Form 8-K - Current report

16 Januar 2024 - 12:55PM

Edgar (US Regulatory)

0001522727false00015227272024-01-162024-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 16, 2024

USA Compression Partners, LP

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

| Delaware | | 1-35779 | | 75-2771546 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

111 Congress Avenue, Suite 2400

Austin, Texas 78701

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (512) 473-2662

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Common units representing limited partner interests | | USAC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01. Regulation FD Disclosure.

Presentation

On January 16, 2024, USA Compression Partners, L.P. (the “Partnership”) posted the slides attached to this report as Exhibit 99.1 to its Investor Relations website under “Presentations” (https://investors.usacompression.com).

Disclosure Channels to Disseminate Information

The Partnership disseminates information to the public about the Partnership, its services and other matters through various channels, including the Partnership’s investor relations website (https://investors.usacompression.com), SEC filings, press releases, public conference calls and webcasts, in order to achieve broad, non-exclusionary distribution of information to the public. The Partnership encourages investors and others to review the information it makes public through these channels, as such information could be deemed to be material information.

The information furnished pursuant to this Item 7.01 (including the exhibit), or on the Partnership’s website, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

ITEM 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | USA COMPRESSION PARTNERS, LP |

| | | |

| | By: | USA Compression GP, LLC, |

| | | its General Partner |

| | | |

| Date: | January 16, 2024 | By: | /s/ Christopher W. Porter |

| | | Christopher W. Porter |

| | | Vice President, General Counsel and Secretary |

USA Compression Partners, LP Series A Preferred Unit Conversions Illustrative Pro Forma Impact

1 © 2024 USA COMPRESSION PARTNERS, LP | CONFIDENTIAL Forward Looking Statements and Non-GAAP Financial Measures Forward Looking Statements This presentation contains forward-looking statements related to the operations of USA Compression Partners, LP (the “Partnership”) that are based on management’s current expectations, estimates, and projections about its operations. You can identify many of these forward-looking statements by words such as “believe,” “expect,” “intend,” “project,” “anticipate,” “estimate,” “continue,” “if,” “outlook,” “will,” “could,” “should,” or similar words or the negatives thereof. You should consider these statements carefully because they discuss our plans, targets, strategies, prospects, and expectations concerning our business, operating results, financial condition, our ability to make distributions, and other similar matters. These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and other factors, some of which are beyond our control and are difficult to predict. These include risks relating to changes in general economic conditions, including inflation or supply chain disruptions; changes in economic conditions of the crude oil and natural gas industries, including any impact from the ongoing military conflict involving Russia and Ukraine; changes in the long-term supply of and demand for crude oil and natural gas; competitive conditions in our industry, including competition for employees in a tight labor market; changes in the availability and cost of capital, including changes to interest rates; renegotiation of material terms of customer contracts; actions taken by our customers, competitors, and third-party operators; and the factors set forth under the heading "Risk Factors" or included elsewhere that are incorporated by reference herein from our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission; and if applicable, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. As a result of such risks and others, our business, financial condition and results of operations could differ materially from what is expressed or forecasted in such forward-looking statements. Before you invest in our common units, you should be aware of such risks, and you should not place undue reliance on these forward– looking statements. Any forward-looking statement made by us in this presentation speaks only as of the date of this presentation. Unpredictable or unknown factors not discussed herein also could have material adverse effects on forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, information regarding the conversion of the Partnership’s Series A Preferred Units (“Preferred Units”) is for illustrative purposes only. As of January 15, 2024, we have received notification to convert 40,000 of the 500,000 Preferred Units to Common Units. We have not received notification from the holders of the Preferred Units to convert 50% or 100% of the Preferred Units to Common Units. Non-GAAP Financial Measures This presentation includes the non-U.S. generally accepted accounting principles (“non-GAAP”) financial measures of Distributable Cash Flow and Distributable Cash Flow Coverage Ratio. Distributable Cash Flow, a non-GAAP measure, is defined as net income (loss) plus non-cash interest expense, non-cash income tax expense (benefit), depreciation and amortization expense, unit-based compensation expense (benefit), impairment of compression equipment, impairment of goodwill, certain transaction expenses, severance charges, loss (gain) on disposition of assets, change in fair value of derivative instrument, proceeds from insurance recovery, and other, less distributions on the Preferred Units, and maintenance capital expenditures. The Partnership’s management believes Distributable Cash Flow is an important measure of operating performance because it allows management, investors, and others to compare the cash flows that the Partnership generates (after distributions on the Preferred Units but prior to any retained cash reserves established by the Partnership’s general partner and the effect of the Distribution Reinvestment Plan (“DRIP”)) to the cash distributions that the Partnership expects to pay its common unitholders. Distributable Cash Flow should not be considered an alternative to, or more meaningful than, net income (loss) or any other measure presented in accordance with GAAP. Moreover, Distributable Cash Flow as presented may not be comparable to similarly titled measures of other companies. The Partnership believes that external users of its financial statements benefit from having access to the same financial measures that management uses to evaluate the results of the Partnership’s business. Distributable Cash Flow Coverage Ratio, a non-GAAP measure, is defined as Distributable Cash Flow divided by distributions declared to common unitholders in respect of such period. We believe Distributable Cash Flow Coverage Ratio is an important measure of operating performance because it permits management, investors, and others to assess our ability to pay distributions to common unitholders out of the cash flows that we generate. Our Distributable Cash Flow Coverage Ratio as presented may not be comparable to similarly titled measures of other companies.

2 © 2024 USA COMPRESSION PARTNERS, LP | CONFIDENTIAL Notice by EIG Veteran Equity Aggregator, L.P., and FS Specialty Lending Fund (collectively “EIG”), of Partial Conversion of Series A Perpetual Preferred Units • On Friday, January 12, 2024, EIG elected to convert 40,000 Series A Perpetual Preferred Units (the “Preferred Units”) of the Partnership into Common Units representing limited partner interests in the Partnership (the “Conversion”). • EIG Veteran Equity Aggregator, L.P. filed a Form 144 with the US Securities and Exchange Commission on the same day. • The Conversion represents 8% (eight percent) of EIG’s Preferred Units. • Prior to the Conversion, EIG held 500,000 Preferred Units. • Following the Conversion, EIG holds 460,000 Preferred Units. • The EIG preferred to common conversion price is $20.0115/unit. • The Preferred Unit coupon rate is 9.75%. • USA Compression Partners, LP management provides the following illustrative summary to provide investors with the possible pro-forma impact to financial metrics. The conversion of 8% of EIG’s Preferred to Common Units has a de minimis effect on USAC’s financial metrics

3 © 2024 USA COMPRESSION PARTNERS, LP | CONFIDENTIAL Illustrative Pro Forma Examples of Potential Preferred Unit Conversions Conversion of the Series A Preferred Units: ✓ Enhances common unitholder liquidity. ✓ Slight increase to total distributions, less than $950,000 per quarter if 100% of Preferred Units were to be converted. ✓ Modestly reduces Distributable Cash Flow Coverage Ratio. The conversion of the Preferred Units to Common Units has minimal impact on financial position ($ in thousands) 8% Election (4) 50% Assumption (5) 100% Assumption (5) Distributable Cash Flow ("DCF") (1) 71,574$ 71,574$ 71,574$ 71,574$ Pro Forma increase upon Preferred Unit Conversion - 975 6,094 12,188 Pro Forma DCF (3) 71,574$ 72,549$ 77,668$ 83,762$ Distributions for DCF Coverage Ratio (2) 51,608$ 51,608$ 51,608$ 51,608$ Pro Forma increase upon Preferred Unit Conversion - 1,049 6,559 13,117 Pro Forma Distributions for DCF Coverage Ratio (3) 51,608$ 52,657$ 58,167$ 64,725$ Pro Forma DCF Coverage Ratio (3) 1.39x 1.38x 1.34x 1.29x Three Months Ended September 30, 2023 Conversion of Preferred Units to Common UnitsAs Reported on Form 10-Q 1. See definitions of Distributable Cash Flow and Distributable Cash Flow Coverage Ratio on Slide 1. 2. Represents distributions to the holders of the Partnership’s common units as of the Q3 2023 record date. 3. Information used herein that is qualified as “pro forma” is presented on an illustrative basis assuming either 8%, 50%, or 100%, as applicable, of the Series A Preferred Units were converted to Common Units as of September 30, 2023, as provided for under the Second Amended and Restated Agreement of Limited Partners of the Partnership. 4. Information presented herein based on January 12, 2024 election by EIG to convert 40,000 Preferred Units to Common Units. 5. Information presented herein is for illustrative purposes only. EIG has not notified the Partnership of an election to convert 50% or 100% of the Series A Preferred Units as of January 15, 2024.

4 © 2024 USA COMPRESSION PARTNERS, LP | CONFIDENTIAL Non-GAAP Reconciliation of DCF and DCF Coverage Ratio 1. See definitions of Distributable Cash Flow and Distributable Cash Flow Coverage Ratio on Slide 1. 2. Represents distributions to the holders of the Partnership’s common units as of the Q3 2023 record date. 3. Information used herein that is qualified as “pro forma” is presented on an illustrative basis assuming either 8%, 50%, or 100%, as applicable, of the Series A Preferred Units were converted to Common Units as of September 30, 2023, as provided for under the Second Amended and Restated Agreement of Limited Partners of the Partnership. 4. Information presented herein based on January 12, 2024 election by EIG to convert 40,000 Preferred Units to Common Units. 5. Information presented herein is for illustrative purposes only. EIG has not notified the Partnership of an election to convert 50% or 100% of the Series A Preferred Units as of January 15, 2024. $ in thousands 8% Election (4) 50% Assumption (5) 100% Assumption (5) Net income 20,902$ 20,902$ 20,902$ 20,902$ Non-cash interest expense 1,819 1,819 1,819 1,819 Depreciation and amortization 64,101 64,101 64,101 64,101 Non-cash income tax benefit (65) (65) (65) (65) Unit-based compensation expense 8,024 8,024 8,024 8,024 Severance charges 45 45 45 45 Gain on disposition of assets (3,865) (3,865) (3,865) (3,865) Change in fair value of derivative instrument (909) (909) (909) (909) Impairment of compression equipment 882 882 882 882 Distributions on Preferred Units (12,188) (11,213) (6,094) - Maintenance capital expenditures (7,172) (7,172) (7,172) (7,172) Distributable Cash Flow (1) 71,574$ 72,549$ 77,668$ 83,762$ Maintenance capital expenditures 7,172 7,172 7,172 7,172 Severance charges (45) (45) (45) (45) Distributions on Preferred Units 12,188 11,213 6,094 - Changes in operating assets and liabilities (40,817) (40,817) (40,817) (40,817) Net cash provided by operating activities 50,072$ 50,072$ 50,072$ 50,072$ Distributions for DCF Coverage Ratio (2) 51,608$ 52,657$ 58,167$ 64,725$ Distributable Cash Flow Coverage Ratio (1) 1.39x 1.38x 1.34x 1.29x Three Months Ended September 30, 2023 Pro Forma (3) Conversion of Preferred Units to Common UnitsAs Reported on Form 10-Q

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

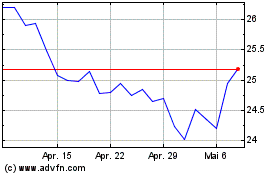

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024