Solid core performance and peer-leading margin

position the company for consistent, sustainable performance.

Regions Financial Corp. (NYSE:RF) today reported earnings for

the first quarter ended March 31, 2024. The company reported first

quarter net income available to common shareholders of $343 million

and earnings per diluted share of $0.37. First quarter results

include the following notable items: an increase to the

industry-wide FDIC special assessment accrual, severance-related

charges, and the impact of certain securities repositioning. The

company reported $1.7 billion in total revenue during the quarter,

including $616 million in reported pre-tax pre-provision income(1)

and $700 million in adjusted pre-tax pre-provision income(1).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240419720638/en/

"We continue to focus on the successful execution of our

strategic plan, and that is reflected in our core performance,"

said John Turner, Chairman and CEO of Regions Financial Corp.

Turner added, "Our results reflect the strength and diversity of

our balance sheet, robust liquidity position, and proactive

interest rate risk management practices. Our hedging strategies

position us for success in a vast array of economic conditions and

support our commitment to generating consistent, sustainable

long-term performance as we once again generated top-quartile

returns and a peer-leading net interest margin."

SUMMARY OF FIRST QUARTER 2024 RESULTS:

Quarter Ended

(amounts in millions, except per share

data)

3/31/2024

12/31/2023

3/31/2023

Net income

$

368

$

391

$

612

Preferred dividends and other

25

24

24

Net income available to common

shareholders

$

343

$

367

$

588

Weighted-average diluted shares

outstanding

923

931

942

Actual shares outstanding—end of

period

918

924

935

Diluted earnings per common share

$

0.37

$

0.39

$

0.62

Selected items impacting

earnings:

Pre-tax adjusted items(1):

Adjustments to non-interest expense(1)

$

(34

)

$

(147

)

$

(2

)

Adjustments to non-interest income(1)

(50

)

(1

)

(1

)

Net provision benefit/(expense) from sale

of unsecured consumer loans***

—

(8

)

—

Total pre-tax adjusted items(1)

$

(84

)

$

(156

)

$

(3

)

Diluted EPS impact*

$

(0.07

)

$

(0.13

)

$

—

Pre-tax additional selected items**:

Incremental operational losses related to

check warranty claims

$

(22

)

$

—

$

—

Capital markets income (loss) -

CVA/DVA

(2

)

(5

)

(33

)

*

Based on income taxes at an approximate

25% incremental rate.

**

Items impacting results or trends during

the period, but are not considered non-GAAP adjustments.

***

The fourth quarter of 2023 loan sale had

an associated allowance of $27 million and incurred a $35 million

fair value mark recorded through charge-offs, resulting in a net

provision expense of $8 million.

Non-GAAP adjusted items(1) impacting the company's earnings are

identified to assist investors in analyzing Regions' operating

results on the same basis as that applied by management and provide

a basis to predict future performance.

Total revenue

Quarter Ended

($ amounts in millions)

3/31/2024

12/31/2023

3/31/2023

1Q24 vs. 4Q23

1Q24 vs. 1Q23

Net interest income

$

1,184

$

1,231

$

1,417

$

(47

)

(3.8

)%

$

(233

)

(16.4

)%

Taxable equivalent adjustment

13

13

13

—

—

%

—

—

%

Net interest income, taxable equivalent

basis

$

1,197

$

1,244

$

1,430

$

(47

)

(3.8

)%

$

(233

)

(16.3

)%

Net interest margin (FTE)

3.55

%

3.60

%

4.22

%

Non-interest income:

Service charges on deposit accounts

$

148

$

143

$

155

$

5

3.5

%

$

(7

)

(4.5

)%

Card and ATM fees

116

127

121

(11

)

(8.7

)%

(5

)

(4.1

)%

Wealth management income

119

117

112

2

1.7

%

7

6.3

%

Capital markets income

91

48

42

43

89.6

%

49

116.7

%

Mortgage income

41

31

24

10

32.3

%

17

70.8

%

Commercial credit fee income

27

27

26

—

NM

1

3.8

%

Bank-owned life insurance

23

22

17

1

4.5

%

6

35.3

%

Securities gains (losses), net

(50

)

(2

)

(2

)

(48

)

NM

(48

)

NM

Market value adjustments on employee

benefit assets*

15

12

(1

)

3

25.0

%

16

NM

Other

33

55

40

(22

)

(40.0

)%

(7

)

(17.5

)%

Non-interest income

$

563

$

580

$

534

$

(17

)

(2.9

)%

$

29

5.4

%

Total revenue

$

1,747

$

1,811

$

1,951

$

(64

)

(3.5

)%

$

(204

)

(10.5

)%

Adjusted total revenue

(non-GAAP)(1)

$

1,797

$

1,812

$

1,952

$

(15

)

(0.8

)%

$

(155

)

(7.9

)%

NM - Not Meaningful

* These market value adjustments relate to

assets held for employee and director benefits that are offset

within salaries and employee benefits and other non-interest

expense.

Total revenue decreased approximately 4 percent on a reported

basis and 1 percent on an adjusted basis(1) compared to the fourth

quarter of 2023. Consistent with the company's expectations, net

interest income decreased 4 percent to $1.2 billion compared to the

fourth quarter attributable to higher deposit and funding costs,

partially offset by the impact of higher market interest rates on

new fixed-rate asset originations. Total net interest margin

decreased 5 basis points to 3.55 percent.

Non-interest income decreased 3 percent on a reported basis but

increased 6 percent on an adjusted basis(1) compared to the fourth

quarter of 2023. The reported difference was attributable to a $50

million pre-tax loss on securities repositioning executed during

the quarter. Service charges increased 3 percent as seasonally

higher treasury management fees offset 1 less business day in the

quarter. Capital markets income increased 90 percent to $91

million, attributable to increased real estate transactions, merger

and acquisitions advisory services, and increased debt capital

markets activity. A portion of both real estate capital markets

activity and merger and acquisitions advisory services initiated in

the prior year were delayed by clients due to market conditions and

ultimately closed in the first quarter. Mortgage income also

increased during the quarter primarily due to a $6 million update

to the company's mortgage pipeline valuation, as well as improved

volumes and margins. Wealth management increased 2 percent

attributable to better production and improved market conditions.

Partially offsetting these increases were decreases in card and ATM

fees, which were negatively impacted by higher costs associated

with a rewards liability as well as seasonally lower transaction

volume, and other non-interest income which was attributable

primarily to prior quarter leasing gains and current quarter

negative valuation adjustments on certain equity investments.

Non-interest expense

Quarter Ended

($ amounts in millions)

3/31/2024

12/31/2023

3/31/2023

1Q24 vs. 4Q23

1Q24 vs. 1Q23

Salaries and employee benefits

$

658

$

608

$

616

$

50

8.2

%

$

42

6.8

%

Equipment and software expense

101

102

102

(1

)

(1.0

)%

(1

)

(1.0

)%

Net occupancy expense

74

71

73

3

4.2

%

1

1.4

%

Outside services

39

43

39

(4

)

(9.3

)%

—

NM

Professional, legal and regulatory

expenses

28

19

19

9

47.4

%

9

47.4

%

Marketing

27

31

27

(4

)

(12.9

)%

—

NM

FDIC insurance assessments

43

147

25

(104

)

(70.7

)%

18

72.0

%

Credit/checkcard expenses

14

15

14

(1

)

(6.7

)%

—

NM

Operational losses(1)

42

29

13

13

44.8

%

29

223.1

%

Branch consolidation, property and

equipment charges

1

3

2

(2

)

(66.7

)%

(1

)

(50.0

)%

Visa class B shares expense

4

6

8

(2

)

(33.3

)%

(4

)

(50.0

)%

Gain on early extinguishment of debt

—

(4

)

—

4

100.0

%

—

NM

Other

100

115

89

(15

)

(13.0

)%

11

12.4

%

Total non-interest expense

$

1,131

$

1,185

$

1,027

$

(54

)

(4.6

)%

$

104

10.1

%

Total adjusted non-interest expense(1)

$

1,097

$

1,038

$

1,025

$

59

5.7

%

$

72

7.0

%

NM - Not Meaningful

(1) The incremental increase in

operational losses primarily due to check-related warranty claims

totaled $22 million in the first quarter of 2024.

Non-interest expense decreased 5 percent on a reported basis,

but increased 6 percent on an adjusted basis(1) compared to the

fourth quarter of 2023. First quarter adjusted items included an

$18 million increase for Regions' FDIC insurance special assessment

accrual and $13 million associated with severance charges. Salaries

and benefits increased 8 percent driven primarily by seasonal

factors such as payroll tax and 401(k) match resets, one month of

merit increases, and higher incentive compensation. Recognized

severance charges are expected to lead to lower overall salaries

and benefits expense beginning in the second quarter. Operational

losses increased compared to the prior quarter attributable to

check-related warranty claims from deposits that occurred last

year. Despite this increase, current activity has normalized to

expected levels and the company continues to expect operational

losses to be approximately $100 million for all of 2024.

The company's first quarter efficiency ratio was 64.3 percent on

a reported basis and 60.6 percent on an adjusted basis(1). The

effective tax rate was 20.7 percent in the first quarter.

Loans and Leases

Average Balances

($ amounts in millions)

1Q24

4Q23

1Q23

1Q24 vs. 4Q23

1Q24 vs. 1Q23

Commercial and industrial

$

50,090

$

50,939

$

51,158

$

(849

)

(1.7

)%

$

(1,068

)

(2.1

)%

Commercial real estate—owner-occupied

5,131

5,136

5,305

(5

)

(0.1

)%

(174

)

(3.3

)%

Investor real estate

8,833

8,772

8,404

61

0.7

%

429

5.1

%

Business Lending

64,054

64,847

64,867

(793

)

(1.2

)%

(813

)

(1.3

)%

Residential first mortgage

20,188

20,132

18,957

56

0.3

%

1,231

6.5

%

Home equity

5,605

5,663

5,921

(58

)

(1.0

)%

(316

)

(5.3

)%

Consumer credit card

1,315

1,295

1,214

20

1.5

%

101

8.3

%

Other consumer—exit portfolios

35

110

527

(75

)

(68.2

)%

(492

)

(93.4

)%

Other consumer*

6,223

6,246

5,791

(23

)

(0.4

)%

432

7.5

%

Consumer Lending

33,366

33,446

32,410

(80

)

(0.2

)%

956

2.9

%

Total Loans

$

97,420

$

98,293

$

97,277

$

(873

)

(0.9

)%

$

143

0.1

%

NM - Not meaningful.

*

Other consumer loans includes EnerBank

(Regions' point of sale home improvement portfolio).

Average loans and leases declined by 1 percent compared to the

prior quarter. Average business loans decreased 1 percent, while

average consumer loans remained relatively stable. Approximately

$870 million of commercial loans were refinanced off the company's

balance sheet during the quarter through the debt capital markets.

Within consumer, growth included residential first mortgage,

EnerBank and consumer credit card loan categories.

Deposits

Average Balances

($ amounts in millions)

1Q24

4Q23

1Q23

1Q24 vs. 4Q23

1Q24 vs. 1Q23

Total interest-bearing deposits

$

86,200

$

83,247

$

79,450

$

2,953

3.5

%

$

6,750

8.5

%

Non-interest-bearing deposits

40,926

43,167

49,592

(2,241

)

(5.2

)%

(8,666

)

(17.5

)%

Total Deposits

$

127,126

$

126,414

$

129,042

$

712

0.6

%

$

(1,916

)

(1.5

)%

($ amounts in millions)

1Q24

4Q23

1Q23

1Q24 vs. 4Q23

1Q24 vs. 1Q23

Consumer Bank Segment

$

79,150

$

79,384

$

82,200

$

(234

)

(0.3

)%

$

(3,050

)

(3.7

)%

Corporate Bank Segment

37,064

36,291

36,273

773

2.1

%

791

2.2

%

Wealth Management Segment

7,766

7,690

8,463

76

1.0

%

(697

)

(8.2

)%

Other

3,146

3,049

2,106

97

3.2

%

1,040

49.4

%

Total Deposits

$

127,126

$

126,414

$

129,042

$

712

0.6

%

$

(1,916

)

(1.5

)%

Ending Balances as of

3/31/2024

3/31/2024

($ amounts in millions)

3/31/2024

12/31/2023

3/31/2023

vs. 12/31/2023

vs. 3/31/2023

Consumer Bank Segment

$

81,129

$

80,031

$

83,296

$

1,098

1.4

%

$

(2,167

)

(2.6

)%

Corporate Bank Segment

37,043

36,883

35,185

160

0.4

%

1,858

5.3

%

Wealth Management Segment

7,792

7,694

7,941

98

1.3

%

(149

)

(1.9

)%

Other

3,018

3,180

2,038

(162

)

(5.1

)%

980

48.1

%

Total Deposits

$

128,982

$

127,788

$

128,460

$

1,194

0.9

%

$

522

0.4

%

The company's deposit base continues to be a source of strength

and a differentiator in liquidity and margin performance. Total

ending and average deposits increased modestly during the first

quarter and included continued remixing out of non-interest-bearing

products into interest-bearing products. Declines in average

Consumer deposits were offset by stability or growth in the other

segments.

Asset quality

As of and for the Quarter

Ended

($ amounts in millions)

3/31/2024

12/31/2023

3/31/2023

Allowance for credit losses (ACL) at

period end

$1,731

$1,700

$1,596

ACL/Loans, net

1.79%

1.73%

1.63%

ALL/Loans, net

1.67%

1.60%

1.50%

Allowance for credit losses to

non-performing loans, excluding loans held for sale

191%

211%

288%

Allowance for loan losses to

non-performing loans, excluding loans held for sale

179%

196%

266%

Provision for credit losses

$152

$155

$135

Net loans charged-off

$121

$132

$83

Adjusted net loan charge-offs

(non-GAAP)(1)

$121

$97

$83

Net loans charged-off as a % of average

loans, annualized

0.50%

0.54%

0.35%

Adjusted net loan charge-offs as a % of

average loans, annualized (non-GAAP) (1)

0.50%

0.39%

0.35%

Non-performing loans, excluding loans held

for sale/Loans, net

0.94%

0.82%

0.56%

NPAs (ex. 90+ past due)/Loans, foreclosed

properties, and non-performing loans held for sale

0.95%

0.84%

0.58%

NPAs (inc. 90+ past due)/Loans, foreclosed

properties, and non-performing loans held for sale*

1.10%

1.01%

0.71%

Total Criticized Loans—Business

Services**

$4,978

$4,659

$3,725

*

Excludes guaranteed residential

first mortgages that are 90+ days past due and still accruing.

**

Business services represents the

combined total of commercial and investor real estate loans.

Overall asset quality continued to normalize during the quarter.

Business services criticized loans and non-performing loans

increased driven primarily by downgrades within loan categories

previously identified as under stress. The increase in

non-performing loans in the first quarter was primarily

attributable to office, professional services, transportation, and

manufacturing industries. Total reported and adjusted(1) net

charge-offs for the quarter were $121 million, or 50 basis points

of average loans. The increase in adjusted net charge-offs versus

the prior quarter was attributable primarily to a large restaurant

credit and a commercial manufacturing credit.

The increase to the allowance for credit losses compared to the

fourth quarter was attributable primarily to adverse risk migration

and continued credit quality normalization, as well as higher

qualitative adjustments for incremental risk in certain portfolios

previously identified as under stress.

The allowance for credit loss ratio increased 6 basis points to

1.79 percent of total loans, while the allowance as a percentage of

nonperforming loans decreased to 191 percent.

Capital and liquidity

As of and for Quarter

Ended

3/31/2024

12/31/2023

3/31/2023

Common Equity Tier 1 ratio(2)

10.3%

10.3%

9.9%

Tier 1 capital ratio(2)

11.6%

11.6%

11.2%

Tangible common stockholders’ equity to

tangible assets (non-GAAP)(1)

6.42%

6.79%

6.31%

Tangible common book value per share

(non-GAAP)(1)*

$10.42

$10.77

$10.01

Loans, net of unearned income, to total

deposits

75.1%

77.0%

76.3%

*

Tangible common book value per share

includes the impact of quarterly earnings and changes to market

value adjustments within accumulated other comprehensive income, as

well as continued capital returns.

Regions maintains a solid capital position with estimated

capital ratios remaining well above current regulatory

requirements. The Common Equity Tier 1(2) and Tier 1(2) ratios were

estimated at 10.3 percent and 11.6 percent, respectively, at

quarter-end.

During the first quarter, the company repurchased 5.5 million

shares of common stock for a total of $102 million through open

market purchases and declared $220 million in dividends to common

shareholders.

The company's liquidity position also remains robust as of March

31, 2024, with total available liquidity of approximately $60.8

billion, which includes cash held at the Federal Reserve, FHLB

borrowing capacity, unencumbered securities, and capacity at the

Federal Reserve's Discount Window. These sources are sufficient to

cover uninsured deposits at a ratio of 182 percent as of quarter

end (this ratio excludes intercompany and secured deposits).

(1)

Non-GAAP; refer to pages 11, 14, 15 and 17 of the financial

supplement to this earnings release for reconciliations.

(2)

Current quarter Common Equity Tier 1, and Tier 1 capital ratios

are estimated.

Conference Call In addition to the live audio webcast at

10 a.m. ET on Apr. 19, 2024, an archived recording of the webcast

will be available at the Investor Relations page of ir.regions.com

following the live event.

About Regions Financial Corporation Regions Financial

Corporation (NYSE:RF), with $155 billion in assets, is a member of

the S&P 500 Index and is one of the nation’s largest

full-service providers of consumer and commercial banking, wealth

management, and mortgage products and services. Regions serves

customers across the South, Midwest and Texas, and through its

subsidiary, Regions Bank, operates approximately 1,250 banking

offices and more than 2,000 ATMs. Regions Bank is an Equal Housing

Lender and Member FDIC. Additional information about Regions and

its full line of products and services can be found at

www.regions.com.

Forward-Looking Statements This release may include

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. The words “future,” “anticipates,”

“assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,”

“potential,” “objectives,” “estimates,” “expects,” “targets,”

“projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,”

“could,” “should,” “can,” and similar terms and expressions often

signify forward-looking statements. Forward-looking statements are

subject to the risk that the actual effects may differ, possibly

materially, from what is reflected in those forward-looking

statements due to factors and future developments that are

uncertain, unpredictable and in many cases beyond our control.

Forward-looking statements are not based on historical information,

but rather are related to future operations, strategies, financial

results or other developments. Forward-looking statements are based

on management’s current expectations as well as certain assumptions

and estimates made by, and information available to, management at

the time the statements are made. Those statements are based on

general assumptions and are subject to various risks, and because

they also relate to the future they are likewise subject to

inherent uncertainties and other factors that may cause actual

results to differ materially from the views, beliefs and

projections expressed in such statements. Therefore, we caution you

against relying on any of these forward-looking statements. These

risks, uncertainties and other factors include, but are not limited

to, those described below:

- Current and future economic and market conditions in the United

States generally or in the communities we serve (in particular the

Southeastern United States), including the effects of possible

declines in property values, increases in interest rates and

unemployment rates, inflation, financial market disruptions and

potential reductions of economic growth, which may adversely affect

our lending and other businesses and our financial results and

conditions.

- Possible changes in trade, monetary and fiscal policies of, and

other activities undertaken by, governments, agencies, central

banks and similar organizations, which could have a material

adverse effect on our businesses and our financial results and

conditions.

- Changes in market interest rates or capital markets could

adversely affect our revenue and expense, the value of assets (such

as our portfolio of investment securities) and obligations, as well

as the availability and cost of capital and liquidity.

- Volatility and uncertainty about the direction of interest

rates and the timing of any changes, which may lead to increased

costs for businesses and consumers and potentially contribute to

poor business and economic conditions generally.

- Possible changes in the creditworthiness of customers and the

possible impairment of the collectability of loans and leases,

including operating leases.

- Changes in the speed of loan prepayments, loan origination and

sale volumes, charge-offs, credit loss provisions or actual credit

losses where our allowance for credit losses may not be adequate to

cover our eventual losses.

- Possible acceleration of prepayments on mortgage-backed

securities due to declining interest rates, and the related

acceleration of premium amortization on those securities.

- Possible changes in consumer and business spending and saving

habits and the related effect on our ability to increase assets and

to attract deposits, which could adversely affect our net

income.

- Loss of customer checking and savings account deposits as

customers pursue other, higher-yield investments, or the need to

price interest-bearing deposits higher due to competitive forces.

Either of these activities could increase our funding costs.

- Possible downgrades in our credit ratings or outlook could,

among other negative impacts, increase the costs of funding from

capital markets.

- The loss of value of our investment portfolio could negatively

impact market perceptions of us.

- Our ability to manage fluctuations in the value of assets and

liabilities and off-balance sheet exposure so as to maintain

sufficient capital and liquidity to support our businesses.

- The effects of social media on market perceptions of us and

banks generally.

- Market replacement of LIBOR and the related effect on our

LIBOR-based financial products and contracts, including, but not

limited to, derivative products, debt obligations, deposits,

investments, and loans.

- The effects of problems encountered by other financial

institutions that adversely affect us or the banking industry

generally could require us to change certain business practices,

reduce our revenue, impose additional costs on us, or otherwise

negatively affect our businesses.

- Volatility in the financial services industry (including

failures or rumors of failures of other depository institutions),

along with actions taken by governmental agencies to address such

turmoil, could affect the ability of depository institutions,

including us, to attract and retain depositors and to borrow or

raise capital.

- Our ability to effectively compete with other traditional and

non-traditional financial services companies, including fintechs,

some of which possess greater financial resources than we do or are

subject to different regulatory standards than we are.

- Our inability to develop and gain acceptance from current and

prospective customers for new products and services and the

enhancement of existing products and services to meet customers’

needs and respond to emerging technological trends in a timely

manner could have a negative impact on our revenue.

- Our inability to keep pace with technological changes,

including those related to the offering of digital banking and

financial services, could result in losing business to

competitors.

- Our ability to execute on our strategic and operational plans,

including our ability to fully realize the financial and

nonfinancial benefits relating to our strategic initiatives.

- The risks and uncertainties related to our acquisition or

divestiture of businesses and risks related to such acquisitions,

including that the expected synergies, cost savings and other

financial or other benefits may not be realized within expected

timeframes, or might be less than projected; and difficulties in

integrating acquired businesses.

- The success of our marketing efforts in attracting and

retaining customers.

- Our ability to achieve our expense management initiatives.

- Changes in commodity market prices and conditions could

adversely affect the cash flows of our borrowers operating in

industries that are impacted by changes in commodity prices

(including businesses indirectly impacted by commodities prices

such as businesses that transport commodities or manufacture

equipment used in the production of commodities), which could

impair the ability of those borrowers to service any loans

outstanding to them and/or reduce demand for loans in those

industries.

- The effects of geopolitical instability, including wars,

conflicts, civil unrest, and terrorist attacks and the potential

impact, directly or indirectly, on our businesses.

- Fraud, theft or other misconduct conducted by external parties,

including our customers and business partners, or by our

employees.

- Any inaccurate or incomplete information provided to us by our

customers or counterparties.

- Inability of our framework to manage risks associated with our

businesses, such as credit risk and operational risk, including

third-party vendors and other service providers, which inability

could, among other things, result in a breach of operating or

security systems as a result of a cyber-attack or similar act or

failure to deliver our services effectively.

- Our ability to identify and address operational risks

associated with the introduction of or changes to products,

services, or delivery platforms.

- Dependence on key suppliers or vendors to obtain equipment and

other supplies for our businesses on acceptable terms.

- The inability of our internal controls and procedures to

prevent, detect or mitigate any material errors or fraudulent

acts.

- Our ability to identify and address cyber-security risks such

as data security breaches, malware, ransomware, “denial of service”

attacks, “hacking” and identity theft, including account

take-overs, a failure of which could disrupt our businesses and

result in the disclosure of and/or misuse or misappropriation of

confidential or proprietary information, disruption or damage to

our systems, increased costs, losses, or adverse effects to our

reputation.

- The effects of the failure of any component of our business

infrastructure provided by a third party could disrupt our

businesses, result in the disclosure of and/or misuse of

confidential information or proprietary information, increase our

costs, negatively affect our reputation, and cause losses.

- The effects of any developments, changes or actions relating to

any litigation or regulatory proceedings brought against us or any

of our subsidiaries.

- The costs, including possibly incurring fines, penalties, or

other negative effects (including reputational harm) of any adverse

judicial, administrative, or arbitral rulings or proceedings,

regulatory enforcement actions or other legal actions to which we

or any of our subsidiaries are a party, and which may adversely

affect our results.

- Changes in laws and regulations affecting our businesses,

including legislation and regulations relating to bank products and

services, such as changes to debit card interchange fees, special

FDIC assessments, any new long-term debt requirements, as well as

changes in the enforcement and interpretation of such laws and

regulations by applicable governmental and self-regulatory

agencies, including as a result of the changes in U.S. presidential

administration, control of the U.S. Congress, and changes in

personnel at the bank regulatory agencies, which could require us

to change certain business practices, increase compliance risk,

reduce our revenue, impose additional costs on us, or otherwise

negatively affect our businesses.

- Our capital actions, including dividend payments, common stock

repurchases, or redemptions of preferred stock, must not cause us

to fall below minimum capital ratio requirements, with applicable

buffers taken into account, and must comply with other requirements

and restrictions under law or imposed by our regulators, which may

impact our ability to return capital to shareholders.

- Our ability to comply with stress testing and capital planning

requirements (as part of the CCAR process or otherwise) may

continue to require a significant investment of our managerial

resources due to the importance of such tests and

requirements.

- Our ability to comply with applicable capital and liquidity

requirements (including, among other things, the Basel III capital

standards), including our ability to generate capital internally or

raise capital on favorable terms, and if we fail to meet

requirements, our financial condition and market perceptions of us

could be negatively impacted.

- Our ability to recruit and retain talented and experienced

personnel to assist in the development, management and operation of

our products and services may be affected by changes in laws and

regulations in effect from time to time.

- Our ability to receive dividends from our subsidiaries, in

particular Regions Bank, could affect our liquidity and ability to

pay dividends to shareholders.

- Fluctuations in the price of our common stock and inability to

complete stock repurchases in the time frame and/or on the terms

anticipated.

- The effects of anti-takeover laws and exclusive forum provision

in our certificate of incorporation and bylaws.

- The effect of new tax legislation and/or interpretation of

existing tax law, which may impact our earnings, capital ratios and

our ability to return capital to shareholders.

- Changes in accounting policies or procedures as may be required

by the FASB or other regulatory agencies could materially affect

our financial statements and how we report those results, and

expectations and preliminary analyses relating to how such changes

will affect our financial results could prove incorrect.

- Any impairment of our goodwill or other intangibles, any

repricing of assets or any adjustment of valuation allowances on

our deferred tax assets due to changes in tax law, adverse changes

in the economic environment declining operations of the reporting

unit or other factors.

- The effects of man-made and natural disasters, including fires,

floods, droughts, tornadoes, hurricanes and environmental damage

(especially in the Southeastern United States), which may

negatively affect our operations and/or our loan portfolios and

increase our cost of conducting business. The severity and

frequency of future earthquakes, fires, hurricanes, tornadoes,

droughts, floods and other weather-related events are difficult to

predict and may be exacerbated by global climate change.

- The impact of pandemics on our businesses, operations and

financial results and conditions. The duration and severity of any

pandemic as well as government actions or other restrictions in

connection with such events could disrupt the global economy,

adversely affect our capital and liquidity position, impair the

ability of borrowers to repay outstanding loans and increase our

allowance for credit losses, impair collateral values and result in

lost revenue or additional expenses.

- The effects of any damage to our reputation resulting from

developments related to any of the items identified above.

- Other risks identified from time to time in reports that we

file with the SEC.

The foregoing list of factors is not exhaustive. For discussion

of these and other factors that may cause actual results to differ

from expectations, look under the captions “Forward-Looking

Statements” and “Risk Factors” in Regions’ Annual Report on Form

10-K for the year ended December 31, 2023 and in Regions’

subsequent filings with the SEC.

You should not place undue reliance on any forward-looking

statements, which speak only as of the date made. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible to predict all of them. We assume

no obligation and do not intend to update or revise any

forward-looking statements that are made from time to time, either

as a result of future developments, new information or otherwise,

except as may be required by law.

Use of non-GAAP financial measures

Management uses pre-tax pre-provision income (non-GAAP) and

adjusted pre-tax pre-provision income (non-GAAP), as well as the

adjusted efficiency ratio (non-GAAP) and the adjusted fee income

ratio (non-GAAP) to monitor performance and believes these measures

provide meaningful information to investors. Non-interest expense

(GAAP) is presented excluding certain adjustments to arrive at

adjusted non-interest expense (non-GAAP), which is the numerator

for the adjusted efficiency ratio. Non-interest income (GAAP) is

presented excluding certain adjustments to arrive at adjusted

non-interest income (non-GAAP), which is the numerator for the

adjusted fee income ratio. Adjusted non-interest income (non-GAAP)

and adjusted non-interest expense (non-GAAP) are used to determine

adjusted pre-tax pre-provision income (non-GAAP). Net interest

income (GAAP) on a taxable-equivalent basis and non-interest income

are added together to arrive at total revenue on a

taxable-equivalent basis. Adjustments are made to arrive at

adjusted total revenue on a taxable-equivalent basis (non-GAAP),

which is the denominator for the adjusted fee income and adjusted

efficiency ratios. Net loan charge-offs (GAAP) are presented

excluding adjustments to arrive at adjusted net loan-charge offs

(non-GAAP). Adjusted net loan charge-offs as a percentage of

average loans (non-GAAP) are calculated as adjusted net loan

charge-offs (non-GAAP) divided by average loans (GAAP) and

annualized. Regions believes that the exclusion of these

adjustments provides a meaningful basis for period-to-period

comparisons, which management believes will assist investors in

analyzing the operating results of the Company and predicting

future performance. These non-GAAP financial measures are also used

by management to assess the performance of Regions’ business. It is

possible that the activities related to the adjustments may recur;

however, management does not consider the activities related to the

adjustments to be indications of ongoing operations. Regions

believes that presentation of these non-GAAP financial measures

will permit investors to assess the performance of the Company on

the same basis as that applied by management.

Tangible common stockholders’ equity ratios have become a focus

of some investors and management believes they may assist investors

in analyzing the capital position of the Company absent the effects

of intangible assets and preferred stock. Analysts and banking

regulators have assessed Regions’ capital adequacy using the

tangible common stockholders’ equity measure. Because tangible

common stockholders’ equity is not formally defined by GAAP or

prescribed in any amount by federal banking regulations it is

currently considered to be a non-GAAP financial measure and other

entities may calculate it differently than Regions’ disclosed

calculations. Since analysts and banking regulators may assess

Regions’ capital adequacy using tangible common stockholders’

equity, management believes that it is useful to provide investors

the ability to assess Regions’ capital adequacy on this same

basis.

Non-GAAP financial measures have inherent limitations, are not

required to be uniformly applied and are not audited. Although

these non-GAAP financial measures are frequently used by

stakeholders in the evaluation of a company, they have limitations

as analytical tools, and should not be considered in isolation, or

as a substitute for analyses of results as reported under GAAP. In

particular, a measure of earnings that excludes selected items does

not represent the amount that effectively accrues directly to

stockholders.

Management and the Board of Directors utilize non-GAAP measures

as follows:

- Preparation of Regions' operating budgets

- Monthly financial performance reporting

- Monthly close-out reporting of consolidated results (management

only)

- Presentation to investors of company performance

- Metrics for incentive compensation

Regions’ Investor Relations contact is Dana Nolan at (205)

264-7040; Regions’ Media contact is Jeremy King at (205)

264-4551.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240419720638/en/

Media Contact: Jeremy King (205) 264-4551

Investor Relations Contact: Dana Nolan (205) 264-7040

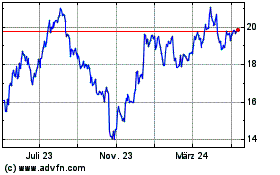

Regions Financial (NYSE:RF)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

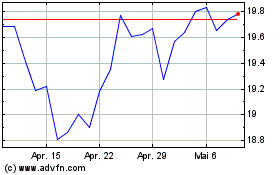

Regions Financial (NYSE:RF)

Historical Stock Chart

Von Dez 2023 bis Dez 2024