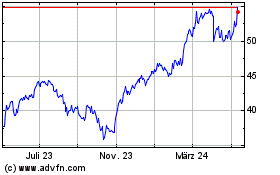

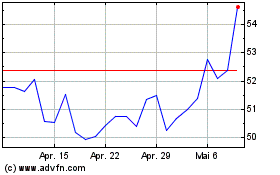

US Foods (NYSE:USFD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

US Foods (NYSE:USFD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024