ServisFirst Bancshares, Inc. (NYSE: SFBS), today announced

earnings and operating results for the quarter ended September 30,

2024.

Third Quarter 2024 Highlights:

- Diluted EPS grew 16% from the second quarter of 2024, and

12% year-over-year.

- Net interest margin increased 5 basis points from the second

quarter of 2024.

- Net income grew by 15% from the second quarter of 2024 and

12% year-over-year.

- Non-interest-bearing deposits grew by $101 million, or 16%

annualized from the second quarter of 2024.

- Loans grew by 6.0% year-over-year.

- Credit quality continues to be strong with non-performing

assets to total assets of 0.25%.

- Liquidity remains solid with over $1.76 billion in cash and

no FHLB advances or brokered deposits.

- Book value per share of $28.79, up 12%

year-over-year.

Tom Broughton, Chairman, President, and CEO, said, “With a solid

loan pipeline, an improving margin, strong liquidity and strong

credit quality, we are optimistic about the outlook for the

bank.”

Kirk Pressley, CFO, said, “Margin expansion accelerated during

the quarter with dollar interest margin increasing by $9.2 million,

a 35% annualized linked quarter increase, and net interest margin

expanded five basis points to 2.84%. Noninterest bearing demand

deposits grew by 4% from the second quarter, a 16% annualized

linked quarter increase. Expenses remained well controlled with the

efficiency ratio dropping to 36.9% for the quarter.”

FINANCIAL SUMMARY (UNAUDITED)

(in Thousands except share and per share

amounts)

Period Ending September 30,

2024

Period Ending June 30, 2024

% Change From Period Ending June

30, 2024 to Period Ending September 30, 2024

Period Ending September 30,

2023

% Change From Period Ending

September 30, 2023 to Period Ending September 30, 2024

QUARTERLY OPERATING RESULTS

Net Income

$

59,907

$

52,136

14.9

%

$

53,340

12.3

%

Net Income Available to Common

Stockholders

$

59,907

$

52,105

15.0

%

$

53,340

12.3

%

Diluted Earnings Per Share

$

1.10

$

0.95

15.8

%

$

0.98

12.2

%

Return on Average Assets

1.43

%

1.34

%

1.37

%

Return on Average Common Stockholders'

Equity

15.55

%

14.08

%

15.34

%

Average Diluted Shares Outstanding

54,642,582

54,608,679

54,530,635

YEAR-TO-DATE OPERATING RESULTS

Net Income

$

162,069

$

164,779

(1.6)

%

Net Income Available to Common

Stockholders

$

162,038

$

164,748

(1.6)

%

Diluted Earnings Per Share

$

2.97

$

3.02

(1.7)

%

Return on Average Assets

1.35

%

1.50

%

Return on Average Common Stockholders'

Equity

14.51

%

16.23

%

Average Diluted Shares Outstanding

54,615,647

54,530,797

Adjusted Net Income, net of tax*

$

163,416

$

164,779

(0.8)

%

Adjusted Net Income Available to

Common

Stockholders, net of tax*

$

163,385

$

164,748

(0.8)

%

Adjusted Diluted Earnings Per Share, net

of tax*

$

2.99

$

3.02

Adjusted Return on Average Assets, net of

tax*

1.36

%

1.50

%

Adjusted Return on Average Common

Stockholders' Equity, net of tax*

14.63

%

16.23

%

BALANCE SHEET

Total Assets

$

16,447,876

$

16,049,812

2.5

%

$

16,044,332

2.5

%

Loans

12,338,226

12,332,780

-

%

11,641,130

6.0

%

Non-interest-bearing Demand Deposits

2,576,329

2,475,415

4.1

%

2,621,072

(1.7)

%

Total Deposits

13,146,529

13,259,392

(0.9)

%

13,142,376

-

%

Stockholders' Equity

1,570,269

1,510,576

4.0

%

1,401,384

12.1

%

* This press release includes certain

non-GAAP financial measures: adjusted net income, adjusted net

income available to common stockholders, adjusted diluted earnings

per share, adjusted return on average assets, adjusted return on

average common stockholders’ equity, adjusted efficiency ratio,

tangible common stockholders' equity, total tangible assets,

tangible book value per share, and tangible common equity to total

tangible assets. Please see “GAAP Reconciliation and Management

Explanation of Non-GAAP Financial Measures.”

DETAILED FINANCIALS

ServisFirst Bancshares, Inc. reported net income and net income

available to common stockholders of $59.9 million for the quarter

ended September 30, 2024, compared to net income and net income

available to common stockholders of $52.1 million for the second

quarter of 2024 and net income and net income available to common

stockholders of $53.3 million for the third quarter of 2023. Basic

and diluted earnings per common share were both $1.10 in the third

quarter of 2024, compared to $0.96 and $0.95, respectively, in the

second quarter of 2024 and $0.98 for both in the third quarter of

2023.

Annualized return on average assets was 1.43% and annualized

return on average common stockholders’ equity was 15.55% for the

third quarter of 2024, compared to 1.37% and 15.34%, respectively,

for the third quarter of 2023.

Net interest income was $115.1 million for the third quarter of

2024, compared to $105.9 million for the second quarter of 2024 and

$99.7 million for the third quarter of 2023. The net interest

margin in the third quarter of 2024 was 2.84% compared to 2.79% in

the second quarter of 2024 and 2.64% in the third quarter of 2023.

Loan yields were 6.62% during the third quarter of 2024 compared to

6.48% during the second quarter of 2024 and 6.13% during the third

quarter of 2023. Investment yields were 3.57% during the third

quarter of 2024 compared to 3.33% during the second quarter of 2024

and 3.07% during the third quarter of 2023. Average

interest-bearing deposit rates were 4.12% during the third quarter

of 2024, compared to 4.09% during the second quarter of 2024 and

3.84% during the third quarter of 2023. Average federal funds

purchased rates were 5.42% during third quarter of 2024, compared

to 5.50% during the second quarter of 2024 and 5.43% during the

third quarter of 2023.

Average loans for the third quarter of 2024 were $12.37 billion,

an increase of $303.7 million, or 10.0% annualized, from average

loans of $12.06 billion for the second quarter of 2024, and an

increase of $803.6 million, or 7.0%, from average loans of $11.56

billion for the third quarter of 2023. Ending total loans for the

third quarter of 2024 were $12.34 billion, an increase of $5.4

million, or 0.2% annualized, from $12.33 billion for the second

quarter of 2024, and an increase of $697.1 million, or 6.0%, from

$11.64 billion for the third quarter of 2023.

Average total deposits for the third quarter of 2024 were $13.52

billion, an increase of $653.7 million, or 20.2% annualized, from

average total deposits of $12.86 billion for the second quarter of

2024, and an increase of $838.3 million, or 6.6%, from average

total deposits of $12.68 billion for the third quarter of 2023.

Ending total deposits for the third quarter of 2024 were $13.15

billion, a decrease of $112.9 million, or 3.4% annualized, from

$13.26 billion for the second quarter of 2024, and remained

unchanged from $13.14 billion for the third quarter of 2023.

Non-performing assets to total assets were 0.25% for the third

quarter of 2024, compared to 0.23% for the second quarter of 2024

and 0.15% for the third quarter of 2023. The increase in

non-performing assets to total assets can primarily be attributed

to a single relationship that moved to non-accrual status during

the first quarter of 2024. Annualized net charge-offs to average

loans were 0.09% for the third quarter of 2024, compared to 0.10%

for the second quarter of 2024 and 0.15% for the third quarter of

2023. The allowance for credit losses as a percent of total loans

at September 30, 2024, June 30, 2024, and September 30, 2023, was

1.31%, 1.28%, and 1.31%, respectively. We recorded a $5.7 million

provision for credit losses in the third quarter of 2024, $2.7

million of which is a provision for the potential impact of

Hurricane Helene, which struck the Florida coast on September 26th

and caused widespread damage from Florida to the Carolinas. In

early October Hurricane Milton struck the west coast of Florida and

tracked across the middle of the state. Management is assessing the

impact of both hurricanes to determine if additional provisions are

warranted. We recorded provision for credit losses of $5.4 million

in the second quarter of 2024, and $4.3 million in the third

quarter of 2023. During the third quarter of 2024, we reclassified

the Reserve for Unfunded Commitments from Other Liabilities and

Other Expenses to Allowance for Credit Losses and Provision for

Credit Losses, respectively.

Non-interest income increased $414,000, or 5.1%, to $8.5 million

for the third quarter of 2024 from $8.1 million in the third

quarter of 2023, and decreased $342,000, or 3.8%, on a linked

quarter basis. Service charges on deposit accounts increased

$178,000, or 8.2%, to $2.3 million for the third quarter of 2024

from $2.2 million in the third quarter of 2023, and increased

$48,000, or 2.1%, on a linked quarter basis. Mortgage banking

revenue increased $527,000, or 63.9%, to $1.4 million for the third

quarter of 2024 from $825,000 in the third quarter of 2023, and

decreased $27,000, or 2.0%, on a linked quarter basis. Net credit

card revenue decreased $607,000, or 24.0%, to $1.9 million for the

third quarter of 2024 from $2.5 million in the third quarter of

2023, and decreased $408,000, or 17.5%, on a linked quarter basis.

Bank-owned life insurance (“BOLI”) income increased $295,000, or

16.2%, to $2.1 million for the third quarter of 2024 from $1.8

million in the third quarter of 2023, and increased $55,000, or

2.7%, on a linked quarter basis. Other operating income increased

$21,000, or 2.6%, to $818,000 for the third quarter of 2024 from

$797,000 in the third quarter of 2023, and decreased $10,000, or

1.2%, on a linked quarter basis.

Non-interest expense increased $4.0 million, or 9.5%, to $45.6

million for the third quarter of 2024 from $41.7 million in the

third quarter of 2023, and increased $2.8 million, or 6.6%, on a

linked quarter basis. During the second quarter of 2024, the

Company recorded the impact from election of the proportional

amortization method to account for historical and new market tax

credit investments made primarily for the purpose of receiving

income tax credits due to our adoption of Accounting Standards

Update 2023-02. The proportional amortization method results in the

cost of the investment being amortized in proportion to the income

tax credits and other income tax benefits received, with the

amortization of the investment and the income tax credits being

presented net in the income statement as a component of income tax

expense. Previously the amortization of the investment was included

in other non-interest expenses. Salary and benefit expense

increased $5.0 million, or 24.8%, to $25.1 million for the third

quarter of 2024 from $20.1 million in the third quarter of 2023,

and increased $844,000, or 3.5%, on a linked quarter basis. The

number of full-time equivalent (“FTE”) employees increased by 52,

or 9.2%, to 620 at September 30, 2024 compared to 568 at September

30, 2023, and decreased by 5, or 0.8%, from the end of the second

quarter of 2024. The increase in salary and benefit expense

year-over-year continues to be largely due to the normalization of

incentives and increased salary expenses due to an increase in FTE

employees. Incentives increased approximately $1.8 million, and

salaries increased approximately $2.1 million from the third

quarter of 2023. Equipment and occupancy expense increased

$216,000, or 6.0%, to $3.8 million for the third quarter of 2024

from $3.6 million in the third quarter of 2023, and increased

$228,000, or 6.4%, on a linked quarter basis. Third party

processing and other services expense increased $1.5 million, or

22.7%, to $8.0 million for the third quarter of 2024 from $6.5

million in the third quarter of 2023, and increased $570,000, or

7.6%, on a linked quarter basis. Professional services expense

increased $450,000, or 35.6%, to $1.7 million for the third quarter

of 2024 from $1.3 million in the third quarter of 2023, and

decreased $26,000, or 1.5%, on a linked quarter basis. FDIC and

other regulatory assessments increased $9,000, or 0.4%, to $2.4

million for the third quarter of 2024 from $2.3 million in the

third quarter of 2023, and increased $153,000, or 6.9%, on a linked

quarter basis. In the first quarter of 2024, the FDIC implemented a

special assessment adjustment to recapitalize the Deposit Insurance

Fund resulting in an expense of $1.8 million. See “GAAP

Reconciliation and Management Explanation of Non-GAAP Financial

Measures”. Other operating expenses decreased $3.3 million, or

41.6%, to $4.6 million for the third quarter of 2024 from $7.8

million in the third quarter of 2023, and increased $949,000, or

26.2%, on a linked quarter basis. The decrease in other operating

expenses were largely due to the application of the proportional

amortization method to account for historical and new market tax

credit investments, discussed above. The efficiency ratio was

36.90% during the third quarter of 2024 compared to 38.64% during

the third quarter of 2023 and 37.31% during the second quarter of

2024.

Income tax expense increased $3.9 million, or 45.9%, to $12.5

million in the third quarter of 2024, compared to $8.5 million in

the third quarter of 2023. Our effective tax rate was 17.23% for

the third quarter of 2024 compared to 13.81% for the third quarter

of 2023. We recognized a reduction in provision for income taxes

resulting from excess tax benefits from the exercise and vesting of

stock options and restricted stock during the third quarters of

2024 and 2023 of $111,000 and $0, respectively.

About ServisFirst Bancshares, Inc.

ServisFirst Bancshares, Inc. is a bank holding company based in

Birmingham, Alabama. Through its subsidiary ServisFirst Bank,

ServisFirst Bancshares, Inc. provides business and personal

financial services from locations in Alabama, Florida, Georgia,

North and South Carolina, Tennessee, and Virginia. We also operate

loan production offices in Florida and Tennessee. Through the

ServisFirst Bank, we originate commercial, consumer and other loans

and accept deposits, provide electronic banking services, such as

online and mobile banking, including remote deposit capture,

deliver treasury and cash management services and provide

correspondent banking services to other financial institutions.

ServisFirst Bancshares, Inc. files periodic reports with the

U.S. Securities and Exchange Commission (SEC). Copies of its

filings may be obtained through the SEC’s website at www.sec.gov or

at www.servisfirstbancshares.com.

Statements in this press release that are not historical facts,

including, but not limited to, statements concerning future

operations, results or performance, are hereby identified as

"forward-looking statements" for the purpose of the safe harbor

provided by Section 21E of the Securities Exchange Act of 1934 and

Section 27A of the Securities Act of 1933. The words "believe,"

"expect," "anticipate," "project," “plan,” “intend,” “will,”

“could,” “would,” “might” and similar expressions often signify

forward-looking statements. Such statements involve inherent risks

and uncertainties. ServisFirst Bancshares, Inc. cautions that such

forward-looking statements, wherever they occur in this press

release or in other statements attributable to ServisFirst

Bancshares, Inc., are necessarily estimates reflecting the judgment

of ServisFirst Bancshares, Inc.’s senior management and involve a

number of risks and uncertainties that could cause actual results

to differ materially from those suggested by the forward-looking

statements. Such forward-looking statements should, therefore, be

considered in light of various factors that could affect the

accuracy of such forward-looking statements, including, but not

limited to: general economic conditions, especially in the credit

markets and in the Southeast; the performance of the capital

markets; changes in interest rates, yield curves and interest rate

spread relationships; changes in accounting and tax principles,

policies or guidelines; changes in legislation or regulatory

requirements; changes as a result of our reclassification as a

large financial institution by the FDIC; changes in our loan

portfolio and the deposit base; possible changes in laws and

regulations and governmental monetary and fiscal policies,

including, but not limited to, the Federal Reserve policies in

connection with continued or re-emerging inflationary pressures and

the ability of the U.S. Congress to increase the U.S. statutory

debt limit as needed; computer hacking or cyber-attacks resulting

in unauthorized access to confidential or proprietary information;

substantial, unexpected or prolonged changes in the level or cost

of liquidity; the cost and other effects of legal and

administrative cases and similar contingencies; possible changes in

the creditworthiness of customers and the possible impairment of

the collectability of loans and the value of collateral; the effect

of natural disasters, such as hurricanes and tornados, in our

geographic markets; and increased competition from both banks and

non-bank financial institutions. For discussion of these and other

risks that may cause actual results to differ from expectations,

please refer to “Cautionary Note Regarding Forward-looking

Statements” and “Risk Factors” in our most recent Annual Report on

Form 10-K, in our Quarterly Reports on Form 10-Q for fiscal year

2024, and our other SEC filings. If one or more of the factors

affecting our forward-looking information and statements proves

incorrect, then our actual results, performance or achievements

could differ materially from those expressed in, or implied by,

forward-looking information and statements contained herein.

Accordingly, you should not place undue reliance on any

forward-looking statements, which speak only as of the date made.

ServisFirst Bancshares, Inc. assumes no obligation to update or

revise any forward-looking statements that are made from time to

time.

More information about ServisFirst Bancshares, Inc. may be

obtained over the Internet at www.servisfirstbancshares.com or by

calling (205) 949-0302.

SELECTED FINANCIAL HIGHLIGHTS

(UNAUDITED)

(In thousands except share and per share

data)

3rd Quarter 2024

2nd Quarter 2024

1st Quarter 2024

4th Quarter 2023

3rd Quarter 2023

CONSOLIDATED STATEMENT OF INCOME

Interest income

$

247,979

$

227,540

$

226,710

$

229,062

$

213,206

Interest expense

132,858

121,665

124,215

127,375

113,508

Net interest income

115,121

105,875

102,495

101,687

99,698

Provision for credit losses

5,659

5,353

4,368

3,582

4,282

Net interest income after provision for

credit losses

109,462

100,522

98,127

98,105

95,416

Non-interest income

8,549

8,891

8,813

7,379

8,135

Non-interest expense

45,632

42,818

46,303

58,258

41,663

Income before income tax

72,379

66,595

60,637

47,226

61,888

Provision for income tax

12,472

14,459

10,611

5,152

8,548

Net income

59,907

52,136

50,026

42,074

53,340

Preferred stock dividends

-

31

-

31

-

Net income available to common

stockholders

$

59,907

$

52,105

$

50,026

$

42,043

$

53,340

Earnings per share - basic

$

1.10

$

0.96

$

0.92

$

0.77

$

0.98

Earnings per share - diluted

$

1.10

$

0.95

$

0.92

$

0.77

$

0.98

Average diluted shares outstanding

54,642,582

54,608,679

54,595,384

54,548,719

54,530,635

CONSOLIDATED BALANCE SHEET DATA

Total assets

$

16,447,876

$

16,049,812

$

15,721,630

$

16,129,668

$

16,044,332

Loans

12,338,226

12,332,780

11,880,696

11,658,829

11,641,130

Debt securities

1,867,587

1,941,641

1,941,625

1,882,847

1,878,701

Non-interest-bearing demand deposits

2,576,329

2,475,415

2,627,639

2,643,101

2,621,072

Total deposits

13,146,529

13,259,392

12,751,448

13,273,511

13,142,376

Borrowings

64,741

64,739

64,737

64,735

64,751

Stockholders' equity

1,570,269

1,510,576

1,476,036

1,440,405

1,401,384

Shares outstanding

54,551,543

54,521,479

54,507,778

54,461,580

54,425,447

Book value per share

$

28.79

$

27.71

$

27.08

$

26.45

$

25.75

Tangible book value per share (1)

$

28.54

$

27.46

$

26.83

$

26.20

$

25.50

SELECTED FINANCIAL RATIOS (Annualized)

Net interest margin

2.84

%

2.79

%

2.66

%

2.57

%

2.64

%

Return on average assets

1.43

%

1.34

%

1.26

%

1.04

%

1.37

%

Return on average common stockholders'

equity

15.55

%

14.08

%

13.82

%

11.78

%

15.34

%

Efficiency ratio

36.90

%

37.31

%

43.30

%

55.23

%

38.64

%

Non-interest expense to average earning

assets

1.13

%

1.13

%

1.20

%

1.47

%

1.10

%

CAPITAL RATIOS (2)

Common equity tier 1 capital to

risk-weighted assets

11.25

%

10.93

%

11.07

%

10.91

%

10.69

%

Tier 1 capital to risk-weighted assets

11.25

%

10.93

%

11.08

%

10.92

%

10.69

%

Total capital to risk-weighted assets

12.77

%

12.43

%

12.61

%

12.45

%

12.25

%

Tier 1 capital to average assets

9.54

%

9.81

%

9.44

%

9.12

%

9.35

%

Tangible common equity to total tangible

assets (1)

9.47

%

9.33

%

9.31

%

8.85

%

8.66

%

(1) This press release contains certain

non-GAAP financial measures. Please see “GAAP Reconciliation and

Management Explanation of Non-GAAP Financial Measures.”

(2) Regulatory capital ratios for most

recent period are preliminary.

GAAP Reconciliation and Management Explanation of Non-GAAP

Financial Measures

This press release contains certain non-GAAP financial measures,

including adjusted net income, adjusted net income available to

common stockholders, adjusted diluted earnings per share, adjusted

return on average assets, adjusted return on average common

stockholders’ equity, and adjusted efficiency ratio. During the

fourth quarter of 2023, we recorded a one-time expense of $7.2

million associated with the FDIC’s special assessment to

recapitalize the Deposit Insurance Fund following bank failures in

the spring of 2023. This assessment was updated in the first

quarter of 2024 resulting in additional expense of $1.8 million.

These expenses are unusual, or infrequent, in nature and not part

of the noninterest expense run rate. Each of adjusted net income,

adjusted net income available to common stockholders, adjusted

diluted earnings per share, adjusted return on average assets,

adjusted return on average common stockholders’ equity and adjusted

efficiency ratio excludes the impact of these items, net of tax,

and are all considered non-GAAP financial measures. This press

release also contains the non-GAAP financial measures of tangible

common stockholders’ equity, total tangible assets, tangible book

value per share and tangible common equity to total tangible

assets, each of which excludes goodwill associated with our

acquisition of Metro Bancshares, Inc. in January 2015.

We believe these non-GAAP financial measures provide useful

information to management and investors that is supplementary to

our financial condition, results of operations and cash flows

computed in accordance with GAAP; however, we acknowledge that

these non-GAAP financial measures have a number of limitations. As

such, you should not view these disclosures as a substitute for

results determined in accordance with GAAP, and they are not

necessarily comparable to non-GAAP financial measures that other

companies, including those in our industry, use. The following

reconciliation table provides a more detailed analysis of the

non-GAAP financial measures as of and for the comparative periods

presented in this press release. Dollars are in thousands, except

share and per share data.

At September 30, 2024

At June 30, 2024

At March 31, 2024

At December 31, 2023

At September 30, 2023

Book value per share - GAAP

$

28.79

$

27.71

$

27.08

$

26.45

$

25.75

Total common stockholders' equity -

GAAP

1,570,269

1,570,994

1,476,036

1,440,405

1,401,384

Adjustment for Goodwill

(13,615)

(13,615)

(13,615)

(13,615)

(13,615)

Tangible common stockholders' equity -

non-GAAP

$

1,556,654

$

1,557,379

$

1,462,421

$

1,426,790

$

1,387,769

Tangible book value per share -

non-GAAP

$

28.54

$

27.46

$

26.83

$

26.22

$

25.50

Stockholders' equity to total assets -

GAAP

9.55

%

9.55

%

9.39

%

8.93

%

8.73

%

Total assets - GAAP

$

16,447,876

$

16,448,582

$

16,048,819

$

16,129,668

$

16,044,332

Adjustment for Goodwill

(13,615)

(13,615)

(13,615)

(13,615)

(13,615)

Total tangible assets - non-GAAP

$

16,434,261

$

16,434,967

$

16,035,204

$

16,116,053

$

16,030,717

Tangible common equity to total tangible

assets - non-GAAP

9.47

%

9.48

%

9.33

%

8.85

%

8.66

%

Nine Months Ended September 30,

2024

Nine Months Ended September 30,

2023

Net income - GAAP

$

162,069

$

164,779

Adjustments:

FDIC special assessment

1,799

-

Tax on adjustments

(452)

-

Adjusted net income - non-GAAP

$

163,416

$

164,779

Net income available to common

stockholders - GAAP

$

162,038

$

164,748

Adjustments:

FDIC special assessment

1,799

-

Tax on adjustments

(452)

-

Adjusted net income available to common

stockholders - non-GAAP

$

163,385

$

164,748

Diluted earnings per share - GAAP

$

2.97

$

3.02

Adjustments:

FDIC special assessment

0.03

-

Tax on adjustments

(0.01)

-

Adjusted diluted earnings per share -

non-GAAP

$

2.99

$

3.02

Return on average assets - GAAP

1.34

%

1.50

%

Net income available to common

stockholders - GAAP

$

162,038

$

164,748

Adjustments:

FDIC special assessment

1,799

-

Tax on adjustments

(452)

-

Adjusted net income available to common

stockholders - non-GAAP

$

163,385

$

164,748

Average assets - GAAP

$

16,095,859

$

14,711,108

Adjusted return on average assets -

non-GAAP

1.36

%

1.50

%

Return on average common stockholders'

equity - GAAP

14.51

%

16.23

%

Net income available to common

stockholders - GAAP

$

162,038

$

164,748

Adjustments:

FDIC special assessment

1,799

-

Tax on adjustments

(452)

-

Adjusted diluted earnings per share -

non-GAAP

$

163,385

$

164,748

Average common stockholders' equity -

GAAP

$

1,491,880

$

1,356,857

Adjusted return on average common

stockholders' equity non-GAAP

14.63

%

16.23

%

Efficiency ratio

38.53

%

36.05

%

Non-interest expense - GAAP

$

134,250

$

119,793

Adjustments:

FDIC special assessment

1,799

-

Adjusted non-interest expense

$

132,451

$

119,793

Net interest income plus non-interest

income - GAAP

$

349,744

$

332,288

Adjusted efficiency ratio - non-GAAP

37.87

%

36.05

%

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(Dollars in thousands)

September 30, 2024

September 30, 2023

% Change

ASSETS

Cash and due from banks

$

142,372

$

112,150

27

%

Interest-bearing balances due from

depository institutions

1,614,317

1,861,924

(13)

%

Federal funds sold

3,542

91,035

(96)

%

Cash and cash equivalents

1,760,231

2,065,109

(15)

%

Available for sale debt securities, at

fair value

1,139,007

834,802

36

%

Held to maturity debt securities (fair

value of $673,023 and $933,006, respectively)

728,580

1,043,899

(30)

%

Restricted equity securities

11,300

10,226

11

%

Mortgage loans held for sale

8,453

6,333

33

%

Loans

12,338,226

11,641,130

6

%

Less allowance for credit losses

(162,057)

(152,247)

6

%

Loans, net

12,176,169

11,488,883

6

%

Premises and equipment, net

61,328

59,516

3

%

Goodwill

13,615

13,615

-

%

Other assets

549,194

521,949

5

%

Total assets

$

16,447,876

$

16,044,332

3

%

LIABILITIES AND STOCKHOLDERS' EQUITY

Liabilities:

Deposits:

Non-interest-bearing demand

$

2,576,329

$

2,621,072

(2)

%

Interest-bearing

10,570,200

10,521,304

-

%

Total deposits

13,146,529

13,142,376

-

%

Federal funds purchased

1,542,623

1,370,289

13

%

Other borrowings

64,741

64,751

-

%

Other liabilities

123,714

65,532

89

%

Total liabilities

14,877,607

14,642,948

2

%

Stockholders' equity:

Preferred stock, par value $0.001 per

share; 1,000,000 authorized and undesignated at September 30, 2024

and September 30, 2023

-

-

-

%

Common stock, par value $0.001 per share;

200,000,000 shares authorized; 54,551,543 shares issued and

outstanding at September 30, 2024, and 54,425,447 shares issued and

outstanding at September 30, 2023

54

54

-

%

Additional paid-in capital

235,649

231,588

2

%

Retained earnings

1,365,701

1,229,080

11

%

Accumulated other comprehensive loss

(31,635)

(59,838)

(47)

%

Total stockholders' equity attributable to

ServisFirst Bancshares, Inc.

1,569,769

1,400,884

12

%

Noncontrolling interest

500

500

-

%

Total stockholders' equity

1,570,269

1,401,384

12

%

Total liabilities and stockholders'

equity

$

16,447,876

$

16,044,332

3

%

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(In thousands except per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Interest income:

Interest and fees on loans

$

205,952

$

178,754

$

587,230

$

514,204

Taxable securities

17,493

15,522

49,630

37,987

Nontaxable securities

7

15

25

53

Federal funds sold

31

985

1,110

1,826

Other interest and dividends

24,496

17,930

64,234

30,114

Total interest income

247,979

213,206

702,229

584,184

Interest expense:

Deposits

113,211

95,901

321,948

223,585

Borrowed funds

19,647

17,607

56,790

51,349

Total interest expense

132,858

113,508

378,738

274,934

Net interest income

115,121

99,698

323,491

309,250

Provision for credit losses

5,659

4,282

15,883

15,133

Net interest income after provision for

credit losses

109,462

95,416

307,608

294,117

Non-interest income:

Service charges on deposit accounts

2,341

2,163

6,784

6,239

Mortgage banking

1,352

825

3,409

1,963

Credit card income

1,925

2,532

6,413

6,627

Bank-owned life insurance income

2,113

1,818

7,402

5,935

Other operating income

818

797

2,245

2,274

Total non-interest income

8,549

8,135

26,253

23,038

Non-interest expense:

Salaries and employee benefits

25,057

20,080

72,256

57,941

Equipment and occupancy expense

3,795

3,579

10,919

10,435

Third party processing and other

services

8,035

6,549

22,666

20,031

Professional services

1,715

1,265

4,920

4,499

FDIC and other regulatory assessments

2,355

2,346

8,462

6,105

Other real estate owned expense

103

18

141

30

Other operating expense

4,572

7,826

14,886

20,752

Total non-interest expense

45,632

41,663

134,250

119,793

Income before income tax

72,379

61,888

199,611

197,362

Provision for income tax

12,472

8,548

37,542

32,583

Net income

59,907

53,340

162,069

164,779

Dividends on preferred stock

-

-

31

31

Net income available to common

stockholders

$

59,907

$

53,340

$

162,038

$

164,748

Basic earnings per common share

$

1.10

$

0.98

$

2.97

$

3.03

Diluted earnings per common share

$

1.10

$

0.98

$

2.97

$

3.02

LOANS BY TYPE (UNAUDITED)

(In thousands)

3rd Quarter 2024

2nd Quarter 2024

1st Quarter 2024

4th Quarter 2023

3rd Quarter 2023

Commercial, financial and agricultural

$

2,793,989

$

2,935,577

$

2,834,102

$

2,823,986

$

2,890,535

Real estate - construction

1,439,648

1,510,677

1,546,716

1,519,619

1,509,937

Real estate - mortgage:

Owner-occupied commercial

2,441,687

2,399,644

2,377,042

2,257,163

2,237,684

1-4 family mortgage

1,409,981

1,350,428

1,284,888

1,249,938

1,170,099

Other mortgage

4,190,935

4,072,007

3,777,758

3,744,346

3,766,124

Subtotal: Real estate - mortgage

8,042,603

7,822,079

7,439,688

7,251,447

7,173,907

Consumer

61,986

64,447

60,190

63,777

66,751

Total loans

$

12,338,226

$

12,332,780

$

11,880,696

$

11,658,829

$

11,641,130

SUMMARY OF CREDIT LOSS EXPERIENCE

(UNAUDITED)

(Dollars in thousands)

3rd Quarter 2024

2nd Quarter 2024

1st Quarter 2024

4th Quarter 2023

3rd Quarter 2023

Allowance for credit losses:

Beginning balance

$

158,092

$

155,892

$

153,317

$

152,247

$

152,272

Loans charged off:

Commercial, financial and agricultural

3,020

3,355

1,842

2,831

4,783

Real estate - construction

-

-

-

89

19

Real estate - mortgage

252

119

67

14

-

Consumer

155

108

98

231

341

Total charge offs

3,427

3,582

2,007

3,165

5,143

Recoveries:

Commercial, financial and agricultural

616

406

199

614

825

Real estate - construction

-

8

-

-

-

Real estate - mortgage

2

-

6

-

-

Consumer

37

15

9

39

11

Total recoveries

655

429

214

653

836

Net charge-offs

2,772

3,153

1,793

2,512

4,307

Reclassification from other

liabilities

1,079

-

-

-

-

Provision for credit losses

5,658

5,353

4,368

3,582

4,282

Ending balance

$

162,057

158,092

155,892

153,317

152,247

Allowance for credit losses to total

loans

1.31

%

1.28

%

1.31

%

1.32

%

1.31

%

Allowance for credit losses to total

average loans

1.31

%

1.31

%

1.33

%

1.32

%

1.31

%

Net charge-offs to total average loans

0.09

%

0.10

%

0.06

%

0.09

%

0.15

%

Provision for credit losses to total

average loans

0.18

%

0.18

%

0.15

%

0.12

%

0.15

%

Nonperforming assets:

Nonaccrual loans

$

37,075

$

33,454

$

34,457

$

19,349

$

20,912

Loans 90+ days past due and accruing

2,093

1,482

380

2,184

1,692

Other real estate owned and repossessed

assets

2,723

1,458

490

995

690

Total

$

41,891

$

36,394

$

35,327

$

22,528

$

23,294

Nonperforming loans to total loans

0.32

%

0.28

%

0.29

%

0.18

%

0.19

%

Nonperforming assets to total assets

0.25

%

0.23

%

0.22

%

0.14

%

0.15

%

Nonperforming assets to earning assets

0.26

%

0.23

%

0.23

%

0.14

%

0.16

%

Allowance for credit losses to nonaccrual

loans

437.11

%

472.57

%

452.42

%

795.17

%

731.74

%

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(In thousands except per share data)

3rd Quarter 2024

2nd Quarter 2024

1st Quarter 2024

4th Quarter 2023

3rd Quarter 2023

Interest income:

Interest and fees on loans

$

205,952

$

194,300

$

186,978

$

184,897

$

178,754

Taxable securities

17,493

16,158

15,979

15,512

15,522

Nontaxable securities

7

9

9

12

15

Federal funds sold

31

538

541

1,018

985

Other interest and dividends

24,496

16,535

23,203

27,623

17,930

Total interest income

247,979

227,540

226,710

229,062

213,206

Interest expense:

Deposits

113,211

104,671

104,066

108,155

95,901

Borrowed funds

19,647

16,994

20,149

19,220

17,607

Total interest expense

132,858

121,665

124,215

127,375

113,508

Net interest income

115,121

105,875

102,495

101,687

99,698

Provision for credit losses

5,659

5,353

4,368

3,582

4,282

Net interest income after

provision for credit losses

109,462

100,522

98,127

98,105

95,416

Non-interest income:

Service charges on deposit accounts

2,341

2,293

2,150

2,181

2,163

Mortgage banking

1,352

1,379

678

792

825

Credit card income

1,925

2,333

2,155

2,004

2,532

Bank-owned life insurance income

2,113

2,058

3,231

1,639

1,818

Other operating income

818

828

599

763

797

Total non-interest income

8,549

8,891

8,813

7,379

8,135

Non-interest expense:

Salaries and employee benefits

25,057

24,213

22,986

23,024

20,080

Equipment and occupancy expense

3,795

3,567

3,557

3,860

3,579

Third party processing and other

services

8,035

7,465

7,166

7,841

6,549

Professional services

1,715

1,741

1,464

1,417

1,265

FDIC and other regulatory assessments

2,355

2,202

3,905

9,509

2,346

Other real estate owned expense

103

7

30

17

18

Other operating expense

4,572

3,623

7,195

12,590

7,826

Total non-interest expense

45,632

42,818

46,303

58,258

41,663

Income before income tax

72,379

66,595

60,637

47,226

61,888

Provision for income tax

12,472

14,459

10,611

5,152

8,548

Net income

59,907

52,136

50,026

42,074

53,340

Dividends on preferred stock

-

31

-

31

-

Net income available to common

stockholders

$

59,907

$

52,105

$

50,026

$

42,043

$

53,340

Basic earnings per common share

$

1.10

$

0.96

$

0.92

$

0.77

$

0.98

Diluted earnings per common share

$

1.10

$

0.95

$

0.92

$

0.77

$

0.98

AVERAGE BALANCE SHEETS AND NET INTEREST

ANALYSIS (UNAUDITED)

ON A FULLY TAXABLE-EQUIVALENT BASIS

(Dollars in thousands)

3rd Quarter 2024

2nd Quarter 2024

1st Quarter 2024

4th Quarter 2023

3rd Quarter 2023

Average Balance

Yield / Rate

Average Balance

Yield / Rate

Average Balance

Yield / Rate

Average Balance

Yield / Rate

Average Balance

Yield / Rate

Assets:

Interest-earning assets:

Loans, net of unearned income (1)

Taxable

$

12,351,073

6.63

%

$

12,045,743

6.48

%

$

11,723,391

6.41

%

$

11,580,716

6.33

%

$

11,545,003

6.13

%

Tax-exempt (2)

15,584

1.86

17,230

2.08

17,605

5.00

17,787

4.71

18,023

4.71

Total loans, net of unearned income

12,366,657

6.62

12,062,973

6.48

11,740,996

6.40

11,598,503

6.32

11,563,026

6.13

Mortgage loans held for sale

10,674

3.80

6,761

6.13

4,770

5.57

5,105

6.22

5,476

6.67

Debt securities:

Taxable

1,955,632

3.57

1,936,818

3.33

2,013,295

3.16

2,007,636

3.08

2,029,995

3.07

Tax-exempt (2)

815

4.42

1,209

3.64

1,296

3.40

1,739

2.30

2,408

2.49

Total securities (3)

1,956,447

3.57

1,938,027

3.33

2,014,591

3.16

2,009,375

3.08

2,032,403

3.07

Federal funds sold

2,106

5.86

38,475

5.62

37,298

5.83

72,178

5.60

74,424

5.25

Restricted equity securities

11,290

7.36

11,290

7.16

10,417

7.57

10,216

8.74

8,471

5.90

Interest-bearing balances with banks

1,775,192

5.46

1,183,482

5.57

1,687,977

5.48

1,981,411

5.49

1,293,243

5.45

Total interest-earning assets

$

16,122,366

6.12

$

15,241,008

6.01

$

15,496,049

5.88

$

15,676,788

5.80

$

14,977,043

5.65

Non-interest-earning assets:

Cash and due from banks

103,539

96,646

98,813

101,741

111,566

Net premises and equipment

60,607

59,653

60,126

60,110

60,121

Allowance for credit losses, accrued

interest and other assets

340,621

300,521

302,592

283,435

283,357

Total assets

$

16,627,133

$

15,697,828

$

15,957,580

$

16,122,074

$

15,432,087

Interest-bearing liabilities:

Interest-bearing deposits:

Checking

$

2,318,384

2.97

%

$

2,227,527

2.85

%

$

2,339,548

2.69

%

$

2,245,431

2.91

%

$

2,153,973

2.72

%

Savings

102,627

1.76

105,955

1.71

106,924

1.76

107,035

1.72

112,814

1.61

Money market

7,321,503

4.45

6,810,799

4.46

6,761,495

4.48

7,106,190

4.44

6,538,426

4.24

Time deposits

1,197,650

4.52

1,157,528

4.47

1,164,204

4.37

1,111,350

4.18

1,093,388

3.89

Total interest-bearing deposits

10,940,164

4.12

10,301,809

4.09

10,372,171

4.04

10,570,006

4.06

9,898,601

3.84

Federal funds purchased

1,391,118

5.42

1,193,190

5.50

1,422,828

5.50

1,338,110

5.49

1,237,721

5.43

Other borrowings

64,738

4.22

64,738

4.27

64,736

4.26

64,734

4.23

64,734

4.23

Total interest-bearing liabilities

$

12,396,020

4.26

%

$

11,559,737

4.23

%

$

11,859,735

4.21

%

$

11,972,850

4.22

%

$

11,201,056

4.02

%

Non-interest-bearing liabilities:

Non-interest-bearing checking

2,575,575

2,560,245

2,550,841

2,656,504

2,778,858

Other liabilities

122,455

89,418

91,066

76,651

72,924

Stockholders' equity

1,574,902

1,536,013

1,503,240

1,475,366

1,437,766

Accumulated other comprehensive loss

(41,819)

(47,584)

(47,302)

(59,297)

(58,517)

Total liabilities and stockholders'

equity

$

16,627,133

$

15,697,828

$

15,957,580

$

16,122,074

$

15,432,087

Net interest spread

1.86

%

1.78

%

1.67

%

1.58

%

1.63

%

Net interest margin

2.84

%

2.79

%

2.66

%

2.57

%

2.64

%

(1) Average loans include nonaccrual loans

in all periods. Loan fees of $3,949, $3,317, $3,655, $4,175, and

$2,996 are included in interest income in the third quarter of

2024, second quarter of 2024, first quarter of 2024, fourth quarter

of 2023, and third quarter of 2023, respectively.

(2) Interest income and yields are

presented on a fully taxable equivalent basis using a tax rate of

21%.

(3) Unrealized losses on debt securities

of $(48,770), $(67,823), $(68,162), $(84,647), and $(83,815) for

the third quarter of 2024, second quarter of 2024, first quarter of

2024, fourth quarter of 2023, and third quarter of 2023,

respectively, are excluded from the yield calculation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021376550/en/

ServisFirst Bank Davis Mange (205) 949-3420

dmange@servisfirstbank.com

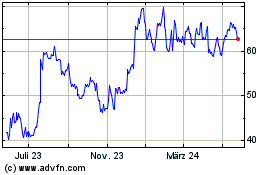

ServisFirst Bancshares (NYSE:SFBS)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

ServisFirst Bancshares (NYSE:SFBS)

Historical Stock Chart

Von Jan 2024 bis Jan 2025