Current Report Filing (8-k)

08 Juni 2023 - 2:31PM

Edgar (US Regulatory)

TEVA PHARMACEUTICAL INDUSTRIES LTD false 0000818686 0000818686 2023-06-08 2023-06-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 8, 2023

TEVA PHARMACEUTICAL INDUSTRIES LIMITED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Israel |

|

001-16174 |

|

00-0000000 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

| 124 Dvora Hanevi’a Street |

| Tel Aviv 6944020, Israel |

| (Address of Principal Executive Offices, including Zip Code) |

+972-3-914-8213

(Registrant’s Telephone Number, including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| American Depositary Shares, each representing one Ordinary Share |

|

TEVA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 1.01 |

Entry into a Material Definitive Agreement |

On June 8, 2023, Teva Pharmaceutical Industries Ltd. (the “Company”) determined that it will make effective its nationwide agreement to settle a substantial majority of the opioids-related claims brought against the Company by various states and subdivisions (the “Nationwide Opioids Settlement Agreement”), having previously secured sufficient participation by those states and subdivisions. The Nationwide Opioids Settlement Agreement will become effective on August 7, 2023. Under the terms of the Nationwide Opioids Settlement Agreement, the Company will pay the participating states and subdivisions up to $4.25 billion (including already settled cases, excluding the settlement with the state of Nevada, which is discussed below), spread over 13 years. This total includes the supply of up to $1.2 billion of the Company’s generic version of Narcan® (naloxone hydrochloride nasal spray), valued at wholesale acquisition cost, over 10 years or cash at 20% of the wholesale acquisition cost ($240 million) in lieu of product.

| ITEM 7.01 |

Regulation FD Disclosure |

Additionally, on June 7, 2023 the Company reached a settlement to resolve all opioid-related claims brought by the state of Nevada and its litigating subdivisions and special districts. Trial in the state’s case had been scheduled to begin in August 2023. Under the terms of the settlement with Nevada, Teva will pay Nevada $193 million over 20 years (including all fees and costs).

The Company issued a press release on June 8, 2023 to announce that it has fully resolved its Nationwide Opioids Settlement Agreement and to announce its separate settlement with the state of Nevada. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. As of the date of this Current Report on Form 8-K, the Company has settled opioid claims brought by all 50 U.S. states and more than 99% of the litigating subdivisions and special districts within those states.

The information in this Item 7.01 and Exhibit 99.1 hereto is being furnished to the Securities and Exchange Commission (the “Commission”) and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act, except as set forth by specific reference in such filing.

Cautionary Statements Regarding Forward-Looking Statements

The foregoing description of the Nationwide Opioids Settlement Agreement and the expected resolution of the opioids-related claims brought against the Company by various state and political subdivisions contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on management’s current beliefs and expectations and are subject to substantial risks and uncertainties, both known and unknown, that could cause our future results, performance or achievements to differ significantly from that expressed or implied by such forward-looking statements. You can identify these forward-looking statements by the use of words such as “should,” “expect,” “anticipate,” “estimate,” “target,” “may,” “project,” “guidance,” “intend,” “plan,” “believe” and other words and terms of similar meaning and expression. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are first made. Except to the extent required by law, the Company undertakes no obligation to publicly update forward-looking statements. Risk factors include, but are not limited to: the Nationwide Opioids Settlement Agreement is not expected to result in a resolution of all governmental entity claims against the Company regarding its role in distributing opioids; the Company expects to continue to experience costly and disruptive legal disputes and settlements related to distribution of controlled substances, including opioids; and the settlement payments that the Company is required to make under the Nationwide Opioids Settlement Agreement may have an adverse impact on the Company’s operations and cash flows and there is no assurance that the Company will have the liquidity or other resources necessary to make such payments and provide supplies of its generic version of Narcan® (naloxone hydrochloride nasal spray) in the amounts and at the times required under the terms of the Nationwide Opioids Settlement Agreement. Investors should read the important risk factors described in the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q and Current Reports on Form 8-K filed with the Commission.

| ITEM 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

TEVA PHARMACEUTICAL INDUSTRIES LIMITED |

|

|

|

| Date: June 8, 2023 |

|

By: |

|

/s/ Eli Kalif |

|

|

Name: |

|

Eli Kalif |

|

|

Title: |

|

Executive Vice President, Chief Financial Officer |

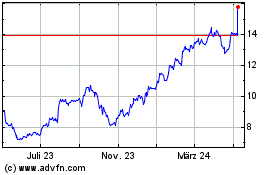

Teva Pharmaceutical Indu... (NYSE:TEVA)

Historical Stock Chart

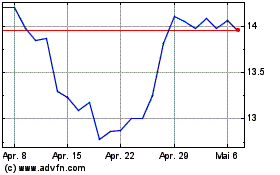

Von Mär 2024 bis Apr 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024