Putnam Investments Survey Finds Most Americans Think They Are Not Saving Enough and Yet Expect to Reduce IRA Savings in 2010

27 April 2010 - 8:30PM

Business Wire

Almost 40 percent fewer Americans expect to fully fund their

IRAs this year than did in 2009, according to the results of a

survey of 1,000 Americans released today by Putnam Investments.

Only one in seven (14%) survey respondents plan to fully fund their

IRAs in 2010, versus 23 percent who fully funded an IRA in 2009.

More than half of those who did not fund their IRA for 2009 said

they either lacked the cash to invest or preferred to keep the cash

available for other reasons, and another quarter were worried about

market risk.

Americans also are not planning to convert from traditional IRAs

to Roth IRAs, in spite of a new tax law change that allows

higher-income investors to perform Roth conversions. Only 14

percent of respondents were considering converting some or all of

their traditional IRA assets to a Roth IRA either this year or

next, with a majority (56%) saying they definitely would not

convert. Other findings from the Putnam research include:

- Two-thirds of respondents (67%)

said they are not confident that the taxes they would pay now

because of a Roth IRA conversion will produce better results in the

future. Nearly as many (61%) say they do not want to pay the taxes

required by a Roth conversion because of previous investment

losses, and 56 percent said they simply cannot afford the costs of

a Roth IRA conversion.

- Investor skepticism is

underscored by the fact that two in five respondents (41%) think

they will have more money in the long run if they pay taxes later

with a traditional IRA rather than converting to a Roth IRA and

paying taxes now (26%).

- The lower IRA savings come even

as three-fifths of the survey respondents (58%) report they are not

saving more overall this year than last, even about the same number

(62%) thinks their savings are unlikely to provide them with a

sizeable retirement nest egg.

Survey Finds Confusion, Uncertainty About IRA

Investing

A lack of knowledge about both traditional and Roth IRAs could

play a role in Americans’ use of these investment vehicles. Nearly

a third of respondents (29%) who rated themselves as “expert” or

“educated” about IRAs did not realize they would be required to pay

ordinary income tax on each dollar converted to a Roth IRA. An

equal number (33%) did not realize that retirement withdrawals of

principal and income are free of income tax for Roth IRAs. A fifth

(21%) admit that they are unsure of how a Roth IRA differs from

other IRAs.

Some Americans also have unrealistic expectations about what

their IRAs can generate in retirement income. For example, nearly a

third (28%) of those with IRA assets of $100,000 or more expect

that their IRAs would generate $100,000 or more in annual

retirement income.

“The economic turmoil of recent years has made clear to

Americans the uncertainty of their prospects for a secure

retirement. They understand the need to save more, but are finding

it difficult to do so, leaving them with a significant retirement

income gap,” said Jeffrey R. Carney, Head of Retirement and Global

Products at Putnam Investments. “Government, employers and the

financial services industry need to continue to find new strategies

to help workers increase their retirement savings through

education, guidance and retirement income tools. Americans need to

make the most of their IRAs, 401(k) plans and other savings

vehicles that are built to provide significant contributions to

their lifetime income.”

Americans are taking some positive steps to prepare for

retirement.

More than one-quarter of survey respondents (26%) expect to use

their tax refund this year to pay down debt, while 22 percent plan

to save it for a rainy day and 11 percent expect to invest it in a

retirement account. Fewer than one in 10 expects to splurge on a

vacation, dinner or some other personal extravagance.

Investments Yielding Positive Results Over Time Favored for

IRAs

When asked what types of investments they felt most comfortable

including in their IRA, half (50%) cited an investment designed to

provide positive, steady returns.

Putnam Investments and Retirement

Among the other products and services Putnam has introduced to

assist retirement plan participants is a Lifetime Income SM

Analysis Tool, which shows 401(k) plan participants project how

much income their current retirement savings may generate in

retirement compared to what they may need, and then offer

actionable next steps.

The findings of the Putnam survey underscore importance of the

company’s deepened commitment to the retirement market, including

the launch of a content-rich Roth IRA Conversion Resource Center

targeted at advisors, brokers, and other financial professionals;

an interactive Roth IRA Conversion Evaluator to assist investors in

determining whether they should convert from a traditional IRA to a

Roth IRA; and a new blog Putnam has created to keep investors and

financial professionals alike informed about developments in Roth

IRAs (www.rothirablog.com).

Putnam RetirementReady® Funds, the firm’s suite of 10

target-date/lifecycle retirement funds, recently added target

Absolute Return Funds* to its mix of underlying investments.

RetirementReady Funds became the only suite of lifecycle funds to

integrate absolute return strategies, which seek positive returns

over time with less volatility than more traditional mutual funds.

Employed in retirement portfolios, absolute return strategies are

intended to pursue positive returns in up and down markets, to

protect against the harmful effects of adverse investment returns,

and to reduce volatility, particularly for investors in or near

retirement.

Putnam also has expanded the services it offers to retirement

plans and developed products to meet the needs of those planning

for or already in retirement. The firm has created a platform that

provides flexible and scalable services and solutions for advisors,

consultants, and their plan sponsor clients in every segment of the

retirement market.

Putnam Consumer Retirement Survey

The survey findings, which were conducted for and paid for by

Putnam Investments, are based on a representative nationwide sample

of 1,001 U.S. adults, age 22 and older, polled online April 2–7,

2010, by Insight Express.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. The

firm was recently ranked #1 out of 61 fund families based on its

funds’ performance during 2009 in a Lipper/Barron’s Fund Families

Survey and named “Mutual Fund Manager of the Year” by Institutional

Investor. At the end of March 2010, Putnam had $118 billion in

assets under management. Putnam has offices in Boston, London,

Frankfurt, Amsterdam, Tokyo, Singapore, and Sydney. For more

information, visit putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

* Putnam’s target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

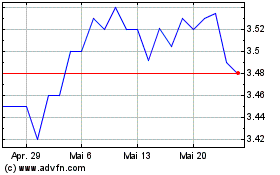

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024