Current Report Filing (8-k)

07 Dezember 2022 - 10:01PM

Edgar (US Regulatory)

0001324948

false

0001324948

2022-12-05

2022-12-05

0001324948

RBC:CommonStockParValue0.01PerShareMember

2022-12-05

2022-12-05

0001324948

RBC:Sec5.00SeriesMandatoryConvertiblePreferredStockParValue0.01PerShareMember

2022-12-05

2022-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report: December 7, 2022 (Date of

earliest event reported: December 5, 2022)

RBC BEARINGS INCORPORATED

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-40840 |

|

95-4372080 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

One Tribology Center

Oxford, CT 06478

(Address of principal executive offices) (Zip Code)

(203) 267-7001

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2.):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

|

Securities registered pursuant to Section 12(b)

of the Act:

|

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share |

|

RBC |

|

New York Stock Exchange |

| 5.00% Series A Mandatory Convertible Preferred Stock, par value $0.01 per share |

|

RBCP |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement.

On December 5, 2022, RBC Bearings

Incorporated (the “Company”) and its subsidiary, Roller Bearing Company of America, Inc. (“RBCA”), entered into

the First Amendment to Credit Agreement with Wells Fargo Bank, National Association, as administrative agent (the “Agent”),

and the lenders party thereto (the “Amendment”). The Amendment amends that certain Credit Agreement, dated as of November

1, 2021, by and among the Company, RBCA, the Agent, the lending institutions party thereto and the other agents and entities party thereto

(as amended, the “Credit Agreement”) governing the Company’s $500,000,000 revolving credit facility (the “Revolving

Credit Facility”) and $1,300,000,000 term loan facility (the “Term Loan Facility,” and together with the Revolving Credit

Facility, the “Facilities”).

The Company entered into the

Amendment in order to, among other things, replace the London interbank offered rate (LIBOR) as a benchmark interest rate

for loans under the Credit Agreement with the secured overnight financing rate administered by the Federal Reserve Bank of New York (SOFR).

Pursuant to the Amendment, borrowings under the Facilities denominated in U.S. dollars bear interest at a rate per annum equal to Term

SOFR (as defined in the Credit Agreement) plus a credit spread adjustment of 0.10% plus a margin ranging from 0.75% to 2.00% depending

on the Company’s consolidated ratio of total net debt to consolidated EBITDA. The Facilities

are subject to a SOFR floor of 0.00%.

Capitalized terms in this Item

1.01, unless defined herein, shall have the meanings ascribed thereto in the Credit Agreement. Except as amended by the Amendment, the

Credit Agreement remains in full force and effect.

The foregoing description of

the Amendment does not purport to be complete and is qualified in its entirety by the full text of the Amendment, which is attached as

Exhibit 10.01 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in

Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

According to the requirements of the Securities

Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Date: December 7, 2022

|

|

RBC BEARINGS INCORPORATED |

| |

|

|

| |

By: |

/s/ John J. Feeney |

| |

|

Name: |

John J. Feeney |

| |

|

Title: |

Vice President, General Counsel & Secretary |

2

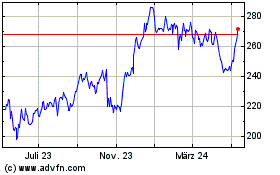

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

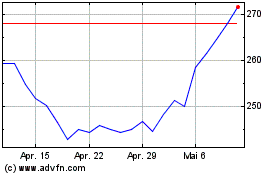

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025