Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

31 Oktober 2023 - 9:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2023

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

+34 91-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica: Virgin Media O2 sells minority stake in Cornerstone to GLIL Infrastructure | 2 |

TELEFÓNICA, S.A. (“Telefónica”), in compliance with the Securities Market legislation, hereby communicates the following

OTHER RELEVANT INFORMATION

Telefónica informs that VMED O2 UK Limited ("VMO2") (Telefónica’s 50-50 joint venture with Liberty Global plc in the United Kingdom) has today reached an agreement to sell a 16.67% minority stake in its mobile tower joint venture, Cornerstone Telecommunications Infrastructure Limited (“Cornerstone”), to the UK-based infrastructure fund, GLIL Infrastructure LLP (“GLIL”).

VMO2 will receive approximately 360 million pounds payable in cash at closing of the transaction (approximately 413 million euros at the current exchange rate), which represents a multiple of 18.7 times on Cornerstone’s adjusted EBITDAaL of the year ended in March 2023 and will retain a 33.33% stake in Cornerstone upon completion of the transaction.

The sale has been structured through a VMO2 holding company (“HoldCo”), which owns 50% of the Cornerstone shares. After the transaction, GLIL will own 33.33% of HoldCo and VMO2 the remaining 66.67%. As the majority shareholder of HoldCo, VMO2 will continue co-controlling Cornerstone, together with Vantage Towers, and continue to proportionally consolidate Cornerstone in its financial accounts.

The transaction is expected to close in the coming weeks.

Madrid, October 31, 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | October 31, 2023 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

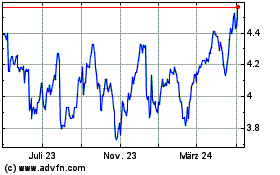

Telefonica (NYSE:TEF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

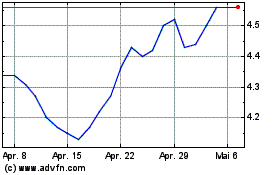

Telefonica (NYSE:TEF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024