0001554625false424B300015546252023-10-022023-10-020001554625pris:InvestorsWillNotKnowThePurchasePricePerShareMember2023-10-022023-10-02

Filed Pursuant to Rule 424(b)(3)

File No. 333-268702

Maximum Offering of 50,748,029 Shares

______________

Supplement No. 16 dated October 2, 2023

to the

Prospectus dated February 17, 2023

________________

This supplement contains information which amends, supplements or modifies certain information contained in the Prospectus of Priority Income Fund, Inc. (the “Company”) dated February 17, 2023 as amended or supplemented (the “Common Stock Prospectus”). Capitalized terms used but not defined herein shall have the same meaning given them in the Common Stock Prospectus.

You should carefully consider the “Risk Factors” beginning on page 39 of the Common Stock Prospectus before you decide to invest.

Cover

In the first sentence in the third paragraph on the cover of the Common Stock Prospectus, the phrase “at a current offering price of $12.14 per share” is deleted in its entirety and replaced with the following:

at an offering price equal to our net asset value, or “NAV,” per share, as of the effective date of the monthly share purchase date, plus selling commissions and dealer manager fees

The disclosure appearing under the fourth paragraph on the cover of the Common Stock Prospectus is deleted in its entirety and replaced with the following:

We are offering our shares on a continuous basis at an offering price equal to our NAV per share, as of the effective date of the monthly share purchase date, plus selling commissions and dealer manager fees. Therefore, persons who tender subscriptions for our shares in this offering must submit subscriptions for a certain dollar amount, rather than a number of shares and, as a result, may receive fractional shares.

Prospectus Summary

The fourth paragraph under the heading “Prospectus Summary – Plan of Distribution” on page 13 is deleted in its entirety and replaced with the following:

We are offering our shares on a continuous basis at an offering price equal to our NAV per share, as of the effective date of the monthly share purchase date, plus selling commissions and dealer manager fees. We expect to report our NAV per share as of the last calendar day of the applicable month on our website at www.priorityincomefund.com (which is not intended to be an active hyperlink) generally within 15 business days of the last calendar day of the applicable month.

The second to last paragraph under the heading “Prospectus Summary – How to Subscribe” on page 13 is deleted in its entirety and replaced with the following:

Subscriptions to purchase our shares may be made on an ongoing basis, but investors may only purchase our shares pursuant to accepted subscription orders as of the first day of each month (based on the NAV per share as determined as of the previous day, being the last day of the preceding month), and to be accepted, a subscription request must be made with a completed and executed subscription agreement in good order, including satisfying any additional requirements imposed by the

subscriber’s broker, and payment of the full purchase price of our shares being subscribed at least four business days prior to the first day of the month (unless waived by us).

For example, if you wish to subscribe for shares in October, your subscription request must be received in good order at least four business days before November 1. Notice of each share transaction will be furnished to shareholders (or their financial representatives) as soon as practicable after the Fund’s NAV as of October 31 is determined and credited to the shareholder’s account While a shareholder will not know our NAV applicable on the effective date of the share purchase, we expect that our NAV applicable to a purchase of shares will be available generally within 15 business days after the effective date of the share purchase; at that time, the number of shares based on that NAV and each shareholder’s purchase will be determined and shares are credited to the shareholder’s account as of the effective date of the share purchase. In this example, if accepted, your subscription would be effective on the first calendar day of November.

If for any reason we reject the subscription, or if the subscription request is canceled before it is accepted or withdrawn as described below, we will return the subscription agreement and our transfer agent, will return the related funds, without interest or deduction, promptly after such rejection, cancellation or withdrawal.

Questions and Answers About this Offering

The seventh question under the heading “Question and Answers About this Offering” on page 34 is deleted in its entirety and replaced with the following:

Q: How do I subscribe for shares?

A: In order to purchase shares of our common stock, you must (1) complete a subscription agreement, the form of which is attached to this prospectus as Appendix A, and (2) pay for the shares at the time you subscribe. Investors may only purchase our shares pursuant to accepted subscription orders effective as of the first day of each month (based on the NAV per share as determined as of the previous day, being the last day of the preceding month), and to be accepted, a subscription request including the full subscription amount must be received in good order at least four business days prior to the first day of the month (unless waived by us).

Q: What is the per share purchase price?

A: We are offering our shares at an offering price equal to our NAV, per share, as of the effective date of the monthly share purchase date, plus selling commissions and dealer manager fees.

Q: When will the NAV per share be available?

A: We expect to report our NAV per share as of the last calendar day of the applicable month on our website generally within 15 business days of the last calendar day of the applicable month. Because subscriptions must be submitted at least four business days prior to the first day of the applicable month, you will not know the NAV per share at which you will be subscribing at the time you subscribe.

For example, if you are subscribing in October, your subscription must be submitted at least four business days prior to November 1. The purchase price for your Common Shares will be the NAV per share determined as of October 31. The NAV per share as of October 31 will generally be available within 15 business days from October 31.

Risk Factors

The first two risk factors under the heading “Risk Factors – Risks Related to an Investment in Our Shares” on page 50 are deleted in their entirety and replaced with the following:

Investors will not know the purchase price per share at the time they submit their subscription agreements and could receive fewer shares than anticipated.

We expect to report our NAV per share as of the last calendar day of the applicable month on our website generally within 15 business days of the last calendar day of the applicable month. Because subscriptions must be submitted at least four business days prior to the first day of the applicable month, you will not know the NAV per share at which you will be

subscribing at the time you subscribe. If a subscription request, including the full subscription amount, is not received in good order at least four business days prior to the first day of the month, you may not be eligible to purchase securities during that month’s offering. Accordingly, you will not know the NAV per share until the following month’s NAV is determined, which will be a significant period of time from the initial subscription. As a result, your purchase price may be higher than the prior closing price per share, and therefore you may receive a smaller number of shares than if you had subscribed at the prior closing price. See “Determination of Net Asset Value” and “Plan of Distribution”.

Determination of Net Asset Value

The disclosure under the heading “Determination of Net Asset Value – Determinations in Connection with Offerings” beginning on page 88 is deleted in its entirety and replaced with the following:

We are offering our shares on a continuous basis at an offering price equal to our NAV per share, as of the effective date of the monthly share purchase date, plus selling commissions and dealer manager fees. Persons who subscribe for shares in this offering must submit subscriptions for a certain dollar amount, rather than a number of shares and, as a result, may receive fractional shares.

We expect to report our NAV per share as of the last calendar day of the applicable month on our website generally within 15 business days of the last calendar day of the applicable month.

Distribution Reinvestment Plan

The first paragraph under the heading “Distribution Reinvestment Plan” on page 106 is deleted in its entirety and replaced with the following:

Subject to our Board of Directors’ discretion and applicable legal restrictions, we intend to authorize and declare ordinary cash distributions on a quarterly basis and pay such distributions on a monthly basis. We have adopted a distribution reinvestment plan pursuant to which shareholders will automatically have the full amount of their distributions reinvested in additional shares. Participants in our distribution reinvestment plan are free to revoke or reinstate participation in the distribution reinvestment plan within a reasonable time as specified in the plan. If you elect not to participate in the plan you will automatically receive any distributions we declare in cash. For example, if our Board of Directors authorizes, and we declare, a cash distribution, then if you have “opted out” of our distribution reinvestment plan you will receive your distributions in cash rather than having them reinvested in additional shares. During this offering, we generally intend to coordinate distribution payment dates so that the calculation of the issuance price for purchasers under the distribution reinvestment plan is based on a recently available net asset value. In such case, the issuance price for your reinvested distributions will be equal to 95% of the Class I offering price that is based on the net asset value most recently available at the time the distribution is payable. Shares issued pursuant to our distribution reinvestment plan will have the same voting rights as our shares offered pursuant to this prospectus.

The fourth paragraph under the heading “Distribution Reinvestment Plan” on page 106 is deleted in its entirety and replaced with the following:

Distributions on fractional shares will be credited to each participant's account. In the event of termination of a participant's account under the Plan, the plan administrator will adjust for any such undivided fractional interest in cash at the most recent available NAV per share for such shares in effect at the time of termination.

Plan of Distribution

The disclosure under the heading “Plan of Distribution – General” beginning on page 122 is deleted in its entirety and replaced with the following:

This is a continuous offering of our shares as permitted by the federal securities laws. We intend to continue this offering until the earlier of the completion of the offering or the expiration of the offering period. This offering will be complete when we have sold the maximum number of shares offered hereby, or earlier in the event we determine in our sole discretion to cease offering additional shares for sale to investors. We commenced the initial public offering of our shares in 2013. Since that time, we have filed new registration statements and post-effective amendments that have allowed us to continue the offering of our shares. On November 3, 2022, our Board of Directors approved the filing of this new registration statement and the extension of the offering until the date upon which 150,000,000 shares of our common stock have been sold in the course of our offerings,

unless terminated or further extended or increased by the Board of Directors, in its sole discretion. As of February 13, 2023, we had sold an aggregate of 49,251,971 shares of our common stock for gross proceeds of approximately $700.5 million.

We sell our shares of common stock with differing up-front sales loads. For example, holders will either pay (i) selling commissions and dealer manager fees, (ii) dealer manager fees, but no selling commissions or (iii) no selling commissions or dealer manager fees. However, regardless of the sales load paid, each share of our common stock will have identical rights with respect to voting and distributions, and will likewise bear its own pro rata portion of our expenses and have the same net asset value as each other share of our common stock. Shares available to the general public are charged selling commissions and dealer manager fees and are referred to as our “Class R Shares.” Shares available to accounts managed by certain registered investment advisers and broker-dealers that are managing wrap or other fee-based accounts are charged dealer manager fees but no selling commissions and are referred to as our “Class RIA Shares.” Shares available for purchase (1) through certain fee-based programs, also known as wrap accounts, of investment dealers, (2) through certain participating broker-dealers that have alternative fee arrangements with their clients, (3) through certain registered investment advisers, (4) through bank trust departments or any other organization or person authorized to act in a fiduciary capacity for its clients or customers, such as an endowment, foundation, or pension fund, or (5) to other institutional investors are charged no selling commissions or dealer manager fees and are referred to as our “Class I Shares.” Although we use “Class” designations to indicate our differing sales load structures, the Company does not operate as a multi-class fund. Before making your investment decision, please consult with your financial advisor regarding your account type and the classes of shares you may be eligible to purchase.

The Dealer Manager is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered. The minimum permitted purchase is $1,000 of our shares. Investors subscribing through a given broker-dealer or registered investment adviser may have interests aggregated to meet these minimums, so long as denominations are not less than $500. Additional purchases must be in increments of $500. Any sales made by us through our officers or directors must be made pursuant to the principles of SEC Rule 3a4-1.

To purchase shares in this offering, you must complete and sign a subscription agreement (in the form attached to this prospectus as Appendix A) for a specific dollar amount equal to or greater than that share class’ investment minimum and pay such amount at the time of subscription. You should make your check payable to Priority Income Fund, Inc. and your check and subscription agreement should be mailed to: | | | | | | | | |

Via Mail: | | Via Express/Overnight Delivery: |

Priority Income Fund, Inc. | | Priority Income Fund, Inc. |

c/o Preferred Capital Securities, LLC | | c/o Preferred Capital Securities, LLC |

P.O. Box 219768 | | 430 West 7th Street |

Kansas City, MO 64121-9768 | | Kansas City, MO 64105-1407 |

866-655-3650 | | 866-655-3650 |

Subscriptions to purchase our shares may be made on an ongoing basis, but investors may only purchase our shares pursuant to accepted subscription orders as of the first day of each month (based on the NAV per share as determined as of the previous day, being the last day of the preceding month), and to be accepted, a subscription request must be made with a completed and executed subscription agreement in good order, including satisfying any additional requirements imposed by the subscriber’s broker, and payment of the full purchase price of our shares being subscribed at least four business days prior to the first day of the month (unless waived by us).

For example, if you wish to subscribe for shares in October, your subscription request must be received in good order at least four business days before November 1. Notice of each share transaction will be furnished to shareholders (or their financial representatives) as soon as practicable after the Fund’s NAV as of October 31 is determined and credited to the shareholder’s account. While a shareholder will not know our NAV applicable on the effective date of the share purchase, we expect that our NAV applicable to a purchase of shares will be available generally within 15 business days after the effective date of the share purchase; at that time, the number of shares based on that NAV and each shareholder’s purchase will be determined and shares are credited to the shareholder’s account as of the effective date of the share purchase. In this example, if accepted, your subscription would be effective on the first calendar day of November.

If for any reason we reject the subscription, or if the subscription request is canceled before it is accepted or withdrawn as described below, we will return the subscription agreement and our transfer agent will return the related funds, without interest or deduction, promptly after such rejection, cancellation or withdrawal.

An approved trustee must process and forward to us purchases made through IRAs, Keogh plans and 401(k) plans. In the case of investments through IRAs, Keogh plans and 401(k) plans, we will send the confirmation and notice of our acceptance to the trustee.

v3.23.3

N-2

|

Oct. 02, 2023 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001554625

|

| Amendment Flag |

false

|

| Document Type |

424B3

|

| Entity Registrant Name |

Priority Income Fund, Inc.

|

| Investors will not know the purchase price per share [Member] |

|

| General Description of Registrant [Abstract] |

|

| Risk [Text Block] |

Investors will not know the purchase price per share at the time they submit their subscription agreements and could receive fewer shares than anticipated.

We expect to report our NAV per share as of the last calendar day of the applicable month on our website generally within 15 business days of the last calendar day of the applicable month. Because subscriptions must be submitted at least four business days prior to the first day of the applicable month, you will not know the NAV per share at which you will be subscribing at the time you subscribe. If a subscription request, including the full subscription amount, is not received in good order at least four business days prior to the first day of the month, you may not be eligible to purchase securities during that month’s offering. Accordingly, you will not know the NAV per share until the following month’s NAV is determined, which will be a significant period of time from the initial subscription. As a result, your purchase price may be higher than the prior closing price per share, and therefore you may receive a smaller number of shares than if you had subscribed at the prior closing price. See “Determination of Net Asset Value” and “Plan of Distribution”.

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form N-2

-Section Item 8

| Name: |

cef_GeneralDescriptionOfRegistrantAbstract |

| Namespace Prefix: |

cef_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

cef_RiskTextBlock |

| Namespace Prefix: |

cef_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

cef_RiskAxis=pris_InvestorsWillNotKnowThePurchasePricePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

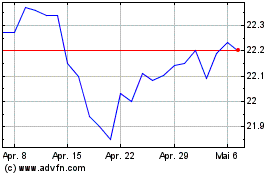

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

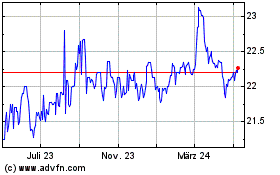

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Jul 2023 bis Jul 2024