UPDATE: Pearson Sees Digital-Fueled Growth In 2012

27 Februar 2012 - 10:50AM

Dow Jones News

LONDON (Dow Jones)--Pearson PLC (PSON.LN) Monday said it expects

to increase sales and profits in 2012 despite a tough market, as

investment in its digital businesses helped drive full-year

adjusted earnings above guidance, although net profit fell.

The company said it expects digital revenue to overtake revenue

from its traditional publishing operations in the forthcoming year

as it looks set to post further growth in sales and operating

profit.

Pearson, which publishes the Financial Times and Penguin Books,

is dominated by its large north American education division--all of

which have been under pressure from the rise in digital media, from

schools using ebooks and online learning, to commuters reading the

newspaper on their tablet computers.

Pearson has been shifting its portfolio to reflect this change

and has made several disposals and acquisitions which will tip the

balance of revenue in 2012 in favour of its digital and services

businesses, enabling the company to grow sales and profits despite

the economic constraints evident in some of its core markets,

especially the U.S.

Sales in 2011 grew 6% at exchange rates to GBP5.86 billion,

boosted by an 18% rise in sales from its digital businesses, which

accounted for 33% of overall sales.

While net profit fell to GBP957 million in 2011 from GBP1.30

billion a year earlier, this was due to larger disposal profits in

the year-earlier period, and adjusting for these one-off items

Pearson reported a 12% rise in operating profit at constant

exchange rates to GBP942 million.

Adjusted earnings per share, which is one of the key figures

tracked by U.K. analysts, rose to 86.5 pence per share from 77.5

pence last time, above raised guidance provided by Pearson last

month.

Chief executive Marjorie Scardino said the company has a

potential war chest of GBP1 billion to spend on further bolt-on

acquisitions this year, which will most likely be used to grow its

emerging markets business where the company has already invested in

education in fast-growing economies like India, China, Brazil and

South Africa.

International education revenue rose to GBP1.42 billion in 2011

from GBP1.23 billion in 2010.

And while international education is expected to show good

growth in 2012, U.S. education is forecast to grow more modestly as

state budgets are squeezed and traditional school textbook sales

come under pressure amid the transition to digital media and

services.

North American education sales in 2011 slipped slightly to

GBP2.58 billion from GBP2.64 billion the year earlier.

Still, Pearson's shift in focus to digital media means it is

widely involved in the transition of U.S. educational tools into

online and digital formats, and last month announced the

publication of several textbooks redesigned for the Apple Co Inc's

(APPL) iPad.

However Scardino was quick to point out that its digital reach

is far wider than Apple's, going beyond content, operating systems

and devices to encompass the broader aspects of teacher and

technology development rather than just "beautiful textbooks".

Speaking to reporters on a conference call Monday Scardino also

repeated her assertion that the Financial Times is not for sale,

after media reports last month suggested the company was in talks

with Thomson Reuters about selling the flagship paper.

As other traditional print newspapers struggle to hold onto

subscription and circulation revenue, digital subscriptions at the

FT rose 29% last year and accounted for around 44% of total paid

circulation. Sales at the FT Group rose to GBP427 million from

GBP403 million last year.

Pearson declared a final dividend of 28 pence a share, taking

the total for 2011 to 42p, up from 38.7p in 2010.

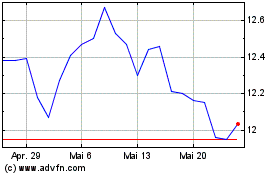

At 0901 GMT, Pearson shares were down 2.2% or 27 pence at 1224

pence. The stock has risen almost 20% over the past 12 months as

Pearson has upgraded its outlook steadily throughout the year.

-By Lilly Vitorovich, Dow Jones Newswires; 44-0-207 842 9290;

lilly.vitorovich@dowjones.com

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024